The Importance of the Role of IT in Accounting Information S

16. For each of the following entries, enter the letter of the explanation that most closely describes...

For each of the following entries, enter the letter of the explanation that most closely describes it in the space beside each entry. (You can use letters more than once.)

A. To record receipt of unearned revenue.

B. To record this period’s earning of prior unearned revenue.

C. To record payment of an accrued expense.

D. To record receipt of an accrued revenue.

E. To record an accrued expense.

F. To record an accrued revenue.

G. To record this period’s use of a prepaid expense.

H. To record payment of a prepaid expense.

I. To record this period’s depreciation expense.

1. | Rent Expense | 2,000 |

|

| Prepaid Rent |

| 2,000 |

2. | Interest Expense | 1,000 |

|

| Interest Payable |

| 1,000 |

3. | Depreciation Expense | 4,000 |

|

| Accumulated Depreciation |

| 4,000 |

4. | Unearned Professional Fees | 3,000 |

|

| Professional Fees Earned |

| 3,000 |

5. | Insurance Expense | 4,200 |

|

| Prepaid Insurance |

| 4,200 |

6. | Salaries Payable | 1,400 |

|

| Cash |

| 1,400 |

7. | Prepaid Rent | 4,500 |

|

| Cash |

| 4,500 |

8. | Salaries Expense | 6,000 |

|

| Salaries Payable |

| 6,000 |

9. | Interest Receivable | 5,000 |

|

| Interest Revenue |

| 5,000 |

10. | Cash | 9,000 |

|

| Accounts Receivable (from consulting) |

| 9,000 |

11. | Cash | 7,500 |

|

| Unearned Professional Fees |

| 7,500 |

12. | Cash | 2,000 |

|

| Interest Receivable |

| 2,000 |

17. Miller Toy Company manufactures a plastic swimming pool at its Westwood Plant. The plant has been...

Miller Toy Company manufactures a plastic swimming pool at its Westwood Plant. The plant has been experiencing problems as shown by its June contribution format income statement below: Budgeted Actual $290,000 $290,000 Sales (8,000 pools) Variable expenses: Variable cost of goods sold 104,400 124,770 Variable selling expenses 20,000 20,000 Total variable expenses 124,400 144,770 Contribution margin 165,600 145,230 Fixed expenses: Manufacturing overhead 68,000 68,000 86,000 86,000 Selling and administrative Total fixed expenses 154,000 154,000 11,600 (8,770) Net operating income (loss) Contains direct materials, direct labor, and variable manufacturing overhead. Janet Dunn, who has just been appointed general manager of the Westwood Plant, has been given instructions to "get things under control." Upon reviewing the plant's income statement, Ms. Dunn has concluded that the major problem lies in the variable cost of goods sold. She has been provided with the following standard cost per swimming pool Standard Quantity Standard Price Standard or Hours or Rate Cost 7.92 Direct materials 3.6 pounds $2.20 per pound Direct labor $7.70 per hour 0.5 hours 3.85 Variable manufacturing overhead 0.4 hours $3.20 per hour 1.28 13.05 Total standard cost Based on machine-hours. During June the plant produced 8,000 pools and incurred the following costs: a. Purchased 33,800 pounds of materials at a cost of $2.65 per pound. b. Used 28,600 pounds of materials in production. (Finished goods and work in process inventories are insignificant and can be ignored.) c. Worked 4,600 direct labor-hours at a cost of $7.40 per hour d. Incurred variable manufacturing overhead cost totaling $12,600 for the month. A total of 3,500 machine-hours was recorded. It is the company's policy to close all variances to cost of goods sold on a monthly basis.

18. Verne Cova Company has the following balances in selected accounts on December 31, 2014. Accounts...

Verne Cova Company has the following balances in selected accounts on December 31, 2014.

Accounts Receivable | $ -0- |

Accumulated Depreciation—Equipment | -0- |

Equipment | 7,000 |

Interest Payable | -0- |

Notes Payable | 10,000 |

Prepaid Insurance | 2,100 |

Salaries and Wages Payable | -0- |

Supplies | 2,450 |

Unearned Service Revenue | 30,000 |

All the accounts have normal balances. The information below has been gathered at December 31, 2014.

1. | Verne Cova Company borrowed $10,000 by signing a 12%, one-year note on September 1, 2014. |

2. | A count of supplies on December 31, 2014, indicates that supplies of $900 are on hand. |

3. | Depreciation on the equipment for 2014 is $1,000. |

4. | Verne Cova Company paid $2,100 for 12 months of insurance coverage on June 1, 2014. |

5. | On December 1, 2014, Verne Cova collected $30,000 for consulting services to be performed from December 1, 2014, through March 31, 2015. |

6. | Verne Cova performed consulting services for a client in December 2014. The client will be billed $4,200. |

7. | Verne Cova Company pays its employees total salaries of $9,000 every Monday for the preceding 5-day week (Monday through Friday). On Monday, December 29, employees were paid for the week ending December 26. All employees worked the last 3 days of 2014. |

Instructions

Prepare adjusting entries for the seven items described above.

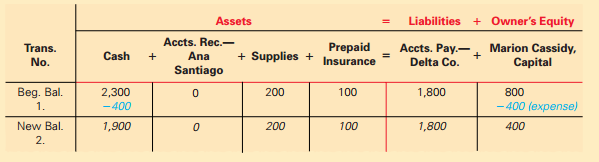

19. Determining how transactions change an accounting equation Marion Cassidy operates a service...

Determining how transactions change an accounting equation Marion Cassidy operates a service business called Cassidy Company. Cassidy Company uses the accounts shown in the following accounting equation. Use the form in your Working Papers to complete this problem

Transactions:

1. Paid cash for rent, $400.00.

2. Received cash from owner as an investment, $500.00.

3. Paid cash for telephone bill, $50.00.

4. Received cash from sales, $1,025.00.

5. Bought supplies on account from Delta Company, $450.00.

6. Sold services on account to Ana Santiago, $730.00.

7. Paid cash for advertising, $660.00.

8. Paid cash for supplies, $150.00.

9. Received cash on account from Ana Santiago, $400.00.

10. Paid cash on account to Delta Company, $1,500.00.

11. Paid cash for one month of insurance, $100.00.

12. Received cash from sales, $1,230.00.

13. Paid cash to owner for personal use, $1,200.00.

20. Hillside issues $4,000,000 of 6%, 15-year bonds dated January 1, 2015, that pay interest semiannu...

21. payroll

In May of the current year, your employer received a PIER report from the CRA that identified Canada Pension Plan (CPP) contribution deficiencies for employees in the organization who:

- turned 18 during the year

- turned 70 during the year

- had chosen to opt out of paying CPP by submitting a completed CPT30 form

To avoid a recurrence, the Payroll Manager, Mary Arnstein, has asked you to prepare a summary of the CPP reporting requirements on T4 information slips. The summary will be used to validate the current payroll setup to ensure that the T4s will be completed properly in future. Provide information on the CPP related boxes that must be completed, including how any amounts are calculated, for employees who:

- are under 18 for the entire year

- turn 18 during the year

- are over 70 for the entire year

- turn 70 during the year

- submit a completed CPT30 form during the year, electing to stop contributing to the Canada Pension Plan

- submit a completed CPT30 form during the year, revoking their previous election to stop contributing to the Canada Pension Plan

22. The following selected data are taken from the comparative financial statements of Superior Curling...

The following selected data are taken from the comparative financial statements of Superior Curling Club. The club prepares its financial statements using the accrual basis of accounting.

September 30 | 2012 | 2011 |

Accounts receivable for member dues | $ 15,000 | $ 19,000 |

Unearned sales revenue | 20,000 | 23,000 |

Service revenue (from member dues) | 151,000 | $135,000 |

Dues are billed to members based upon their use of the club"s facilities. Unearned sales revenues arise from the sale of tickets to events, such as the Skins Game.

Instructions

(Hint:You will find it helpful to use T accounts to analyze the following data. You must analyze these data sequentially, as missing information must first be deduced before moving on. Post your journal entries as you progress, rather than waiting until

the end.)

(a) Prepare journal entries for each of the following events that took place during 2012.

1. Dues receivable from members from 2011 were all collected during 2012.

2. Unearned sales revenue at the end of 2011 was all earned during 2012.

3. Additional tickets were sold for $44,000 cash during 2012; a portion of these were used by the purchasers during the year. The entire balance remaining in Unearned Sales Revenue relates to the upcoming Skins Game in 2012.

4. Dues for the 2011–2012 fiscal year were billed to members.

5. Dues receivable for 2012 (i.e., those billed in item (4) above) were partially collected.

(b) Determine the amount of cash received by the Club from the above transactions during the year ended September 30, 2012.

23. Dos Passos Company sells televisions at an average price of R$900 and also offers to each custome...

Dos Passos Company sells televisions at an average price of R$900 and also offers to each customer a separate 3-year service-type warranty contract for R$90 that requires the company to perform periodic services and to replace defective parts. During 2014, the company sold 300 televisions and 270 warranty contracts for cash. It estimates the 3-year warranty costs as R$20 for parts and R$40 for labor and accounts for warranties separately. Assume sales occurred on December 31, 2014, and straight-line recognition of warranty revenues occurs.

24. On January 1, 2012, Roosevelt Company purchased 12% bonds, havin

On January 1, 2012, Roosevelt Company purchased 12% bonds, having a maturity value of $500,000, for $537,907.40. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2012, and mature January 1, 2017, with interest receivable December 31 of each year. Roosevelt’s business model is to hold these bonds to collect contractual cash flows.

Instructions

(a) Prepare the journal entry at the date of the bond purchase.

(b) Prepare a bond amortization schedule.

(c) Prepare the journal entry to record the interest received and the amortization for 2012.

(d) Prepare the journal entry to record the interest received and the amortization for 2013.