Demystifying Taxation: A Primer for Accounting Students

30. If Draper wants to earn profits equal to 25% of sales revenue, how much (what fee) should it charge

If Draper wants to earn profits equal to 25% of sales revenue, how much (what fee) should it charge each of these two clients?

Why does Draper assign costs to jobs?

Do you agree with the cost analysis for the second order? Explain your answer.

Q99. Should the two orders be accounted for as one job or two in Hiebert’s system?

What sale price per box should Ben Hiebert set for the second order? What are the advan- tages and

disadvantages of this price?

Q101. What are the advantages and disadvantages of Ortega’s proposal?

Should Nature’s Own Garden compute its predetermined manufacturing overhead rate on an annual basis or monthly basis? Explain.

Q103. How did using manufacturing cost only, instead of using all costs associated with the CompWest.com job, affect the amount of Farley’s bid for the job?

Identify the parties involved in Paul York’s dilemma. What are his alternatives? How would each party be affected by each alternative? What should York do next?

Q105. Based on what you have read above, what was Jerry’s company using as a cost driver to allocate overhead to the various jobs?

Name two ways that reducing costs on the civilian contracts would benefit the company.

Q107. Use the data to determine the following for Delta :

- The total cost of Flight 1247, assuming a full plane (100% load factor)

- The revenue generated by Flight 1247, assuming a 100% load factor and average revenue per one-way ticket of $102

- The profit per Flight 1247, given the responses to a. and b.

Q108. Use the data to determine the following for JetBlue :

- The total cost of Flight 53, assuming a full plane (100% load factor)

- The revenue generated by Flight 53, assuming a 100% load factor

- The profit per Flight 53, given the responses to a. and b.

Q109. Based on the responses to Requirements 1 and 2, carefully evaluate each of the four alter- native strategies discussed in Delta ’s executive meeting.

The analysis in this project is based on several simplifying assumptions. As a team, brain- storm factors that your quantitative evaluation does not include, but that may affect a comparison of Delta ’s operations to budget carriers.

Q111. The Filtration Department completely processed 150,000 liters in February. What was the filtration cost per liter?

Draw a timeline for the filtration process.

Q113. Compute the equivalent units of direct materials and conversion costs for the Filtration Department.

Compute the total equivalent units of direct materials and conversion costs for October.

Q115. Compute the cost per equivalent unit for direct materials and for conversion costs.

Calculate the cost of the 35,000 units completed and transferred out and the 30,000 units, 40% complete, in the ending Work in process inventory.

Q117. Fill in the timeline for the Blending Department.

Use the timeline to help you compute the Blending Department’s equivalent units for direct materials and for conversion costs.

Q119. Compute the total costs of the units (gallons)

- completed and transferred out to the Packaging Department.

- in the Blending Department ending Work in process inventory.

Q120. Prepare the journal entries to record the assignment of direct materials and direct labor, and the allocation of manufacturing overhead to the Blending Department. Also, prepare the journal entry to record the costs of the gallons completed and transferred out to the Packaging Department.

Q121. Post the journal entries to the Work in process inventory—Blending T-account. What is the ending balance?

What is the average cost per gallon transferred out of Blending into Packaging? Why would the company managers want to know this cost?

Q123. Draw a timeline for the Fermenting Department.

Use the timeline to help you compute the equivalent units for direct materials and for conversion costs.

Compute the total costs of the units (gallons)

- completed and transferred out to the Packaging Department.

- in the Fermenting Department ending Work in process inventory.

Q126. Prepare the journal entries to record the assignment of Direct materials and Direct labor and the allocation of Manufacturing overhead to the Fermenting Department. Also prepare the journal entry to record the cost of the gallons completed and transferred out to the Packaging Department.

Q127. Post the journal entries to the Work in process inventory—Fermenting T-account. What is the ending balance?

What is the average cost per gallon transferred out of Fermenting into Packaging? Why would Samson Winery’s managers want to know this cost?

Q129. Compute the Bottling Department equivalent units for the month of February. Use the weighted-average method.

Compute the cost per equivalent unit for February.

Q131. Assign the costs to units completed and transferred out and to ending Work in process inventory.

Prepare the journal entry to record the cost of units completed and transferred out.

Q133. Post all transactions to the Work in process inventory—Bottling Department T-account. What is the ending balance?

Compute the number of equivalent units and the cost per equivalent unit in the Assembly Department for November.

Q135. Assign total costs in the Assembly Department to (a) units completed and trans- ferred to Programming during November and (b) units still in process at November 30.

Q136. Prepare a T-account for Work in process inventory—Assembly to show its activ- ity during November, including the November 30 balance.

Compute the number of equivalent units and the cost per equivalent unit in the Mixing Department for March.

Q138. Show that the sum of (a) cost of goods transferred out of the Mixing Department and (b) ending Work in process inventory—Mixing equals the total cost accumu- lated in the department during March.

Q138. Journalize all transactions affecting the company’s mixing process during March, including those already posted.

Draw a timeline for the Preparation Department.

Q140. Use the timeline to help you compute the equivalent. ( Hint : Each direct material added at a different point in the production process requires its own equivalent- unit computation.)

Q141. Compute the total costs of the units (sheets)

- completed and transferred out to the Compression Department in the Preparation Department’s ending Work in process inventory.

Q142. Prepare a timeline for Christine’s Dyeing Department.

Use the timeline to help you compute the equivalent units, cost per equivalent unit, and total costs to account for in Christine’s Dyeing Department for November

Q144. Prepare the November production cost report for Christine’s Dyeing Department.

Journalize all transactions affecting Christine’s Dyeing Department during November, including the entries that have already been posted.

Q146. Draw a timeline for the Testing Department.

Use the timeline to compute the number of equivalent units of work performed by the Testing Department during the period.

Q148. Compute WaterBound’s transferred-in and conversion costs per equivalent unit. Use the unit costs to assign total costs to (a) units completed and transferred out of Testing and (b) units in Testing’s ending Work in process inventory.

Q149. Compute the cost per unit for lifts completed and transferred out to Finished goods inventory. Why would management be interested in this cost?

Compute the number of equivalent units and the cost per equivalent unit in the Assembly Department for April.

Assign total costs in the Assembly Department to (a) units completed and trans- ferred to Programming during April and (b) units still in process at April 30.

Q152. Prepare a T-account for Work in process inventory—Assembly to show its activ- ity during April, including the April 30 balance.

Compute the number of equivalent units and the cost per equivalent unit in the Mixing Department for September.

Q153. Show that the sum of (a) cost of goods transferred out of the Mixing Department and (b) ending Work in process inventory—Mixing equals the total cost accumu- lated in the department during September.

Journalize all transactions affecting the company’s mixing process during September, including those already posted.

Q155. Draw a timeline for the Preparation Department.

Use the timeline to help you compute the equivalent units. ( Hint : Each direct material added at a different point in the production process requires its own equivalent-unit computation.)

Q157. Compute the total costs of the units (sheets)

- completed and transferred out to the Compression Department.

- in the Preparation Department’s ending Work in process inventory.

Q158. Prepare the journal entry to record the cost of the sheets completed and trans- ferred out to the Compression Department.

Post the journal entries to the Work in process inventory—Preparation T-account. What is the ending balance?

Prepare a timeline for Carol’s Dyeing Department.

Q161. Use the timeline to help you compute the equivalent units, cost per equivalent unit, and total costs to account for in Carol’s Dyeing Department for July.

Prepare the July production cost report for Carol’s Dyeing Department.

Journalize all transactions affecting Carol’s Dyeing Department during July, including the entries that have already been posted.

Q164. Draw a timeline for the Testing Department.

Use the timeline to compute the number of equivalent units of work performed by the Testing Department during the period.

Q166. Compute OceanBound’s transferred-in and conversion costs per equivalent unit. Use the unit costs to assign total costs to (a) units completed and transferred out of Testing and (b) units in Testing’s ending Work in process inventory.

Q167. Compute the cost per unit for lifts completed and transferred out to Finished goods inventory. Why would management be interested in this cost?

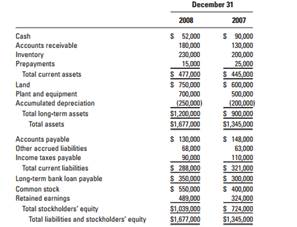

31. Statement of Cash Flows—Direct Method Peoria Corp. just completed another successful year, as...

Statement of Cash Flows—Direct Method

Peoria Corp. just completed another successful year, as indicated by the following income statement:

Other information is as follows:

a. Dividends of $60,000 were declared and paid during the year.

b. Operating expenses include $50,000 of depreciation.

c. Land and plant and equipment were acquired for cash, and additional stock was issued for

cash. Cash also was received from additional bank loans.

The president has asked you some questions about the year’s results. She is very impressed with

the profit margin of 18% (net income divided by sales revenue). She is bothered, however, by the

decline in the company’s cash balance during the year. One of the condit

32. St. Genevieve Petroleum Company is an independent oil producer in Baton Parish, Louisiana. In...

St. Genevieve Petroleum Company is an independent oil producer in Baton Parish, Louisiana. In February, company geologists discovered a pool of oil that tripled the company’s proven reserves. Prior to disclosing the new oil to the public, St. Genevieve quietly bought most of its stock as treasury stock. After the discovery was announced, the company’s stock price increased from $6 to $27.

33. HOW DO THE THREE LEVELS OF COMPUTER ETHICS--POP, PARA, AND THEORETICAL-DIFFER?

HOW DO THE THREE LEVELS OF COMPUTER ETHICS--POP, PARA, AND THEORETICAL-DIFFER?

34. Question 3 Basic CBP relationships: Manufacturer (12 marks) Divine DVD’s Ltd manufactures and...

Question 3 Basic CBP relationships: Manufacturer (12 marks)

Divine DVD’s Ltd manufactures and sells DVDs. Price and cost data are as follows:

In the following requirements ignore income taxes

Required:

- What is Divine DVD’s break-even point in units?

- What is the company’s break-even point in sales value (kina).

- How many units would Divine DVDs have to sell in order to earn a profit of K260 000?

- What is the firm’s safety margin?

- Management estimate that direct labour costs will increase by 8 per cent next year. How many units will the company have to sell next year to reach its break-even point?

- If Divine DVDs’ direct labour costs do increase by 8 per cent, what selling price per unit of product must it charge to maintain the same contribution margin ration?

Question 4 Basic CVP relationships: income taxes: manufacturer (10 marks)

Refer to the data given in Question 2. Now assume that Divine DVDs pays income taxes of 30 per cent.

Required:

- What is Divine DVDs’ break-even point in units?

- What is the company’s break-even point in sales value?

- How many units would Divine DVDs gave to sell in order to earn a profit of $300 000 after tax?

- What is the firm’s safety margin?

- If Divine DVDs’ direct labour costs increase by 8 per cent, what selling price per unit of product must it charge to maintain the same contribution margin ratio?

35. Kapanga applies manufacturing overhead at a rate of 150% of direct labor cost. During October,...

Kapanga Manufacturing Company uses a job-order costing system and started the month of October with a zero balance in its work in process and finished goods inventory accounts. During October, Kapanga worked on three jobs and incurred the following direct costs on those jobs:

| Job B18 | Job B19 | Job C11 |

Direct materials | $12,000 | $25,000 | $18,000 |

Direct labor | $8,000 | $10,000 | $5,000 |

Kapanga applies manufacturing overhead at a rate of 150% of direct labor cost. During October, Kapanga completed Jobs B18 and B19 and sold Job B19. What is Kapanga"s cost of goods manufactured for October?

A) $ 50,000

B) $ 55,000

C) $ 78,000

D) $ 82,000

36. What are the major sources of financial information for publicly owned corporations?

What are the major sources of financial information for publicly owned corporations?

The higher the accounts receivable turnover rate, the better off the company is. Do you agree? Why?

Can you think of a situation where the current ratio is very misleading as an indicator of short-term, debt-paying ability? Does the acid-test ratio offer a remedy to the situation you have described? Describe a situation where the acid-test ratio does not suffice either.

37. The management of Therriault Corporation is considering dropping product U51Y. Data from the...

The management of Therriault Corporation is considering dropping product U51Y. Data from the company's accounting system appear below:

All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $280,000 of the fixed manufacturing expenses and $140,000 of the fixed selling and administrative expenses are avoidable if product U51Y is discontinued.

Required:

What would be the effect on the company's overall net operating income if product U51Y were dropped? Should the product be dropped? Show your work!

38. Other comprehensive income affects earnings per share.

Other comprehensive income

a. affects earnings per share.

b. includes extraordinary investments.

c. includes unrealized gains and losses on gains and losses.

d. has no effect on income tax.

39. An auditor assesses control risk because it

An auditor assesses control risk because it

- Is relevant to the auditor’s understanding of the control environment.

- Provides assurance that the auditor’s materiality levels are appropriate.

- Indicates to the auditor where inherent risk may be the greatest.

- Affects the level of detection risk that the auditor may accept.

40. Explain how the risk preferences of the management members responsible for the choice of advance...

Siteraze Ltd is a company which engages in site clearance and site preparation work. Information concerning its operations is as follows:

(i) It is company policy to hire all plant and machinery required for the implementation of all orders obtained, rather than to purchase its own plant and machinery.

(ii) Siteraze Ltd will enter into an advance hire agreement contract for the coming year at one of three levels — high, medium or low, which correspond to the requirements of a high, medium or low level of orders obtained.

(iii) The level of orders obtained will not be known when the advance hire agreement contract is entered into. A set of probabilities have been estimated by management as to the likelihood of the orders being at a high, medium or low level.

(iv) Where the advance hire agreement entered into is lower than that required for the level of orders actually obtained, a premium rate must be paid to obtain the additional plant and machinery required.

(v) No refund is obtainable where the advance hire agreement for plant and machinery is at a level in excess of that required to satisfy the site clearance and preparation orders actually obtained.

A summary of the information relating to the above points is as follows:

Plant and machinery hire costs | ||||

Level of | Advance | Conversion | ||

orders | Turnover | Probability | hire | premium |

(£000) | (£000) | (£000) | ||

High | 15000 | 0.25 | 2300 | |

Medium | 8 500 | 0.45 | 1500 | |

Low | 4 000 | 0.30 | 1000 | |

Low to medium | 850 | |||

Medium to | ||||

high | 1300 | |||

Low to high | 2150 | |||

Variable cost (as percentage of turnover) 70%

Required: Using the information given above:

(a) Prepare a summary which shows the forecast net margin earned by Siteraze Ltd for the coming year for each possible outcome.

(b) On the basis of maximizing expected value, advise Siteraze whether the advance contract for the hire of plant and machinery should be at the low, medium or high level.

(c) Explain how the risk preferences of the management members responsible for the choice of advance plant and machinery hire contract may alter the decision reached in (b) above.

(d) Siteraze Ltd are considering employing a market research consultant who will be able to say with certainty in advance of the placing of the plant and machinery hire contract, which level of site clearance and preparation orders will be obtained. On the basis of expected value, determine the maximum sum which Siteraze Ltd should be willing to pay the consultant for this information.

41. Compute the face value of a 30-year fixed-rate mortgage with a monthly payment of $1,100, assuming a...

1. Compute the required monthly payment on an $80,000 30-year fixed-rate mortgage with a nominal interest rate of 5.80%. How much of the payment goes toward principal and interest during the first year?

2. Compute the face value of a 30-year fixed-rate mortgage with a monthly payment of $1,100, assuming a nominal interest rate of 9%. If the mortgage requires 5% down, what is the maximum house price?

3. Consider a 30-year fixed-rate mortgage for $100,000 at a nominal rate of 9%. If the borrower wants to pay off the remaining balance on the mortgage after making the 12th payment, what is the remaining balance on the mortgage?