Navigating Accounting Assignments: Expert Tips

1. A partnership agreement should include each of the following except:

A partnership agreement should include each of the following except:

2. What difficulties could arise if no cross-indexing existed between the general journal and the...

Describe a ledger and a chart of accounts. How do these two compare with a book and its table of contents? Describe the act of posting. What difficulties could arise if no cross-indexing existed between the general journal and the ledger accounts?

3. Rivera Company has several processing departments. Costs charged to the Assembly Department for N...

Rivera Company has several processing departments. Costs charged to the Assembly Department for November 2017 totaled $2,280,000 as follows Work in process, November 1 $79,000 Materials $127,150 48,150 Conversion costs Materials added 1,589,000 Labor 225,920 337,930 Overhead Production records show that 35,000 units were in beginning work in process 30% complete as to conversion costs, 660,000 units were started into production, and 25,000 units were in ending work in process 40% complete as to conversion costs. Materials are entered at the beginning of each process. Determine the equivalent units of production and the unit production costs for the Assembly Department. (Round unit costs to 2 decimal places, e.g. 2.25.) Conversion Costs Materials Equivalent Units Cost per unit Determine the assignment of costs to goods transferred out and in process. Costs accounted for: Transferred out Work in process, November 30 Materials Conversion costs Total costs Prepare a production cost report for the Assembly Department.

4. The Bengal Coal Co. Ltd. is the lessee of a mine on a royalty of Re 1 per ton of coal raised,...

The Bengal Coal Co. Ltd. is the lessee of a mine on a royalty of Re 1 per ton of coal raised, without any minimum rent. The output (in tons) for the first 3 years were as : 2012 ---- 10,000; 2013 ---- 50,000; and 2014 75,000.

Pass necessary Journal Entries and show the necessary Ledger Accounts in the books of The Bengal Coal Co Ltd.

The facts are the same as in the Illustration 1 (except last para). You are required to pass necessary Journal Entries in the books of Ram and also post and balance the appropriate accounts in the ledger

5. EX 11-6 Selected stock transactions ObJ. 2 Alpha Sounds Corp., an electric guitar retailer, was...

EX 11-6 Selected stock transactions ObJ. 2

Alpha Sounds Corp., an electric guitar retailer, was organized by Michele Kirby, Paul Glenn, and Gretchen Northway. The charter authorized 1,000,000 shares of common stock with a par of $1. The following transactions affecting stockholders’ equity were completed during the first year of operations:

a. Issued 100,000 shares of stock at par to Paul Glenn for cash.

b. Issued 3,000 shares of stock at par to Michele Kirby for promotional services provided in connection with the organization of the corporation, and issued 45,000 shares of stock at par to Michele Kirby for cash.

c. Purchased land and a building from Gretchen Northway in exchange for stock issued at par. The building is mortgaged for $180,000 for 20 years at 6%, and there is accrued interest of $5,200 on the mortgage note at the time of the purchase. It is agreed that the land is to be priced at $60,000 and the building at $225,000 and that Gretchen Northway’s equity will be exchanged for stock at par. The corporation agreed to as- sume responsibility for paying the mortgage note and the accrued interest.

Journalize the entries to record the transactions.

6. Exercise 13-5 Stock dividends and splits LO P2 On June 30, 2015, Sharper Corporation's common sto...

Exercise 13-5 Stock dividends and splits LO P2 On June 30, 2015, Sharper Corporation's common stock is priced at $52 per share before any stock dividend or split, and the stockholders' equity section of its balance sheet appears as follows. Common stock $10 par value, 120,000 shares authorized, 50,000 500,000 shares issued and outstanding 200,000 Paid-in capital in excess of par value, common stock Retained earnings 600,000 Total stockholders equity $1,360,000

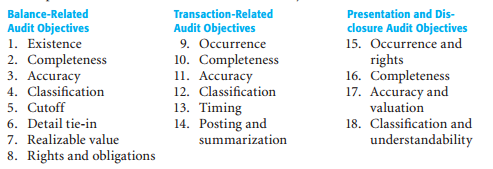

7. The following (1 through 18) are the balance-related, transactionrelated, and presentation and...

The following (1 through 18) are the balance-related, transactionrelated, and presentation and disclosure-related audit objectives.

Required

Identify the specific audit objective (1 through 18) that each of the following specific audit procedures (a. through l.) satisfies in the audit of sales, accounts receivable, and cash receipts for fiscal year ended December 31, 2013.

a. Examine a sample of duplicate sales invoices to determine whether each one has a shipping document attached.

b. Add all customer balances in the accounts receivable trial balance and agree the amount to the general ledger.

c. For a sample of sales transactions selected from the sales journal, verify that the amount of the transaction has been recorded in the correct customer account in the accounts receivable subledger.

d. Inquire of the client whether any accounts receivable balances have been pledged as collateral on long-term debt and determine whether all required information is included in the footnote description for long-term debt.

e. For a sample of shipping documents selected from shipping records, trace each shipping document to a transaction recorded in the sales journal.

f. Discuss with credit department personnel the likelihood of collection of all accounts as of December 31, 2013, with a balance greater than $100,000 and greater than 90 days old as of year end.

g. Examine sales invoices for the last five sales transactions recorded in the sales journal in 2013 and examine shipping documents to determine they are recorded in the correct period.

h. For a sample of customer accounts receivable balances at December 31, 2013, examine subsequent cash receipts in January 2014 to determine whether the customer paid the balance due.

i. Determine whether all risks related to accounts receivable are adequately disclosed.

j. Foot the sales journal for the month of July and trace postings to the general ledger.

k. Send letters to a sample of accounts receivable customers to verify whether they have an outstanding balance at December 31, 2013.

l. Determine whether long-term receivables and related party receivables are reported separately in the financial statements.

8. Marr Co. sells its products in reusable containers. The customer is charged a deposit for each...

Marr Co. sells its products in reusable containers. The customer is charged a deposit for each container delivered and receives a refund for each container returned within two years after the year of delivery. Marr accounts for the containers not returned within the time limit as being retired by sale at the deposit amount. Information for 2006 is as follows:

align="left">

Container deposits at December 31, 2004, from deliveries in | ||||

2004 | $150,000 | |||

2005 | 430,000 | $580,000 | ||

Deposits for containers delivered in 2006 | 780,000 | |||

Deposits for containers returned in 2006 from deliveries in | ||||

2004 | $ 90,000 | |||

2005 | 250,000 | |||

2006 | 286,000 | 626,000 | ||

In Marr’s December 31, 2006 balance sheet, the liability for deposits on returnable containers should be

- $494,000

- $584,000

- $674,000

- $734,000

9. Sharp Company manufactures a product for which the following standards have been set: Standard Qu...

Show transcribed image text Sharp Company manufactures a product for which the following standards have been set: Standard Quantity Standard Price Standard or Hours 3 feet ? hours Cost $15 or Rate $5 per foot Direct materials Direct labor ? per hour During March, the company purchased direct materials at a cost of $43,335, all of which were used in the production of 2,425 units of product. In addition, 4,000 hours of direct labor time were worked on the product during the month. The cost of this labor time was $28,000. The following variances have been computed for the month: Materials quantity variance Labor spending variance Labor efficiency variance $3,750 U $2,780 U 780 U Required 1. For direct materials: a. Compute the actual cost per foot for materials for March. (Round your answer to 2 decimal places.) Actual cost per foot

10. Winter Co. is being sued for illness caused to local residents as a result of negligence on the c...

Winter Co. is being sued for illness caused to local residents as a result of negligence on the company's part in permitting the local residents to be exposed to highly toxic chemicals from its plant. Winter's lawyer states that it is probable that Winter will lose the suit and be found liable for a judgment costing Winter anywhere from $1, 200,000 to $5,000,000. However the lawyer states that the most probable cost is $3, 600.000 As a result of the above facts, a loss contingency of $1, 200,000 and disclose an additional contingency of up to $4, 800,000 loss contingency of $3, 600,000 and disclose any additional contingency of up to $2, 400,000. a loss contingency $3, 600,000 but not discloses a contingency of $1, 200,000 to $6,00,000. Information available prior to the issuance of the financial statements indicates that t is probable that, at the date of the financial statements, a liability has been incurred for obligations related to product warranties. The amount of the loss involved can be reasonably estimated. Based on the above facts, an estimated loss contingency should be neither accrued nor disclosed but not accrued. Accrued classified as an retained earnings. When is a contingent liability recorded? When the amount can be reasonably estimated. When the future events are probable to occur and the amount can be reasonably estimated. When the future events are probable to occur. when the future events will possibly occur and the amount can be reasonably estimated. Which of the following is not considered a part of the definition of a liability? Unavoidable obligation. Transaction or other event creating the has already occurred. Present obligation that entails settlement by probable future transfer or use of cash goods or services Liquidation is reasonably expected to require use of existing resources classified as current assets or create other current liabilities What is a contingency? An existing situation where certainly exists as to a gain or loss that will be resolved when one or more future events occur or fail to occur. An existing situation where uncertainty exists as to possible loss that will be resolved when one or more future events occur An existing situation where be resolved future exists as to possible gain or loss that will not be resolved in the foreseeable future. An existing situation where uncertainty exists as to possible gain or loss that will be resolved when one or more future events occur or fail to occur.

11. Stratford Company distributes a lightweight lawn chair that sells for $120 per unit. Variable exp...

Stratford Company distributes a lightweight lawn chair that sells for $120 per unit. Variable expenses are $60.00 per unit, and fixed expenses total $160,000 annually. |

Required: | |

| |

Answer the following independent questions. | |

| |

1. | What is the product's CM ratio? |

2. | Use the CM ratio to determine the break-even point in sales dollars. |

3. | The company estimates that sales will increase by $54,000 during the coming year due to increased demand. By how much should net operating income increase? |

4. | Assume that the operating results for last year were as follows: |

| ||

Sales | $ | 3,120,000 |

Variable expenses | 1,560,000 | |

Contribution margin | 1,560,000 | |

Fixed expenses | 160,000 | |

Net operating income | $ | 1,400,000 |

a. | Compute the degree of operating leverage at the current level of sales. (Round your answer to 2 decimal places.) |

b. | The president expects sales to increase by 11% next year. By how much should net operating income increase? (Round your answer to the nearest dollar.) |

5. | Refer to the original data. Assume that the company sold 42,000 units last year. The sales manager is convinced that a 10% reduction in the selling price, combined with a $62,000 increase in advertising expenditures, would increase annual unit sales by 50%. |

a. | Prepare two contribution format income statements, one showing the results of last year’s operations and one showing what the results of operations would be if these changes were made. (Do not round intermediate calculations. Round your "Per unit" answers to 2 decimal places.) |

b. | Would you recommend that the company do as the sales manager suggests? | ||||

|

6. | Refer to the original data. Assume again that the company sold 42,000 units last year. The president feels that it would be unwise to change the selling price. Instead, he wants to increase the sales commission by $2.20 per unit. He thinks that this move, combined with some increase in advertising, would double annual unit sales. By how much could advertising be increased with profits remaining unchanged? Do not prepare an income statement; use the incremental analysis approach. |

12. answer and show your solution Problem 16-10 (AICPA Adapted) Maxim Company acquired 40,000 ordinary s

answer and show your solution for P6,600,000 to be held for trading On November 30, the investee distributed a 10% ordinary share dividend when the market price of the share was P250 On December 31, the entity sold 4,000 shares for P1,000,000 What amount should be reported as gain on sale ofinvestment in the current year? 340,000 b. 400,000 500,000 d. 600,000 a. C. Problem 16-11 (AICPA Adapted) Presumptuous Company revealed the following information pertaining to dividends from nontrading investments in ordinary shares during the year ended December 31, 2019: The entity owned a 10% interest in Beal Company, which declared a cash dividend of P500,000 on November 30, 2019 to shareholders of record on December 31, 2019 and payable on January 15, 2020. On October 15, 2019, the entity received a liquidating dividend of P100,000 from Clay Mining Company. The entity owned a 5% interest in Clay Mining Company What amount of dividend income should be reported for the current year? 500,000 b. a. 600,000 150,000 d. C. 50,000 425

13. Farris Corporation, which has only one product, has provided the following data concerning its mo...

Farris Corporation, which has only one product, has provided the following data concerning its most recent month of operations: Selling price $ 78 Units in beginning inventory Units produced Units sold Units in ending inventory 8,800 8,700 100 Variable costs per unit $18 10 Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense rixed costs Pixed manufacturing overhead rixed selling and administrative expense $255,200 87,000 What is the unit product cost for the month under absorption costing? $32 per unit $61 per unit $37 per unit $66 per unit

14. Each of the following scenarios is based on facts in an actual fraud. Categorize each scenario as

Each of the following scenarios is based on facts in an actual fraud. Categorize each scenario as primarily indicating (1) an incentive to commit fraud, (2) an opportunity to commit fraud, or (3) a rationalization for committing fraud. Also state your reasoning for each scenario.

a. There was intense pressure to keep the corporation’s stock from declining further. This pressure came from investors, analysts, and the CEO, whose financial well-being was significantly dependent on the corporation’s stock price.

b. A group of top-level management was compensated (mostly in the form of stock-options) well in excess of what would be considered normal for their positions in this industry.

c. Top management of the company closely guards internal financial information, to the extent that even some employees on a “need-to-know basis” are denied full access.

d. Managing specific financial ratios is very important to the company, and both management and analysts are keenly observant of variability in key ratios. Key ratios for the company changed very little even though the ratios for the overall industry were quite volatile during the time period.

e. In an effort to reduce certain accrued expenses to meet budget targets, the CFO directs the general accounting department to reallocate a division’s expenses by a significant amount. The general accounting department refuses to acquiesce to the request, but the journal entry is made through the corporate office. An accountant in the general accounting department is uncomfortable with the journal entries required to reallocate divisional expenses. He brings his concerns to the CFO, who assures him that everything will be fine and that the entries are necessary. The accountant considers resigning, but he does not have another job lined up and is worried about supporting his family. Therefore, he never voices his concerns to either the internal or external auditors.

f. Accounting records were either nonexistent or in a state of such disorganization that significant effort was required to locate or compile them.