Modules Plan: Expert Assistance for Excelling in Accounting

30. A firm had two departments X and Y. Department Y (which was a Manufacturing Department) received...

A firm had two departments X and Y. Department Y (which was a Manufacturing Department) received goods from Department X as its raw materials. Department X supplied the said goods to Y at cost price. From the following particulars you are required to prepare a Departmental Trading and Profit and Loss Account for the year ended on 31st December, 2014. (all figures in ~).

Particulars | Dept X | Dept Y |

Opening Stock (as on 1.1.2014) | 2,50,000 | 75,000 |

Purchases (from outside suppliers) | 10,00,000 | 20,000 |

Sales (to outside customers) | 12,00,000 | 3,00,000 |

Closing stock (as on 31.12.2014) | 1,50,000 | 50,000 |

The following information is to be taken into account:

(a) Depreciation of Buildings to be provided at 20% p.a. The value of the Building occupied by both the Departments was ~ 1,05,000 (Department X occupying two-third portion and Department Y occupying the rest).

(b) Goods transferred from Department X to Department Y ~ 2,50,000 at cost.

(c) Manufacturing Expenses amounted to ~ 10,000.

(d) Selling expenses amounted to ~ 15,000 (to be apportioned on the basis of sales of respective departments).

(e) General expenses of the business as a whole amounted to ~ 58,000.

31. MULTIPLE CHOICE 1.Which system is not part of the expenditure cycle? a.cash disbursements b.payroll.

MULTIPLE CHOICE

1.Which system is not part of the expenditure cycle?

a.cash disbursements

b.payroll

c.production planning/control

d.purchases/accounts payable

2.Which system produces information used for inventory valuation, budgeting, cost control, performance reporting, and make-buy decisions?

a.sales order processing

b.purchases/accounts payable

c.cash disbursements

d.cost accounting

3.Which of the following is a turn-around document?

a.remittance advice

b.sales order

c.purchase order

d.payroll check

4.The order of the entries made in the ledger is by

a.transaction number

b.account number

c.date

d.user

5.The order of the entries made in the general journal is by

a.date

b.account number

c.user

d.customer number

6.In general a special journal would not be used to record

a.sales

b.cash disbursements

c.depreciation

d.purchases

7.Which account is least likely to have a subsidiary ledger?

a.sales

b.accounts receivable

c.fixed assets

d.inventory

8.Subsidiary ledgers are used in manual accounting environments. What file is comparable to a subsidiary ledger in a computerized environment?

a.archive file

b.reference file

c.transaction file

d.master file

9.A journal is used in manual accounting environments. What file is comparable to a journal in a computerized environment?

a.archive file

b.reference file

c.transaction file

d.master file

10.In a computerized environment, a list of authorized suppliers would be found in the

a.master file

b.transaction file

c.reference file

d.archive file

32. 5.24 Investment advisors agree that near-retirees, defined as people aged 55 to 65, should have...

5.24 Investment advisors agree that near-retirees, defined as people aged 55 to 65, should have balanced portfolios. Most advisors suggest that the near-retirees have no more than 50% of their investments in stocks. However, during the huge decline in the stock market in 2008, 22% of nearretirees had 90% or more of their investments in stocks (P. Regnier, “What I Learned from the Crash,” Money, May 2009, p. 114). Suppose you have a random sample of 10 people who would have been labeled as near-retirees in 2008. What is the probability that during 2008 a. none had 90% or more of their investment in stocks? b. exactly one had 90% or more of his or her investment in stocks? c. two or fewer had 90% or more of their investment in stocks? d. three or more had 90% or more of their investment in stocks?

33. Vulcan Company is a monthly depositor whose tax liability for March 2013 is $2,505.

Vulcan Company is a monthly depositor whose tax liability for March 2013 is $2,505.

1. What is the due date for the deposit of these taxes?

2. Assume that no deposit was made until May

3. Compute the following penalties:

a. Penalty for failure to make timely deposit. $

b. Penalty for failure to fully pay tax. $

c. Interest on taxes due and unpaid. $

d. Total penalty imposed. $

34. Warranty and Coupon Computation Schmitt Company must make comput

Warranty and Coupon Computation Schmitt Company must make computations and adjusting entries for the following independent situations at December 31, 2011.

1. Its line of amplifiers carries a 3-year warranty against defects. On the basis of past experience the estimated warranty costs related to dollar sales are: first year after sale—2% of sales; second year after sale—3% of sales; and third year after sale—5% of sales. Sales and actual warranty expenditures for the first 3 years of business were: Compute the amount that Schmitt Company should report as a liability in its December 31, 2011, balance sheet. Assume that all sales are made evenly throughout each year with warranty expenses also evenly spaced relative to the rates above.

2. With some of its products, Schmitt Company includes coupons that are redeemable in merchandise. The coupons have no expiration date and, in the company’s experience, 40% of them are redeemed. The liability for unredeemed coupons at December 31, 2010, was $9,000. During 2011, coupons worth $30,000 were issued, and merchandise worth $8,000 was distributed in exchange for coupons redeemed. Compute the amount of the liability that should appear on the December 31, 2011, balance sheet.

(AICPAadapted)

35. Which of the following is not involved in CVP analysis?

Which of the following is not involved in CVP analysis?

(a) Sales mix.

(b) Unit selling prices.

(c) Fixed costs per unit.

(d) Volume or level of activity.

keeps comming back as incorrect. Am I missing something here if it is not $995 for Cash?

Expedia reported total cash of approximately $1,510 million at September 30, 2013. Of this amount, $50 million was set aside to "fulfill the requirement of an aviation authority of a certain foreign country to protect against the potential nondelivery of travel services in that country" in the short term. Another $465 million was invested in money market funds and time deposits with original maturities of less than 90 days. The remaining $995 million was held in bank accounts. Expedia also reported $475 million in short-term investments (maturing in 90-360 days), $54 million of unearned revenue, $750 million of accounts receivable, $235 million of prepaid insurance, and $3,770 of goodwill. Show the current assets section of Expedia's balance sheet. TIP: Some items are not current assets. (Enter your answers in millions) EXPEDIA Balance Sheet (Partial) At September 30 in millions Current Assets Cash and Cash Equivalents Restricted Cash (short-term) Short-term Investments Accounts Receivable Prepaid Insurance 50 475 750 235 Total Current Assets 1,510

37. All of the current year's entries for Zimmerman Company have been made, except the following adju...

All of the current year's entries for Zimmerman Company have been made, except the following adjusting entries. The company's annual according you ends on December 31. a. On September 1 of the current year, Zimmerman collected six month's rent of $8.640 on storage space. At the date, Zimmerman debited Cash and created Unearned Revenue for $6.640. b. On October 1 of the current year, the company borrowed $14, 400 from a local bank and signed a one year, 13 percent note for that amount. The principal and interest payable on the monthly data. c. Depreciation of $1, 700 must be recognized on a service truck purchased in July of the current year at a cost of $22,000. d. Cash of $5, 400 was collected on November of the current year, for services to be rendered evenly over the next year beginning on November 1 of the current year. Unearned service credited when the cash was received. e. On November 1 of the current year. Zimmerman paid a one year premium for properly insurance, $9, 720, for converge starting on that date. Cash was credited and Prepaid insurance and this amount. f. The company earned service revenue of $4, 200 on a special job that was completed December 29 of the current year. Collection will be made during January of the next year. No has been recorded. g. At December 31 of the current year, wages earned by employees totaled $15,000. The employees will be paid on the next payroll date in January of the next year. h. On December 31 of the current year, the company estimated it owed $490 for this year's properly taxes on land. The tax will be paid when the bill is received in January or next year.

6)

A product is currently made in a process-focused shop, where fixed costs are

$8,000 per year and variable cost is $40 per unit. The firm currently sells 200

units of the product at $200 per unit. A manager is considering a repetitive

focus to lower costs (and lower prices, thus raising demand). The costs of this

proposed shop are fixed costs = $24,000 per year and variable costs = $10 per

unit. If a price of $80 will allow 400 units to be sold, what profit (or loss)

can this proposed new process expect? Do you anticipate that the manager will

want to change the process? Explain.

7)

A firm sells two products. Product R sells for $20; its variable cost is $6.

Product S sells for $50; its variable cost is $30. Product R accounts for 60

percent of the firm’s sales, while S accounts for 40 percent. The firm’s fixed

costs are $4 million annually. Calculate the firm’s break-even point.

8)

A firm is weighing three capacity alternatives: small, medium, and large job

shop. Whatever capacity choice is made, the market for the firm’s product can

be “moderate” or “strong.” The probability of moderate

acceptance is estimated to be 40 percent; strong acceptance has a probability

of 60 percent. The payoffs are as follows. Small job shop, moderate market =

$24,000; Small job shop, strong market = $54,000. Medium job shop, moderate

market = $20,000; medium job shop, strong market = $64,000. Large job shop,

moderate market = -$2,000; large job shop, strong market = $96,000. Which

capacity choice should the firm make?

9)

The efficiency of a factory is 75% and its utilization 50%. If effective capacity is 1000 find design

capacity.

10)

A factory outputs 1000 units a month. If

design capacity is 3000 and efficiency is 50% find utilization and effective

capacity.

11)

A graphic design studio is considering three new computers. The first model, A, costs $5000. Model B and C cost $3000 and $1000

respectively. If each customer provides

$50 of revenue and variable costs are $20/customer, find the number of

customers required for each model to break even.

12)

A firm is considering adding a second secretary to answer phone calls and make

appointments. The cost of the secretary

will be $10/hour and she will work 200 hours each month. If each new client adds $400 of profit to the

firm, how many clients must the secretary arrange for the firm to break

even? Suppose that the secretary has an

equal chance of providing either 0, 2, or 6 new clients each month. Should the firm hire the secretary?

39. Inventory information for Part 311 of Monique Aaron Corp. disclo

Inventory information for Part 311 of Monique Aaron Corp. discloses the following information for the month of June.

June 1 Balance 300 units ………. @ $10

11 Purchased 800 units ………… @ $12

20 Purchased 500 units ………… @ $13

June 10 Sold 200 units ………… @ $24

15 Sold 500 units @ ……………… $25

27 Sold 300 units @ ……………… $27

Instructions

(a) Assuming that the periodic inventory method is used, compute the cost of goods sold and ending inventory under

(1) LIFO and

(2) FIFO.

(b) Assuming that the perpetual inventory record is kept in dollars and costs are computed at the time of each withdrawal, what is the value of the ending inventory at LIFO?

(c) Assuming that the perpetual inventory record is kept in dollars and costs are computed at the time of each withdrawal, what is the gross profit if the inventory is valued at FIFO?

(d) Why is it stated that LIFO usually produces a lower gross profit than FIFO?

40. 9.11 Many consumer groups feel that the U.S. Food and Drug Administration (FDA) drug approval...

9.11 Many consumer groups feel that the U.S. Food and Drug Administration (FDA) drug approval process is too easy and, as a result, too many drugs are approved that are later found to be unsafe. On the other hand, a number of industry lobbyists have pushed for a more lenient approval process so that pharmaceutical companies can get new drugs approved more easily and quickly. Consider a null hypothesis that a new, unapproved drug is unsafe and an alternative hypothesis that a new, unapproved drug is safe. a. Explain the risks of committing a Type I or Type II error. b. Which type of error are the consumer groups trying to avoid? Explain. c. Which type of error are the industry lobbyists trying to avoid? Explain. H1, H0, ZSTAT = -1.38? ZSTAT = + 2.00? ZSTAT = -2.61? H0 : m = 12.5 ZSTAT = + 2.21? ZSTAT = -0.76? d. How would it be possible to lower the chances of both Type I and Type II errors?

41. Pal Corporation acquired 70 percent of the outstanding voting

Pal Corporation acquired 70 percent of the outstanding voting stock of Sal Corporation for $91,000 cash on January 1, 2011, when Sal’s stockholders’ equity was $130,000. All the assets and liabilities of Sal were stated at fair values (equal to book values) when Pal acquired its 70 percent interest. Financial statements of the two corporations at and for the year ended December 31, 2011, are summarized as follows (in thousands):

REQUIRED

1. Prepare consolidation workpapers for Pal Corporation and Subsidiary for 2011.

2. Prepare a consolidated income statement and a consolidated balance sheet for Pal Corporation andSubsidiary.

42. Part A Santana Rey of Business Solutions is evaluating her inventory to determine whether it must be

Part A Santana Rey of Business Solutions is evaluating her inventory to determine whether it must be adjusted based on lower of cost or market rules. Business Solutions has three different types of software in its inventory and the following information is available for each. Inventory items Units Cost Market Office productivity 3 $76 $74 Desktop publishing 2 103 100 Accounting 3 90 96 Required: 1. Compute the lower of cost or market for ending inventory assuming Rey applies the lower of cost or market rule to inventory as a whole. Must Rey adjust the reported inventory value? Explain. 2. Assume that Rey had instead applied the lower of cost or market rule to each product in inventory. Under this assumption, must Rey adjust the reported inventory value? Explain. Part B Selected accounts and balances for the three months ended March 31 ,2012 for Business Solutions follow. January 1 beginning inventory $ 0 Cost of goods sold 14,052 March 31 ending inventory 704 Required. 1.Compute inventory turnover and days' sales in inventory for the three months ended March 31,2012. 2. Assets the company's performance if competitors average 15 times for inventory turnover and 25 days for days' sales in inventory.

43. Discuss how conceptual and physical systems differ and which functions are responsible for each of...

1. Discuss how conceptual and physical systems differ and which functions are responsible for each of these systems.

2. If accountants are viewed as providers of information, then why are they consulted as system users in the systems development process?

3. Do you agree with the statement, “The term IT auditor should be considered obsolete because it implies a distinction between regular auditors and auditors who examine computerized AIS”?

Why or why not?

4. What are the primary reasons for segmenting organizations?

Listed below are various transactions that a company incurred during the current year. Select the impact on total stockholders' equity for each scenario. Specifically state whether stockholders' equity would Increase, " "Decrease, " or have-No Effect" as a result of each transaction listed below. Consider each transaction independently.

45. Channing Corporation has two divisions, C and D. The overall company contribution margin ratio is...

Channing Corporation has two divisions, C and D. The overall company contribution margin ratio is 30%, with sales in the two divisions totaling $750,000. If variable expenses are $450,000 in Division C and if Division C's contribution margin ratio is 25%, then sales in Division D must be:

A. $75,000

B. $225,000

C. $150,000

D. $300,000

46. 36. The Oscar Corporation acquired land, buildings, and equipment from a bankrupt company at a...

36. The Oscar Corporation acquired land, buildings, and equipment from a bankrupt company at a lump-sum price of $180,000. At the time of acquisition, Oscar paid $12,000 to have the assets appraised. The appraisal disclosed the following values:

18.The Kolkata Commercial Company invoiced goods to its Jamshedpur Branch at

cost. The head office paid all the branch expenses from its bank except petty cash

expenses which were paid by the branch. From the following details relating to the

branch, prepare,

(1) Branch Stock Account

(2) Branch Debtors Account

(3) Branch Expenses Account

(4) Branch Profit and Loss Account

48. Bank reconciliation and adjusting entries El Gato Painting Company maintains a checking account...

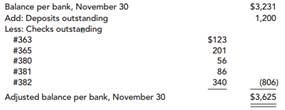

Bank reconciliation and adjusting entries

El Gato Painting Company maintains a checking account at American Bank. Bank statements are prepared at the end of each month. The November 30, 2016, reconciliation of the bank balance is as follows:

The company’s general ledger checking account showed the following for December:

The December bank statement contained the following information:

The checks that were processed by the bank in December include all of the outstanding checks at the end of November except for check #365. In addition, there are some December checks that had not been processed by the bank by the end of the month. Also, you discover that check #411 for $320 was correctly recorded by the bank but was incorrectly recorded on the books as a $230 disbursement for advertising expense. Included in the bank’s deposits is a $1,300 deposit incorrectly credited to the company’s account. The deposit should have been posted to the credit of the Los Gatos Company. The NSF checks have not been redeposited and the company will seek payment from the customers involved.

Required:

1. Prepare a bank reconciliation for the El Gato checking account at December 31, 2016.

2. Prepare any necessary adjusting journal entries indicated.

49. Wendall Company specializes in producing fashion outfits. On Jul

Wendall Company specializes in producing fashion outfits. On July 31, 2014, a tornado touched down at its factory and general office. The inventories in the warehouse and the factory were completely destroyed as was the general office nearby. Next morning, through a careful search of the disaster site, however, Bill Francis, the company’s controller, and Elizabeth Walton, the cost accountant, were able to recover a small part of manufacturing cost data for the current month. ?oWhat a horrible experience,?? sighed Bill ?oAnd the worst part is that we may not have enough records to use in fi ling an insurance claim.?? ?oIt was terrible,?? replied Elizabeth. ?oHowever, I managed to recover some of the manufacturing cost data that I was working on yesterday afternoon. The data indicate that our direct labor cost in July totaled $250,000 and that we had purchased $365,000 of raw materials. Also, I recall that the amount of raw materials used for July was $350,000. But I’m not sure this information will help. The rest of our records are blown away.?? ?oWell, not exactly,?? said Bill. ?oI was working on the year-to-date income statement when the tornado warning was announced. My recollection is that our sales in July were $1,240,000 and our gross profit ratio has been 40% of sales. Also, I can remember that our cost of goods available for sale was $770,000 for July.??

?oMaybe we can work something out from this information!?? exclaimed Elizabeth. ?oMy experience tells me that our manufacturing overhead is usually 60% of direct labor.?? ?oHey, look what I just found,?? cried Elizabeth. ?oIt’s a copy of this June’s balance sheet, and it shows that our inventories as of June 30 are Finished goods $38,000, Work in process $25,000, and Raw materials $19,000.?? ?oSuper,?? yelled Bill. ?oLet’s go work something out.?? In order to fi le an insurance claim, Wendall Company must determine the amount of its inventories as of July 31, 2014, the date of the tornado touchdown.

Instructions

With the class divided into groups, determine the amount of cost in the Raw Materials, Work in Process, and Finished Goods inventory accounts as of the date of the tornado touchdown.

50. Peroni Company paid wages of $170,900 this year. Of this amount, $114,000 was taxable for net FUTA...

Peroni Company paid wages of $170,900 this year. Of this amount, $114,000 was taxable for net FUTA and SUTA purposes. The state’s contribution tax rate is 3.1% for Peroni Company. Due to cash flow problems, the company did not make any SUTA payments until after the Form 940 filing date. Compute:

a. Amount of credit the company would receive against the FUTA tax for its SUTA contributions . . $

b. Amount that Peroni Company would pay to the federal government for its FUTA tax. . . . . . . . . $

c. Amount that the company lost because of its late payments . . . . $

51. Last year Vaughn Corporation had sales of $315,000 and a net income of $17,832, and its year-end...

Last year Vaughn Corporation had sales of $315,000 and a net income of $17,832, and its year-end assets were $210,000. The firm's total-debt-to-total-assets ratio was 42.5%. Bases on the Du Pont equation, what was Vaughn's ROE?