METHODOLOGY FOR DESIGNING TESTS OF CONTROLS IN ACCOUNTING

1. Earned but unbilled fees at July 31 were $1,400 (b) Depreciation for the month was $200 (c )...

Earned but unbilled fees at July 31 were $1,400

(b) Depreciation for the month was $200

(c ) One-twelfth of the insurance expired

(d) An inventory count showed $300 of cleaning supplies remaining on July 31

(e) Accrued but unpaid employee salaries were $500

2. ACC 308 Final Project Scenario Overview: You just began a position as a financial accountant at P...

ACC 308 Final Project Scenario

Overview: You just began a position as a financial accountant at Peyton Approved. In this role, your first task is to prepare the company’s financials for the year-end audit. Additionally, the company is interested in expanding its business within the next year. They would like your support in assessing their ability to meet their goals.

Refer to the data below and use the Final Project Workbook that includes the income statement, balance sheet, retained earnings statement and cash flow statement to complete the final project and associated milestones.

Peyton Approved Financial Data: Preliminary Financial Statements have already been prepared (2017 statements in the Final Project Workbook). Final adjusting entries have not yet been made. See table for possible adjustments that indicate what will be recorded at 12/31/17 (fiscal year end). Use the following to complete year-to-year documentation and notes for managing depreciation, inventory, and long-term debt.

On 12/03/2017, a mixer with a cost of $2,000, accumulated depreciation $1,200, was destroyed by a forklift. As of 12/23/17, insurance company has agreed to pay $700 in January, 2018, for accidental destruction. |

Note about later borrowing - financials will show loan from parents repaid and use of bank financing. |

For notes to the financial statements and Management Analysis Memo, consider the following:

Peyton Approved uses the following accounting practices:

Inventory: Periodic, LIFO for both baking and merchandise

Baking supplies: $27,850 ending inventory

Equipment: Straight line method used for equipment

Business Financing Information: Use this information to calculate interest rates and insurance information, and to assess their impact on the company’s financial obligations:

6% interest note payable was made on Jan 31, 2017, and is due Feb 1, 2019.

5-year loan was made on June 1, 2016. Terms are 7.5% annual rate, interest only until due date.

Insurance: Annual policy covers 12 months, purchased in February, covering March 2017 to February 2018. No monthly adjustments have been made.

3. If Year 1 equals $1,400, Year 2 equals $1,554, and Year 3 equals $1,750, the index number to be...

If Year 1 equals $1,400, Year 2 equals $1,554, and Year 3 equals $1,750, the index number to be assigned for Year 3 in trend analysis, assuming that Year 1 is the base year, is?

4. On July 1, 2006, East Co. purchased as a long-term investment $500,000 face amount, 8% bonds of Rand...

On July 1, 2006, East Co. purchased as a long-term investment $500,000 face amount, 8% bonds of Rand Corp. for $461,500 to yield 10% per year. The bonds pay interest semiannually on January 1 and July 1. In its December 31, 2006 balance sheet, East should report interest receivable of

- $18,460

- $20,000

- $23,075

- $25,000

5. Devin Wolf Company has the following balances in selected accounts on December 31, 2017. Accou...

Devin Wolf Company has the following balances in selected accounts on December 31, 2017.

Accounts Receivable | 0 |

Accumulated Depreciation—Equipment | 0 |

Equipment | 6,000 |

Interest Payable | 0 |

Notes Payable | 10,200 |

Prepaid Insurance | 2,340 |

Salaries and Wages Payable | 0 |

Supplies | 3,000 |

Unearned Service Revenue | 28,000 |

All the accounts have normal balances. The information below has been gathered at December 31, 2017.

1. | Devin Wolf Company borrowed $10,200 by signing a 9%, one-year note on September 1, 2017. | |

2. | A count of supplies on December 31, 2017, indicates that supplies of $930 are on hand. | |

3. | Depreciation on the equipment for 2017 is $2,000. | |

4. | Devin Wolf Company paid $2,340 for 12 months of insurance coverage on June 1, 2017. | |

5. | On December 1, 2017, Devin Wolf collected $28,000 for consulting services to be performed from December 1, 2017, through March 31, 2018. The company had performed 1/4 of the services by December 31. | |

6. | Devin Wolf performed consulting services for a client in December 2017. The client will be billed $3,500. | |

7. | Devin Wolf Company pays its employees total salaries of $5,700 every Monday for the preceding 5-day week (Monday through Friday). On Monday, December 29, employees were paid for the week ending December 26. All employees worked the last 3 days of 2017. |

Prepare adjusting entries for the seven items described above. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

No. Account Titles and Explanation | Debit | Credit |

1. | ||

1. | ||

2. | ||

2. | ||

3. | ||

3. | ||

4. | ||

4. | ||

5. | ||

5. |

6. Thomas Kratzer is the purchasing manager for the headquarters of

Thomas Kratzer is the purchasing manager for the headquarters of a large insurance company chain with a central inventory operation. Thomas's fastest-moving inventory item has a demand of 6,000 units per year. The cost of each unit is $100, and the inventory carrying cost is $10 per unit per year. The average ordering cost is $30 per order. It takes about 5 days for an order to arrive, and the demand for 1 week is 120 units. (This is a corporate operation, and the are 250 working days per year.)

a) What is the EOQ?

b) What is the average inventory if the EOQ is used?

c) What is the optimal number of orders per year?

d) What is the optimal number of days in between any two orders?

e) What is the annual cost of ordering and holding inventory?

f) What is the total annual inventory cost, including cost of the 6,000 units?

1- Zane Perelli currently has $100 that he can spend today on polo shirts costing $25 each. Alternatively, he could invest the $100 in a risk-free U.S. Treasury security that is expected to earn a 9% nominal rate of interest. The consensus forecast of leading economists is a 5% rate of inflation over the coming year.

a. How many polo shirts can Zane purchase today?

b. How much money will Zane have at the end of 1 year if he forgoes purchasing the polo shirts today?

c. How much would you expect the polo shirts to cost at the end of 1 year in light of the expected inflation?

d. Use your findings in parts b and c to determine how many polo shirts (fractions are OK) Zane can purchase at the end of 1 year. In percentage terms, how many more or fewer polo shirts can Zane buy at the end of 1 year?

e. What is Zane s real rate of return over the year? How is it related to the percentage change in Zane s buying power found in part d? Explain.

2-Bond interest payments before and after taxes Charter Corp. has issued 2,500 debentures with a total principal value of $2,500,000. The bonds have a coupon interest rate of 7%.

a. What dollar amount of interest per bond can an investor expect to receive each year from Charter?

b. What is Charter s total interest expense per year associated with this bond issue?

c. Assuming that Charter is in a 35% corporate tax bracket, what is the company s net after-tax interest cost associated with this bond issue?

3 - Valuation Fundamentals: Imagine that you are trying to evaluate the economics of purchasing an automobile. You expect the car to provide annual after-tax cash benefits of $1,200 at the end of each year and assume that you can sell the car for after tax proceeds of $5,000 at the end of the planned 5-year ownership period. All funds for purchasing the car will be drawn from your savings, which are currently earning 6% after taxes.

A. Identify the cash flows, their timing, and the required return applicable to valuing the car.

B. What is the maximum price you would be willing to pay to acquire the car? Explain.

4- Midland Utilities has outstanding a bond issue that will mature to its $1,000 par value in 12 years. The bond has a coupon interest rate of 11% and pays interest annually.

a. Find the value of the bond if the required return is

(1) 11%,

(2) 15%, and

(3) 8%.

b. Plot your findings in part a on a set of required return (x axis) market value of bond (y axis) axes.

c. Use your findings in parts a and b to discuss the relationship between the coupon interest rate on a bond and the required return and the market value of the bond relative to its par value.

d. What two possible reasons could cause the required return to differ from the coupon interest rate?

5-The Salem Company bond currently sells for $955, has a 12% coupon interest rate and a $1,000 par value, pays interest annually, and has 15 years to maturity.

a. Calculate the yield to maturity(YTM) on this bond.

b. Explain the relationship that exists between the coupon interest rate and yield to maturity and the par value and market value of a bond.

8. (Objective 20-3) You are assessing internal control in the audit of the payroll and personnel...

(Objective 20-3) You are assessing internal control in the audit of the payroll and personnel cycle for Rogers Products Company, a manufacturing company specializing in assembling computer parts. Rogers employs approximately two hundred hourly and thirty salaried employees in three locations. Each location has one foreman who is responsible for overseeing operations. The owner of the company lives in Naples, Florida and is not actively involved in the business. The two key executives are the vice president of sales and con - troller, and both have been employed by the company for more than fifteen years. New hourly employees are hired by the foremen at each location on an as needed basis. Each foreman recommends the wage rate for each new employee as well as wage rate increases. The effectiveness of employees varies considerably and their wages are adjusted accord - ingly. All wage rates are approved by the controller. Since each hourly employee works independently, Rogers has a highly flexible work schedule policy, as long as they start after 7:00 a.m. and are finished by 6:00 p.m. Each foreman has a supply of prenumbered time cards that they distribute to employees on Monday morning. Because some employees do not start until later in the day several time cards are kept in a box by the time clock for their use. Hourly employees use time clocks to record when they start and stop working. Each Friday, after the employees complete their work for the week, the foremen account for the time cards they distributed, approve them, and send them by an overnight courier to the main office in Cincinnati. The payroll clerk receives the time cards on Saturday and enters the information using payroll software that prepares the checks or direct deposit authorizations and the related payroll records. The checks are ready for the controller to sign Monday morning. She compares each check to the payroll transactions list sent by the payroll department and returns the checks using the same courier to each location. The foremen pick up the checks and distribute each check to the appropriate employee. If an employee is not present at the end of the day the foreman mails it to the employee’s address. Except for the foremen, all salaried employees work in the Cincinnati office. The vice president of sales or controller hires all salaried employees, depending on their responsi - bilities, and determines their salaries and salary adjustments. The owner determines the salary of the vice president of sales and controller. The payroll clerk also processes the payroll transactions for salaried employees using the same payroll software that is used for hourly employees, but all salaried employees use direct deposit so no check is prepared. The payroll software has access controls that are set by the controller. She is the only person who has access to the salary and wage rate module of the software. She updates the software for new wage rates and salaries and changes of existing ones. The accounting clerk has access to all other payroll modules. The controller’s assistant has been taught to reconcile bank accounts and does the reconciliation monthly.

Required

a. Identify the internal control deficiencies in the Rogers Products Company’s payroll system.

b. For each deficiency, state the type of misstatement that is likely to result. Be as specific as possible in describing the nature of the misstatement. If the potential misstatement involves fraud, identify who is most likely to perpetuate the fraud.

(Objective 20-3)

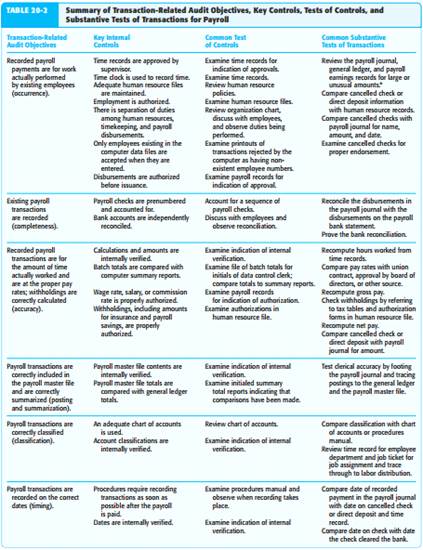

METHODOLOGY FOR DESIGNING TESTS OF CONTROLS AND SUBSTANTIVE TESTS OF TRANSACTIONS

Now that you are familiar with the business functions and related documents and records in the payroll and personnel cycle, we will discuss assessing control risk and the design of tests of controls and substantive tests of transactions for the cycle. The methodology for designing tests of controls and substantive tests of transactions for the payroll and personnel cycle is the same as that used in Chapter 14 for the sales and collection cycle and in Chapter 18 for the acquisition and payment cycle: understand internal control, assess planned control risk, determine the extent of testing of controls, and design tests of controls and substantive tests of transactions to meet transaction-related audit objectives. Internal control for payroll is normally highly structured and well controlled to manage cash disbursed, to minimize employee complaints and dissatisfaction and to minimize payroll fraud. Because of relatively common payroll concerns from company to company, high-quality computerized payroll accounting programs are available. Because processing payroll is similar for most organizations, and programs need to be modified annually for changes in withholding schedules, companies commonly use an outside payroll service for processing payroll. The auditor can often rely on the internal con trols of the service organization if the service organiza tion’s auditor issues a report on the service organization’s internal control, discussed in Chapter 12 (pp. 389–390). It is usually not difficult for companies to establish good control in the payroll and personnel cycle. For factory and office employees, there are usually a large number of relatively homogeneous, small-amount transactions. For executives, there are usually fewer payroll transactions, but they are ordinarily consistent in timing and amount. Consequently, auditors seldom expect to find exceptions in testing payroll transactions. Occasionally, control test deviations occur, but most monetary misstatements are corrected by internal verification controls or in response to employee complaints. Even when there are misstatements, they are rarely material. Tests of controls and substantive tests of transactions procedures are the most important means of verifying account balances in the payroll and personnel cycle. These tests are emphasized because of the lack of independent third-party evidence, such as confirmation, for verifying accrued wages, withheld income taxes, accrued payroll taxes, and other balance sheet accounts. Furthermore, in most audits, the amounts in the balance sheet accounts are small and can be verified with relative ease if the auditor is confident that payroll transactions are correctly entered into the computer and payroll tax returns are correctly prepared. Even though tests of controls and substantive tests of transactions are the most important parts of testing payroll, tests in this area are usually not extensive. Many audits have a minimal risk of material misstatements, even though payroll is often a significant part of total expenses. There are three reasons for this:

1. Employees are likely to complain to management if they are underpaid.

2. All payroll transactions are typically uniform and uncomplicated.

3. Payroll transactions are subject to audit by federal and state governments for income tax withholding, Social Security, and unemployment taxes. Following the same approach used in Chapter 14 for tests of sales and cash receipts transactions, the internal controls, tests of controls, and substantive tests of trans - actions for each transaction-related audit objective are summarized in Table 20-2 (p. 666). Again, you should recognize the following:

• Internal controls vary from company to company; therefore, the auditor must identify the controls, significant deficiencies, and material weaknesses for each organization.

• Controls the auditor intends to rely on to reduce assessed control risk must be tested with tests of controls.

• If the auditor is reporting on the effectiveness of internal control over financial reporting, the level of understanding controls and extent of tests of controls must be sufficient to issue an opinion on the effectiveness of internal control over financial reporting.

• Substantive tests of transactions vary depending on the assessed control risk and the other considerations of the audit, such as the effect of payroll on inventory.

• Tests are not actually performed in the order given in Table 20-2. The tests of controls and substantive tests of transactions are combined when appropriate and are performed in as convenient a manner as possible, using a performance format audit program. The purposes of many internal controls and the nature of the tests of controls and substantive tests of transactions are apparent for most tests from their descriptions in Table 20-2. Next, the key controls for the payroll and personnel cycle for assessing control risk are discussed. Adequate Separation of Duties Separation of duties is important in the payroll and personnel cycle, especially to prevent overpayments and payments to nonexistent employees. The payroll function should be kept independent of the human resources department, which controls key payroll activities, such as adding and deleting employees. Payroll processing should also be separate from the issuance of payroll disbursements. Proper Authorization As already noted, only the human resources department should be authorized to add and delete employees from the payroll or change pay rates and deductions. The number of hours worked by each employee, especially overtime, should be authorized by the employee’s supervisor. Approval may be noted on all time records or done on an exception basis only for overtime hours. Adequate Documents and Records The appropriate documents and records depend on the nature of the payroll system. Time records are necessary for hourly employees but not for salaried employees. For employees compensated based on piece rate or other incentive systems, different records are required. For many companies, time records must be adequate to accumulate payroll costs by job or assignment. Prenumbered documents for recording time are less of a concern for payroll because the completeness objective is normally not a concern. Physical Control Over Assets and Records Access to unsigned payroll checks should be restricted. Checks should be signed by a responsible employee, and payroll should be distributed by someone independent of the payroll and timekeeping functions. Any unclaimed checks should be returned for redeposit. If checks are signed by a signature machine, access to the machine should be restricted. Similarly, when pay - ment occurs through direct deposit, access to systems used to authorize payments should be restricted. Independent Checks on Performance Payroll computations should be indepen - dently verified, including comparison of batch totals to summary reports. A member of management or other responsible employee should review the payroll output for any obvious misstatements or unusual amounts. When manufacturing labor affects inven - tory valuation or when it is necessary to accumulate costs by job, adequate controls are necessary to verify the proper assignment of costs. Payroll taxes and other withholdings are important in many companies, both because the amounts are often material and because the potential liability for failure to timely file tax forms can be severe. Preparation of Payroll Tax Forms As a part of understanding internal control, the auditor should review the preparation of at least one of each type of payroll tax form

that the client is responsible for filing. The potential for liability for unpaid taxes, penalty, and interest arises if the client fails to prepare the tax forms correctly. The payroll tax forms are for such taxes as federal income and FICA withholding, state and city income withholding, and federal and state unemployment. A detailed reconciliation of the information on the tax forms and the payroll records may be necessary when the auditor believes the tax returns may be incorrectly prepared. Indications of potential misstatements in the returns include the payment of penalties and interest in the past for improper payments, new personnel in the payroll department who are responsible for the preparation of the returns, the lack of internal verification of the information, and cash flow problems for the client. Timely Payment of the Payroll Taxes Withheld and Other Withholdings It is desirable to test whether the client has fulfilled its legal obligation in submitting payments for all payroll withholdings as a part of the