Expert Guidance for Accounting Assignments and Research Papers

17. Douglas and Pamela Frank are a married couple. They both worked for a railroad company for 30...

Part A: Case Study Analysis (15 Marks)

You are to answer the 5 questions relating to the case study of a child care business. It includes both theory

and calculation type questions. Do show your working for the calculations.

Case Background

Douglas and Pamela Frank are a married couple. They both worked for a railroad company for 30 years. At age

57, Douglas and age 52, Pamela retired and moved to the small town of Ovilla, Texas, which has a population

of approximately 3,500 residents. When the Franks moved to the town, they decided to start a child care

business in their home called Nanna’s House. Nanna’s House is licensed by the state. The state charges an

annual fee of $225 to maintain the license. Insurance is required at a cost of $3,840 annually. The facility is

licensed to care for a maximum of six children. The Franks charge a fee of $800 per month for each child. The

monthly fee is based on a full day of care, from 8:00 a.m. to 4:00 p.m. If additional time is required beyond

4:00 p.m., parents must pay an additional charge of $15 per hour for each child. The couple provides two

meals and a snack for the children. The cost of the meals and snack is $3.20 per child per day. There are six

children currently enrolled.

The facility is very nice. It is an 820 square foot addition to their home that was built in 1964. The Franks

purchased the home and completed the renovations for $79,500 and they believe the addition has a useful

life of 25 years. The facility has a large open space for play, reading, and other activities. There is a section for

sleeping which contains small cots. The facility is equipped with a small kitchen, two bathrooms and a small

laundry area. The daycare increased the Franks’ utility cost by $50 each month.

During the first week of operations, the washer and dryer stopped working. Both appliances were old and had

been used by the couple for many years. The old appliances cost a total of $440. While a laundry room was

not initially a necessity, it became increasingly important for laundering the soiled clothes of the children,

blankets, and sheets. A company nearby, Red Oak Laundry and Dry Cleaning, can launder clothing for the

Franks, including pick-up and delivery, for $52 per month. Alternatively, the Franks can take clothes to the

laundromat once a week, which is three miles away (one way). The applicable mileage rate is $0.56/mile. They

can launder the clothes themselves at a cost of $8 per week. The self-service alternative does not include

detergent or fabric sheets. The couple would need to purchase these items in order to use the laundromat.

Purchasing laundry supplies in bulk from MegaMart would cost $35 every quarter. The final alternative is for

the Franks to purchase a washer and dryer. The cost of the appliances is: washer $420 and dryer $380. The

additional accessories for both appliances, needed for installation, cost $43.72. The store will deliver the

appliances at a total cost of $35. The cost of installing the appliances is free. Both appliances are expected to

last 8 years. According to the manufacturer the washer will increase energy costs by $120 per year. The dryer

will increase energy costs by $145 per year.

18. Colleen Fernandez, president of Rhino Enterprises, applied for a $175,000 loan from First Federal...

Colleen Fernandez, president of Rhino Enterprises, applied for a $175,000 loan from First Federal Bank. The bank requested financial statements from Rhino Enterprises as a basis for granting the loan. Colleen has told her accountant to provide the bank with a balance sheet. Colleen has decided to omit the other financial statements because there was a net loss during the past year.

In groups of three or four, discuss the following questions:

1. Is Colleen behaving in a professional manner by omitting some of the financial statements?

2. a. What types of information about their businesses would owners be willing to pro- vide bankers? What types of information would owners not be willing to provide?

b. What types of information about a business would bankers want before extending a loan?

c. What common interests are shared by bankers and business owners?

19. PDR plc manufactures four products using the same machinery. The following details relate to its...

PDR plc manufactures four products using the same machinery. The following details relate to its products: (a) Determine the production plan which will maximize the weekly profit of PDR plc and prepare a profit statement showing the profit your plan will yield. (10 marks) (b) The marketing director of PDR plc is concerned at the company s inability to meet the quantity demanded by its customers. Two alternative strategies are being considered to overcome this: (i) To increase the number of hours worked using the existing machinery by working overtime. Such overtime would be paid at a premium of 50 per cent above normal labour rates, and variable overhead costs would be expected to increase in proportion to labour costs. (ii) To buy product B from an overseas supplier at a cost of £19 per unit including carriage. This would need to be repackaged at a cost of £1 per unit before it could be sold. Requirement: Evaluate each of the two alternative strategies and, as management accountant, prepare a report to the marketing director, stating your reasons (quantitative and qualitative) as to which, if either, should be adopted.

20. On August 1, 2016, Bill Hudson established Heritage Realty, which completed the following transac...

On August 1, 2016, Bill Hudson established Heritage Realty, which completed the following transactions during the month:

Aug. | 1 | Bill Hudson transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $31,500. |

2 | Paid rent on office and equipment for the month, $2,650. | |

3 | Purchased supplies on account, $2,200. | |

4 | Paid creditor on account, $830. | |

5 | Earned sales commissions, receiving cash, $14,580. | |

6 | Paid automobile expenses for month, $1,630, and miscellaneous expenses, $460. | |

7 | Paid office salaries, $2,400. | |

8 | Determined that the cost of supplies used was $1,150. | |

9 | Paid dividends, $3,200. |

1. | Journalize entries for transactions Aug. 1 through 9. Refer to the Chart of Accounts for exact wording of account titles. | ||||||

2. | Post the journal entries to the T accounts, selecting the appropriate date to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. | ||||||

3. | Prepare an unadjusted trial balance as of August 31, 2016. | ||||||

4. | Determine the following:

| ||||||

5. | Determine the increase or decrease in retained earnings for August. |

21. What control procedures could Petty Corporation have employed to prevent this unauthorized use of...

While auditing the financial statements of Petty Corporation, the certified public accounting firm of True blue and Smith discovered that its client’s legal expense account was abnormally high. Further investigation of the records indicated the following: _ Since the beginning of the year, several disbursements totaling $15,000 had been made to the law firm of Swindle, Fox, and Kreip. _ Swindle, Fox, and Kreip were not Petty Corporation’s attorneys. _ A review of the canceled checks showed that they had been written and approved by Mary Boghas, the cash disbursements clerk. _ Boghas’s other duties included performing the end of- month bank reconciliation. _ Subsequent investigation revealed that Swindle, Fox, and Kreip are representing Mary Boghas in an unrelated embezzlement case in which she is the defendant. The checks had been written in payment of her personal legal fees.

Required

a. What control procedures could Petty Corporation have employed to prevent this unauthorized use of cash? Classify each control procedure in accordance with the SAS 78/COSO framework (authorization, segregation of functions, supervision, and so on).

b. Comment on the ethical issues in this case.

22. (Objectives 8-5, 8-7, 8-8) You are auditing payroll for the Morehead Technologies company for the...

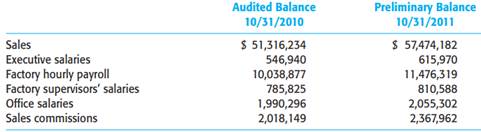

(Objectives 8-5, 8-7, 8-8) You are auditing payroll for the Morehead Technologies company for the year ended October 31, 2011. Included next are amounts from the client’s trial balance, along with comparative audited information for the prior year.

You have obtained the following information to help you perform preliminary analytical procedures for the payroll account balances.

1. There has been a significant increase in the demand for Morehead’s products. The increase in sales was due to both an increase in the average selling price of 4 percent and an increase in units sold that resulted from the increased demand and an increased marketing effort.

2. Even though sales volume increased there was no addition of executives, factory supervisors, or office personnel.

3. All employees including executives, but excluding commission salespeople, received a 3 percent salary increase starting November 1, 2010. Commission salespeople receive their increased compensation through the increase in sales.

4. The increased number of factory hourly employees was accomplished by recalling employees that had been laid off. They receive the same wage rate as existing employees. Morehead does not permit overtime.

5. Commission salespeople receive a 5 percent commission on all sales on which a commission is given. Approximately 75 percent of sales earn sales commission. The other 25 percent are “call-ins”, for which no commission is given. Commissions are paid in the month following the month they are earned.

a. Use the final balances for the prior year included on the preceding page and the infor - mation in items 1 through 5 to develop an expected value for each account, except sales.

b. Calculate the difference between your expectation and the client’s recorded amount as a percentage using the formula (expected value-recorded amount)/expected value.

(Objectives 8-5)

PERFORM PRELIMINARY ANALYTICAL PROCEDURES

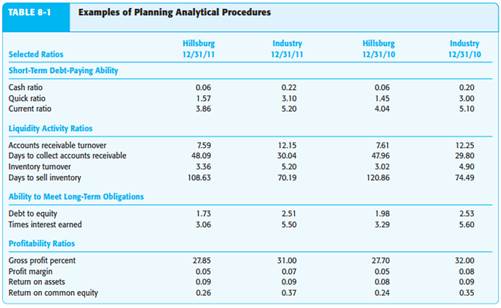

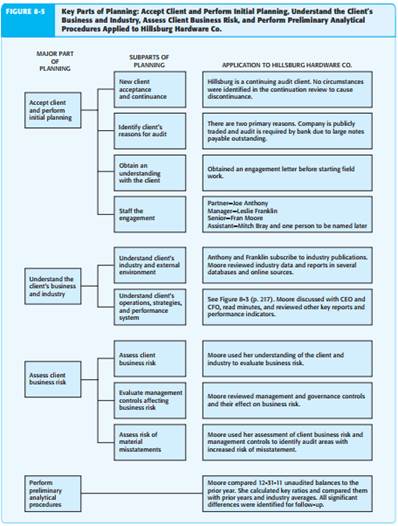

Auditors perform preliminary analytical procedures to better understand the client’s business and to assess client business risk. One such procedure compares client ratios to industry or competitor benchmarks to provide an indication of the company’s performance. Such preliminary tests can reveal unusual changes in ratios compared to prior years, or to industry averages, and help the auditor identify areas with increased risk of misstatements that require further attention during the audit. The Hillsburg Hardware Co. example is used to illustrate the use of preliminary analytical procedures as part of audit planning. This is followed by a summary of the audit planning process, and further discussion of the use of analytical procedures throughout the audit. Table 8-1 presents key financial ratios for Hillsburg Hardware Co., along with comparative industry information that auditors might consider during audit planning. These ratios are based on the Hillsburg Hardware Co. financial statements. (See the glossy insert in this textbook.) Hillsburg’s Annual Report to Shareholders described the company as a wholesale distributor of hardware equipment to inde pendent,

high-quality hardware stores in the midwestern United States. The company is a niche provider in the overall hardware industry, which is dominated by national chains like Home Depot and Lowe’s. Hillsburg’s auditors identified potential increased compe - tition from national chains as a specific client business risk. Hillsburg’s market consists of smaller, indepen dent hardware stores. Increased competition could affect the sales and profitability of these customers, likely affecting Hillsburg’s sales and the value of assets such as accounts receivable and inventory. An auditor might use ratio information to identify areas where Hillsburg faces increased risk of material mis - statements. The profitability measures indicate that Hillsburg is performing fairly well, despite the increased competition from larger national chains. Although lower than the industry averages, the liquidity measures indicate that the company is in good financial condition, and the leverage ratios indicate additional borrowing capacity. Because Hillsburg’s market consists of smaller, independent hardware stores, the company holds more inventory and takes longer to collect receivables than the industry average. In identifying areas of specific risk, the auditor is likely to focus on the liquidity activity ratios. Inventory turnover has improved but is still lower than the industry average. Accounts receivable turnover has declined slightly and is lower than the industry average. The collectibility of accounts receivable and inventory obsolescence are likely to be assessed as high inherent risks and will therefore likely warrant addi - tional attention in the current year’s audit. These areas likely received additional attention during the prior year’s audit as well.

(Objective 8-6)

Analytical procedures are one of the eight types of evidence introduced in Chapter 7. Because of the increased emphasis on analytical procedures in professional practice, this section moves beyond the preliminary analytical procedures discussed earlier in this chapter to discuss the uses of analytical procedures throughout the audit. Analytical procedures are defined by auditing standards as evaluations of financial information made by a study of plausible relationships among financial and nonfinancial data . . . involving comparisons of recorded amounts . . . to expec tations developed by the auditor. This definition is more formal than the description of analytical procedures used in Chapter 7, but both say essentially the same thing. Analytical procedures use comparisons and relationships to assess whether account balances or other data appear reasonable relative to the auditor’s expectations.

The emphasis in the definition of analytical procedures is on expectations developed by the auditor. For example, the auditor might compare current-year recorded commission expense to an expectation of commission expense based on total recorded sales multiplied by the average commission rate as a test of the overall reasonableness of recorded commissions. For this analytical procedure to be relevant and reliable, the auditor has likely concluded that recorded sales are correctly stated, all sales earn a commission, and that the average actual commission rate is readily determinable. Analytical procedures may be performed at any of three times during an engagement:

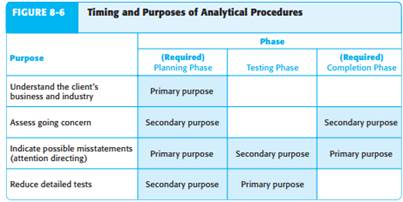

1. Analytical procedures are required in the planning phase to assist in determining the nature, extent, and timing of audit procedures. This helps the auditor identify significant matters requiring special consideration later in the engage - ment. For example, the calculation of inventory turnover before inventory price tests are done may indicate the need for special care during those tests. Ana - lytical procedures done in the planning phase typically use data aggregated at a high level, and the sophistication, extent, and timing of the procedures vary among clients. For some clients, the comparison of prior-year and current-year account balances using the unaudited trial balance may be sufficient. For other clients, the procedures may involve extensive analysis of quarterly financial statements based on the auditor’s judgment.

2. Analytical procedures are often done during the testing phase of the audit as a substantive test in support of account balances. These tests are often done in conjunction with other audit procedures. For example, the prepaid portion of each insurance policy might be compared with the same policy for the previous year as a part of doing tests of prepaid insurance. The assurance provided by analytical procedures depends on the predictability of the relationship, as well as the precision of the expectation and the reliability of the data used to develop the expectation. When analytical procedures are used during the testing phase of the audit, auditing standards require the auditor to document in the working papers the expectation and factors considered in its development.

3. Analytical procedures are also required during the completion phase of the audit. Such tests serve as a final review for material misstatements or financial problems and help the auditor take a final “objective look” at the audited finan - cial statements. Typically, a senior partner with extensive knowledge of the client’s business conducts the analytical procedures during the final review of the audit files and financial statements to identify possible oversights in an audit.

Figure 8-6 (p. 225) shows the purposes of analytical procedures during each of the three phases. The shaded boxes indicate when a purpose is applicable in each phase. More than one purpose may be indicated. Notice how analytical procedures are done during the planning phase for all four purposes, while procedures during the other two phases are used primarily to determine appropriate audit evidence and to reach conclusions about the fair presentation of financial statements.

(Objective 8-7)