IDEA Introduction and Accounts Receivable Audit

23. Emily Valley is a licensed dentist. During the first month of the operation of her business, the...

Emily Valley is a licensed dentist. During the first month of the operation of her business, the following events and transactions occurred.

April 1 | Invested $21,000 cash in her business. | |

1 | Hired a secretary-receptionist at a salary of $900 per week payable monthly. | |

2 | Paid office rent for the month $1,300. | |

3 | Purchased dental supplies on account from Dazzle Company $4,500. | |

10 | Performed dental services and billed insurance companies $4,700. | |

11 | Received $1,000 cash advance from Leah Mataruka for an implant. | |

20 | Received $2,000 cash for services performed from Michael Santas. | |

30 | Paid secretary-receptionist for the month $3,600. | |

30 | Paid $3,150 to Dazzle for accounts payable due. |

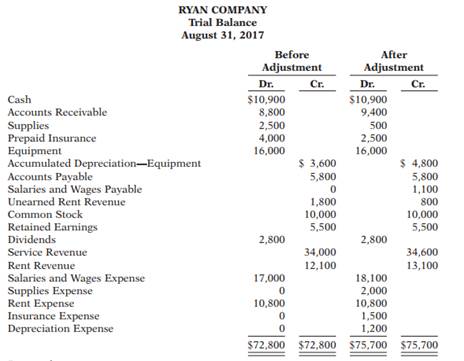

24. The adjusted trial balance for Ryan Company is given in E4-21. Instructions Prepare the income...

The adjusted trial balance for Ryan Company is given in E4-21.

Instructions Prepare the income and retained earnings statements for the year and the classified balance sheet at August 31

Problem E4-21

The trial balances shown below are before and after adjustment for Ryan Company at the end of its fiscal year.

Instructions

Prepare the adjusting entries that were made.

25. 41.A firm operated at 80% of capacity for the past year, during which fixed costs were $210,000,...

41.A firm operated at 80% of capacity for the past year, during which fixed costs were $210,000, variable costs were 65% of sales, and sales were $1,000,000. Operating profit was:

a.$140,000

b.$150,000

c.$310,000

d.$200,000

42.If sales are $425,000, variable costs are 63% of sales, and operating income is $50,000, what is the contribution margin ratio?

a.37%

b.26.8%

c.11.8%

d.63%

43.Variable costs as a percentage of sales for Leamon Inc. are 75%, current sales are $600,000, and fixed costs are $110,000. How much will operating income change if sales increase by $40,000?

a.$10,000 increase

b.$10,000 decrease

c.$30,000 decrease

d.$30,000 increase

44.Salter Inc.'s unit selling price is $50, the unit variable costs are $35, fixed costs are $125,000, and current sales are 10,000 units. How much will operating income change if sales increase by 5,000 units?

a.$150,000 decrease

b.$175,000 increase

c.$75,000 increase

d.$150,000 increase

45.If sales are $820,000, variable costs are $524,800, and operating income is $260,000, what is the contribution margin ratio?

a.53.1%

b.33%

c.64%

d.36%

46.A firm operated at 80% of capacity for the past year, during which fixed costs were $220,000, variable costs were 66% of sales, and sales were $1,000,000. Operating profit was:

a.$140,000

b.$120,000

c.$340,000

d.$220,000

47.If sales are $525,000, variable costs are 64% of sales, and operating income is $50,000, what is the contribution margin ratio?

a.36%

b.26.5%

c.9.5%

d.64%

48.Halter Inc.'s unit selling price is $70, the unit variable costs are $45, fixed costs are $150,000, and current sales are 10,000 units. How much will operating income change if sales increase by 5,000 units?

a.$125,000 decrease

b.$175,000 increase

c.$75,000 increase

d.$125,000 increase

49.Bailey Company sells 25,000 units at $15 per unit. Variable costs are $8 per unit, and fixed costs are $35,000. The contribution margin ratio and the unit contribution margin, (rounding to two decimal points) are:

a.47% and $7 per unit

b.53% and $7 per unit

c.47% and $8 per unit

d.53% and $8 per unit

50.If the contribution margin ratio for Lyndon Company is 37%, sales were $425,000. and fixed costs were $100,000, what was the income from operations?

a.$167,750

b.$57,250

c.$54,730

d.$125,310

26. 1. Explain the relationships among audit services, attestation services, and assurance services,...

1. Explain the relationships among audit services, attestation services, and assurance services, and give examples of each.

2. Discuss the major factors in today’s society that have made the need for independent audits much greater than it was 50 years ago.

3. Describe the nature of the evidence the internal revenue agent will use in the audit of Jones Company’s tax return.

27. E7-3 The following control procedures are used in Kelton Company for over-the-counter cash receipts.

E7-3 The following control procedures are used in Kelton Company for over-the-counter cash receipts. Each store manager is responsible for interviewing applicants for cashier jobs. They are hired if they seem honest and trustworthy. All over-the-counter receipts are registered by three clerks who share a cash register with a single cash drawer. To minimize the risk of robbery, cash in excess of $100 is stored in an unlocked attachAf© case in the stock room until it is deposited in the bank. At the end of each day the total receipts are counted by the cashier on duty and reconciled to the cash register total. The company accountant makes the bank deposit and then records the dayAc€?cs receipts. Instructions: For each procedure, explain the weakness in internal control and identify the control principle that is violated. For each weakness, suggest a change in the procedure that will result in good internal control.

28. Discuss the importance of accounting independence in accounting information systems. Give an...

Discuss the importance of accounting independence in accounting information systems. Give an example of where this concept is important (use an example other than inventory control).

29. Following is the Balance Sheet of Punita, Rashi and Seema who are sharing profits in the ratio 2:1:2

Following is the Balance Sheet of Punita, Rashi and Seema who are sharing profits in the ratio 2:1:2 as on 31st March 2013. (4) Liabilities Amount(`) Assets Amount(`) Creditors Bills Payable Capitals: Punita 1,44,000 Rashi 92,000 Seema 1,24,000 38,000 2,000 3,60,000 Building Stock Debtors Cash at bank Profit and Loss Account 2,40,000 65,000 30,000 5,000 60,000 4,00,000 4,00,000 Punita died on 30th September 2013. She had withdrawn 44,000 from her capital on July 1, 2013. According to the partnership agreement, she was entitled to interest on capital @8% p.a. Her share of profit till the date of death was to be calculated on the basis of the average profits of the last three years. Goodwill was to be calculated on the basis of three times the average profits of the last four years. The profits for the years ended 2009-10, 2010-11 and 2011-12 were `30,000, `70,000 and `80,000 respectively. Prepare Punita’s account to be rendered to her executors.

30. The Cheyenne Hotel in Big Sky, Montana, has accumulated

The Cheyenne Hotel in Big Sky, Montana, has accumulated records of the total electrical costs of the hotel and the number of occupancy-days over the last year. An occupancy-day represents a room rented out for one day. The hotel’s business is highly seasonal, with peaks occurring during the ski season and in the summer.

1. Using the high-low method, estimate the fixed cost of electricity per month and the variable cost of electricity per occupancy-day. Round off the fixed cost to the nearest whole dollar and the variable cost to the nearest whole cent.

2. What other factors other than occupancy-days are likely to affect the variation in electrical costs from month tomonth?

31. Which of the following statements regarding transfer pricing is false?

Which of the following statements regarding transfer pricing is false?

- When idle capacity exists, there is no opportunity cost to producing intermediate products for another division.

- Market-based transfer prices should be reduced by any costs avoided by selling internally rather than externally.

- No contribution margin is generated by the transferring division when variable cost-based transfer prices are used.

- The goal of transfer pricing is to provide segment managers with incentive to maximize the profits of their divisions

32. Bentley Enterprises uses process costing to control costs in the manufacture of Dust Sensors for ...

Bentley Enterprises uses process costing to control costs in the manufacture of Dust Sensors for the mining industry. The following information pertains to operations for November. (CMA Exam adapted) Units Work in process, November 1st 16,400 Started in production during November 104,000 Work in process, November 30th 24,400 The beginning inventory was 60% complete as to materials and 20% complete as to conversion costs. The ending inventory was 90% complete as to materials and 40% complete as to conversion costs. Costs pertaining to November are as follows: Beginning inventory: direct materials, $54,960; direct labor, $20,720; manufacturing overhead, $15,640. Costs incurred during the month: direct materials, $472,000; direct labor, $186,880; manufacturing overhead, $395,160. What is the equivalent unit cost for the conversion costs assuming Bentley uses weighted-average process costing?

33. The owner of Neros company has hired you to analyze her company's performance and financial posi

company's performance and financial position, as well as the positions of its competitors, Centar and Xenmix. However, the data Neros obtained is incomplete and is shown in the following Tableau Dashboard Accounting Equation Data Neros Centar Xenmix -Book $100,000 Salve for Liabilities erences $80,000 H $60,000 Solve for Assets $40,000 Solve for Equity $20,000 Assets Assets Assets Llabilities Equity Liabilities + Equity Liabilities Equity Neros Income Statement Data Neros Revenue Accounts Neros Expense Accounts < Prev 2013 Next > 1 Neros Income Statement Data Neros Revenue Accounts Neros Expense Accounts $50,000 -Book $40,000 erences Utilities Expense Rent Expense $30,000 Hnsurance Expense Advertising Expense $20,000 Salaries Expense $10,000 Consulting Revenue Rental Revenue +ableau statement data for Neros, prepare a December income statement dated December 31 1. Using Income statement data for Neros, prepare a December income statement dated December 31. 2. If Neros pays a cash dividend to its sole stockholder to pay for a family vacation, how is this reported on the financial statements? 3. If the sole stockholder of Neros invests cash into the business, how is this reported on the financial statements? 1.33 points Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 eBook Using Income statement data for Neros, prepare a December income statement dated December 31. References NEROS Income Statement As of December 31 (Assets

34. EX 11-2 Dividends per share ObJ. 2 Lightfoot Inc., a software development firm, has stock...

EX 11-2 Dividends per share

Lightfoot Inc., a software development firm, has stock outstanding as follows: 40,000 shares of cumulative preferred 1% stock, $125 par, and 100,000 shares of $150 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $36,000; second year, $58,000; third year, $75,000; fourth year, $124,000. Calculate the dividends per share on each class of stock for each of the four years.

35. Sako Company’s Audio Division produces a speaker that is used

Sako Company’s Audio Division produces a speaker that is used by manufacturers of various audio products. Sales and cost data on the speaker follow:

Sako Company has a Hi-Fi Division that could use this speaker in one of its products. The Hi-Fi Division will need 5,000 speakers per year. It has received a quote of $57 per speaker from another manufacturer. Sako Company evaluates division managers on the basis of divisional profits.

Required:

1. Assume that the Audio Division is now selling only 20,000 speakers per year to outside customers.

(a) From the standpoint of the Audio Division, what is the lowest acceptable transfer price for speakers sold to the Hi-Fi Division?

(b)From the standpoint of the Hi-Fi Division, what is the highest acceptable transfer price for speakers acquired from the Audio Division?

(c) If left free to negotiate without interference, would you expect the division managers to voluntarily agree to the transfer of 5,000 speakers from the Audio Division to the Hi-Fi Division? Why or why not?

(d) From the standpoint of the entire company, should the transfer take place? Why or why not?

2. Assume that the Audio Division is selling all of the speakers it can produce to outside customers.

(a) From the standpoint of the Audio Division, what is the lowest acceptable transfer price for speakers sold to the Hi-Fi Division?

(b) From the standpoint of the Hi-Fi Division, what is the highest acceptable transfer price for speakers acquired from the Audio Division?

(c)If left free to negotiate without interference, would you expect the division managers to voluntarily agree to the transfer of 5,000 speakers from the Audio Division to the Hi-Fi Division? Why or why not?

(d) From the standpoint of the entire company, should the transfer take place? Why or whynot?

36. What is the advantages and disadvantages of prudence concept

What is the advantages and disadvantages of prudence concept

37. The Classic Theater opened on April 1. All facilities were completed on March 31.

The Classic Theater opened on April 1. All facilities were completed on March 31. At this time, the ledger showed: No. 101 Cash $7,009, No. 140 Land $8,991, No. 145 Buildings (concession stand, projection room, ticket booth, and screen) $6,991, No. 157 Equipment $7,009, No. 201 Accounts Payable $3,009, No. 275 Mortgage Payable $6,991, and No. 311 Common Stock $20,000. During April, the following events and transactions occurred.

Apr. 2 Paid film rental of $1,023 on first movie.

3 Ordered two additional films at $1,709 each.

9 Received $2,798 cash from admissions.

10 Made $2,452 payment on mortgage and $1,430 for accounts payable due.

11 Classic Theater contracted with D. Zarle Company to operate the concession stand.

Zarle is to pay 16% of gross concession receipts (payable monthly) for the rental of the concession stand.

12 Paid advertising expenses $346.

20 Received one of the films ordered on April 3 and was billed $1,709. The film will be shown in April.

25 Received $5,289 cash from admissions.

29 Paid salaries $1,144.

30 Received statement from D. Zarle showing gross concession receipts of $1,900 and the balance due to The Classic Theater of $304 ($1,900 X 16%) for April. Zarle paid one-half of the balance due and will remit the remainder on May 5.

30 Prepaid $875 rental on special film to be run in May.

In addition to the accounts identified above, the chart of accounts shows No. 112 Accounts Receivable, No. 136 Prepaid Rent, No. 400 Service Revenue, No. 429 Rent Revenue, No.610 Advertising Expense, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense.

Instructions:

a. Enter the beginning balances in the ledger as of April 1. Insert a check mark (v) in the reference columns of the ledger for the beginning balance.

b. Journalize the April transactions.

c. Post the April journal entries to the ledger. Assume that all entries are posted from page 1 of the journal.

d. Prepare a trial balance on April 30, 2008.

38. LIFO, FIFO or Average cost

Answer FIFO, LIFO or Average cost | |

2. Rarely used with a perpetual inventory system. | |

3. Produces results that are similar to the specific identification method. | |

4. Widely used for tax purposes. | |

5. Never results in either the highest or lowest possible net income. | |

6. Produces the highest gross profit when costs are decreasing. | |

7. Produces the highest ending inventory when costs are increasing. | |

8. Assigns the same value to all inventory units. | |

9. Prohibited under International Financial Reporting Standards (IFRS). | |

10. Does not follow the physical flow of goods in most cases. | |

11. Cost of the latest purchases are assigned to ending inventory |

39. Principles

Set up an amortization schedule for a $25,000 loan to be repaid in equal installments at the end of each of the next 5 years. This interest rate is 10%.

b.How large must each annual payment be if the loan is for 50,000? Assume that interest rate remains at 10% and that the loan is still paid off over 5 years

c. How large must each payment be if the loan is for 50,000, the interest rate is 10%, and the loan is paid off in equal installments at the end of each of the next 10 years? This loan isfor the same amount as the loan in part b, but the payments are spread out over twice as many periods. Why are these payments not half as large as the payments on the loan I part b,

40. Fickel Company has two manufacturing departments—Assembly and Testing & Packaging. The pred...

Fickel Company has two manufacturing departments—Assembly and Testing & Packaging. The predetermined overhead rates in Assembly and Testing & Packaging are $18.00 per direct labor-hour and $14.00 per direct labor-hour, respectively. The company’s direct labor wage rate is $20.00 per hour. The following information pertains to Job N-60: Assembly Testing & Packaging Direct materials $ 370 $ 37 Direct labor $ 150 $ 70 Required: 1. What is the total manufacturing cost assigned to Job N-60? (Do not round intermediate calculations.) 2. If Job N-60 consists of 10 units, what is the unit product cost for this job? (Do not round intermediate calculations. Round your answer to 2 decimal places.) 1. Total manufacturing cost 2. Unit product cost per unit

41. “A service is rented rather than owned.” Explain what this statement means, and use examples to...

“A service is rented rather than owned.” Explain what this statement means, and use examples to support your explanation. Describe the four broad “processing” categories of services, and provide examples for each.

42. Q9. Which of the following statements best describes the difference between a realized niche and a..

Q9. Which of the following statements best describes the difference between a realized niche and a f… Show more Q9. Which of the following statements best describes the difference between a realized niche and a fundamental niche? A realized niche describes the current environmental conditions in which a species is found, while a fundamental niche describes the environmental conditions in which a species lived in the past. A realized niche describes the interactions between a species and other species in the area, while a fundamental niche describes the interactions between a species and the abiotic environment. A realized niche describes the conditions of the environment in which a species is actually found, while a fundamental niche describes the potential environmental conditions tolerated by a species. Q10. Which of the following would NOT make up part of a bird’s fundamental niche? The composition of the bird’s diet The bird’s nesting requirements The bird’s tolerated temperature range Effects of the bird’s competitors Q11. Which of the following mechanisms of competition could NOT occur between ground-dwelling rodents, such as the bank vole (Clethrionomys glareolus) on the right? Allelopathy Exploitation Preemption Territoriality Q12. As described, both territoriality and preemption are mechanisms of competition for space. How are they different? • Show less

43. Delphi Company has developed a new product that will be

Delphi Company has developed a new product that will be marketed for the first time during the next fiscal year. Although the marketing department estimates that $35,000 units could be sold at $36 per unit, Delphi’s management has allocated only enough manufacturing capacity to produce a maximum of 25,000 units of the new product annually. The fixed expenses associated with the new product are budgeted at $450,000 for the year. The variable expenses of the new product are $16 per unit.

Required:

How much units of the new product must Delphi sell during the next fiscal year in order to break even on the product?

What is the profit Delphi would earn on the new product if all of the manufacturing capacity allocated by management is used and the products is sold for $36 per unit?

44. Mr. Lucas has prepared the following list of statements about

Mr. Lucas has prepared the following list of statements about service companies and merchandisers.

1. Measuring net income for a merchandiser is conceptually the same as for a service company.

2. For a merchandiser, sales less operating expenses is called gross profit.

3. For a merchandiser, the primary source of revenues is the sale of inventory.

4. Sales salaries and wages is an example of an operating expense.

5. The operating cycle of a merchandiser is the same as that of a service company.

6. In a perpetual inventory system, no detailed inventory records of goods on hand are maintained.

7. In a periodic inventory system, the cost of goods sold is determined only at the end of the accounting period.

8. A periodic inventory system provides better control over inventories than a perpetual system.

Instructions

Identify each statement as true or false. If false, indicate how to correct the statement.

45. 131. The following are steps in the accounting cycle. Of the following, which would be..

131. The following are steps in the accounting cycle. Of the following, which would be prepared last?

A. An adjusted trial balance is prepared.

B. Transactions are posted to the ledger.

C. An unadjusted trial balance is prepared.

D. Adjusting entries are journalized and posted to the ledger.

132. The accounting cycle requires three trial balances be done. In what order should they be prepared?

A. Post-closing, unadjusted, adjusted

B. Unadjusted, post-closing, adjusted

C. Unadjusted, adjusted, post-closing

D. Post-closing, adjusted, unadjusted

133. The fiscal year selected by companies

A. is the same as the calendar year

B. begins with the first day of the month and ends on the last day of the twelfth month

C. must always begin on January 1.

D. will change each year

134. A fiscal year

A. ordinarily begins on the first day of a month and ends on the last day of the following twelfth month

B. for a business is determined by the federal government

C. always begins on January 1 and ends on December 31 of the same year

D. should end at the height of the business's annual operating cycle

135. The natural business year

A. is a fiscal year that ends when business activities are at its lowest point.

B. is a calendar year that ends when business activities are at its lowest point.

C. is a fiscal year that ends when business activities are at its highest point.

D. is a calendar year that ends when business activities are at its highest point.

136. The worksheet

A. is an integral part of the accounting cycle

B. eliminates the need to rewrite the financial statements

C. is a working paper that is required

D. is used to summarize account balances and adjustments for the financial statements

137. Which one of the steps below is not aided by the preparation of the work sheet?

A. preparing the adjusted trial balance

B. posting to the general ledger

C. preparing the financial statements

D. preparing the closing entries

138. A work sheet includes columns for

A. adjusting entries

B. closing entries

C. reversing entries

D. adjusting and closing entries

139. When a work sheet is complete, the adjustment columns should have

A. total credits greater than total debits if a net income was earned

B. total debits greater than total credits if a net loss was incurred

C. total debits greater than total credits if a net income was earned

D. total debits equal total credits

140. The difference between the totals of the debit and credit columns of the Adjusted Trial Balance columns on a work sheet

A. is the amount of net income or loss

B. indicates there is an error on the work sheet

C. is not unusual when preparing the work sheet

D. is the net difference between revenue, expenses, and capital stock

46. Problem 24-1A U3 Company is considering three long-term capital investment proposals. Each invest...

Problem 24-1A U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. Project Edge Project Clayton Project Bono $183,750 Capital investment $168,000 $210,000 Annual net income: 14,700 18,900 Year 1 28,350 17,850 24,150 14,700 14,700 16,800 22,050 14,700 12,600 13,650 14,700 9,450 $73,500 $75,600 12,600 $100,800 Total Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Click here to view PV table Compute the cash payback period for each project. (Round answers to 2 decimal places, e.g. 10.50.) years Project Bono Project Edge years years Project Clayton

47. Healthy Products, Inc., uses a traditional product costing system to assign overhead costs uniformly

Healthy Products, Inc., uses a traditional product costing system to assign overhead costs uniformly to all products. To meet Food and Drug Administration requirements and to assure its customers of safe, sanitary, and nutritious food, Healthy engages in a high level of quality control. Healthy assigns its quality-control overhead costs to all products at a rate of 17% of direct labor costs. Its direct labor cost for the month of June for its low-calorie dessert line is $65,000. In response to repeated requests from its financial vice president, Healthy's management agrees to adopt activity-based costing. Data relating to the low-calorie dessert line for the month of June are as follows.

Number of Cost | |||

Overhead | Drivers Used | ||

Activity Cost Pools | Cost Drivers | Rate | per Activity |

Inspections of | |||

material received | Number of pounds | $0.80 per pound | 6,000 pounds |

In-process inspections | Number of servings | $0.33 per serving | 10,000 servings |

FDA certification | Customer orders | $12.00 per order | 420 orders |

Instructions

(a) Compute the quality-control overhead cost to be assigned to the low-calorie dessert product line for the month of June: (1) using the traditional product costing system (direct labor cost is the cost driver), and (2) using activity-based costing.

(b) By what amount does the traditional product costing system undercost or overcost the low-calorie dessert line?

(c) Classify each of the activities as value-added or non–value-added.

48. (a) Which of the following examples definitely illustrates a depreciation of the U.S. dollar? A) The

(a)

Which of the following examples definitely illustrates a depreciation of the U.S. dollar?

A) The dollar exchanges for 200 yen and then exchanges for 250 yen.

B) The dollar exchanges for 2,000 pesos and then exchanges for 3,400 pesos.

C) The dollar exchanges for 250 yen and then exchanges for 200 francs.

D) The dollar exchanges for 120 yen and then exchanges for 100 yen.

(b)

When the U.S. dollar depreciates against the yen, the yen becomes ________ expensive and the exchange rate ________.

A) more; rises

B) less; falls

C) more; falls

D) less; rises

(c)

When the U.S. dollar depreciates against the yen, the yen ________ and the exchange rate ________.

A) appreciates; rises

B) depreciates; rises

C) depreciates; falls

D) appreciates; falls

49. Product layout is preferably used for: a: Repetitive processing b: Intermittent processing c: Both..

Product layout is preferably used for:

a: Repetitive processing

b: Intermittent processing

c: Both (a: and (b:

d: Neither (a: nor (b:

50. The following transactions occurred during July: 1. Received $950 cash for services provided to ...

The following transactions occurred during July: 1. Received $950 cash for services provided to a customer during July. 2. Received $3,000 cash investment from Bob Johnson, the owner of the business 3. Received $800 from a customer in partial payment of his account receivable which arose from sales in June. 4. Provided services to a customer on credit. $425. 5. Borrowed $6, 500 from the bank by signing a promissory note. 6. Received $1, 300 cash from a customer for services to be rendered next year. What was the amount of revenue for July? $1, 375. $12, 550. $950. $3, 475. $2, 675.