Fall Semester Focus: Excel in Accounting Assignments

1. EXERCISE 2–1 Classifying Manufacturing Costs [LO1] The costs below all relate to Sounds Good, a...

EXERCISE 2–1 Classifying Manufacturing Costs [LO1]

The costs below all relate to Sounds Good, a company based in Alberta that manufactures high- end audio equipment such as speakers, receivers, CD players, turntables, and home theatre systems. The company owns all of the manufacturing facilities (building and equipment) but rents the space used by the non-manufacturing employees (accounting, marketing, sales, human resources).

Required:

For each cost, indicate whether it would most likely be classified as a direct labour, direct material, manufacturing overhead, marketing and selling, or administrative cost.

1. Depreciation, taxes, and insurance on the manufacturing facilities.

2. Rent on the office space used by the non-manufacturing staff.

3. Salaries paid to the employees who produce the audio equipment.

4. Cost of the glue used to fasten the company’s logo to the grill used on all of its speakers.

5. The cost of online advertising.

6. Salaries paid to the accounting employees.

7. Salary paid to the production manager who supervises the manufacturing activities for all products.

8. Cost of the plastic used for turntable dust covers.

9. Bonuses paid to sales staff for meeting their monthly sales goals.

10. Salary paid to the manager of the human resources department.

2. Natalie had a very busy December. At the end of

Natalie had a very busy December. At the end of the month, after journalizing and posting the December transactions and adjusting entries, Natalie prepared the following adjusted trial balance.

Instructions

Using the information in the adjusted trial balance, do the following.

(a) Prepare an income statement and an owner’s equity statement for the 2 months ended December 31, 2011, and a classified balance sheet as at December 31, 2011. The note payable has a stated interest rate of 6%, and the principal and interest are due on November 16, 2013.

(b) Natalie has decided that her year-end will be December 31, 2011. Prepare and post closing entries as of December 31, 2011.

(c) Prepare a post-closing trialbalance.

3. Calculate the monthly rent for Art.

Art Neuner, an investor in real estate, bought an office condominium. The market value of the condo was $250,000 with a 70% assessment rate. Art feels that his return should be 12% per month on his investment after all expenses. The tax rate is $31.50 per $1,000. Art estimates it will cost $275 per month to cover general repairs, insurance, and so on. He pays a $140 condo fee per month. All utilities and heat are the responsibility of the tenant. Calculate the monthly rent for Art. Round your answer to the nearest dollar (at intermediate stages).

4. Bert Garro is a waiter at La Bron House, where he receives a weekly wage of $75 plus tips for a...

2-2B LO 1. Bert Garro is a waiter at La Bron House, where he receives a weekly wage of $75 plus tips for a 40-hour workweek. Garro’s weekly tips usually range from $300 to $350.

a. Under the Fair Labor Standards Act, the minimum amount of wages that Garro must receive for a 40-hour workweek is . . . . . . . . . $

b. Since La Bron House is in violation of the FLSA, the additional amount it should pay Garro each week to meet the minimum wage requirement for a tipped employee is . . . . $

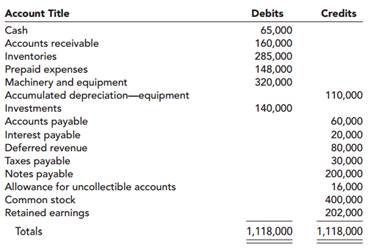

5. Balance sheet preparation The following is the ending balances of accounts at December 31, 2016...

Balance sheet preparation

The following is the ending balances of accounts at December 31, 2016 for the Weismuller Publishing Company.

Additional Information:

1. Prepaid expenses include $120,000 paid on December 31, 2016, for a two-year lease on the building that houses both the administrative offices and the manufacturing facility.

2. Investments include $30,000 in Treasury bills purchased on November 30, 2016. The bills mature on January 30, 2017. The remaining $110,000 includes investments in marketable equity securities that the company intends to sell in the next year.

3. Deferred revenue represents customer prepayments for magazine subscriptions. Subscriptions are for periods of one year or less.

4. The notes payable account consists of the following: a. a $40,000 note due in six months. b. a $100,000 note due in six years. c. a $60,000 note due in three annual installments of $20,000 each, with the next installment due August 31, 2017.

5. The common stock account represents 400,000 shares of no par value common stock issued and outstanding. The corporation has 800,000 shares authorized.

Required:

Prepare a classified balanced sheet for the Weismuller Publishing Company at December 31, 2016.

Question- BuyCo holds 25 percent of the outstanding shares of Marqueen and appropriately applies the equity method of accounting. Excess cost amortization (related to a patent) associated with this investment amounts to $10,000 per year. For 2014, Marqueen reported earnings of $100,000 and declares cash dividends of $30,000. During that year, Marqueen acquired inventory for $50,000, which it then sold to BuyCo for $80,000. At the end of 2014, BuyCo continued to hold merchandise with a transfer price of $32,000. a. What Equity in Investee Income should BuyCo report for 2014? b. How will the intra-entity transfer affect BuyCo?s reporting in 2015? c. If BuyCo had sold the inventory to Marqueen, how would the answers to ( a ) and ( b ) have changed?

7. Prepare a Cost–Volume–Profit (CVP) Graph [LO2

Karlik Enterprises distributes a single product whose selling price is $24 and whose variable expense is $18 per unit. The company’s monthly fixed expense is $24,000.

Required:

1. Prepare a cost-volume-profit graph for the company up to a sales level of 8,000 units.

2. Estimate the company’s break-even point in unit sales using your cost-volume-profit graph.

8. A machine costing $257500 with a four-year life and an estimated $20,000 salvage value is install...

Show transcribed image text A machine costing $257500 with a four-year life and an estimated $20,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 475,000 units of product during its life. It actually produces the following units: 220.000 in 1st year, 124,600 in 2nd year, 121,800 in 3rd year, 15,200 in 4th year. The total number of units produced by the end of year 4 exceeds the original estimate-this difference was not predicted. The machine must not be depreciated below its estimated salvage value) Required Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. your depreciation to 2 decimal places.) Complete this question by entering your answers in the tabs below. Straight Line Units of Compute depreciation for each year (and total depreciation of all years combined) for the machine under each Straight-line depreciation. Depreciation Expense next

9. 13. The following information was available from the inventory records of Queen Company for July: Un

13. The following information was available from the inventory records of Queen Company for July: Units Unit Cost Total Cost Balance at July 1 30,000 £ 2.25 £67,500 Purchases: July 6 20,000 2.55 51,000 July 26 27,000 2.60 70,200 Sales: July 7 July 31 Balance at July 31 (25,000) (40,000) 12.000 What should be the inventory reported on Queen's July 31 statement of financial position using the average-cost inventory method (round per unit amounts to two decimal places)? a. £27,000. b. £29,400. c. £29,610. d. £31,500.

10. Maria Juarez is a licensed dentist. During the first month of operation of her business, the...

Maria Juarez is a licensed dentist. During the first month of operation of her business, the following events andtransactions occurred.April 01: Invested $40000 cash.April 02: Paid office rent expense for the month $1000.April 03: Purchased dental supplies on account from Smile Company $4000.April 10: Provided dental services and billed insurance company $5100.April 11: Received $1000 cash from the insurance company.April 20: Received $2200 cash for service completed and delivered to John Stanly.April 30: Paid secretary-receptionist at a salary expense for the month $2400.April 30: Paid $1600 to smile Company for accounts payable due.April 30: Withdrew $1000 cashRequired:1.Record each transaction in the general journal form. Include a brief explanation of the transaction.Maria Juarez licensed dentistGeneral JournalApril , 2011DateAccounts Title and ExplanationsDebitCreditApril 1Cash40000Capital40000Issued capitalApril 2Rent Expense1000Cash1000Paid rentApril 03Supplies4000Accounts payable4000Purchased suppliesApril 10Accounts Receivable5100Revenue5100Provide servicesApril 11Cash1000Accounts Receivable1000Received cash from insurance companyApril 20Cash2200Revenue2200Provide a service cashApril 30Salary expense2400Cash2400Paid salary expenseApril 30Accounts payable1600Cash1600Paid accounts payableApril 30Withdrawals1000Cash1000Withdrew cash

11. The trial balance columns of the worksheet for Gibson Roofing

The trial balance columns of the worksheet for Gibson Roofing at March 31, 2012, are as follows.

Other data:

1. A physical count reveals only $550 of roofing supplies on hand.

2. Depreciation for March is $250.

3. Unearned revenue amounted to $210 at March 31.

4. Accrued salaries are $700.

Instructions

(a) Enter the trial balance on a worksheet and complete the worksheet.

(b) Prepare an income statement and owner’s equity statement for the month of March and a classified balance sheet at March 31. T. Gibson did not make any additional investments in the business in March.

(c) Journalize the adjusting entries from the adjustments columns of the worksheet.

(d) Journalize the closing entries from the fiancial statement columns of theworksheet.

12. multiple-step income statement

The accountant of Weatherspoon Shoe Co. has compiled the following information from the company's records as a basis for an income statement for the year ended December 31, 2010.

Rental revenue $29,000

Interest expense 18,000

Market appreciation on land above cost 31,000

Wages and salaries-sales 114,800

...

13. The Dud Company purchases raw materials on terms of “2/10, net 30.” A review of the company’s...

The Dud Company purchases raw materials on terms of “2/10, net 30.” A review of the company’s records by the owner, Ms. Dud, revealed that payments are usually made 15 days after purchases are received. When asked why the firm did not take advantage of its discounts, the bookkeeper, Mr. Blunder, replied that it costs only 2 percent for these funds, whereas a bank loan would cost the firm 12 percent.

a. What mistakes is Mr. Blunder making?

b. What is the real cost of not taking advantage of the discount?

c. If the firm could not borrow from the bank and were forced to resort to the use of trade credit funds, what suggestion might be made to Mr. Blunder that would reduce the annual interest cost?

14. The following figures are extracted from the trial balance of Gogetter company on 30 September 1998:

The following figures are extracted from the trial balance of Gogetter company on 30 September 1998:

i. Inventories:

Finished stock | 40,000 |

Raw materials | 70,000 |

WIP | 1,00,000 |

Office appliances | 8,700 |

Plant and machinery | 2,30,250 |

Buildings | 1,00,000 |

Sales | 3,84,000 |

Sales return and rebates | 7,000 |

Material purchased | 1,60,000 |

Freight incurred on materials | 8,000 |

Purchase returns | 2,400 |

Direct labour | 80,000 |

Indirect labour | 9,000 |

Factory supervision | 5,000 |

Repairs and upkeep of factory | 7,000 |

Heat, light and power | 32,500 |

Rates and taxes | 3,150 |

Sales travelling | 5,500 |

Miscellaneous factory expenses | 9,350 |

Sales commission | 16,800 |

Sales promotion | 11,250 |

Distribution department salaries and expenses | 9,000 |

ii.Office salaries and expenses:

Office salaries and expenses | 4,300 |

Interest on borrowed funds | 1,000 |

Further details are available as follows:

i.Closing inventories:

Finished goods | 57,500 | |

Raw materials | 90,000 | |

Work-in-process | 96,000 |

ii. Accrued expenses on

Direct labour | 4,000 | |

Indirect labour | 600 | |

Interest on borrowed funds | 1,000 |

iii. Depreciation to be provided on

Office appliances | 5% |

Plant and machinery | 10% |

Buildings | 4% |

iv.Distribution of the following costs:

Heat, light and power to factory, office and selling in the ratio 8:1:1. Rates and taxes two thirds of factory and one third of office. Depreciation on buildings to factory, office and selling in the ratio 8:1:1.

Prepare

- Administration ratio

- Selling and distribution expenses

- Cost of sales

- Profit and sales statement

15. Matt Stiner started a delivery service, Stiner Deliveries, on June 1, 2014. The following...

|

|

|

|

|