Expert Assistance for Accounting Assignments and Research Papers

40. 00413 2.pdf Omega Company adjusts its accounts at the end of each month. The following Informatio...

00413 2.pdf Omega Company adjusts its accounts at the end of each month. The following Information has been assembled in order to prepare the required adjusting entries at December 31: (1) A one-year bank loan of $720,000 at an annual interest rate of 12% had been obtained on December 1. (2) The company pays all employees up-to-date each Friday. Since December 31 fell on Tuesday. there was a liability to employees at December 31 for two day's pay amounting to $6,800 (3) On December 1, rent on the office building had been paid for four months. The monthly rent is S6,000 (4) Depreciation of office equipment is based on an estimated useful life of six years. The balance in the Office Equipment account is S9,360; no change has occurred in the account during the year. (5) Fees of $9 800 were earned during the month for clients who had paid in advance 3. Refer to the information above. What amount of interest expense has accrued on the bank loan? S6 400

41. Equivalent units, zero beginning inventory. Candid, Inc. is a manufacturer of digital cameras. It...

Equivalent units, zero beginning inventory. Candid, Inc. is a manufacturer of digital cameras. It has two departments: assembly and testing. In January 2017, the company incurred $800,000 on direct materials and $805,000 on conversion costs, for a total manufacturing cost of $1,605,000.

1. Assume there was no beginning inventory of any kind on January 1, 2017. During January, 5,000 cameras were placed into production and all 5,000 were fully completed at the end of the month. What is the unit cost of an assembled camera in January?

2. Assume that during February 5,000 cameras are placed into production. Further assume the same total assembly costs for January are also incurred in February, but only 4,000 cameras are fully completed at the end of the month. All direct materials have been added to the remaining 1,000 cameras. However, on average, these remaining 1,000 cameras are only 60% complete as to conversion costs. (a) What are the equivalent units for direct materials and conversion costs and their respective costs per equivalent unit for February? (b) What is the unit cost of an assembled camera in February 2017?

3. Explain the difference in your answers to requirements 1 and 2.

42. 1. A company issues a new 10 per cent debentures of Rs 1,000 face value to be redeemed after 10...

1. A company issues a new 10 per cent debentures of Rs 1,000 face value to be redeemed after 10 years The debenture is expected to be sold at 5 per cent discount. It will also involve floatation costs of 5 per cent of face value. The company’s tax rate is 35 per cent. What would the cost of debt be? Illustrate the computations using (i) trial and error approach and (ii) shortcut method.

2. A company issues 11 per cent debentures of Rs 100 for an amount aggregating Rs 1,00,000 at 10 per cent premium, redeemable at par after five years. The company’s tax rate is 35 per cent. Determine the cost of debt, using the shortcut method.

43. 71) Yummy Tummy Desserts has 3,200 quarts of ice cream in WIP inventory, with all materials already.

71) Yummy Tummy Desserts has 3,200 quarts of ice cream in WIP inventory, with all materials already added. What are equivalent units in ending WIP inventory for materials if the ice cream is 75% through the process?

A) 3,200

B) 2,400

C) 800

D) 0

72) Yummy Tummy Desserts has 3,200 quarts of ice cream in WIP inventory, with all materials already added. The ice cream is 75% through the process. Assuming all conversion costs are added evenly throughout the process, what are the equivalent units for conversion costs?

A) 0

B) 3,200

C) 2,400

D) 800

73) The following information is provided by Alexandria Corporation:

WIP inventory, January 1 | 0 units |

Units started | 14,000 |

Units completed and transferred out | 9,000 |

WIP inventory, December 31 | 5,000 |

Direct materials | $28,200 |

Direct labor | $18,000 |

Manufacturing overhead | $7,500 |

The units in ending WIP inventory were 75% complete for materials and 50% complete for conversion costs.

What are the total equivalent units for direct materials?

A) 12,750

B) 3,750

C) 5,000

D) 14,000

74) The following information is provided by Alexandria Corporation:

WIP inventory, January 1 | 0 units |

Units started | 14,000 |

Units completed and transferred out | 9,000 |

WIP inventory, December 31 | 5,000 |

Direct materials | $28,200 |

Direct labor | $18,000 |

Manufacturing overhead | $7,500 |

The units in ending WIP inventory were 75% complete for materials and 50% complete for conversion costs.

At the end of the year, what are the equivalent units for conversion costs?

A) 7,000

B) 9,000

C) 2,500

D) 11,500

75) The following information is provided by Zander Corporation:

WIP inventory, January 1 | 0 units |

Units started | 14,000 |

Units completed and transferred out | 9,000 |

WIP inventory, December 31 | 5,000 |

Direct materials | $28,200 |

Direct labor | $18,000 |

Manufacturing overhead | $7,500 |

The units in ending WIP inventory were 80% complete for materials and 45% complete for conversion costs.

What are the total equivalent units for direct materials?

A) 14,000

B) 5,000

C) 4,000

D) 13,000

76) The following information is provided by Zander Corporation:

WIP inventory, January 1 | 0 units |

Units started | 14,000 |

Units completed and transferred out | 9,000 |

WIP inventory, December 31 | 5,000 |

Direct materials | $28,200 |

Direct labor | $18,000 |

Manufacturing overhead | $7,500 |

At the end of the year, what are the equivalent units for conversion costs?

A) 11,250

B) 6,300

C) 2,250

D) 9,000

77) The following information is provided by Arrow Company:

WIP inventory, January 1 | 0 units |

Units started | 7,000 |

Units completed and transferred out | 4,000 |

WIP inventory, December 31 | 3,000 |

Direct materials | $15,500 |

Direct labor | $18,400 |

Manufacturing overhead | $9,000 |

The units in ending WIP inventory were 80% complete for materials and 40% complete for conversion costs.

What are the total equivalent units for direct materials?

A) 2,400

B) 6,400

C) 3,000

D) 7,000

78) The following information is provided by Arrow Company:

WIP inventory, January 1 | 0 units |

Units started | 7,000 |

Units completed and transferred out | 4,000 |

WIP inventory, December 31 | 3,000 |

Direct materials | $15,500 |

Direct labor | $18,400 |

Manufacturing overhead | $9,000 |

The units in ending WIP inventory were 80% complete for materials and 40% complete for conversion costs.

At the end of the year, what are the equivalent units for conversion costs?

A) 5,200

B) 1,200

C) 4,000

D) 2,800

79) The following information is provided by Adametz Company:

WIP inventory, January 1 | 0 units |

Units started | 7,500 |

Units completed and transferred out | 3,300 |

WIP inventory, December 31 | 4,200 |

Direct materials | $15,500 |

Direct labor | $18,400 |

Manufacturing overhead | $9,000 |

The units in ending WIP inventory were 90% complete for materials and 50% complete for conversion costs.

What are the total equivalent units for direct materials?

A) 7,080

B) 3,780

C) 4,200

D) 7,500

80) The following information is provided by Adametz Company:

WIP inventory, January 1 | 0 units |

Units started | 7,500 |

Units completed and transferred out | 3,300 |

WIP inventory, December 31 | 4,200 |

Direct materials | $15,500 |

Direct labor | $18,400 |

Manufacturing overhead | $9,000 |

The units in ending WIP inventory were 90% complete for materials and 50% complete for conversion costs.

At the end of the year, what are the equivalent units for conversion costs?

A) 3,750

B) 3,300

C) 5,400

D

44. Under the terms of the current contractual agreement, Burger Queen (BQ) is entitled to 20 percent of

Under the terms of the current contractual agreement, Burger Queen (BQ) is entitled to 20 percent of the revenue earned by each of its

franchises. BQ’s best-selling item is the Slopper (it slops out of the bun). BQ supplies the ingredients for the Slopper (bun, mystery meat, etc.) at cost to the franchise. The franchisee’s average cost per Slopper (including ingredients, labor cost, and so on) is $.80. At a particular franchise restaurant, weekly demand for Sloppers is given by P = 3.00 - Q/800.

- If BQ sets the price and weekly sales quantity of Sloppers, what quantity and price would it set? How much does BQ receive? What is the franchisee’s net profit?

- Suppose the franchise owner sets the price and sales quantity. What price and quantity will the owner set? ( Hint: Remember that the owner keeps only $.80 of each extra dollar of revenue earned.) How does the total profit earned by the two parties compare to their total profit in part (a)?

- Now, suppose BQ and an individual franchise owner enter into an agreement in which BQ is entitled to a share of the franchisee’s profit. Will profit sharing remove the conflict between BQ and the franchise operator? Under profit sharing, what will be the price and quantity of Sloppers? (Does the exact split of the profit affect your answer? Explain briefly.) What is the resulting total profit?

- Profit sharing is not widely practiced in the franchise business. What are its disadvantages relative to revenue sharing?

45. Balance sheet preparation The following is a December 31, 2016, post-closing trial balance for...

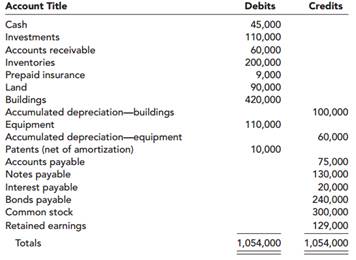

Balance sheet preparation

The following is a December 31, 2016, post-closing trial balance for Almway Corporation.

Additional Information:

1. The investment account includes an investment in common stock of another corporation of $30,000 which management intends to hold for at least three years. The balance of these investments is intended to be sold in the coming year.

2. The land account includes land which cost $25,000 that the company has not used and is currently listed for sale.

3. The cash account includes $15,000 restricted in a fund to pay bonds payable that mature in 2019 and $23,000 restricted in a three-month Treasury bill.

4. The notes payable account consists of the following:

a. a $30,000 note due in six months.

b. a $50,000 note due in six years.

c. a $50,000 note due in five annual installments of $10,000 each, with the next installment due

February 15, 2017.

5. The $60,000 balance in accounts receivable is net of an allowance for uncollectible accounts of $8,000.

6. The common stock account represents 100,000 shares of no par value common stock issued and outstanding. The corporation has 500,000 shares authorized.

Required:

Prepare a classified balance sheet for the Almway Corporation at December 31, 2016.

46. On July 1, 2006, Leon Cruz established an interior decorating business, Ingres Designs. During...

On July 1, 2006, Leon Cruz established an interior decorating business, Ingres Designs. During the remainder of the month, Leon Cruz completed the following transactions related to the business:

July 1 Leon transferred cash from a personal bank account to an account to be used for the business in exchange for capital stock, $18,000.

5 Paid rent for the period of July 5 to the end of the month, $1,500.

10 Purchased a truck for $15,000, paying $5,000 cash and giving a note payable for the remainder.

13 Purchased equpment on account, $4,500.

14 Purchased supplies for cash, $975.

15 Paid annual premiums on property and casualty insurance, $3,000.

15 Received cash for job completed, $4,100.

21 Paid creditor a portion of the amount owed for equipment purchased on July 13, $2,400.

24 Recorded jobs completed on account and sent invoices to customers, $6,100.

26 Received an invoice for truck expenses, to be paid in August, $580.

27 Paid utilities expense, $950.

27 Paid miscellaneous expense, $315.

29 Received cash from customers on account, $3,420.

30 Paid wages of employees, $2,500.

31 Paid dividends, $2,000.

Instructions

1. Journalize each transaction in a two-column journal, referring to the following chart of accounts in selecting the accounts to be debited and credited.

Cash Capital Stock

Accounts Receivable Dividends

Supplies Fees Earned

Prepaid Insurance Wages Expense

Equipment Rent Expense

Truck Utilities Expense

Notes Payable Truck Expense

Accounts Payable Miscellaneous Expense

2. Post the journal to a ledger of T accounts. For accounts with more than one posting, determine the account balance.

3. Prepare a trial balance for Ingres Designs as of July 31, 2006.

47. List the three stages in the consumption process. Describe the issues that you considered in each of

List the three stages in the consumption process. Describe the issues that you considered in each of these stages when you made a recent important purchase.

48. Alladin Company purchased Machine #201 on May 1, 2014. The following information relating to...

|

|

|

|

| ||||||||||||||||||||||||||||

49. Julia Baker died, leaving to her husband Brent an insurance policy contract that provides that the b

Julia Baker died, leaving to her husband Brent an insurance policy contract that provides that the beneficiary (Brent) can choose any one of the following four options. Money is worth 2.50% per quarter, compounded quarterly. Compute Present value if: (Use the tables below.)

1)$55,130 immediate cash. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.)

Present value | $ |

2)$4,162 every 3 months payable at the end of each quarter for 5 years. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.)

Present value | $ |

3)$19,420 immediate cash and $1,942 every 3 months for 10 years, payable at the beginning of each 3-month period. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.)

Present value | $ |

4)$4,162 every 3 months for 3 years and $1,472 each quarter for the following 25 quarters, all payments payable at the end of each quarter. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.)

Present value | $ |

50. Four different corporations, Aries, Germini, Leo, and Pisces,

Four different corporations, Aries, Germini, Leo, and Pisces, show the same balance sheet data at the beginning and end of a year. These data, exclusive of the amount of stockholders’ equity, are summarized as follows:

On the basis of the above data and the following additional information for the year, determine the net income (or loss) of each company for the year.

Aries: No additional capital stock was issued and no dividends were paid.

Gemini: No additional capital stock was issued, but dividends of $40,000 were paid.

Leo: Additional capital stock of $90,000 was issued, but no dividends were paid.

Pisces: Additional capital stock of $90,000 was issued and dividends of $40,000 were paid.