Every Assignment: Accounting Help for Superior Performance

16. Which of the following is a common reason for using headhunters in recruitment? Option 1: It...

Which of the following is a common reason for using headhunters in recruitment?Option 1: It leads to the appointment of individuals who stay for longer periods of time

Option 2: It allows confidential channels of communication to be opened to individuals working for competitors

Option 3: It is less expensive than advertising a position

Option 4: It produces a good cross-section of applicants

17. 3.17 A bank branch located in a commercial district of a city has the business objective of...

3.17 A bank branch located in a commercial district of a city has the business objective of developing an improved process for serving customers during the noon-to-1:00 P.M. lunch period. The waiting time, in minutes, is defined as the time the customer enters the line to when he or she reaches the teller window. Data are collected from a sample of 15 customers during this hour. The file contains the results, which are also listed here:4.21 5.55 3.02 5.13 4.77 2.34 3.54 3.20a. Compute the mean and median. b. Compute the variance, standard deviation, range, coefficient of variation, and Z scores. Are there any outliers? Explain. c. Are the data skewed? If so, how? d. As a customer walks into the branch office during the lunch hour, she asks the branch manager how long she can expect to wait. The branch manager replies, “Almost certainly less than five minutes.” On the basis of the results of (a) through (c), evaluate the accuracy of this statement

18. On November 10th, JumpStart Co. provides $2,900 in services to clients

On November 10th, JumpStart Co. provides $2,900 in services to clients. At the time of service, the clients paid $600.00 in cash and put the balance on account.

(a) Journalize this event.

(b) On November 20th, JumpStart Co. clients paid an additional $900 on their accounts due. Journalize this event.

(c) Calculate the amount of accounts receivable on November 30th.

19. Jurvin Enterprises recorded the following transactions for the just completed month. The company ...

Jurvin Enterprises recorded the following transactions for the just completed month. The company had no beginning inventories. |

a. | $94,000 in raw materials were purchased for cash. |

b. | $89,000 in raw materials were requisitioned for use in production. Of this amount, $78,000 was for direct materials and the remainder was for indirect materials. |

c. | Total labor wages of $132,000 were incurred and paid. Of this amount, $112,000 was for direct labor and the remainder was for indirect labor. |

d. | Additional manufacturing overhead costs of $143,000 were incurred and paid. |

e. | Manufacturing overhead costs of $152,000 were applied to jobs using the company’s predetermined overhead rate. |

f. | All of the jobs in progress at the end of the month were completed and shipped to customers. |

g. | Any underapplied or overapplied overhead for the period was closed out to Cost of Goods Sold. |

Required: | |

1. | Post the above transactions to T-accounts. |

2. | Determine the cost of goods sold for the period. |

20. Public utilities' balance sheets list the plant assets before the current assets. This is accept

Public utilities' balance sheets list the plant assets before the current assets. This is acceptable under which accounting principle/guideline?

Select one:

a. Conservatism

b. Industry Practices

c. Cost

A large company purchases a $250 digital camera and expenses it immediately instead of recording it as an asset and depreciating it over its useful life. This practice may be acceptable because of which principle/guideline?

Select one:

a. Materiality

b. Cost

c. Matching

A corporation pays its annual property tax bill of approximately $12,000 in one payment each December 28. During the year, the corporation's monthly income statements report Property Tax Expense of $1,000. This is an example of which accounting principle/guideline?

Select one:

a. Monetary Unit

b. Matching

c. Conservatism

A company sold merchandise of $8,000 to a customer in December. The company's sales terms require the customer to pay the company in 30 days. The company's income statement reported the sale in December. This is proper under which accounting principle/guideline?

Select one:

a. Revenue Recognition

b. Monetary Unit

c. Full Disclosure

Accrual accounting is based on this principle/guideline.

Select one:

a. Matching

b. Full Disclosure

c. Cost

21. The Payroll Manager, Gilles Lowney, has requested a summary of how the Canada Revenue Agency...

1. Scenario

The Payroll Manager, Gilles Lowney, has requested a summary of how the Canada Revenue Agency shares responsibility for the administration of the Canada Pension Plan and Employment Insurance programs with other federal agencies. In a memo format, outline the responsibilities of each appropriate agency, for each of the programs.

2. Scenario

Your supervisor, Janine Beauregard, has requested you prepare a memo explaining what a Record of Employment is, the importance of the form, and the importance of completing the form accurately. She is going to use the information you provide in a meeting with the payroll professionals to reinforce the importance of completing accurate Record of Employment forms.

3. Scenario

The new Finance Manager, Rose Wilson, does not have experience with payroll and has requested that you explain how the statutory deductions are calculated.

Write a memo to Rose explaining what the statutory deductions consist of and by what methods they may be determined.

4. Scenario

You have been asked by the payroll manager to create a memo explaining gross pensionable/taxable income and net taxable income for the junior payroll professionals in the department. Your summary will assist them with this learning curve.

5. Scenario

Your organization in Manitoba is going through financial difficulties. They are planning to terminate the employment of 80 employees. You have been asked to prepare a memo for the Vice-President of Finance, outlining the regulations for group termination in Manitoba.

6. Scenario

In the past your organization has encountered problems implementing the changes required by new union collective agreements. These problems have included being unable to meet agreed deadlines for processing retroactive pay and implementing new earnings and deductions. It is time once again for negotiations and, as Payroll Manager, you would like to be part of the process. After discussions with the Vice-President, Finance, Shirley Jackson, you have been asked to provide a written document outlining the advantages of having payroll participate in this process.

Prepare a memo to Shirley outlining the problems you have encountered in the past and how they could have been avoided if you had been part of the negotiation process.

22. Entries for the Warren Clinic 2015 Income Statement are listed below in alphabetical order. Reord...

Entries for the Warren Clinic 2015 Income Statement are listed below in alphabetical order. Reorder the data in proper format.

Depreciation Expense 90,000

General/administrative expenses 70,000

Interest expense 20,000

Investment income 40,000

Net income 30,000

Net operating revenues 410,000

Other revenue 10,000

Patient service revenue 440,000

Provision for bad debts 40,000

Purchased clinic services 90,000

Salaries and benefits 150,000

Total expenses 460,000

23. write a procedure detailing how you would set up and operate a computerised accounting system....

1. For this task you are to write a procedure detailing how you would set up and operate a computerised accounting system. This procedure is to be written to an audience who have no previous knowledge of the subject and should be designed to instruct them on the exact procedure for setting up and operating a computerised accounting system. In line with organisational requirements, procedures and policies. industry legislation relating to computerised accounting systems Ensure you cover the following areas in your procedure: a. Setting up an integrated accounting system b. Setting up customers, suppliers and inventory items c. Processing transactions within the system d. Ensuring integrity of the data e. Generating, producing and printing reports f. Maintaining the system g. Ensuring system integrity h. Identifying technical help 2. For this task you must research each of the following topics and complete a basic report on your findings. The research topics are: a. What are the key features and characteristics of information included in source documents of financial data? b. Discuss the key features of desktop and cloud-based computerised accounting systems c. Outline the key features of organisational policies and procedures relating to setting up and operating a computerised accounting system. d. What are the key requirements of financial services industry legislation relating to information privacy when using computerised accounting systems? Discuss three.

Document Preview:

ASSESSMENT GUIDE FNSACC416 SET UP AND OPERATE A COMPUTERISED ACCOUNTING SYSTEM

ASSESSMENT INFORMATION for students Throughout your training we are committed to your learning by providing a training and assessment framework that ensures the knowledge gained through training is translated into practical on the job improvements. You are going to be assessed for: Your skills and knowledge using written and observation activities that apply to the workplace. Your ability to apply your learning. Your ability to recognise common principles and actively use these on the job. All of your assessment and training is provided as a positive learning tool. Your assessor will guide your learning and provide feedback on your responses to the assessment materials until you have been deemed competent in this unit. HOW YOU WILL BE ASSESSED The process we follow is known as competency-based assessment. This means that evidence of your current skills and knowledge will be measured against national standards of best practice, not against the learning you have undertaken either recently or in the past. Some of the assessment will be concerned with how you apply your skills and knowledge in the workplace, and some in the training room as required by each unit. The assessment tasks have been designed to enable you to demonstrate the required skills and knowledge and produce the critical evidence to successfully demonstrate competency at the required standard. Your assessor will ensure that you are ready for assessment and will explain the assessment process. Your assessment tasks will outline the evidence to be collected and how it will be collected, for example; a written activity, case study, or demonstration and observation. The assessor will also have determined if you have any special needs to be considered during assessment. Changes can be made to the way assessment is undertaken to account for special needs and this is called making Reasonable Adjustment.

What if I believe...

24. The 2017 financial statements for Armstrong and Blair companies are summarized below Armstrong Blair

The 2017 financial statements for Armstrong and Blair companies are summarized below Armstrong Blair Company Company Statement of Financial Position Cash $ 34,200 62,000 230,000 195,000 92,000 $ 20,000 41,000 46,000 490,000 350,000 Accounts receivable (net) Inventory Property, plant, and equipment (net) Other non-current assets $ 613,200 $947,000 Total assets $ 148,000 71,500 292,500 40,000 61,200 Current liabilities Long-term debt (10%) Share capital Contributed surplus Retained earnings $ 45,000 70,000 610,000 145,500 76,500 $ 613,200 Total liabilities and shareholders' equity $947,000 Statement of Earnings Sales revenue (1/3 on credit) Cost of sales $640,000 (320,000) (230,400) $950,000 (427,500) (380,000) Expenses (including interest and income tax) $ 89,600 $ 142,500 Net earnings Selected data from the 2016 statements follows: $ 53,000 35,000 70,000 $35,000 73,000 71,500 Accounts receivable (net) Inventory Long-term debt Other data: Share price at end of 2017 Income tax rate $ 18 15 30% $40,000 15,000 30% $280,000 50,000 Dividends declared and paid in 2017 Number of common shares during 2017 The companies are in the same line of business and are direct competitors in a large metropolitan area. Both have been in business approximately 10 years, and each has had steady growth. The management of each has a different viewpoint in many respects. Blair Company is more conservative, and as its president said, "We avoid what we consider to be undue risk." Neither company is publicly held. Armstrong Company has an annual audit by an independent auditor, but Blair Company does not. Required: 1. Complete a schedule that reflects a ratio analysis of each company. Use ending balances if average balances are not available. (Round intermediate calculations and final answers to 2 decimal places.) Armstrong Company Blair Company Ratio Tests of profitability: Return on equity % % Return on assets Financial leverage percentage Earnings per share per share per share Profit margin Fixed asset turnover times times Tests of liquidity: Cash ratio Current ratio Quick ratio Receivables turnover times times Inventory turnover times times Tests of solvency: Times-interest-earned ratio times times Debt-to-equity ratio Market tests: Price/earnings ratio Dividend yield ratic

25. Exercise 2-6 Analyzing account entries and balances LO A1 Use the information in each of the...

Exercise 2-6 Analyzing account entries and balances LO A1 Use the information in each of the following separate cases to calculate the unknown amount.

Document Preview:

Exercise 2-6 Analyzing account entries and balances LO A1 Use the information in each of the following separate cases to calculate the unknown amount. a.Corentine Co. had $152,000 of accounts payable on September 30 and $132,500 on October 31. Total purchases on account during October were $281,000. Determine how much cash was paid on accounts payable during October.

26. (Bank Reconciliation and Adjusting Entries) The cash account of Aguilar Co. showed a ledger...

(Bank Reconciliation and Adjusting Entries) The cash account of Aguilar Co. showed a ledger balance of $3,969.85 on June 30, 2014. The bank statement as of that date showed a balance of $4,150. Upon comparing the statement with the cash records, the following facts were determined.

1. There were bank service charges for June of $25.

2. A bank memo stated that Bao Dai’s note for $1,200 and interest of $36 had been collected on June 29, and the bank had made a charge of $5.50 on the collection. (No entry had been made on Aguilar’s books when Bao Dai’s note was sent to the bank for collection.)

3. Receipts for June 30 for $3,390 were not deposited until July 2.

4. Checks outstanding on June 30 totaled $2,136.05.

5. The bank had charged the Aguilar Co.’s account for a customer’s uncollectible check amounting to $253.20 on June 29.

6. A customer’s check for $90 had been entered as $60 in the cash receipts journal by Aguilar on June 15.

7. Check no. 742 in the amount of $491 had been entered in the cash journal as $419, and check no. 747 in the amount of $58.20 had been entered as $582. Both checks had been issued to pay for purchases of equipment.

Instructions

(a) Prepare a bank reconciliation dated June 30, 2014, proceeding to a correct cash balance. (b) Prepare any entries necessary to make the books correct and complete.

27. For each item below, indicate whether a debit (DR)or credit (CR) applies.????

For each item below, indicate whether a debit (DR)or credit (CR) applies.????

1. Decrease in Prepaid Rent ?

2. ?. Increase in Unearned Revenue ??

3. ?. Increase in Accounts Payable ??

4. . Increase in Dividends ??

5. . Increase in Dividend Receivable ??

6.Increase in Wages expense ?

6. ?Increase in Accounts Receivable ?

7. ? Decrease in Supplies ??

8. Increase in Accumulated Depreciation???

9. Increase in Copyrights

Prepare, in good form, journal entries for the following transactions from Buster Brown Corporation.???

May 1 Stockholders invest $40,000 cash to start the business.??

May 2 Purchased equipment for $100,000, paying $20,000 and signing a five-year, 6% note for the remainder.?

?May 3 Purchased $2,000 of paper supplies on account.??

May 4 Cash received for services amounted to $5,500.?

?5. Paid $800 for radio advertising.??

6. Paid $500 on account for paper supplies purchased on May 3rd.

?7. Dividends of $200 were paid to stockholders.?

?8. Paid $600 for the current month's rent.?

?9. Received $2,000 cash advance from a customer. ??

10. Billed a customer for $900 for services completed.??

?The company's chart of accounts includes: Cash, Accounts Receivable, Paper Supplies, Equipment, Accounts Payable, Notes Payable, Unearned Revenue, Common Stock, Retained Earnings, Dividends, Service Revenue, Advertising Expense, Paper Supplies Expense, and Rent Expense.

28. A worksheet is a permanent accounting record and its use is required in the accounting cycle....

A worksheet is a permanent accounting record and its use is required in the accounting cycle. Choose a position and support your answer.

(Make sure the Answer not from the Internet )

29. An accounting record, into which the essential facts and figures in connection with

An accounting record, into which the essential facts and figures in connection with all transactions are initially recorded, is called the:a. general ledger. b. account. c.journal. d. trial balance.

30. Sherman Company employs 400 production, maintenance, and janitorial workers in eight separate...

Sherman Company employs 400 production, maintenance, and janitorial workers in eight separate departments. In addition to supervising operations, the supervisors of the departments are responsible for recruiting, hiring, and firing workers within their areas of responsibility. The organization attracts casual labor and experiences a 20 to 30 percent turnover rate in employees per year. Employees clock on and off the job each day to record their attendance on time cards. Each department has its own clock machine located in an unattended room away from the main production area. Each week, the supervisors gather the time cards, review them for accuracy, and sign and submit them to the payroll department for processing. In addition, the supervisors submit personnel action forms to reflect newly hired and terminated employees. From these documents, the payroll clerk prepares payroll checks and updates the employee records. The supervisor of the payroll department signs the paychecks and sends them to the department supervisors for distribution to the employees. A payroll register is sent to accounts payable for approval.

Based on this approval, the cash disbursements clerk transfers funds into a payroll clearing account.

Required

Discuss the risks for payroll fraud in the Sherman Company payroll system. What controls would you implement to reduce the risks? Use the SAS 78/COSO standard of control activities to organize your response.

The Retained Earnings account has a credit balance of $40,000 before closing entries are made. Total revenues for the period are $58,200, total expenses are $41,300, and dividends are $10,200. What is the correct closing entry for the expense accounts?

A. Debit Income Summary $41,300; credit Expense accounts $41,300.

B. Debit Expense accounts $40,000; credit Retained Earnings $40,000.

C. Credit Expense accounts $41,300; debit Retained Earnings $41,300.

D. Debit Expense accounts $41,300; credit Income Summary $41,300.

E. Debit Income Summary $41,300; credit Retained Earnings $41,300.

32. Explain the similarities and differences among target costing, kaizen costing, and life cycle...

Explain the similarities and differences among target costing, kaizen costing, and life cycle costing.

33. Give three examples of important trade-offs that you face in your life. What items would you inc...

Give three examples of important trade-offs that you face in your life. What items would you include to figure out the opportunity cost of a vacation to Disneyworld? Why is productivity important?

34. On December 1, Milton Company borrowed $310,000, at 9% annual interest, from the Tennessee Nation...

On December 1, Milton Company borrowed $310,000, at 9% annual interest, from the Tennessee National Bank. Interest is paid when the loan matures one year from the issue date. What is the adjusting entry for accruing interest that Milton would need to make on December 31, the calendar year-end? debit Interest Payable, $2, 325; credit Interest Expense, $2, 325 debit Interest Expense, $2.325; credit Interest Payable, $2, 325. debit Interest Expense, $2.325; credit Cash, $2.325. debit Interest Expense, $4, 650; credit Interest Payable, $4, 650. debit Interest Expense, $27900: credit Interest Payable, $27900.

2.4 Questions

1) A cost-volume-profit graph has a line for ________ and a line for ________.

A) revenues; variable costs only

B) revenues; fixed costs only

C) revenues; total costs

D) net profit; net loss

2) The break-even point on the cost-volume-profit graph is where the ________.

A) total cost line intersects the net profit line

B) total cost line intersects the net loss line

C) revenue line intersects the total cost line

D) revenue line intersects the variable cost line

3) On a cost-volume-profit graph, the vertical distance between the Revenue line and the Total Cost line represents ________ or ________.

A) mixed cost; step cost

B) variable cost; fixed cost

C) net profit; net loss

D) step cost; fixed cost

4) To construct the Total Cost line on a cost-volume-profit graph, plot ________ and then plot ________.

A) mixed costs; step costs

B) step costs; mixed costs

C) fixed costs; variable costs

D) fixed costs; fixed costs plus variable costs

5) On a cost-volume-profit graph, when the Total Cost line is higher than the Total Revenue line, the difference represents ________.

A) net income

B) a positive return on the investment

C) a net loss

D) not enough information is presented

6) It is misleading to call a cost-volume-profit graph a break-even graph. Why?

A) The graph reveals more information than the break-even point.

B) The graph does not show the break-even point.

C) The main purpose of the graph is to show the cost drivers for different activity levels.

D) The main purpose of the graph is to show the margin of safety.

7) If a company faces declining sales over time, it must restructure its costs to break-even at a lower volume. In order to carry this out, what costs can be reduced?

A) variable costs only

B) fixed costs only

C) variable and fixed costs

D) step costs only

8) On a cost-volume-profit graph, the net profit area is found ________.

A) at the break-even point

B) to the right of the break-even point

C) to the left of the break-even point

D) to the right of the intersection of the y-axis and x-axis

9) On a cost-volume-profit graph, at the point where the Total Revenue line intersects the Total Cost line, ________.

A) net income is positive

B) net income is negative

C) net income is zero

D) not enough information is given

10) The horizontal axis on the cost-volume-profit graph is the ________.

A) dollars of cost

B) sales volume in units

C) dollars of revenue

D) net income

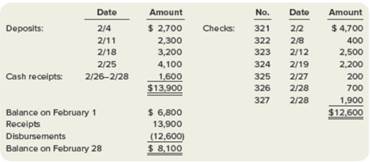

36. Prepare the bank reconciliation and record cash adjustments (LO4–5) P4–2A Oscar’s Red Carpet...

Prepare the bank reconciliation and record cash adjustments (LO4–5)

P4–2A Oscar’s Red Carpet Store maintains a checking account with Academy Bank. Oscar’s sells carpet

each day but makes bank deposits only once per week. The following provides information from the

company’s cash ledger for the month ending February 28, 2018.

Information from February’s bank statement and company records reveals the following additional

information:

a. The ending cash balance recorded in the bank statement is $13,145.

b. Cash receipts of $1,600 from 2/26–2/28 are outstanding.

c. Checks 325 and 327 are outstanding.

d. The deposit on 2/11 includes a customer’s check for $200 that did not clear the bank (NSF check).

e. Check 323 was written for $2,800 for advertising in February. The bank properly recorded the check

for this amount.

f. An automatic withdrawal for Oscar’s February rent was made on February 4 for $1,100.

g. Oscar’s checking account earns interest based on the average daily balance. The amount of interest

earned for February is $20.

h. In January, one of Oscar’s suppliers, Titanic Fabrics, borrowed $6,000 from Oscar. On February 24,

Titanic paid $6,250 ($6,000 borrowed amount plus $250 interest) directly to Academy Bank in

payment for January’s borrowing.

i. Academy Bank charged service fees of $125 to Oscar’s for the month.

Required:

1. Prepare a bank reconciliation for Oscar’s checking account on February 28, 2018.

2. Record the necessary cash adjustments.

37. Ravi, Mukesh, Naresh and Yogesh are partners in a firm sharing profits in the ratio of 2 : 2 : 1 :..

Ravi, Mukesh, Naresh and Yogesh are partners in a firm sharing profits in the ratio of 2 : 2 : 1 : 1. On Mukesh’s retirement, the goodwill of the firm is valued at ~ 90,000. Ravi, Naresh and Yogesh decided to share future profits equally. Pass the necessary Journal Entry for the treatment of goodwill without opening Goodwill Account.