Ethical Issues in Accounting: Assignment Help

38. 170.The partnership of Abraham Associates began operations on January 1, 2010, with contributions...

170.The partnership of Abraham Associates began operations on January 1, 2010, with contributions from two partners as follows:

Waverley | $35,000 |

Marquez | 40,000 |

The following additional partner transactions took place during the year:

(1) | In early January, Houston is admitted to the partnership by contributing $25,000 cash for a 25% interest. |

(2) | Net income of $160,000 was earned in 2010. In addition, Waverley received a salary allowance of $30,000 for the year. The three partners agree to an income-sharing ratio equal to their capital balances after admitting Houston. |

(3) | The partners’ withdrawals are equal to half of their respective distributions of income after salary (i.e., half their respective portions of the $130,000). |

Required:

Prepare a statement of partnership equity for the year ended December 31, 2010.

171.The capital accounts of Hope and Indiana have balances of $115,000 and $95,000, respectively. Clint and Casey are to be admitted to the partnership. Clint buys one-fifth of Hope’s interest for $30,000 and one-fourth of Indiana’s interest for $20,000. Casey contributes $45,000 cash to the partnership, for which he is to receive an ownership equity of $45,000.

Required:

(1) Journalize the entries to record the admission of (a) Clint and (b) Casey.

(2) What are the capital balances of each partner after the admission of the new partners?

172.Holly and Luke formed a partnership, investing $240,000 and $80,000, respectively. Determine their participation in the year’s net income of $200,000 under each of the following independent assumptions:

(a) | No agreement concerning division of net income; |

(b) | Divided in the ratio of original capital investment; |

(c) | Interest at the rate of 15% allowed on original investments and the remainder divided in the ratio of 2:3; |

(d) | Salary allowances of $50,000 and $70,000, respectively, and the balance divided equally; |

(e) | Allowance of interest at the rate of 15% on original investments, salary allowances of $50,000 and $70,000, respectively, and the remainder divided equally. |

173.Holly and Luke formed a partnership, investing $240,000 and $80,000, respectively. Determine their participation in the year’s net income of $380,000 under each of the following independent assumptions:

(a) | No agreement concerning division of net income; |

(b) | Divided in the ratio of original capital investment; |

(c) | Interest at the rate of 15% allowed on original investments and the remainder divided in the ratio of 2:3; |

(d) | Salary allowances of $50,000 and $70,000, respectively, and the balance divided equally; |

(e) | Allowance of interest at the rate of 15% on original investments, salary allowances of $50,000 and $70,000, respectively, and the remainder divided equally. |

174.Benson contributed land, inventory, and $22,000 cash to a partnership. The land had a book value of $65,000 and a market value of $111,000. The inventory had a book value of $60,000 and a market value of $58,000. The partnership also assumed a $52,000 note payable owned by Benson that was used originally to purchase the land.

Required:

Provide the journal entry for Benson’s contribution to the partnership.

39. X and Y are in partnership sharing profits and losses equally. Their accounts are made up to 31st...

X and Y are in partnership sharing profits and losses equally. Their accounts are made up to 31st December each year. They have decided that from 1.10.2014, the profit sharing ratio is to become X 3/5th and Y 2/5th.

Their Balance Sheet at 31.12.2014 prior to sharing profits is as under :

Liabilities | ~ | Assets | ~ |

Capitals : X Y Profit for the year | 80,000 70,000 60,000 | Sundry Assets | 2,10,000 |

2,10,000 | 2,10,000 |

It was decided that the impact of the change in profit sharing ratio would be affected at 31.12.2014 when the sundry assets were revalued at ~ 2,50,000. The goodwill was valued at ~ 25,000 but no goodwill account is to be maintained in the books. It is to be assumed that profits have been earned evenly throughout the period.

You are required to prepare Profit and Loss Appropriation Account for the year ended 31.12.2014 and the Partners’ Capital Accounts.

40. Caldwell Supply, a wholesaler, has determined thats its operations have three primary activities-...

Caldwell Supply, a wholesaler, has determined thats its operations have three primary activities- purchasing, warehousing, and distributing. The firm reports the following operational data for the year just compelted:

Activity | Cost Driver | Quanity of Cost Driver | Cost Per Unit of Cost Driver |

Purchasing | # of purchase orders | 1,160 | $166 per order |

Warehousing | # of moves | 8,500 | $35 per move |

Distributing | # of shipments | 660 | $96per shipment |

Caldwell buys 101,600 units at an average unit cost of $15 and sells them at an average unit price of $25. The firm also has fixed operating costs of $251,600 for the year. Caldwels customers are demanding a 15% discount for the coming year. The company expects to the sell the same amount if the demand for price reduction can be met. Caldwell's suppliers, however, are willing to give only a 8% discount.

Required:

1. Caldwell has estimated that it can reduce the number of purschase orders to 840 and can decrease the cost of each shipment by $19 with minor changes in its operations. Any further cost savings must come from reenginerring the warehouse processes. What is the target cost (maximun cost) for warehousing if the firm desires to earn the same amount of profit next year?

41. Siteraze Ltd is a company which engages in site clearance and site preparation work. Information...

Siteraze Ltd is a company which engages in site clearance and site preparation work. Information concerning

its operations is as follows:

(a) It is company policy to hire all plant and machinery required for the implementation of all orders

obtained, rather than to purchase its own plant and machinery.

(b) Siteraze Ltd will enter into an advance hire agreement contract for the coming year at one of three levels

- high, medium or low, which correspond to the requirements of a high, medium or low level of orders

obtained.

(c) The level of orders obtained will not be known when the advance hire agreement contract is entered into.

A set of probabilities have been estimated by management as to the likelihood of the orders being at

high, medium or low level.

(d) Where the advance hire agreement entered into is lower than that required for the level of orders actually

obtained, a premium rate must be paid to obtain additional plant and machinery required.

(e) No refund is obtainable where the advance hire agreement for plant and machinery is at a level in excess

of that required to satisfy the site clearance and preparation orders actually obtained.

A summary of the information relating to the above points is as follows:

Plant and machinery hire costs

Level of orders Revenue

£000

Probability Advance hire

£000

Conversion

premium

£000

High 15,000 0.25 2,300

Medium 8,500 0.45 1,500

Low 4,000 0.30 1,000

Low to medium 850

Medium to high 1,300

Low to high 2,150Variable cost (as a percentage of turnover) 70%

Required:

(a) Prepare a summary which shows the forecast net margin earned by Siteraze Ltd for the coming year for

each possible outcome.

(b) On the basis of maximising expected value, calculate for Siteraze whether the advance contract for the

hire of plant and machinery should be at the low, medium or high level.

(c) Explain how the risk preferences of the management members responsible for the choice of advance

plant and machinery hire contract may alter the decision reached in (b) above.

(d) Siteraze Ltd are considering employing a market research consultant who will be able to say with

certainty in advance of the placing of the plant and machinery hire contract, which level of site clearance

and preparation orders will be obtained. On the basis of expected value, calculate the maximum sum

which Siteraze Ltd should be willing to pay the consultant for this information.

42. (Objective 7-4) Distinguish between attention-directing analytical procedures and those intended...

(Objective 7-4) Distinguish between attention-directing analytical procedures and those intended to eliminate or reduce detailed substantive procedures.

(Objective 7-4)

TYPES OF AUDIT EVIDENCE

In deciding which audit procedures to use, the auditor can choose from eight broad categories of evidence, which are called types of evidence. Every audit procedure obtains one or more of the following types of evidence:

1. Physical examination

2. Confirmation

3. Documentation

4. Analytical procedures

5. Inquiries of the client

6. Recalculation

7. Reperformance

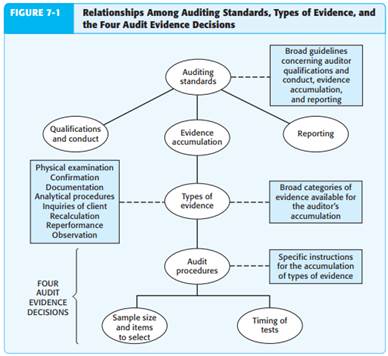

8. Observation Figure 7-1 (p. 180) shows the relationships among auditing standards, types of evidence, and the four evidence decisions. Auditing standards provide general guidance in three categories, including evidence accumulation. The types of evidence are broad categories of the evidence that can be accumulated. Audit procedures include the four evidence decisions and provide specific instructions for the accumulation of evidence.

Physical examination is the inspection or count by the auditor of a tangible asset. This type of evidence is most often associated with inventory and cash, but it is also appli - cable to the verification of securities, notes receivable, and tangible fixed assets. There is a distinction in auditing between the physical examination of assets, such as market - able securities and cash, and the examination of documents, such as cancelled checks and sales documents. If the object being examined, such as a sales invoice, has no inherent value, the evidence is called documentation. For example, before a check is signed, it is a document; after it is signed, it becomes an asset; and when it is cancelled, it becomes a document again. For correct auditing terminology, physical examination of the check can occur only while the check is an asset. Physical examination is a direct means of verifying that an asset actually exists (existence objective), and to a lesser extent whether existing assets are recorded (completeness objective). It is considered one of the most reliable and useful types of audit evidence. Generally, physical examination is an objective means of ascertaining both the quantity and the description of the asset. In some cases, it is also a useful method for evaluating an asset’s condition or quality. However, physical examination is not sufficient evidence to verify that existing assets are owned by the client (rights and obligations objective), and in many cases the auditor is not qualified to judge qualitative factors such as obsolescence or authenticity (realizable value objective). Also, proper valuation for financial statement purposes usually cannot be determined by physical examination (accuracy objective). Confirmation describes the receipt of a direct written response from a third party verifying the accuracy of information that was requested by the auditor. The response may be in electronic or paper form. The request is made to the client, and the client asks the third party to respond directly to the auditor. Because confirmations come from sources independent of the client, they are a highly regarded and often-used type of evidence. However, confirmations are relatively costly to obtain and may cause some inconvenience to those asked to supply them. Therefore, they are not used in every instance in which they are applicable. Auditors decide whether or not to use confirmations depending on the reliability needs of the situation as well as the alternative evidence available. Traditionally, con - firmations are seldom used in the audit of fixed asset additions because these can be verified adequately by documentation and physical examination. Similarly, confirma - tions are ordinarily not used to verify individual transactions between organizations, such as sales transactions, because the auditor can use documents for that purpose. Naturally, there are exceptions. Assume the auditor determines that there are two extraordinarily large sales transactions recorded 3 days before year-end. Confirmation of these two transactions may be appropriate. When practical and reasonable, U.S. auditing standards require the confirmation of a sample of accounts receivable. This requirement exists because accounts receivable usually represent a significant balance on the financial statements, and confirmations are a highly reliable type of evidence. Confirmation of accounts receivable is not required by international auditing standards, and is one example of differences between U.S. and international auditing standards. Confirmation of accounts receivable is discussed further in Chapter 16. Although confirmation is not required under U.S. GAAS for any account other than accounts receivable, this type of evidence is useful in verifying many types of information. The major types of information that are often confirmed, along with the source of the confirmation.

43. Bart's Company has prepared the PP&E and depreciation schedule shown in Exhibit 8.46.1...

Bart's Company has prepared the PP&E and depreciation schedule shown in Exhibit 8.46.1 below.The following information is available (assume the beginning balance has been audited):•The land was purchased eight years ago when building 1 was erected. The location was then remote but now isbordered by a major freeway. The appraised value of the land is $35 million.•Building 1 has an estimated useful life of 35 years and no residual value.•Building 2 was built by a local contractor this year. It also has an estimated useful life of 35 years and noresidual value. The company occupied it on May 1 this year.•Computer A system was purchased January 1 six years ago when the estimated useful life was eight years withno residual value. It was sold on May 1 for $500,000

44. Passion Company is trying to decide whether or not to acquire Desiree Inc. The following balance...

Passion Company is trying to decide whether or not to acquire Desiree Inc. The following balance sheet for Desiree Inc. provides information about book values. Estimated market values are also listed, based upon Passion Company’s appraisals./Passion Company expects that Desiree will earn approximately $150,000 per year in net income over the next five years. This income is higher than the 12% annual return on tangible assets considered to be the industry “norm.”Required:A. Compute an estimation of goodwill based on the information above that Passion might be willing to pay (include in its purchase price), under each of the following additional assumptions:(1) Passion is willing to pay for excess earnings for an expected life of five years (undis counted).(2) Passion is willing to pay for excess earnings for an expected life of five years, which should be capitalized at the industry normal rate of return.(3) Excess earnings are expected to last indefinitely, but Passion demands a higher rate of return of 20% because of the risk involved.B. Comment on the relative merits of the three alternatives in part (A) above.C. Determine the amount of goodwill to be recorded on the books if Passion pays $800,000 cash and assumes Desiree’sliabilities.

View Solution:

Passion Company is trying to decide whether or not to

45. 31) The Amazing Widget Company issues $500,000 of 6%, 10-year bonds at 103 on March 31, 2014. The...

31) The Amazing Widget Company issues $500,000 of 6%, 10-year bonds at 103 on March 31, 2014. The bonds pay interest on March 31 and September 30. Assume that the company uses the straight-line method for amortization. The journal entry to record the issuance would include a ________.

A) debit to Cash for $500,000

B) credit to Bonds Payable for $515,000

C) debit to Premium on Bonds Payable for $15,000

D) debit to Cash for $515,000

32) The Amazing Widget Company issues $500,000 of 6%, 10-year bonds at 103 on March 31, 2014. The bond pays interest on March 31 and September 30. Assume that the company uses the straight-line method for amortization. The journal entry to record the first interest payment on September 30, 2014 is a ________.

A) debit to Cash for $15,000

B) debit to Interest Expense for $15,750

C) debit to Interest Expense for $14,250

D) credit to Premium on Bonds Payable for $750

33) The Amazing Widget Company issues $500,000 of 6%, 10-year bonds at 103 on March 31, 2014. The bond pays interest on March 31 and September 30. Assume that the company uses the straight-line method for amortization. Calculate the net balance that will be reported for the bonds on the balance sheet on September 30, 2014.

A) $500,000

B) $515,000

C) $514,250

D) $515,250

34) Case Wines Company issues $800,000 of 7%, 10-year bonds on March 31, 2013. The bond pays interest on March 31 and September 30. Which of the following statements is true?

A) If the market rate of interest is 8%, the bonds will issue at a premium.

B) If the market rate of interest is 8%, the bonds will issue at a discount.

C) If the market rate of interest is 8%, the bonds will issue at par.

D) If the market rate of interest is 8%, the bonds will issue above par.

35) Blandings Glassware Company issues $1,000,000 of 8%, 10-year bonds at 98 on February 28, 2015. The bond pays interest on February 28 and August 31. On August 31, 2015, how much cash did Blandings pay out to bondholders?

A) $41,000

B) $40,000

C) $80,000

D) $39,000

36) The Amazing Widget Company issues $500,000 of 6%, 10-year bonds at 103 on March 31, 2013. The bond pays interest on March 31 and September 30. On September 30, 2013, how much cash did the company pay out to bondholders?

A) $14,250

B) $30,000

C) $15,000

D) $7,500

37) On January 1, 2013, Davie Services issued $20,000 of 8% bonds that mature in five years. They were issued at par. Provide the journal entry to issue bonds.

38) On January 1, 2013, Davie Services issued $20,000 of 8% bonds that mature in five years. They were sold for a total of $19,000. Provide the journal entry to issue bonds.

39) On January 1, 2013, Davie Services issued $20,000 of 8% bonds that mature in five years. They were sold at a premium, for a total of $20,750. Provide the journal entry to issue bonds.

40) On January 1, 2013, Davie Services issued $20,000 of 8% bonds that mature in five years. They were sold at par. The bonds pay semiannual interest payments on June 30 and December 31 of each year. Provide the journal entry for the payment made on June 30, 2013.

41) On January 2, 2014, Mahoney Sales issued $10,000 in bonds for $9,400. They were 5-year bonds with a stated rate of 4%, and pay semiannual interest. Mahoney Sales uses the straight-line method to amortize bond discount. Provide the journal entry for the first interest payment on June 30, 2014.

42) On January 2, 2014, Mahoney Sales issued $10,000 in bonds for $10,900. They were 5-year bonds with a stated rate of 4%, and pay semiannual interest. Mahoney Sales uses the straight-line method to amortize bond premium. Provide the journal entry for the first interest payment to be made on June 30, 2014.

46. question in the brackets ,(Record the chart of account reference number underneath each column to be

question in the brackets ,(Record the chart of account reference number underneath each column to be posted to the general ledger then post the journal totals to the general ledger. Please note predictive text is available for the general ledger details fields. When posting totals to the Bank Account general ledger account from the Cash Payments Journal and the Cash Receipts Journal use the generic terms 'Payments' and 'Receipts' in the details field. When posting from the sales, purchases, cash payments and cash receipts journals, you must enter in the details the opposing debit/credits as per the column headings in the respective journals (e.g. When posting to Accounts Payable 200 from the Cash Payments Journal, the details field will be Bank Account/Discount Received/GST Paid (Outlays)).)

47. Roberts Company uses a standard costing system. The following information pertains to direct materia

Roberts Company uses a standard costing system. The following information pertains to direct materials for the monthof July:Standard price per lb. $18.00Actual purchase price per lb. $16.50Quantity purchased 3,100 lbs.Quantity used 2,950 lbs.Standard quantity allowed for actual output 3,000 lbs.Actual output 1,000 unitsRoberts Company reports its material price variances at the time of purchase.What is the journal entry to record material purchases?Bender Corporation produced 100 units of Product AA. The total standard and actual costs for materials and directlabor for the 100 units of Product AA are as follows:Materials: Standard ActualStandard: 200 pounds at $3.00 per pound $600Actual: 220 pounds at $2.85 per pound $627Direct labor:Standard: 400 hours at $15.00 per hour $6,000Actual: 368 hours at $16.50 per hour $6,072What is the journal entry to record labor variances?Harry Company’s standard variable manufacturing overhead rate is $6 per direct labor hour, and each unit requires 2standard direct labor hours. During March, Harry recorded 6,000 actual direct labor hours, $37,000 actual variablemanufacturing overhead costs, and 2,900 units of product manufactured.What are the flexible budget variance for variable manufacturing overhead (FlexVOH) and the variable manufacturingoverhead efficiency variance (VOH-Eff), respectively, for March?Crawford Company’s standard fixed manufacturing overhead cost is $6 per direct labor hour based on budgeted fixedmanufacturing costs of $600,000. The standard allows one direct labor hour per unit. During 2012, Crawford produced110,000 units of product, incurred $630,000 of fixed manufacturing overhead costs, and recorded 212,000 actual hours ofdirect labor.What is Crawford’s fixed manufacturing overhead spending variance (FOH Spending) and production volume variance(PVV) for 2012, respectively?Which of the following is not an inventoriable cost under variable costing?A. direct materials B. variable selling and administrative expensesC. variable manufacturing overhead D. all of these are inventoriable costsHeath CompanyDATA SUMMARYUnits 2012 2013Beginning Inventory 400 600Price $ 90 $ 90Sold 1000 1900Actual Production 1200 1700Budgeted Production 1500 1500Unit Variable CostsManufacturing $ 30 $ 30Selling and Administrative $ 5 $ 5Fixed CostsManufacturing $ 30,000 $ 30,000Selling and Administrative $ 10,000 $ 10,000Ending Inventory 600 400The Production Volume Variance for 2012 isA. $4,000 F B. $6,000 U C. $4,000 U D. $6,000 FFixed manufacturing overhead appears on the absorption costing income statement as aA. fixed expense.B. part of cost of goods sold.C. production volume variance.D. part of cost of goods sold and as a production volume varianceHeath CompanyDATA SUMMARYUnits 2012 2013Beginning Inventory 400 600Price $ 90 $ 90Sold 1000 1900Actual Production 1200 1700Budgeted Production 1500 1500Unit Variable CostsManufacturing $ 30 $ 30Selling and Administrative $ 5 $ 5Fixed CostsManufacturing $ 30,000 $ 30,000Selling and Administrative $ 10,000 $ 10,000Ending Inventory 600 400Gross Margin (GM) and contribution margin (CM) for 2013 will be respectivelyHeath CompanyDATA SUMMARYUnits 2012 2013Beginning Inventory 400 600Price $ 90 $ 90Sold 1000 1900Actual Production 1200 1700Budgeted Production 1500 1500Unit Variable CostsManufacturing $ 30 $ 30Selling and Administrative $ 5 $ 5Fixed CostsManufacturing $ 30,000 $ 30,000Selling and Administrative $ 10,000 $ 10,000Ending Inventory 600 400The difference in operating income for 2012 between absorption and variable costing will beA. $8,000 more under variable costing. B. $8,000 more under absorption costing.C. $4,000 more under absorption costing. D. $4,000 more under variable costing.Variable costing:A. expenses administrative costs as cost of goods soldB. treats direct manufacturing costs as a product costC. includes fixed manufacturing overhead as an inventoriable costD. is required for external reporting to shareholdersBeginning inventory was 15,000 units and ending inventory was 10,000 units. The fixed manufacturing overhead was$8 per unit. How will absorption cost net income differ from variable cost net income?A. absorption cost net income will be $80,000 higher.B. variable cost net income will be $80,000 higher.C. absorption cost net income will be $40,000 higher.D. variable cost net income will be $40,000 higher.Standard cost variances may be prorated in order toA. simplify the accounting process.B. defer income taxes from the current period to a future period.C. make inventory valuation more representative of “actual” costs incurred to make the products.D. all of these responses support proration.When actual volume is less than expected volume, the production volume variance isA. favorable. B. over allocated C. unfavorable D. indeterminable

48. Preparing a Bank Reconciliation and Related Journal Entries The bookkeeper at Wood Company has not..

Preparing a Bank Reconciliation and Related Journal Entries The bookkeeper at Wood Company has not reconciled the bank statement with the Cash account, saying, “I don’t have time.” You have been asked to prepare a reconciliation and review the procedures with the bookkeeper. The April 30, 2011, bank statement and the April ledger accounts for cash showed the following (summarized): A comparison of checks written before and during April with the checks cleared through the bank showed outstanding checks at the end of April of $4,100. No deposits in transit were carried over from March, but a deposit was in transit at the end of April. Required: 1. Prepare a detailed bank reconciliation for April. 2. Give any required journal entries as a result of the reconciliation. Why are they necessary? 3. What was the balance in the cash account in the ledger on May 1, 2011? 4. What total amount of cash should be reported on the balance sheet at the end ofApril?

49. As at December 31, 2017, Kendrick Corporation is having its financial statements audited for the...

As at December 31, 2017, Kendrick Corporation is having its financial statements audited for the first time ever. The auditor has found the following items that might have an effect on previous years. 1. Kendrick purchased equipment on January 2, 2014 for $130,000. At that time, the equipment had an estimated useful life of 10 years, with a $10,000 residual value. The equipment is depreciated on a straight-line basis. On January 2, 2017, as a result of additional information, the company determined that the equipment had a total useful life of seven years with a $6,000 residual value. 2. During 2017, Kendrick changed from the double-declining-balance method for its building to the straight-line method because the company thinks the straight-line method now more closely follows the benefits received from using the assets. The current year depreciation was calculated using the new method following straight-line depreciation. In case the following information was needed, the auditor provided calculations that present depreciation on both bases. The building had originally cost $1.2 million when purchased at the beginning of 2015 and has a residual value of $120,000. It is depreciated over 20 years. The original estimates of useful life and residual value are still accurate. 3. Kendrick purchased a machine on July 1, 2014 at a cost of $160,000. The machine has a residual value of $16,000 and a useful life of eight years. Kendrick s bookkeeper recorded straight-line deprecia

50. 57) Jill lives in St. Louis, which is close to sea level. She decides to spend a month of her summer

57) Jill lives in St. Louis, which is close to sea level. She decides to spend a month of her summer vacation working in the mountains outside of Denver. After a week in the mountains, what kinds of changes would you expect to see as Jill adapts to the higher altitude?

A) decreased hematocrit

B) decreased blood pressure

C) decreased alveolar ventilation rate

D) decreased PO2 in the alveoli

E) All of the answers are correct.

58) Carbon dioxide is more soluble in water than oxygen. To get the same amount of oxygen to dissolve in plasma as carbon dioxide, you would have to

A) decrease the temperature of the plasma.

B) increase the partial pressure of oxygen.

C) decrease the partial pressure of nitrogen.

D) increase the rate of plasma flow through the lungs.

E) decrease the alveolar ventilation rate.

59) For maximum efficiency in loading oxygen at the lungs,

A) the pH should be slightly acidic.

B) the temperature should be slightly lower than normal body temperature.

C) the PO2 should be about 70 mm.

D) DPG levels in the red blood cells should be high.

E) All of the answers are correct.

60) A student in your lab volunteers to enter a hypoxic breathing chamber for 10 minutes, and his alveolar PO2 drops to 50 mm Hg. What other change would occur?

A) decrease in arterial pH

B) decrease in arterial PCO2

C) decrease in pH of cerebrospinal fluid

D) increase in alveolar PCO2

E) hypoventilation

61) A molecule that blocks the activity of carbonic anhydrase would

A) interfere with oxygen binding to hemoglobin.

B) cause an increase in blood pH.

C) increase the amount of bicarbonate formed in the blood.

D) decrease the amount of carbon dioxide dissolved in the plasma.

E) All of the answers are correct.

62) The chloride shift occurs when

A) hydrogen ions leave the red blood cells.

B) hydrogen ions enter the red blood cells.

C) bicarbonate ions enter the red blood cells.

D) bicarbonate ions leave the red blood cells.

E) carbonic acid is formed.

63) Blocking afferent action potentials from the chemoreceptors in the carotid and aortic bodies would interfere with the brain's ability to regulate breathing in response to all EXCEPT which of the following?

A) changes in PCO2

B) changes in PO2

C) changes in pH due to carbon dioxide levels

D) changes in blood pressure

E) All of the answers are correct.

64) Describe the different causes of hypoxia, and give specific examples of the associated conditions.

65) What are the two possible causes of lower alveolar PO2? Give examples of each.