Dominate Your Dissertation: Accounting Research Assistance

19. Various transactions related to securities available-for-sale The following selected transactions...

Various transactions related to securities available-for-sale

The following selected transactions relate to investment activities of Ornamental Insulation Corporation. The company buys securities, not intending to profit from short-term differences in price and not necessarily to hold debt securities to maturity, but to have them available for sale when circumstances warrant. Ornamental’s fiscal year ends on December 31. No investments were held by Ornamental on December 31, 2015.

Required:

1. Prepare the appropriate journal entry for each transaction or event during 2016.

2. Indicate any amounts that Ornamental Insulation would report in its 2016 balance sheet and income statement as a result of these investments.

3. Prepare the appropriate journal entry for each transaction or event during 2017.

4. Indicate any amounts that Ornamental Insulation would report in its 2017 balance sheet and income statement as a result of these investments.

20. What do credit terms 3/20, n/60 mean? How valuable to

What do credit terms 3/20, n/60 mean? How valuable to the customer is the discount offered in these terms?

21. a) Material Price Variance; (b) Material Mix Variance; (c) Labour Efficiency Variance

Explain the following;

(a) Material Price Variance; (b) Material Mix Variance; (c) Labour Efficiency Variance; (d) Labour Yield Variance; (e) Variable Overhead Efficiency Variance; (f) Fixed Overhead Volume Variance; (g) Fixed Overhead Capacity Variance; (h) Sales Mix Variance; and (i) Sales Margin Quantity Variance

22. On July 1, 2011, Lucinda Fogle created a new self-storage business, KeepSafe Co. The following...

On July 1, 2011, Lucinda Fogle created a new self-storage business, KeepSafe Co. The following transactions occurred during the company’s first month.

July 1 Fogle invested $20,000 cash and buildings worth $120,000 in the company.

2 The company rented equipment by paying $1,800 cash for the first month’s (July) rent.

5 The company purchased $2,300 of office supplies for cash.

10 The company paid $5,400 cash for the premium on a 12-month insurance policy. Coverage begins on July 11.

14 The company paid an employee $900 cash for two weeks’ salary earned.

24 The company collected $8,800 cash for storage fees from customers.

28 The company paid $900 cash for two weeks’ salary earned by an employee.

29 The company paid $850 cash for minor repairs to a leaking roof.

30 The company paid $300 cash for this month’s telephone bill.

31 Fogle withdrew $1,600 cash from the company for personal use.

The company’s chart of accounts follows:

101 | Cash | 401 | Storage Fees Earned |

106 | Accounts Receivable | 606 | Depreciation Expense—Buildings |

124 | Office Supplies | 622 | Salaries Expense |

128 | Prepaid Insurance | 637 | Insurance Expense |

173 | Buildings | 640 | Rent Expense |

174 | Accumulated Depreciation—Buildings | 650 | Office Supplies Expense |

209 | Salaries Payable | 684 | Repairs Expense |

301 | L. Fogle, Capital | 688 | Telephone Expense |

302 | L. Fogle, Withdrawals | 901 | Income Summary |

Required

1. Use the balance column format to set up each ledger account listed in its chart of accounts.

2. Prepare journal entries to record the transactions for July and post them to the ledger accounts. Record prepaid and unearned items in balance sheet accounts.

3. Prepare an unadjusted trial balance as of July 31.

4. Use the following information to journalize and post adjusting entries for the month:

a. Two-thirds of one month’s insurance coverage has expired.

b. At the end of the month, $1,550 of office supplies are still available.

c. This month’s depreciation on the buildings is $1,200.

d. An employee earned $180 of unpaid and unrecorded salary as of month-end.

e. The company earned $950 of storage fees that are not yet billed at month-end.

5. Prepare the income statement and the statement of owner’s equity for the month of July and the balance sheet at July 31, 2011.

6. Prepare journal entries to close the temporary accounts and post these entries to the ledger.

7. Prepare a post-closing trial balance.

23. The income statement, balance sheet, and additional information for Video Phones, Inc., are provi...

The income statement, balance sheet, and additional information for Video Phones, Inc., are provided VIDEO PHONES, INC Income Statement For the Year Ended December 31, 2015 2,986,000 Net sales Expenses Cost of goods sold 1,900,000 Operating expenses 848,000 Depreciation expense 26,000 Loss on sale of land 7,900 Interest expense 14,500 47,000 ncome tax expense Total expenses 2,843,400 142,600 Net income VIDEO PHONES, INC Balance Sheet December 31 2015 2014 Assets Current assets: 190,340 $136,220 Cash Accounts receivable 79,900 59,000 Inventory 105,000 134,000 Prepaid rent 10,560 5,280 Long-term assets Investments 104,000 Land 209,000 238,000 Equipment 268,000 209,000 Accumulated depreciation (67,800) (41,800) 899,000 $739,700 Total assets Liabilities and Stockholders' Equity Current liabilities 65,100 80,000 Accounts payable Interest payable 5,900 9,800 Income tax payable 14,900 13,900 Long-term liabilities: Notes payable 283,000 224,000 Stockholders' equity Common stock 290,000 290,000 Retained earnings 240.100 122,000 Total liabilities and stockholders' equity 899,000 739,700

24. What are the normal balances for Apple"s Cash, Accounts Payable, and Interest Expense accounts?

hat are the normal balances for Apple"s Cash, Accounts Payable, and Interest Expense accounts?

25. (Objectives 1-6, 1-7) List five examples of specific operational audits that can be conducted by...

(Objectives 1-6, 1-7) List five examples of specific operational audits that can be conducted by an internal auditor in a manufacturing company.

(Objectives 1-6, 1-7)

(Objective 1-6)

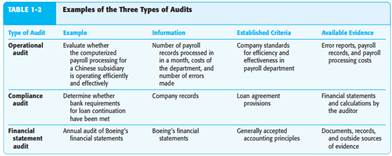

TYPES OF AUDITS

CPAs perform three primary types of audits, as illustrated with examples in Table 1-2:

1. Operational audit

2. Compliance audit

3. Financial statement audit

(Objective 1-7)

TYPES OF AUDITORS

A government accountability office auditor is an auditor working for the U.S. Govern - ment Accountability Office (GAO), a nonpartisan agency in the legislative branch of the federal government. Headed by the Comptroller General, the GAO reports to and is responsible solely to Congress. The GAO’s primary responsibility is to perform the audit function for Congress, and it has many of the same audit responsibilities as a CPA firm. The GAO audits much of the financial information prepared by various federal government agencies before it is submitted to Congress. Because the authority for expenditures and receipts of governmental agencies is defined by law, there is considerable emphasis on compliance in these audits. An increasing portion of the GAO’s audit efforts are devoted to evaluating the operational efficiency and effectiveness of various federal programs. Also, because of the immense size of many federal agencies and the similarity of their operations, the GAO has made significant advances in developing better methods of auditing through the widespread use of highly sophisticated statistical sampling and computer risk assessment techniques. In many states, experience as a GAO auditor fulfills the experience requirement for becoming a CPA. In those states, if an individual passes the CPA examination and fulfills the experience stipulations by becoming a GAO auditor, he or she may then obtain a CPA certificate. As a result of their great responsibility for auditing the expenditures of the federal government, their use of advanced auditing concepts, their eligibility to be CPAs, and

Internal Auditors are employed by all types of organizations to audit for management, much as the GAO does for Congress. Internal auditors’ responsibilities vary considerably, depending on the employer. Some internal audit staffs consist of only one or two employees doing routine compliance auditing. Other internal audit staffs may have more than 100 employees who have diverse responsibilities, including many outside the accounting area. Many internal auditors are involved in operational auditing or have expertise in evaluating computer systems. To maintain independence from other business functions, the internal audit group typically reports directly to the president, another high executive officer, or the audit committee of the board of directors. However, internal auditors cannot be entirely independent of the entity as long as an employer–employee relationship exists. Users from outside the entity are unlikely to want to rely on information verified solely by internal auditors because of their lack of independence. This lack of independence is the major difference between internal auditors and CPA firms. In many states, internal audit experience can be used to fulfill the experience requirement for becoming

26. 1. Name and discuss the five common functions of most organizations. 2. Discuss the roles of the...

1. Name and discuss the five common functions of most organizations.

2. Discuss the roles of the three kinds of management in a corporation.

3. What are the four most common computer-based information systems?

4. Describe the different reports and their roles in managerial decision making.

5. What is the difference between an office automation system and a knowledge work system?

27. 1. The following is the trial balance of T Owen as at 31 March 2019. Draw up a set of financial...

1. The following is the trial balance of T Owen as at 31 March 2019. Draw up a set of financial statements for the year ended 31 March 2019. (25 marks) Dr Cr $ $ Stock 1 April 2018 52,800 Sales 276,400 Purchases 141,300 Carriage inwards 1,350 Carriage outwards 5,840 Returns outwards 2,408 Wages and salaries 63,400 Business rates 3,800 Communication expenses 714 Commissions paid 1,930 Insurance 1,830 Sundry expenses 208 Buildings 125,000 Debtors 45,900 Creditors 24,870 Fixtures 1,106 Cash at bank 31,420 Cash in hand 276 Drawings 37,320 Capital _______ 210,516 514,194 514,194 Stock at 31 March 2019 was $58,440.

2. Trial Balance of Mr. Renrick Reid Dr Cr $ $ Stock 1 may 2007 2,368 Carriage outwards 200 Carriage inwards 310 Return inwards 205 Return outwards 322 Purchases 11,874 Sales 18,600 Wages 3,862 Rent and rates 304 Insurance 78 Motor expenses 664 Office expenses 216 Lighting expenses 166 General expenses 314 Computer equipment 5,000 Motor vehicle 1,800 Fixtures and fittings 350 Debtors 3,896 Creditors 1,731 Cash at bank 482 Drawings 1,200 Capital 12, 636 33,289 33,289 Stock at 30th April 2008 was $2,946 Required: From the above trial balance of Mr. Renrick Reid A. Draw up a trading, and profit and loss account for the year ended 30th April 2008, and (15 marks) B. A balance sheet as at same date.

28. IFRS QUESTIONS 1.Jahnke Corporation issued 5,000 shares of €2 par value ordinary shares for €11 per.

IFRS QUESTIONS

1.Jahnke Corporation issued 5,000 shares of €2 par value ordinary shares for €11 per share. The journal entry to record the sale will include

a.a debit to Cash for €10,000.

b.a credit to Share Premium–Ordinary for €45,000.

c.a credit to Share Capital–Ordinary for €55,000.

d.a debit to Retained Earnings for €22,000.

2.La Vida Corporation issued 18,000 shares of no-par value ordinary shares for €29.50 per share. Which of the following statements is true?

a.Share Premium–Ordinary account will increase by €207,000.

b.The Cash account will increase by €18,000.

c.Retained Earnings account will increase by €513,000.

d.Share Capital–Ordinary account will increase by €531,000.

3.Freidrichs Company has issued and outstanding 11,000 shares of cumulative, 8%, €50 par value preference shares which it sold for €54 per share at the beginning of 2009. The company has never paid preference dividends. As of December 31, 2011, dividends in arrears are

a.€88,000.

b.€132,000.

c.€162,000.

d.€142,560.

4.Looper, Inc. has 25,000 shares of 6%, ?100 par value, noncumulative preference shares and 50,000 ordinary shares with a ?1 par value outstanding at December 31, 2011. There were no dividends declared in 2010. The board of directors declares and pays a ?250,000 dividend in 2011. What is the amount of dividends received by the common shareholders in 2011?

a.?0

b.?150,000

c.?250,000

d.?100,000

5.Manner, Inc. has 5,000 shares of 5%, ?100 par value, noncumulative preference shares and 20,000 ordinary shares with a ?1 par value outstanding at December 31, 2011. There were no dividends declared in 2010. The board of directors declares and pays a ?45,000 dividend in 2011. What is the amount of dividends received by the ordinary shareholders in 2011?

a.?0

b.?25,000

c.?45,000

d.?20,000

6.Anders, Inc has 5,000 shares of 5%, €100 par value, cumulative preference shares and 20,000 ordinary shares with a $1 par value outstanding at December 31, 2011. There were no dividends declared in 2009. The board of directors declares and pays a €45,000 dividend in 2010 and in 2011. What is the amount of dividends received by the ordinary shareholders in 2011?

a.€15,000

b.€25,000

c.€45,000

d.€0

7.On January 1, Swanson Corporation had 60,000 ordinary shares with a €10 par value outstanding. On March 17, the company declared a 15% share dividend to shareholders of record on March 20. Market value of the shares was €13 on March 17. The entry to record the transaction of March 17 would include a

a.credit to Cash Dividends for €27,000.

b.credit to Cash for €117,000.

c.credit to Ordinary Share Dividends Distributable for €90,000.

d.debit to Ordinary Share Dividends Distributable for €90,000.

8.On January 1, Swanson Corporation had 60,000 ordinary shares with a €10 par value outstanding. On March 17, the company declared a 15% share dividend to shareholders of record on March 20. Market value of the shares was €13 on March 17. The shares were distributed on March 30. The entry to record the transaction of March 30 would include a

a.credit to Cash for €90,000.

b.debit to Ordinary Share Dividends Distributable for €90,000.

c.credit to Share Premium–Ordinary for €27,000.

d.debit to Cash Dividends for €27,000.

9.Oxford Inc. was authorized to issue 50,000 £10 par value ordinary shares. As of December 31, 2011, the company had issued 22,000 shares at an average price of £22 per share. During 2011, the company felt that the shares were undervalued so it purchased 5,000 treasury shares at £18 per share. When the share price rebounded later in the year, the company sold 2,000 of the treasury for £25. Retained earnings was £829,000 at December 31, 2011.

The amount of Share Premium reported on the December 31, 2011 Statement of Financial Position is

a.£140,000.

b.£264,000.

c.£278,000.

d.£484,000.

10.Oxford Inc. was authorized to issue 50,000 £10 par value ordinary shares. As of December 31, 2011, the company had issued 22,000 shares at an average price of £22 per share. During 2011, the company felt that the shares were undervalued so it purchased 5,000 treasury shares at £18 per share. When the share price rebounded later in the year, the company sold 2,000 of the treasury for £25. Retained earnings was £829,000 at December 31, 2011.

Total equity at December 31, 2011 is

a.£1,223,000.

b.£1,259,000.

c.£1,273,000.

d.£1,381,000.