Conquer Accounting Challenges Quiz: Assignment Aid Available

15. 10 100 points East Hill Home Healthcare Services was organized by four friends who each invested ...

10 100 points East Hill Home Healthcare Services was organized by four friends who each invested $15,000 in the company and, in turn, was issued 8,200 shares of $1.00 par value stock. To date, they are the only stockholders. At the end of last year, the accounting records reflected total assets of $721,000 ($60,000 cash; $503,000 land; $52,000 equipment, and $106,000 buildings), total liabilities of $212,000 (short-term notes payable of $108,000 and long-term notes payable of $104,000), and stockholders' equity of $509,000 ($20,000 of common stock, S80,000 of additional paid-in capital, and $409,000 retained earnings). During the current year, the following summarized events occurred: a. Sold 9,400 additional shares of stock to the original organizers for a total of $107,000 cash b. Purchased a building for$56,000, equipment for$13,000, and four acres of land for $18,000; paid $12,000 in cash and signed a note for the balance (due in 15 years). (Hint Five different accounts are affected c. Sold one acre of land acquired in (b) for $4,500 cash to another company. d. Purchased short-term investments for$19,000 cash e. One stockholder reported to the company that 350 shares of his East Hill stock had been sold and transferred to another stockholder for $3,500 cash f Lent one of the shareholders $5,700 for moving costs, receiving a signed six-month note from the shareholder. Required: 1. Was East Hill Home Healthcare Services organized as a sole proprietorship, a partnership, or a corporation? Sole proprietorship Partnership O Corporation 2. During the current year, the records of the company were inadequate. You were asked to prepare the summary of the preceding transactions. To develop a quick assessment of their economic effects on East Hill Home Healthcare Services, you have decided to complete the tabulation that follows and to use plus for increases and minus for decreases for each account. The first event is used as an example

16. Revenue from an artistic performance is recognized once

Revenue from an artistic performance is recognized once

(a) The audience register for the event online.

(b) The tickets for the concert are sold.

(c) Cash has been received from the ticket sales.

(d) The event takes place.

17. Widgeon Co. manufactures three products Bales; Tales; and Wales. The selling prices are: $55; $78...

Widgeon Co. manufactures three products Bales; Tales; and Wales. The selling prices are: $55; $78; and $32, respectively. The variable costs for each product are: $20; $50; and $15, respectively. Each product must go through the same processing in a machine that is limited to 2,000 hours per month. Bales take 5 hours to process. Tales take 7 hours, and Wales take 1 hour. Which product has the highest contribution margin per machine hour? a. Bales b. Tales c. Wales d. Bales and Tales have the same What is the contribution margin per machine hour for Bales? a. $5 b. $7 c. $35 d. $28 What is the contribution margin per machine hour for Tales? a. $4 b. $7 c. $28 d. $35 What is the contribution per machine hour for Wales? a. $35 b. $28 c. $17 d. $7 The process by which management plans, evaluates, and controls long-term investment decisions involving fixed called: a. absorption cost analysis b. variable cost analysis c. capital investment analysis d. cost-volume-profit analysis Which of the following is important when evaluating long-term investments? a. Investments must earn a reasonable rate of return. b. The useful life of the asset c. Proposals should match long term goals. d. All of the above.

18. E2-4 Manufacturing cost data for Orlando Company, which uses a job order cost system, are...

E2-4 Manufacturing cost data for Orlando Company, which uses a job order cost system, are presented below.

|

Case A Case B Case C

Instructions

Indicate the missing amount for each letter. Assume that in all cases manufacturing over- head is applied on the basis of direct labor cost and the rate is the same.

19. (Objective 9-9) The following questions deal with audit risk and evidence. Choose the best..

(Objective 9-9) The following questions deal with audit risk and evidence. Choose the best response.

a. As the acceptable level of detection risk decreases, an auditor may

(1) reduce substantive testing by relying on the assessments of inherent risk and control risk.

(2) postpone the planned timing of substantive tests from interim dates to the year-end.

(3) eliminate the assessed level of inherent risk from consideration as a planning factor.

(4) lower the assessed level of control risk from the maximum level to below the maximum.

b. As lower acceptable levels of both audit risk and materiality are established, the auditor should plan more work on individual accounts to

(1) find smaller misstatements.

(2) find larger misstatements.

(3) increase the tolerable misstatement in the accounts.

(4) increase materiality in the accounts.

c. Based on evidence gathered and evaluated, an auditor decides to increase the assessed level of control risk from that originally planned. To achieve an overall audit risk level that is substantially the same as the planned audit risk level, the auditor could

(1) decrease detection risk.

(2) increase materiality levels.

(3) decrease substantive testing.

(4) increase inherent risk.

(Objective 9-9)

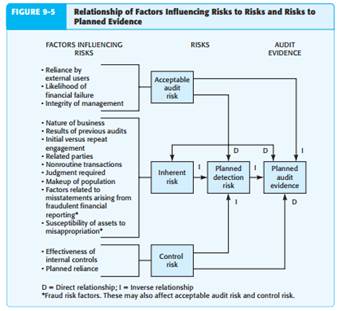

RELATIONSHIP OF RISKS TO EVIDENCE AND FACTORS INFLUENCING RISKS

Figure 9-5 summarizes factors that determine each of the risks, the effect of the three component risks on the determination of planned detection risk, and the relationship of all four risks to planned audit evidence. “D” in the figure indicates a direct relationship between a component risk and planned detection risk or planned evidence. “I” indicates an inverse relationship. For example, an increase in acceptable audit risk results in an increase in planned detection risk (D) and a decrease in planned audit evidence (I). Compare Figure 9-5 to Table 9-2 (p. 260) and observe that these two illustrations include the same concepts. Auditors respond to risk primarily by changing the extent of testing and types of audit procedures, including incorporating unpredictability in the audit procedures used. In addition to modifying audit evidence, there are two other ways that auditors can change the audit to respond to risks

1. The engagement may require more experienced staff. CPA firms should staff all engagements with qualified staff. For low acceptable audit risk clients, special care is appropriate in staffing, and the importance of professional skepticism should be emphasized. Similarly, if an audit area such as inventory has a high inherent risk, it is important to assign that area to someone with experience in auditing inventory.

2. The engagement will be reviewed more carefully than usual. CPA firms need to ensure adequate review of the audit files that document the auditor’s planning, evidence accumulation and conclusions, and other matters in the audit. When acceptable audit risk is low, more extensive review is often warranted, including a review by personnel who were not assigned to the engagement. If the risk of material misstatement (the combination of inherent risk and control risk) is high for certain accounts, the reviewer will likely spend more time making sure the evidence was appropriate and correctly evaluated. Neither control risk nor inherent risk is assessed for the overall audit. Instead, both control risk and inherent risk are assessed for each cycle, each account within a cycle, and some - times even each audit objective for the account. The assessments are likely to vary on the same audit from cycle to cycle, account to account, and objective to objective. For example, internal controls may be more effective for inventory-related accounts than for those related to fixed assets. Control risk will therefore be lower for inventory than for fixed assets. Factors affecting inherent risk, such as susceptibility to misappropriation of assets and routineness of the transactions, are also likely to differ from account to account. For that reason, it is normal to have inherent risk vary for different accounts in the same audit.

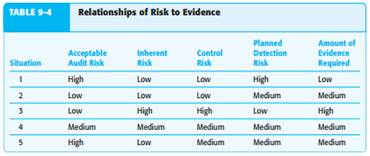

Acceptable audit risk is ordinarily assessed by the auditor during planning and held constant for each major cycle and account. Auditors normally use the same acceptable audit risk for each segment because the factors affecting acceptable audit risk are related to the entire audit, not individual accounts. For example, the extent to which external users’ decisions rely upon financial statements is usually related to the overall financial statements, not just one or two accounts. In some cases, however, a lower acceptable audit risk may be more appropriate for one account than for others. If an auditor decided to use a medium acceptable audit risk for the audit as a whole, the auditor might decide to reduce acceptable audit risk to low for inventory if inventory is used as collateral for a short-term loan. Some auditors use the same acceptable audit risk for all segments based on their belief that at the end of the audit, financial statement users should have the same level of assurance for every segment of the financial statements. Other auditors use a different level of assurance for different segments based on their belief that financial statement users may be more concerned about certain account balances relative to other accounts in a given audit. For illustrations in this and subsequent chapters, we use the same acceptable audit risk for all segments in the audit. Note, however, that changing the risk for different segments is also acceptable. Like control risk and inherent risk, planned detection risk and required audit evidence will vary from cycle to cycle, account to account, or objective to objective. This conclusion should not be surprising. As the circumstances of each engagement differ, the extent and nature of evidence needed will depend on the unique circum - stances. For example, inventory might require extensive testing on an engagement because of weak internal controls and the auditor’s concerns about obsolescence resulting from techno logical changes in the industry. On the same engagement, accounts receiv able may require little testing because of effective internal controls, fast collection of receivables, excellent relationships between the client and customers, and good audit results in previous years. Similarly, for a given audit of inventory, an auditor may assess a higher inherent risk of a realizable value misstatement because of the higher potential for obsolescence but a low inherent risk of a classification misstate ment because there is only purchased inventory. Although it is common in practice to assess inherent and control risks for each balancerelated audit objective, it is not common to allocate materiality to those objectives. Auditors are able to effectively associate most risks with different objectives, and it is reasonably easy to determine the relationship between a risk and one or two objectives. For example, obso - lescence in inventory is unlikely to affect any objective other than realizable value. It is more difficult to decide how much of the materiality allocated to a given account should in turn be allocated to one or two objectives. Therefore, most auditors do not attempt to do so. One major limitation in the application of the audit risk model is the difficulty of measuring the components of the model. Despite the auditor’s best efforts in planning, the assessments of acceptable audit risk, inherent risk, and control risk, and therefore planned detection risk, are highly subjective and are only approximations of reality. Imagine, for example, attempting to precisely assess inherent risk by determining the impact of factors such as the misstatements discovered in prior years’ audits and tech - nology changes in the client’s industry. To offset this measurement problem, many auditors use broad and subjective measurement terms, such as low, medium, and high. As Table 9-4 shows, auditors can use this information to decide on the appropriate amount and types of evidence to accumulate. For example, in situation 1, the auditor has decided on a high acceptable audit risk for an account or objective. The auditor has concluded a low risk of misstate - ment in the financial statements exists and that internal controls are effective. Therefore, a high planned detection risk is appropriate. As a result, a low level of evidence is needed. Situation 3 is at the opposite extreme. If both inherent and control risks are

high and the auditor wants a low acceptable audit risk, considerable evidence is required. The other three situations fall between these two extremes. It is equally difficult to measure the amount of evidence implied by a given planned detection risk. A typical audit program intended to reduce detection risk to the planned level is a combination of several audit procedures, each using a different type of evidence which is applied to different audit objectives. Auditors’ measurement methods are too imprecise to permit an accurate quantitative measure of the combined evidence. Instead, auditors subjectively evaluate whether sufficient appropriate evidence has been planned to satisfy a planned detection risk of low, medium, or high. Presumably, measurement methods are sufficient to permit an auditor to determine whether more or different types of evidence are needed to satisfy a low planned detection risk than for medium or high. Considerable professional judgment is needed to decide how much more. In applying the audit risk model, auditors are concerned about both over-auditing and under-auditing. Most auditors are more concerned about the latter, as underauditing exposes the CPA firm to legal liability and loss of professional reputation. Because of the concern to avoid under-auditing, auditors typically assess risks con - servatively. For example, an auditor might not assess either control risk or inherent risk below .5 even when the likelihood of misstatement is low. In these audits, a low risk might be .5, medium .8, and high 1.0, if the risks are quantified. Auditors develop various types of decision aids to help link judgments affecting audit evidence with the appropriate evidence to accumulate. One such worksheet is included in Figure 9-6 (p. 272) for the audit of accounts receivable for Hillsburg Hardware Co. The eight balance-related audit objectives introduced in Chapter 6 are included in the columns at the top of the worksheet. Rows one and two are acceptable audit risk and inherent risk. Tolerable misstatement is included at the bottom of the worksheet. The engagement in-charge, Fran Moore, made the following decisions in the audit of Hillsburg Hardware Co.:

• Tolerable misstatement. The preliminary judgment about materiality was set at $442,000 (approximately 6 percent of earnings from operations of $7,370,000). She allocated $265,000 to the audit of accounts receivable (see page 255).

• Acceptable audit risk. Fran assessed acceptable audit risk as medium because the company is publicly traded, but is in good financial condition, and has high management integrity. Although Hillsburg is a publicly traded company, its stock is not widely held or extensively followed by financial analysts.

• Inherent risk. Fran assessed inherent risk as medium for existence and cutoff because of concerns over revenue recognition. Fran also assessed inherent risk as medium for realizable value. In past years, audit adjustments to the allowance for uncollectible accounts were made because it was found to be understated. Inherent risk was assessed as low for all other objectives.

20. 1. Scott Butterfield is self-employed as a CPA. He uses the cash method of accounting, and his So...

1. Scott Butterfield is self-employed as a CPA. He uses the cash method of accounting, and his Social Security number is 644-47-7833. His principal business code is 541211. Scott’s CPA practice is located at 678 Third Street, Riverside, CA 92860. During 2016, Scott had the following income and expenses:

Revenues from CPA practice | $130,100 |

Expenses: | |

Car mileage (4,074 business miles) | 2,200 |

Business insurance | 870 |

Office expense | 3,500 |

Country Club dues | 3,200 |

Continuing professional education expenses | 300 |

Contribution to Political Action Committee | 250 |

Rent on office space | 13,800 |

City business license | 250 |

Travel expense | 4,100 |

Meals and entertainment (100%) | 5,400 |

Utilities | 2,724 |

Wages of secretary | 29,400 |

Scott placed his car in service on January 1, 2014. This year, he commuted 3,250 miles in it and drove it 4,500 miles for nonbusiness purposes. His wife has a car for personal use.

Complete Schedule C Form 1040

21. what is the advantages and disadvantages of prudence concept

what is the advantages and disadvantages of prudence concept

22. Chapter 07 case Study Principles of Finance

You ve collected the following information from your favorite financial website. |

52-Week Price | Stock (Div) | Div | PE | Close | Net | |

Hi | Lo | |||||

77.40 | 10.43 | Palm Coal 0.36 | 2.6 | 6 | 13.90 | 0.24 |

56.06 | 33.67 | Lake Lead Grp 1.79 | 4.4 | 10 | 40.68 | 0.01 |

130.93 | 69.50 | SIR 2.00 | 2.2 | 10 | 88.97 | 3.07 |

50.24 | 13.95 | DR Dime 0.80 | 5.2 | 6 | 15.43 | 0.26 |

35.00 | 20.74 | Candy Galore 0.32 | 1.5 | 28 | 0.18 | |

Find the quote for the Lake Lead Group. Assume that the dividend is constant. |

Requirement 1: |

What was the highest dividend yield over the past year (Do not round intermediate calculations.Round your answer to 2 decimal places (e.g., 32.16).) |

Requirement 2: |

What was the lowest dividend yield over the past year (Do not round intermediate calculations.Round your answer to 2 decimal places (e.g., 32.16).) |

You ve collected the following information from your favorite financial website. |

52-Week Price | Stock (Div) | Div | PE | Close | Net | |

Hi | Lo | |||||

77.40 | 10.43 | Palm Coal 0.36 | 2.6 | 6 | 13.90 | 0.24 |

55.81 | 33.42 | Lake Lead Grp 1.54 | 3.8 | 10 | 40.43 | 0.01 |

130.95 | 69.60 | SIR 2.10 | 2.4 | 10 | 88.99 | 3.07 |

50.24 | 13.95 | DR Dime 0.80 | 5.2 | 6 | 15.43 | 0.26 |

35.00 | 20.74 | Candy Galore 0.32 | 1.5 | 28 | 0.18 | |

According to your research, the growth rate in dividends for SIR for the next five years is expected to be 20.5 percent. Suppose SIR meets this growth rate in dividends for the next five years and then the dividend growth rate falls to 5.5 percent indefinitely. Assume investors require a return of 13 percent on SIR stock. |

Requirement 1: |

According to the dividend growth model, what should the stock price be today (Do not round intermediate calculations.Round your answer to 2 decimal places (e.g., 32.16).) |

Requirement 2: |

Based on these assumptions, is the stock currently overvalued, undervalued, or correctly valued? |

You ve collected the following information from your favorite financial website. |

52-Week Price | Stock (Div) | Div | PE | Close | Net | |

Hi | Lo | |||||

78.5 | 10.54 | Palm Coal 0.47 | 3.1 | 6 | 15.00 | 0.24 |

55.81 | 33.42 | Lake Lead Grp 1.54 | 3.8 | 10 | 40.43 | 0.01 |

130.93 | 69.50 | SIR 2.00 | 2.2 | 10 | 88.97 | 3.07 |

50.24 | 13.95 | DR Dime 0.80 | 5.2 | 6 | 15.43 | 0.26 |

35.00 | 20.74 | Candy Galore 0.32 | 1.5 | 28 | 0.18 | |

According to your research, the growth rate in dividends for Palm Coal for the previous 10 years has been 4.25 percent. |

Required: |

If investors feel this growth rate will continue, what is the required return for Palm Coal stock (Do not round intermediate calculations.Round your answer to 2 decimal places (e.g., 32.16).) |

You ve collected the following information from your favorite financial website. |

52-Week Price | Stock (Div) | Div | PE | Close | Net | |

Hi | Lo | |||||

77.40 | 10.43 | Palm Coal 0.36 | 2.6 | 6 | 13.90 | 0.24 |

55.81 | 33.42 | Lake Lead Grp 1.54 | 3.8 | 10 | 40.43 | 0.01 |

130.93 | 69.50 | SIR 2.00 | 2.2 | 10 | 88.97 | 3.07 |

50.33 | 14.04 | DR Dime .89 | 5.7 | 6 | 15.52 | 0.26 |

35.00 | 20.74 | Candy Galore 0.32 | 1.5 | 28 | 0.18 | |

According to your research, the growth rate in dividends for DR Dime for the previous 10 years has been 14 percent. |

Required: |

If investors feel this growth rate will continue, what is the required return for DR Dime stock (Do not round intermediate calculations.Negative amount should be indicated by a minussign.Round your answer to 2 decimal places (e.g., 32.16).) |

You ve collected the following information from your favorite financial website. |

52-Week Price | Stock (Div) | Div | PE | Close | Net | |

Hi | Lo | |||||

77.40 | 10.43 | Palm Coal .36 | 2.6 | 6 | 13.90 | 0.24 |

55.81 | 33.42 | Lake Lead Grp 1.54 | 3.8 | 10 | 40.43 | 0.01 |

130.93 | 69.50 | SIR 2.00 | 2.2 | 10 | 88.97 | 3.07 |

50.24 | 13.95 | DR Dime .80 | 5.2 | 6 | 15.43 | 0.26 |

36.60 | 20.90 | Candy Galore 0.48 | 1.5 | 28 | 0.18 | |

Requirement 1: |

Using the dividend yield, calculate the closing price for Candy Galore on this day. (Do not round intermediate calculations.Round your answer to 2 decimal places (e.g., 32.16).) |

Requirement 2: |

Assume the actual closing price for Candy Galore was $31.69. Your research projects a 4.25 percent dividend growth rate for Candy Galore. What is the required return for the stock using the dividend discount model and the actual stock price (Do not round intermediate calculations.Round your answer to 2 decimal places (e.g., 32.16).) |