Academic Achievement: Accounting Assignment Success

been paid.

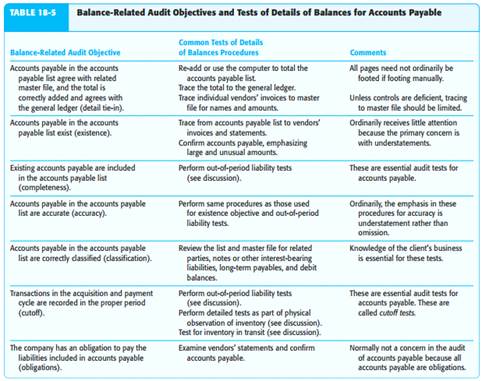

For example, in an audit with a March 31 year-end, assume the auditor examines the supporting documentation for checks paid through June 28. Bills that are still unpaid on June 28 should be examined to determine whether they are obligations at March 31. Trace Receiving Reports Issued Before Year-End to Related Vendors’ Invoices All merchandise received before the year-end of the accounting period should be included as accounts payable. By tracing receiving reports issued up to year-end to vendors’ invoices and making sure that they are included in accounts payable, the auditor is testing for unrecorded obligations. Trace Vendors’ Statements That Show a Balance Due to the Accounts Payable Trial Balance If the client maintains a file of vendors’ statements, auditors can trace any statement that has a balance due at the balance sheet date to the listing to make sure it is included as an account payable. Send Confirmations to Vendors with Which the Client Does Business Although the use of confirmations for accounts payable is less common than for accounts receivable, auditors use them occasionally to test for vendors omitted from the accounts payable list, omitted transactions, and misstated account balances. Sending confirmations to active vendors for which a balance has not been included in the accounts payable list is a useful means of searching for omitted amounts. This type of confirmation is commonly called a zero balance confirmation. Additional discussion of confirmation of accounts payable is deferred until the end of this chapter. Cutoff Tests Accounts payable cutoff tests are done to determine whether transactions recorded a few days before and after the balance sheet date are included in the correct period. The five out-of-period liability audit tests we just discussed are all cutoff tests for acquisitions, but they emphasize understatements. For the first three procedures, it is also appropriate to examine supporting documentation as a test of overstatement of accounts payable. For example, the third procedure tests for understatements (unrecorded accounts payable) by tracing receiving reports issued before year-end to related vendors’ invoices. To test for overstatement cutoff amounts, the auditor should trace receiving reports issued after year-end to related invoices to make sure that they are not recorded as accounts payable (unless they are inventory in transit, which is discussed shortly). We’ve already discussed most cutoff tests in the preceding section, but we will focus on two aspects here: the relationship of cutoff to physical observation of inventory and the determination of the amount of inventory in transit. Relationship of Cutoff to Physical Observation of Inventory In determining that the accounts payable cutoff is correct, it is essential that the cutoff tests be coordinated with the physical observation of inventory. For example, assume that an inventory acquisition for $400,000 is received late in the afternoon of December 31, after the physical inventory is completed. If the acquisition is included in accounts payable and purchases but excluded from ending inventory, the result is an understatement of net earnings of $400,000. Conversely, if the acquisition is excluded from both inventory and accounts payable, there is a misstatement in the balance sheet, but the income statement is correct. The only way the auditor will know which type of misstatement has occurred is to coordinate cutoff tests with the observation of inventory. The cutoff information for acquisitions should be obtained during the physical obser vation of inventory. At that time, the auditor should review the procedures in the receiving department to determine that all inventory received was counted, and the auditor should record in the audit documentation the last receiving report number of inventory included in the physical count. Subsequent to the physical count date, the auditor should then test the accounting records for cutoff. The auditor should trace the previously documented receiving report numbers to the accounts payable records to verify that they are correctly included or excluded. For example, assume that the last receiving report number representing inventory included in the physical count was 3167. The auditor should record this docu ment number and subsequently trace it and several preceding numbers to their related vendors’ invoices and to the accounts payable list or the accounts payable master file to determine that they are all included. Similarly, accounts payable for acquisitions recorded on receiving reports with numbers larger than 3167 should be excluded from accounts payable. When the client’s physical inventory takes place before the last day of the year, the auditor must still perform an accounts payable cutoff at the time of the physical count in the manner described in the preceding paragraph. In addition, the auditor must verify whether all acquisitions that took place between the physical count and the end of the year were added to the physical inventory and accounts payable. For example, if the client takes the physical count on December 27 for a December 31 year-end, the cutoff information is taken as of December 27. After the physical count date, the auditor must first test to determine whether the cutoff was accurate as of December 27. After deter - mining that the December 27 cutoff is accurate, the auditor must test whether all inventory received subsequent to the physical count, but on or before the balance sheet date, was added to inventory and accounts payable by the client. Inventory in Transit In accounts payable, auditors must distinguish between acquisi - tions of inventory that are on an FOB destination basis and those that are made FOB origin. For FOB destination, title passes to the buyer when the inventory is received, so only inventory received on or before the balance sheet date should be included in inventory and accounts payable at year-end. When an acquisition is FOB origin, the company must record the inventory and related accounts payable in the current period if shipment occurred on or before the balance sheet date. Auditors can determine whether inventory has been acquired FOB destination or origin by examining vendors’ invoices. Auditors should examine invoices for merchandise received shortly after year-end to determine whether they were on an FOB origin basis. For those that were, and when the shipment dates were on or before the balance sheet date, the inventory and related accounts payable must be recorded in the current period if the amounts are material.

18. 81. Adding more decision-making authority to a job to increase its motivational potential is...

81. Adding more decision-making authority to a job to increase its motivational potential is known as:

A. job enlargement.

B. job rotation.

C. job involvement.

D. job enrichment.

Job design interventions emphasizing the motivational approach tend to focus on increasing the meaningfulness of jobs. Much of the work on job enlargement, job enrichment and self-managing work teams has its roots in the motivational approach to job design.

82. As a manager, you want to redesign a job to ensure that incumbents have fewer physical ailments, such as backaches and so on. Which job design approach would be most helpful to you?

A. Motivational approach

B. Mechanistic approach

C. Biological approach

D. Perceptual-motor approach

The goal of Biological approach is to minimize physical strain on the worker by structuring the physical work environment around the way the human body works.

83. Which of the following is concerned with examining the interface between individuals' physiological characteristics and the physical work environment?

A. Task identity

B. Ergonomics

C. Job analysis

D. Task significance

Job design that comes primarily from the sciences of biomechanics (i.e., the study of body movements), work physiology, and occupational medicine, and it is usually referred to as ergonomics.

84. Which of the following statements about the biological approach to job design is FALSE?

A. It is usually referred to as ergonomics.

B. It focuses on outcomes such as physical fatigue, aches and pains, and health complaints.

C. It has been applied in redesigning equipment used in jobs that are not physically demanding.

D. Issues like lighting, space, and hours worked become more salient from this perspective.

The goal of Biological approach is to minimize physical strain on the worker by structuring the physical work environment around the way the human body works.

85. Which of the following approaches to job design has roots in human-factors literature?

A. Motivational approach

B. Mechanistic approach

C. Biological approach

D. Perceptual-motor approach

The perceptual – motor approach to job design has roots in human-factors literature. The goal of Perceptual-motor approach is to design jobs in a way that ensures they do not exceed people's mental capabilities and limitations.

86. The perceptual-motor approach to job design focuses on:

A. physical capabilities and limitations.

B. human mental capabilities and limitations.

C. attitudinal variables.

D. work structure.

Perceptual-motor approach generally tries to improve reliability, safety, and user reactions by designing jobs to reduce their information-processing requirements. And design jobs in a way that ensures they do not exceed people's mental capabilities and limitations.

87. The goal of the perceptual – motor approach to job design is:

A. to focus on increasing the meaningfulness of jobs.

B. to design jobs in a way that ensures they do not exceed people's mental capabilities and limitations.

C. to make the work simple so that anyone can be trained quickly and easily to perform it.

D. to minimize physical strain on the worker by structuring the physical work environment around the way the human body works.

Perceptual – Motor Approach designs jobs, by looking at the least capable worker and then constructing job requirements that an individual of that ability level can meet. And generally tries to improve reliability, safety, and user reactions by designing jobs to reduce their information-processing requirements.

88. What term refers to the reduced attentive state that one might experience when simultaneously interacting with multiple media?

A. Multitasking absence

B. Task presence

C. Multimedia tasking

D. Absence presence

Recent changes in technological capacities hold the promise of helping to reduce job demands and errors, but in some cases, these developments have actually made the problem worse. Absence presence refers to reduced attentive state when interacting with multiple media.

89. As a manager, you decide to design a job based on the principles of the motivational approach. Based on existing research, which of the following outcomes should you least expect?

A. Increased job satisfaction

B. Increased quality of production

C. Increased efficiency of production

D. Decreased absenteeism

The motivational and mechanistic approaches are negatively related to each other, suggesting that designing jobs to maximize efficiency very likely results in a lower motivational component to those jobs.

90. As a manager, you decide to design a job based on the principles of the mechanistic approach. Based on existing research, which of the following outcomes should you least expect?

A. Increased job satisfaction

B. Decreased skill requirements

C. Increased efficiency of production

D. Lower wage rates

The motivational and mechanistic approaches are negatively related to each other, suggesting that designing jobs to maximize efficiency very likely results in a lower motivational component to those jobs.

19. 111. What effect will this adjustment have on the accounting records? Unearned Revenue 6,375...

111. What effect will this adjustment have on the accounting records?

Unearned Revenue | 6,375 |

|

Fees Earned |

| 6,375 |

|

|

|

A. increase net income

B. increase revenues reported for the period

C. decrease liabilities

D. all of these

112. What effect will this adjusting journal entry have on the accounting records?

Supplies Expense | 760 |

|

Supplies |

| 760 |

|

|

|

A. increase income

B. decrease net income

C. decrease expenses

D. increase assets

113. What effect will the following adjusting journal entry have on the accounting records?

Depreciation Expense | 2,150 |

|

Accumulated Depreciation |

| 2,150 |

|

|

|

A. increase net income

B. increase revenues

C. decrease expenses

D. decrease net book value

114. How will the following adjusting journal entry affect the accounting equation?

Unearned Subscriptions | 11,500 |

|

Subscriptions Earned |

| 11,500 |

|

|

|

A. increase assets, increase revenues

B. increase liabilities, increase revenues

C. decrease liabilities, increase revenues

D. decrease liabilities, decrease revenues

115. Which of the following is not true regarding depreciation?

A. Depreciation allocates the cost of a fixed asset over its estimated life.

B. Depreciation expense reflects the decrease in market value each year.

C. Depreciation is an allocation not a valuation method.

D. Depreciation expense does not measure changes in market value.

116. The account type and normal balance of Prepaid Expense is

A. revenue, credit

B. expense, debit

C. liability, credit

D. asset, debit

117. The account type and normal balance of Unearned Revenue is

A. revenue, credit

B. expense, debit

C. liability, credit

D. asset, debit

118. Which of the following is an example of an accrued expense?

A. Salary owed but not yet paid

B. Fees received but not yet earned

C. Supplies on hand

D. A two-year premium paid on a fire insurance policy

119. The net book value of a fixed asset is determined by

A. original cost less accumulated depreciation

B. original cost less depreciation expense

C. original cost less accumulated depreciation plus depreciation expense

D. original cost plus accumulated depreciation

120. The balance in the supplies account, before adjustment at the end of the year is $6,250. The proper adjusting entry if the amount of supplies on hand at the end of the year is $1,500 would be

A. debit Supplies $1,500, credit Supplies Expense $1,500

B. debit Supplies Expense $4,750, credit Supplies $4,750

C. debit Supplies Expense $1,500, credit Supplies $1,500

D. debit Supplies $4,750, credit Supplies Expense $4,750

Wilma Company must decide whether to make or buy some of its components. The costs of producing 65, 900 switches for its generators are as follows. Instead of making the switches at an average cost of $2.92 ($192, 428/65, 900), the company has an opportunity to buy the switches at $2.75 per unit. If the company purchases the switches, all the variable costs and one-fourth of the fixed costs will be eliminated. a) Prepare an incremental analysis showing whether the company should buy the switches. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) (b) Would your answer be different if the released productive capacity will generate additional income of $52, 747? (Enter negative amounts using either a negative sign preceding the number e.g. -45).)

21. Business valuation. The Branson Trucking Company was started by three brothers in Columbus, Ohio...

Business valuation. The Branson Trucking Company was started by three brothers in Columbus, Ohio in 1977. In 1982, Dave James came into the company primarily for marketing and growth purposes. Soon Dave showed that he was effective at increasing business and making deals that caused the company to grow significantly. Within 10 years, Branson trucking was one of the major regional carriers in the central Midwest. Over the years, the Branson brothers gave stock options to Dave James to keep him happy with the firm and to reflect his contributions to the firm’s growth and general success. Dave exercised these options over time, and by 1995, the three Branson brothers and Dave James each owned 25 percent of the stock of the Branson Trucking Company. By the late-1990s, two of the Branson brothers wanted to bring children and their spouses into the trucking business. The role that these new family members would play in the business created significant discussions and some strife. Dave James in particular was opposed to bringing in family members. Dave threatened to leave, and some of the Bransons thought that was a good idea. After several months of negotiations, it was agreed that Dave James would receive one year’s severance pay, and the three Branson brothers would buy his stock in the company at its fair value. At the end of 2013, Dave James resigned from the trucking company. Branson Trucking Company is a closely held company that does not trade in any market. The only stock sales have been directly from the company to the original holders of the stock. Below are income statements for the Branson Trucking Company for the years 2009–2013. The Branson Trucking Company financial statements are prepared by the Black & Blue CPA Group directly from Branson’s accounting data. This accounting firm also prepares all of the Branson Trucking Company’s tax returns. The financial statements are prepared directly from Branson Trucking’s accounting data and are not audited by any accounting firm. Dave James received severance pay of $125,000. He is currently employed in a similar marketing position earning $135,000 a year. During the 2009– 2013 time period, the average price earnings ratio for similar trucking firms that were traded in open markets were 9, 11, 12, 10, and 8, respectively, for the five year period. Branson Trucking Company’s net income for the years 2014–2015 was $450,000 and $690,000, respectively, for the two year period. Below is an appraisal of the Branson Trucking Company’s assets as of December 31, 2011. At that time the firm’s total liabilities were $5,100,000. You are hired as a forensic accounting expert. Prepare a business valuation for the Branson Trucking Company at the time that Dave James left the business. Determine what the shares of Dave James were worth at the time of his departure from the company. What limitations, if any, will you list in your report in connection with your valuation of this business? Would your valuation of the business or of the value of Dave James’s share in the business change depending on whether you were hired as an expert by Dave James or the Branson Family? Dan Willens, Appraiser 4610 E. Washington Street Columbus, Ohio 43218 At your request, I have appraised the nonfinancial assets of the Branson Trucking Company as of December 31, 2013. In arriving at my valuations of these assets I used industry trade data, expert evaluations, and other sources of valuations, as I deemed appropriate under the circumstances. Below is a summary of the results: Current Assets: Cash $218,000 Accounts Receivable (net) 610,000 Inventory and Supplies 165,000 Prepaid Expenses 141,000 $1,134,000 Fixed assets: Land 650,000 Building & Fixtures 2,920,000 Rolling Stock 4,230,000 7,800,000 Investments: Bond Sinking Fund 340,000 Common Stock of other firms650,000 990,000 Total Asset Value $9,924,000 UNAUDITED Branson Trucking Company Income Statement For the Year Ended December 31, 2009 Sales $17,281,000 Less Sales Allowances 562,000 Net Sales $16,719,000 Cost of Sales 12,617,000 Gross Profit 4,102,000 Operating Expenses 4,886,000 Operating Income (Loss) (784,000) Other Income: Gain (Loss) on Sale of Assets 588,000 Income (Loss) Before Taxes (196,000) Income Taxes 0 Net Income (Loss) $(196,000) UNAUDITED Branson Trucking Company Income Statement For the Year Ended December 31, 2011 Sales $22,149,000 Less Sales Allowances 883,000 Net Sales $21,266,000 Cost of Sales 14,122,000 Gross Profit 7,144,000 Operating Expense 6,452,000 Operating Income (Loss) 692,000 Other Income: Gain (Loss) on Sale of Assets 254,000 Income (Loss) Before Taxes 946,000 Income Taxes 286,000 Net Income (Loss) $660,000 Switched from ACR (tax) depreciation to straight-line depreciation. Branson Trucking Company Statement of Retained Earnings For the Year Ended December 31, 2009 Branson Trucking Company Statement of Retained Earnings For the Year Ended December 31, 2011 Beginning Retained Earnings $1,456,000 Net Income for the year (196,000) Retained Earnings $1,260,000 Retained Earnings $1,478,000 Net Income 660,000 2,138,000 Less Dividends 400,000 Retained Earnings $1,738,000 UNAUDITED Branson Trucking Company Income Statement For the Year