Score High in Quizz and Discussions: Accounting Assignments

29. Based on Panjim's 2015 cash T-account, which one of the following statements must be true?

The next 4 questions are based on Panjim Trading companys cash T-Account

CASH T

Debit Side Credit Side

-Balance 1/1 225,000

-Collection

from Customers 60,000 44,000 Payments to suppliers

-Stock Issued 20,000 13,000 Purchase of machinery

-5yrBankLoan 75,000 100,000 Salaries paid

-SaleOfUsedVan 10,000 4,000 Dividends paid

5,000 Interest payment

1,000 Garage rental

_____________________________

Balance 12/31 223,000

1) Based on Panjims 2005 cash T-account, which one of the following statements must be true?

A. Panjim did not record any tax expense for 2005

B. During 2005, Panjims total merchandise sales were $60,000

C. During 2005, Panjim issued $75,000 of debt

D. During 2005, Panjims total merchandise purchases were $44,000

30. A worker completes a job in a certain number of hours. The standard time allowed for the job is 10...

A worker completes a job in a certain number of hours. The standard time allowed for the job is 10 hours, and the hourly rate of wages is Re 1. The worker earns at the 50% rate a bonus of Rs 2 under Halsey"s plan. Ascertain his total wages under the Rowan premium plan.

31. Comprehensive Master Budget: Frame-It Company

Comprehensive Master Budget

Accounting 2302

Jeffrey Vaughn, president of Frame-It Company, was just concluding a budget meeting with his senior staff. It was November of 20x0, and the group was discussing preparation of the firm’s master budget for 20x1. “I’ve decided to go ahead and purchase the industrial robot we’ve been talking about. We’ll make the acquisition on January 2 of next year, and I expect it will take most of the year to train the personnel and reorganize the production process to take full advantage of the new equipment.”

AND SO ON

Prepare Frame-It Company’s master budget for 20x1 by completing the following schedules and statements.

1. Sales budget:

2. Cash receipts budget:

3. Production budget:

4. Direct-material budget

5. Cash disbursements budget:

6. Summary cash budget:

7. Prepare a budgeted schedule of cost of good manufactured and sold for the year 20x1. Note: Budgeted and actual MOH will be equal.

8. Prepare Frame-It’s budgeted income statement for 20x1. (Ignore income taxes.)

9. Prepare Frame-It’s budgeted statement of retained earnings for 20x1.

10. Prepare Frame-It’s budgeted balance sheet as of December 31, 20x1.

32. Multiple-step income statement and report form of balance sheet OBJ. 3 The following selected...

Multiple-step income statement and report form of balance sheet OBJ. 3 The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2016:

Cash | $ 240,000 | Dividends | $ 100,000 |

Accounts Receivable | 966,000 | Sales | 11,343,000 |

Merchandise Inventory | 1,712,500 | Cost of Merchandise Sold | 7,850,000 |

Office Supplies | 13,500 | Sales Salaries Expense | 916,000 |

Prepaid Insurance | 8,000 | Advertising Expense | 550,000 |

Office Equipment | 830,000 | Depreciation Expense— |

|

Accumulated Depreciation— |

| Store Equipment | 140,000 |

Office Equipment | 550,000 | Miscellaneous Selling Expense | 38,000 |

Store Equipment | 3,600,000 | Office Salaries Expense | 650,000 |

Accumulated Depreciation— |

| Rent Expense | 94,000 |

Store Equipment | 1,820,000 | Depreciation Expense— |

|

Accounts Payable | 366,000 | Office Equipment | 50,000 |

Salaries Payable | 41,500 | Insurance Expense | 48,000 |

Note Payable |

| Office Supplies Expense | 28,100 |

(final payment due 2022) | 300,000 | Miscellaneous Administrative Exp. | 14,500 |

Common Stock | 500,000 | Interest Expense | 21,000 |

Retained Earnings | 2,949,100 |

|

|

Instructions

1. Prepare a multiple-step income statement.

2. Prepare a retained earnings statement.

3. Prepare a report form of balance sheet, assuming that the current portion of the note payable is $50,000.

4. Briefly explain (a) how multiple-step and single-step income statements differ and (b) how report-form and account-form balance sheets differ.

33. Entrada, an interior decorating firm, uses a job order costing system and applies overhead to...

Entrada, an interior decorating firm, uses a job order costing system and applies overhead to jobs using a predeter- mined rate of $17 per direct labor hour. On June 1, 2013, Job #918 was the only job in process. Its costs included direct material of $8,250 and direct labor of $500 (25 hours at $20 per hour). During June, the company began work on Jobs #919, #920, and #921. Direct material used for June totaled $21,650. June’s direct labor cost totaled $6,300. Job #920 had not been completed at the end of June, and its direct material and direct labor charges were $2,850 and $800, respectively. All other jobs were completed in June.

a. What was the total cost of Job #920 as of the end of June 2013? b. What was the cost of goods manufactured for June 2013? c. If actual overhead for June was $5,054, was the overhead underapplied or overap-

34. Contribution margin, decision making Lurvey Men’s Clothing’s rev

Contribution margin, decision making Lurvey Men’s Clothing’s revenues and cost data for 2011 are as follows:

Mr. Lurvey, the owner of the store, is unhappy with the operating results. An analysis of other operating costs reveals that it includes $30,000 variable costs, which vary with sales volume, and $15,000 (fixed) costs.

Required:

1. Compute the contribution margin of Lurvey Men’s Clothing.

2. Compute the contribution margin percentage.

3. Mr. Lurvey estimates that he can increase revenues by 15% by incurring additional advertising costs of $13,000. Calculate the impact of the additional advertising costs on operatingincome.

35. For number 7, what would be the formulas I put for D5-D9? If you could specify each formula for e...

For number 7, what would be the formulas I put for D5-D9? If you could specify each formula for each cell I'd appreciate it thank you.

raw Design Layout AaBb CCL Ala 14 A' A' Aa Ap E Emphasis He Paragraph Start Excel, Download and open the file named e01 grader al.xsa. Copy the range A5:G5 and paste the data below the Big Data Analytics row. For the pasted a data, change the start date to 6/25/2018 and the end date to 6/29/2018. Change the of Corporate Attendees to 10 and the of Education Attendees to 10. Merge and center the cells F3 and G3. Merge and center the range H3:13. Insert a column to the right of the End Date oolumn. Type of Days in cell D4. In cell D5, calculate the number of days for the first workshop. Add 1 to the results to include the total number of days, incuding the start and end dates. Copy the formula to the range 7 D6: D9 Apply Number format with zero decimal places to the range D5:D9.

36. ALL I REALLY NEED HELP WITH IS #2 WHERE IT SAYS "Assume that the company uses IFRS and that it is...

ALL I REALLY NEED HELP WITH IS #2 WHERE IT SAYS "Assume that the company uses IFRS and that it issued the bonds for net proceeds (after deducting the bond issue costs of $18,000) of $944,091.83, which is consistent with an effective interest rate of 10.49%. Prepare the journal entries for the sale of the bonds and the first two interest payments."

On January 1, 2016, Knorr Corporation issued $1,000,000 of 9%, 5-year bonds dated January 1, 2016. The bonds pay interest annually on December 31. The bonds were issued to yield 10%. Bond issue costs associated with the bonds totaled $18,000.

Required:

1. | Prepare the journal entries to record the following: |

January 1, 2016 | Sold the bonds at an effective rate of 10% |

December 31, 2016 | First interest payment using the effective interest method |

December 31, 2016 | Amortization of bond issue costs using the straight-line method |

December 31, 2017 | Second interest payment using the effective interest method |

December 31, 2017 | Amortization of bond issue costs using the straight-line method |

2. | Assume that the company uses IFRS and that it issued the bonds for net proceeds (after deducting the bond issue costs of $18,000) of $944,091.83, which is consistent with an effective interest rate of 10.49%. Prepare the journal entries for the sale of the bonds and the first two interest payments. |

37. The standard cost of a chemical mixture is as follows

The standard cost of a chemical mixture is as follows:

4 tonnes of materials ‘A’ at Rs. 40 per tonne.

6 tonnes of material ‘B’ at Rs. 60 per tonne.

Standard yield 90% of input.

Actual cost for a period is as under:

4.5 tonnes of material A at Rs. 30 per tonne.

5.5 tonnes of material B at Rs. 68 per tonne.

Actual yield is 9.1 tonnes.

Calculate all material variances:

38. 1. What are the major internal controls over owners’ equity? 2. How does the audit of owners’...

1. What are the major internal controls over owners’ equity?

2. How does the audit of owners’ equity for a closely held corporation differ from that for a publicly held corporation? In what respects are there no significant differences?

3. What kinds of information can be confirmed with a transfer agent?

39. 21) At the break-even point of 200 units, variable costs total $400 and fixed costs total $600. The.

21) At the break-even point of 200 units, variable costs total $400 and fixed costs total $600. The 201st

unit sold will contribute ________ to profits.

21)

A) $1 B) $2 C) $3 D) $5

22) Which of the following will increase a company's break-even point? 22)

A) reducing its total fixed costs B) increasing contribution margin per unit

C) increasing the selling price per unit D) increasing variable cost per unit

7

Answer the following questions using the information below:

Nancy's Niche sells a single product. 8000 units were sold resulting in $80 000 of sales revenue, $20 000 of variable costs, and

$10 000 of fixed costs.

23) The contribution margin percentage is: 23)

A) 12.5% B) 37.5% C) 25.0% D) 75.0%

Answer the following questions using the information below:

Ghan Manufacturing produces a single product that sells for $80. Variable costs per unit equal $32. The company expects

total fixed costs to be $72 000 for the next month at the projected sales level of 2000 units. In an attempt to improve

performance, management is considering a number of alternative actions. Each situation is to be evaluated separately.

24) What is the current break-even point in terms of number of units? 24)

A) 1500 units B) 3333 units

C) 2250 units D) None of these answers are correct.

25) Assume only the specified parameters change in a cost-volume-profit analysis. If the contribution

margin increases by $2 per unit, then operating profits will:

25)

A) decrease by $2 per unit B) also increase by $2 per unit

C) increase by less than $2 per unit D) be indeterminable

8

Answer the following questions using the information below:

Koscuiszko Chalet, Inc. sells burgers during the major ski season. During the current year 11 000 burgers were sold resulting

in $220 000 of sales revenue, $55 000 of variable costs, and $24 000 of fixed costs.

26) If sales increase by $40 000, operating profit will increase by: 26)

A) $10 000 B) $20 000

C) $30 000 D) None of these answers are correct.

Answer the following questions using the information below:

Ghan Manufacturing produces a single product that sells for $80. Variable costs per unit equal $32. The company expects

total fixed costs to be $72 000 for the next month at the projected sales level of 2000 units. In an attempt to improve

performance, management is considering a number of alternative actions. Each situation is to be evaluated separately.

27) Suppose that management believes that a 10% reduction in the selling price will result in a 10%

increase in sales. If this proposed reduction in selling price is implemented:

27)

A) operating profit will decrease by $8000 B) operating profit will increase by $16 000

C) operating profit will increase by $8000 D) operating profit will decrease by $16 000

Answer the following questions using the information below:

Kelly's Armoured Suits sells a single product. 10 000 units were sold resulting in $100 000 of sales revenue, $40 000 of

variable costs, and $12 000 of fixed costs.

28) If sales increase by $25 000, operating profit will increase by: 28)

A) $10 000 B) $15 000

Answer the following questions using the information below:

Gosford Manufacturing produces a single product that sells for $200. Variable costs per unit equal $50. The company expects

total fixed costs to be $140 000 for the next month at the projected sales level of 2000 units. In an attempt to improve

performance, management is considering a number of alternative actions. Each situation is to be evaluated separately.

29) Suppose that management believes that a $48 000 increase in the monthly advertising expense will

result in a considerable increase in sales. Sales must increase by how much to justify this additional

expenditure?

29)

A) 320 units B) 480 units

Answer the following questions using the information below:

Assume the following cost information for Murray River Company:

Selling price $240 per unit

Variable costs $140 per unit

Total fixed costs $140 000

Tax rate 40%

30) What is the number of units that must be sold to earn an after-tax net profit of $42 000? 30)

A) 2100 units B) 1875 units C) 4625 units D) 3050 units

40. Roadside Travel Court was organized on July 1, 2016, by Betty Johnson. Betty is a good manager but...

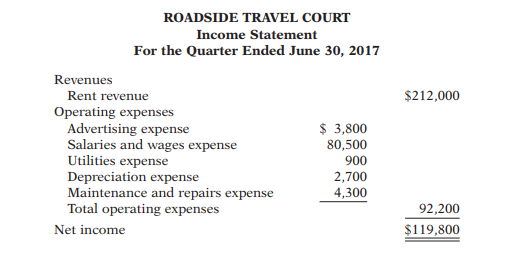

Roadside Travel Court was organized on July 1, 2016, by Betty Johnson. Betty is a good manager but a poor accountant. From the trial balance prepared by a part-time bookkeeper, Betty prepared the following income statement for her fourth quarter, which ended June 30, 2017.

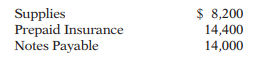

Betty suspected that something was wrong with the statement because net income had never exceeded $30,000 in any one quarter. Knowing that you are an experienced accountant, she asks you to review the income statement and other data. You first look at the trial balance. In addition to the account balances reported above in the income statement, the trial balance contains the following additional selected balances at June 30, 2017.

You then make inquiries and discover the following.

1. Roadside rental revenues include advanced rental payments received for summer occupancy, in the amount of $57,000.

2. There were $1,800 of supplies on hand at June 30.

3. Prepaid insurance resulted from the payment of a 1-year policy on April 1, 2017.

4. The mail in July 2017 brought the following bills: advertising for the week of June 24, $110; repairs made June 18, $4,450; and utilities for the month of June, $215.

5. Wage expense is $300 per day. At June 30, 4 days’ wages have been incurred but not paid.

6. The note payable is a 6% note dated May 1, 2017, and due on July 31, 2017. 7. Income tax of $13,400 for the quarter is due in July but has not yet been recorded

Instructions

(a) Prepare any adjusting journal entries required at June 30, 2017.

(b) Prepare a correct income statement for the quarter ended June 30, 2017.

(c) Explain to Betty the generally accepted accounting principles that she did not recognize in preparing her income statement and their effect on her results.

41. Determine control techniques to make sure that all orders are entered accurately into the system.

A catalog company has hired you to computerize its sales order entry forms. Approximately 60 percent of all orders are received over the telephone, with the remainder received by either mail or fax. The company wants the phone orders to be input as they are received. The mail and fax orders can be batched together in groups of 50 and submitted for keypunching as they become ready. The following information is collected for each order:

- Customer number (if customer does not have one, one needs to be assigned)

- Customer name

- Address

- Payment method (credit card or money order)

- Credit card number and expiration date (if necessary)

- Items ordered and quantity

- Unit price

Required

Determine control techniques to make sure that all orders are entered accurately into the system. Also, discuss any differences in control measures between the batch and the real-time processing.