Revenue Recognition: A Guide for Student Assignments

20. S98. Which of the following basic accounting assumptions is threatened by the existence of severe in

S98. Which of

the following basic accounting assumptions is threatened by the existence of

severe inflation in the economy?

a. Monetary

unit assumption.

b. Periodicity

assumption.

c. Going-concern

assumption.

d. Economic

entity assumption.

S99. During the

lifetime of an entity accountants produce financial statements at artificial

points in time in accordance with the concept of

Relevance Periodicity

a. No No

b. Yes No

c. No Yes

d. Yes Yes

100. Under current IFRS,

inflation is ignored in accounting due to the

a. economic

entity assumption.

b. going

concern assumption.

c. monetary

unit assumption.

d. periodicity

assumption.

101. The economic entity assumption

a. is

inapplicable to unincorporated businesses.

b. recognizes

the legal aspects of business organizations.

c. requires

periodic income measurement.

d. is

applicable to all forms of business organizations.

102. Preparation

of consolidated financial statements when a parent-subsidiary relationship

exists is an example of the

a. economic

entity assumption.

b. relevance

characteristic.

c. comparability

characteristic.

d. neutrality

characteristic.

103. During the lifetime of an entity,

accountants produce financial statements at arbitrary points in time in

accordance with which basic accounting concept?

a. Cost

constraint

b. Periodicity

assumption

c. Conservation

d. Expense

recognition principle

104. The assumption that a company will not be sold or liquidated in the near

future is known as the

a. economic

entity assumption.

b. monetary

unit assumption.

c. materiality

assumption.

d. none

of these answers are correct.

105. Which of the following is an implication of

the going concern assumption?

a. The

historical cost principle is credible.

b. Depreciation

and amortization policies are justifiable and appropriate.

c. The

current-noncurrent classification of assets and liabilities is justifiable and signifiÂcant.

d. All

of these answers are correct.

106. The basic assumptions of accounting used by the International

Accounting StandardsBoard

(IASB) include all of the following except:

a.

Going concern.

b.

Periodicity.

c.

Accrual basis.

d.

Materiality.

107. The basic assumptions of accounting used by the International Accounting

Standards Board (IASB) include

a.

Neutrality.

b.

Periodicity.

c.

Understandability.

d.

Materiality.

21. How does Caxton describe the process of printing a book? What larger conclusions can we draw from...

How does Caxton describe the process of printing a book? What larger conclusions can we draw from this about the market for printed books in general?

22. Recall Sandro Peso from the beginning of the chapter. Now that you have completed the chapter,...

Recall Sandro Peso from the beginning of the chapter. Now that you have completed the chapter, answer the following questions regarding his situation.

1. Describe for Sandro the skills he may perform in each of the three areas (administrative, clinical, and laboratory) of medical assisting at

BWW Associates office.

2. Why should Sandro obtain a credential and membership to a professional organization?

3. How can Sandro find out what to expect on his certification test?

4. What suggestions would you give Sandro to assist him in obtaining the best job?

5. To whom will Sandro be accountable during his work at BWW Associates?

23. The following questions could be asked by an internal user or an external user. ______Can we afford...

The following questions could be asked by an internal user or an external user.

______Can we afford to give our employees a pay raise?

______Did the company earn a satisfactory income?

______Do we need to borrow in the near future?

______How does the company’s profitability compare to other companies?

______What does it cost us to manufacture each unit produced?

______Which product should we emphasize?

______Will the company be able to pay its short-term debts?

Instructions

Identify each of the questions as being more likely asked by an internal user or an external user.

24. Hummer Company uses manufacturing cells to produce its products

Hummer Company uses manufacturing cells to produce its products (a cell is a manufacturing unit dedicated to the production of subassemblies or products). One manufacturing cell produces small motors for lawn mowers. Suppose that the motor manufacturing cell is the cost object. Assume that all or a portion of the following costs must be assigned to the cell.

a. Salary of cell supervisor

b. Power to heat and cool the plant in which the cell is located

c. Materials used to produce the motors

d. Maintenance for the cell’s equipment (provided by the maintenance department)

e. Labor used to produce motors

f. Cafeteria that services the plant’s employees

g. Depreciation on the plant

h. Depreciation on equipment used to produce the motors

i. Ordering costs for materials used in production

j. Engineering support (provided by the engineering department)

k. Cost of maintaining the plant and grounds

l. Cost of the plant’s personnel office

m. Property tax on the plant and land

Required:

Classify each of the costs as a direct cost or an indirect cost to the motor manufacturing cell.

25. Direct and step-down allocation E-books, an online book

Direct and step-down allocation E-books, an online book retailer, has two operating departments—Corporate Sales and Consumer Sales—and two support departments—Human Resources and Information Systems. Each sales department conducts merchandising and marketing operations independently. E-books uses number of employees to allocate Human Resources costs and processing time to allocate Information Systems costs, the following data is available for September 2009:

1. Allocate the support departments’ costs to the operating departments using the direct method.

2. Rank the support departments based on the percentage of their services provided to other support departments. Use this ranking to allocate the support departments’ costs to the operating departments based on the step-down method.

3. How could you have ranked the support departmentsdifferently?

26. Why are most large companies like Microsoft, PepsiCo, Caterpillar, and AutoZone organized as...

Why are most large companies like Microsoft, PepsiCo, Caterpillar, and AutoZone organized as corporations?

27. During the current year, Swallow Corporation, a calendar year C corporation, has the following...

During the current year, Swallow Corporation, a calendar year C corporation, has the following transactions:

Income from operations | $660,000 |

Expenses from operations | 720,000 |

Dividends received from Brown Corporation | 240,000 |

a. Swallow Corporation owns 12% of Brown Corporation’s stock. How much is Swallow’s taxable income or NOL for the year?

b. Assume instead that Swallow Corporation owns 26% of Brown Corporation’s stock.

How much is Swallow’s taxable income or NOL for the year?

28. Overhead allocation based solely on a measure of volume such as direct labor hours: mgmt 640

Overhead allocation based solely on a measure of volume such as direct labor hours:

A). Is a key aspect of the activity-based costing model.

B) Must be used for external financial reporting.

C) Will systematically overcost low-volume products and undercost high-volume products.

D) Will systematically overcost high-volume products and undercost low-volume products.

29. IThe following information applies to the questions displayed below/ Santa Fe Retailing purchased...

IThe following information applies to the questions displayed below/ Santa Fe Retailing purchased merchandise as is (with no urns) from Mesa Wholesalers with credit terms of 2 to ni60 and an invoice price of s24600. The merchand 1. Prepare entries that the buyer records for the (a) purchase, (b) cash payment within the discount period, and (c) cash payment after the discount period view transaction list view general journal Journal Entry Worksheet Record Santa Fe paid within the discount period. Transaction General Journal Debit Credit *Enter debits before credits net clear entry record entry

30. Multiple choice questions 1. The effects of purchasing inventory on credit are to: a. Increase...

Multiple choice questions 1. The effects of purchasing inventory on credit are to: a. Increase assets and increase liabilities. b. Increase assets and increase stockholders ‘equity. c. Decrease assets and decrease stockholders’ equity. d. Decrease assets and decrease liabilities. 2. The effects of paying salaries for the current period are to: a. Increase assets and increase stockholders’ equity. b. Increase assets and increase liabilities. c. Decrease assets and decrease liabilities. d. Decrease assets and decrease stockholders’ equity. 3. Which of the following statements is false? a. Transactions are frequently analyzed using a T-account. b. All T-accounts have both a debit and a credit side. c. The left side of a T-account is called the credit side. d. The amount in an account at any time is called the balance of the account. 4. Which of the following statements are true? I. Debits represent decreases and credits represent increases. II. Debits must always equal credits. III. Assets have normal debit balances while liabilities and stockholders’ equity have normal credit balances. a. I b. I and II c. II and III d. All of these are true. 5. Debits will: a. Increase assets, liabilities, revenues, expenses, and dividends. b. Increase assets, expenses, and dividends. c. Decrease assets, liabilities, revenues, expenses, and dividends. d. Decrease liabilities, revenues, and dividends. 6. Which of the following statemen

31. Jones enterprises was started when it acquired $6,000 cash from creditors and $10,000 from...

Jones enterprises was started when it acquired $6,000 cash from creditors and $10,000 from owners. The company immediately purchased land that cost $12,000. a. record the events under an accounting equation.b. after all events have been recorded, Jones's obligations to creditors represents what percent of total assets?

32. Various cost and sales data for Meriwell Company for the

Various cost and sales data for Meriwell Company for the just completed year appear in the worksheet below:

Finished goods inventory, beginning $20,000

Finished goods inventory, ending$40,000

Depreciation, factory$27,000

Administrative expenses$110,000

Utilities, factory$8,000

Maintenance, factory $40,000

Supplies, factory$11,000

Insurance, factory$4,000

Purchases of raw materials $125,000

Raw materials inventory, beginning$9,000

Raw materials inventory, ending$6,000

Direct labor$70,000

Indirect labor$15,000

Work in process inventory, beginning $17,000

Work in process inventory, ending$30,000

Sales$500,000Selling expenses$80,000

1. Prepare a schedule of cost of goods manufactured.

2. Prepare an income statement.

3. Assume that the company produced the equivalent of 10,000 units of product the year juts completed. What was the average cost per nit for direct materials? What was the average cost per unit for factory depreciation?

4. Assume that the company expects to produce 15,000 units of product during the coming year. What average cost per unit and what total cost would you expect the company to incur for direct materials at this level of activity for factory depreciation? (In preparing you answer, assume that direct materials are a variable cost and that depreciation is a fixed cost; also assume that deprecation is computed on a straight-line basis).

5. As the manger responsible for production costs, explain to the president any difference in the average costs per unit between (3) and (4) above.

33. Problem 6-5A Prepare a bank reconciliation and record adjustments LO P3 [The following...

Problem 6-5A Prepare a bank reconciliation and record adjustments LO P3

[The following information applies to the questions displayed below.]

Chavez Company most recently reconciled its bank statement and book balances of cash on August 31 and it reported two checks outstanding, No. 5888 for $1,054 and No. 5893 for $515. The following information is available for its September 30, 2013, reconciliation. |

From the September 30 Bank Statement |

PREVIOUS BALANCE | TOTAL CHECKS AND DEBITS | TOTAL DEPOSITS AND CREDITS | CURRENT BALANCE |

20,500 | 9,966 | 11,427 | 21,961 |

CHECKS AND DEBITS | DEPOSITS AND CREDITS | DAILY BALANCE | ||||

Date | No. | Amount | Date | Amount | Date | Amount |

09/03 | 5888 | 1,054 | 09/05 | 1,108 | 08/31 | 20,500 |

09/04 | 5902 | 708 | 09/12 | 2,272 | 09/03 | 19,446 |

09/07 | 5901 | 1,836 | 09/21 | 4,084 | 09/04 | 18,738 |

09/17 | 693 NSF | 09/25 | 2,314 | 09/05 | 19,846 | |

09/20 | 5905 | 969 | 09/30 | 16 IN | 09/07 | 18,010 |

09/22 | 5903 | 398 | 09/30 | 1,633 CM | 09/12 | 20,282 |

09/22 | 5904 | 2,139 | 09/17 | 19,589 | ||

09/28 | 5907 | 272 | 09/20 | 18,620 | ||

09/29 | 5909 | 1,897 | 09/21 | 22,704 | ||

09/22 | 20,167 | |||||

09/25 | 22,481 | |||||

09/28 | 22,209 | |||||

09/29 | 20,312 | |||||

09/30 | 21,961 | |||||

From Chavez Company’s Accounting Records |

Cash Receipts Deposited | ||||

Date | Cash | |||

Sept. 5 | 1,108 | |||

12 | 2,272 | |||

21 | 4,084 | |||

25 | 2,314 | |||

30 | 1,685 | |||

11,463 | ||||

Cash Disbursements | ||||

Check No. | Cash | |||

5901 | 1,836 | |||

5902 | 708 | |||

5903 | 398 | |||

5904 | 2,096 | |||

5905 | 969 | |||

5906 | 984 | |||

5907 | 272 | |||

5908 | 384 | |||

5909 | 1,897 | |||

9,544 | ||||

Cash | Acct. No. 101 | |||||

Date | Explanation | PR | Debit | Credit | Balance | |

Aug. 31 | Balance | 18,931 | ||||

Sept. 30 | Total receipts | R12 | 11,463 | 30,394 | ||

30 | Total disbursements | D23 | 9,544 | 20,850 | ||

Additional Information |

Check No. 5904 is correctly drawn for $2,139 to pay for computer equipment; however, the recordkeeper misread the amount and entered it in the accounting records with a debit to Computer Equipment and a credit to Cash of $2,096. The NSF check shown in the statement was originally received from a customer, S. Nilson, in payment of her account. Its return has not yet been recorded by the company. The credit memorandum is from the collection of a $1,650 note for Chavez Company by the bank. The bank deducted a $17 collection fee. The collection and fee are not yet recorded. |

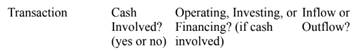

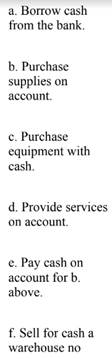

34. Classify cash flows (LO4–7) E4–14 Below are several transactions for Witherspoon Incorporated, a...

Classify cash flows (LO4–7)

E4–14 Below are several transactions for Witherspoon Incorporated, a small manufacturer of decorative

glass designs.