Boost Your Grades with Professional Accounting Assignment Assistance

14. Chapter 9 - Standard Costs

The auto repair shop of Quality Motor Company uses standards to control the labor time and labor cost in the shop. The standard labor cost for a motor tune-up is given below:

Job: Motor tune-up

Standard Hours: 2.2

Standard Rate: $5.5

Standard cost: $12.1

The record showing the time spent in the shop last week on motor tune-ups has been misplaced. However, the shop supervisor recalls that 130 tune-ups were completed during the week, and the controller recalls the following variance data relating to tune-ups:

Labor rate variance

$47F

Total labor variance

$965F

Requirement 1:

Determine the number of actual labor-hours spent on tune-ups during the week.

Requirement 2:

Determine the actual hourly rate of pay for tune-ups last week. (Round your answer to 1 decimal place. Omit the "$" sign in your response.)

15. Operating leverage Beck Inc. and Bryant Inc. have the following operating data: Beck Inc. Bryant...

Operating leverage

Beck Inc. and Bryant Inc. have the following operating data:

| Beck Inc. |

| Bryant Inc. |

Sales | $1,250,000 |

| $2,000,000 |

Variable costs | 750,000 |

| 1,250,000 |

Contribution margin | $ 500,000 |

| $ 750,000 |

Fixed costs | 400,000 |

| 450,000 |

Income from operations | $ 100,000 |

| $ 300,000 |

a. Compute the operating leverage for Beck Inc. and Bryant Inc.

b. How much would income from operations increase for each company if the sales of each increased by 20%?

c.  Why is there a difference in the increase in income from operations for the two companies? Explain.

Why is there a difference in the increase in income from operations for the two companies? Explain.

16. In its first year of operations, Roma Co. earned $45,000 in revenues and received $37,000 cash

In its first year of operations, Roma Co. earned $45,000 in revenues and received $37,000 cash from these customers. The company incurred expenses of $25,500 but had not paid $5,250 of them at year-end. The company also prepaid $6,750 cash for expenses that would be incurred the next year. Calculate the first year's net income under both the cash basis and the accrual basis of accounting. | |||

|

17. Exercise 12-11 indirect: Preparation of statement of cash flows LO P1, P2, P3, A1 IThe following ...

Exercise 12-11 indirect: Preparation of statement of cash flows LO P1, P2, P3, A1 IThe following information applies to the questions displayed belowj The following financial statements and additional information are reported. KIBAN INC. Comparative Balance Sheets June 30, 2015 and 2014 2015 2014 Assets 105,600 55,400 Cash 69,700 Accounts receivable, net 51,000 96,500 66,500 Inventory 5,000 5,800 Prepaid expenses Total current assets 246,800 208,700 118,000 Equipment 129100 (28.100) Accum. depreciation Equipment 0100 347,800 316,600 Total assets Liabilities and Equity 26,500 32,700 Accounts payable 16,600 Wages payable 7800 2,600 Income taxes payable 4100 53,400 36,900 Total current liabilities Notes payable (long term) 48,000 73,000 126,400 Total liabilities 84.900 Equity Common stock, $5 par value 238,000 182,000 Retained earnings 24,900 8,200 347.800 316,600 Total liabilities and equity

18. Internal Controls and Flowchart Analysis

According to the attached Flowhart I need:

a. Identify the physical control waknesses depicted in the flowchart fro Problem 2.

b Describe the IT controls that should be in place in this system.

19. Assets are Always lower than liabilities. Financed by owners and/or creditors. Equal to liabil...

Assets are Always lower than liabilities. Financed by owners and/or creditors. Equal to liabilities less stockholders' equity. The same as expenses because they are acquired with cash.

20. The variable portion of the semi-variable cost of electricity for a manufacturing plant is a...

The variable portion of the semi-variable cost of electricity for a manufacturing plant is a Conversion CostPeriod Cost

A.YesNo B.YesYes C.NoYes D.No No

21. Red Frog Brewery has $1,000-par-value bonds outstanding with the following characteristics:...

Red Frog Brewery has $1,000-par-value bonds outstanding with the following characteristics: currently selling at par; 5 years until final maturity; and a 9 percent coupon rate (with interest paid semiannually). Interestingly, Old Chicago Brewery has a very similar bond issue outstanding. In fact, every bond feature is the same as for the Red Frog bonds, except that Old Chicago’s bonds mature in exactly 15 years. Now, assume that the market’s nominal annual required rate of return for both bond issues suddenly fell from 9 percent to 8 percent.

a. Which brewery’s bonds would show the greatest price change? Why?

b. At the market’s new, lower required rate of return for these bonds, determine the per bond price for each brewery’s bonds. Which bond’s price increased the most, and by how much?

22. A company wishes to pay dividend on shares; which of the following may be utilized? 1.profit and...

A company wishes to pay dividend on shares; which of the following may be utilized?

1.profit and loss A/c

2.premium on shares

3.general reserve

4.other surplus

23. 5) Which of the following does NOT pertain to control charts? A) They plot a series of successive...

5) Which of the following does NOT pertain to control charts?

A) They plot a series of successive observations of a particular step, procedure, or operation.

B) They plot each observation relative to specified ranges that represent the expected distribution.

C) They are used in statistical quality control.

D) They plot only those observations outside specified limits.

E) They plot each observation relative to specified ranges that represent the expected distribution, but only those observations outside specified limits.

6) When using a control chart, a manager does not investigate the activity when

A) most observations are outside the preset range.

B) all observations are outside the preset range.

C) all observations are within the range of preset standard deviations.

D) most observations are within the range of 2 standard deviations.

E) all observations are determined to be non-random.

7) Which of the following indicates how frequently each type of failure occurs?

A) cause-and-effect diagram

B) control chart

C) frequency chart

D) Pareto diagram

E) both frequency charts and Pareto diagrams

8) A graph of a series of successive observations of a particular step, procedure, or operation taken at regular intervals of time is a

A) control chart.

B) Pareto diagram.

C) cause-and-effect diagram.

D) fishbone diagrams.

E) learning curve.

9) Statistical quality control includes a control chart that

A) graphs a series of random events of a process.

B) plots each observation relative to specified ranges that represent the expected distribution.

C) plots control observations over various periods of time.

D) plots only those observations outside specified limits.

E) plots only those observations within one standard deviation from the mean.

10) Discuss the methods used to identify quality problems.

11) Three tools used to detect quality problems include control charts, Pareto charts, and cause and effect diagrams. Briefly explain each of these tools.

12) Baby Care Products has just completed a very successful program of improving quality in its manufacturing operations. The next step is to improve the operations of its administrative functions, starting with the accounting information system. As the manager of the accounting operations, you are requested to begin a quality improvement program.

Required:

What are some possibilities of finding out about the current status of quality in the accounting system?

24. Savallas Company is highly automated and uses computers to contr

Savallas Company is highly automated and uses computers to control manufacturing operations. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of computer-hours. The following estimates were used in preparing the predetermined overhead rate at the beginning of the year:

Computer-hours . . . . . . . . . . . . . . . . . . 85,000

Manufacturing overhead cost . . . . . . . . $1,530,000

During the year, a severe economic recession resulted in cutting back production and a buildup of inventory in the company’s warehouse. The company’s cost records revealed the following actual cost and operating data for the year:

Computer-hours . . . . . . . . . . . . . . . . . . 60,000

Manufacturing overhead cost . . . . . . . . $1,350,000

Inventories at year-end:

Raw materials . . . . . . . . . . . . . . . . . . . . $ 400,000

Work in process . . . . . . . . . . . . . . . . $ 160,000

Finished goods . . . . . . . . . . . . . . . . . $ 1,040,000

Cost of goods sold . . . . . . . . . . . . . . . . $ 2,800,000

Required:

1. Compute the company’s predetermined overhead rate for the year.

2. Compute the underapplied or overapplied overhead for the year.

3. Assume the company closes any underapplied or overapplied overhead directly to Cost of Goods Sold. Prepare the appropriate entry.

4. Assume that the company allocates any underapplied or overapplied overhead to Work in Process, Finished Goods, and Cost of Goods Sold on the basis of the amount of overhead applied during the year that remains in each account at the end of the year. These amounts are $43,200 for Work in Process, $280,800 for Finished Goods, and $756,000 for Cost of Goods Sold. Prepare the journal entry to show the allocation.

5. How much higher or lower will net operating income be for the year if the underapplied or overapplied overhead is allocated rather than closed directly to Cost of Goods Sold?

25. The following n taken from Ronda Co.'s internal records of its factory with two production depart...

The following n taken from Ronda Co.'s internal records of its factory with two production departments. The cost driver for indirect labor and supplies is direct labor costs, and the cost driver for the remaining overhead items is number of hours of machine use. Compute the total amount of overhead cost allocated to Department 1 using activity-based costing.

26. (Objective 6-6) The following are various management assertions (a through m) related to sales...

(Objective 6-6) The following are various management assertions (a through m) related to sales and accounts receivable.

Management Assertion

a. All sales transactions have been recorded.

b. Receivables are appropriately classified as to trade and other receivables in the financial statements and are clearly described.

c. Accounts receivable are recorded at the correct amounts.

d. Sales transactions have been recorded in the proper period.

e. Sales transactions have been recorded in the appropriate accounts.

f . All required disclosures about sales and receivables have been made.

g. All accounts receivable have been recorded.

h. There are no liens or other restrictions on accounts receivable.

i . Disclosures related to receivables are at the correct amounts.

j . Recorded sales transactions have occurred.

k. Recorded accounts receivable exist.

l . Sales transactions have been recorded at the correct amounts.

m. Disclosures related to sales and receivables relate to the entity

Required

a. Explain the differences among management assertions about classes of transactions and events, management assertions about account balances, and management assertions about presentation and disclosure.

b. For each assertion, indicate whether it is an assertion about classes of transactions and events, an assertion about account balances, or an assertion about presentation and disclosure.

c. Indicate the name of the assertion made by management.

(Objective 6-6)

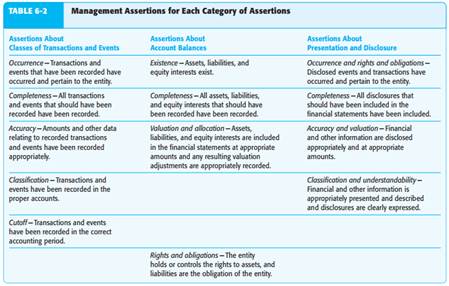

MANAGEMENT ASSERTIONS

Management assertions are implied or expressed representations by management about classes of transactions and the related accounts and disclosures in the financial statements. In most cases they are implied. Examine Figure 6-4 on page 150. Manage - ment of Hillsburg Hardware Co. asserts that cash of $827,568 was present in the company’s bank accounts as of the balance sheet date. Unless otherwise disclosed in the financial statements, management also asserts that the cash was unrestricted and avail - able for normal use. Management also asserts that all required disclosures related to cash are accurate and are understandable. Similar assertions exist for each asset, liability, owners’ equity, revenue, and expense item in the financial statements. These assertions apply to classes of transactions, account balances, and presentation and disclosures. Management assertions are directly related to the financial reporting framework used by the company (usually U.S. GAAP or IFRS), as they are part of the criteria that management uses to record and disclose accounting information in financial statements. The definition of auditing in Chapter 1, in part, states that auditing is a comparison of information (financial statements) to established criteria (assertions established according to accounting standards). Auditors must therefore understand the assertions to do adequate audits. International auditing standards and U.S. GAAS classify assertions into three categories:

1. Assertions about classes of transactions and events for the period under audit

2. Assertions about account balances at period end

3. Assertions about presentation and disclosure The specific assertions included in each category are included in Table 6-2 (p. 154). The assertions are grouped so that assertions related across categories of assertions are included on the same table row.

Management makes several assertions about transactions. These assertions also apply to other events that are reflected in the accounting records, such as recording depre - ciation and recognizing pension obligations. Occurrence The occurrence assertion concerns whether recorded transactions in - cluded in the financial statements actually occurred during the accounting period. For example, management asserts that recorded sales transactions represent exchanges of goods or services that actually took place. Completeness This assertion addresses whether all transactions that should be included in the financial statements are in fact included. For example, management asserts that all sales of goods and services are recorded and included in the financial statements. The completeness assertion addresses matters opposite from the occurrence assertion. The completeness assertion is concerned with the possibility of omitting trans - actions that should have been recorded, whereas the occurrence assertion is concerned with inclusion of transactions that should not have been recorded. Thus, violations of the occurrence assertion relate to account overstatements, whereas violations of the completeness assertion relate to account understatements. The recording of a sale that did not take place is a violation of the occurrence assertion, whereas the failure to record a sale that did occur is a violation of the completeness assertion. Accuracy The accuracy assertion addresses whether transactions have been recorded at correct amounts. Using the wrong price to record a sales transaction and an error in calculating the extensions of price times quantity are examples of violations of the accuracy assertion. Classification The classification assertion addresses whether transactions are recorded in the appropriate accounts. Recording administrative salaries in cost of sales is one example of a violation of the classification assertion.