Expert Assistance with Accounting Assignments and Quizzes

1. Management can expect various benefits to follow from implementing a system of strong internal...

1. Management can expect various benefits to follow from implementing a system of strong internal control. Which of the following benefits is least likely to occur?

a. reduction of cost of an external audit

b. prevention of employee collusion to commit fraud

c. availability of reliable data for decision-making purposes

d. some assurance of compliance with the Foreign Corrupt Practices Act of 1977

e. some assurance that important documents and records are protected

2. Which of the following situations is NOT a segregation of duties violation?

a. The treasurer has the authority to sign checks but gives the signature block to the assistant treasurer to run the check-signing machine.

b. The warehouse clerk, who has custodial responsibility over inventory in the warehouse, selects the vendor and authorizes purchases when inventories are low.

c. The sales manager has the responsibility to approve credit and the authority to write off accounts.

d. The department time clerk is given the undistributed payroll checks to mail to absent employees.

e. The accounting clerk who shares the recordkeeping responsibility for the accounts receivable subsidiary ledger performs the monthly reconciliation of the subsidiary ledger and the control account.

3. The underlying assumption of reasonable assurance regarding implementation of internal control means that

a. auditor is reasonably assured that fraud has not occurred in the period.

b. auditors are reasonably assured that employee carelessness can weaken an internal control structure.

c. implementation of the control procedure should not have a significant adverse effect on efficiency or profitability.

d. management assertions about control effectiveness should provide auditors with reasonable assurance.

e. a control applies reasonably well to all forms of computer technology.

4. To conceal the theft of cash receipts from customers in payment of their accounts, which of the following journal entries should the bookkeeper make?

DR | CR |

a. Miscellaneous Expense | Cash |

b. Petty Cash | Cash |

c. Cash Accounts | Receivable |

d. Sales Returns | Accounts Receivable |

e. None of the above | |

5. Which of the following controls would best prevent the lapping of accounts receivable?

a. Segregate duties so that the clerk responsible for recording in the accounts receivable subsidiary ledger has no access to the general ledger.

b. Request that customers review their monthly statements and report any unrecorded cash payments.

c. Require customers to send payments directly to the company’s bank.

d. Request that customers make checks payable to the company.

2. Moravia Company processes and packages cream cheese. The following data have been compiled for...

Moravia Company processes and packages cream cheese. The following data have been compiled for the month of April. Conversion activity occurs uniformly throughout the production process.

Work in process, April 1—10,000 units:

?

|

Direct material: 100% complete Conversion: 331?3% complete

Costs incurred during April:

Direct material.............................................................................................................................. | $198,000 |

Conversion costs: Direct labor ............................................................................................................................. |

$ 52,800 |

Applied manufacturing overhead .............................................................................................. | 105,600 |

Total conversion costs .............................................................................................................. | $158,400 |

Required: Prepare schedules to accomplish each of the following process-costing steps for the month of April. Use the weighted-average method of process costing.

1. Analysis of physical flow of units.

2. Calculation of equivalent units.

3. Computation of unit costs.

4. Analysis of total costs.

5. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how the solution will change if the following data change: the April 1 work-in-process costs were $27,000 for direct material and $5,000 for conversion.

3. Vinod, Sunita and Simran are partners in a firm sharing profits in the ratio of 3:2:1. Theydecided..

Vinod, Sunita and Simran are partners in a firm sharing profits in the ratio of 3:2:1. Theydecided to share profits equally w.e.f April 1, 2014. On that date the profit and lossaccount showed the credit balance of Rs.60,000 and a balance of Rs.30,000 in generalreserve. Instead of closing profit and loss account, it was decided to record an adjustmententry reflecting the change in the profit sharing ratio. Give necessary journal entry to giveeffect to the same

4. All of the following individuals would likely be SDLC participants EXCEPT

1. All of the following individuals would likely be SDLC participants EXCEPT

a. accountants.

b. shareholders.

c. management.

d. programmers.

e. all of the above.

2. Which of the following represents the correct order in problem resolution?

a. Define the problem, recognize the problem, perform feasibility studies, specify system objectives, and prepare a project proposal.

b. Recognize the problem, define the problem, perform feasibility studies, specify system objectives, and prepare a project proposal.

c. Define the problem, recognize the problem, specify system objectives, perform feasibility studies, and prepare a project proposal.

d. Recognize the problem, define the problem, specify system objectives, perform feasibility studies, and prepare a project proposal.

3. A feasibility study for a new computer system should

a. consider costs, savings, controls, profit improvement, and other benefits analyzed by application area.

b. provide the preliminary plan for converting existing manual systems and clerical operations.

c. provide management with assurance from qualified, independent consultants that the use of a computer system appeared justified.

d. include a report by the internal audit department that evaluated internal control features for each planned application.

4. Which of the following is the most important factor in planning for a system change?

a. Having an auditor as a member of the design team.

b. Using state-of-the-art techniques.

c. Concentrating on software rather than hardware.

d. Involving top management and people who use the system.

e. Selecting a user to lead the design team.

5. In the context of the TELOS acronym, technical feasibility refers to whether

a. a proposed system is attainable, given the existing technology.

b. the systems manager can coordinate and control the activities of the systems department.

c. an adequate computer site exists for the proposed system.

d. the proposed system will produce economic benefits exceeding its costs.

e. the system will be used effectively within the operating environment of an organization.

5. Prepare the journal entries to record the following transactions on Oriole Company’s books usin...

Prepare the journal entries to record the following transactions on Oriole Company’s books using a perpetual inventory system. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.)

(a) | On March 2, Oriole Company sold $878,600 of merchandise to Ivanhoe Company, terms 3/10, n/30. The cost of the merchandise sold was $562,200. | |

(b) | On March 6, Ivanhoe Company returned $118,800 of the merchandise purchased on March 2. The cost of the merchandise returned was $61,000. | |

(c) | On March 12, Oriole Company received the balance due from Ivanhoe Company. |

Prepare the journal entries to record the following transactions on Oriole Company's books using a perpetual inventory system. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) (a) On March 2, Oriole Company sold $878,600 of merchandise to Ivanhoe Company, terms 3/10, n/30. The cost of the merchandise sold was $562,200. (b) On March 6, Ivanhoe Company returned $118,800 of the merchandise purchased on March 2. The cost of the merchandise returned was $61,000. (c) On March 12, Oriole Company received the balance due from Ivanhoe Company. Debit No. Date Account Titles and Explanation Credit (a) (To record sale of merchandise) (b) (To record return of merchandise) (c) March 12

6. Special order, short-run pricing. Diamond Corporation produces baseball bats for kids that it...

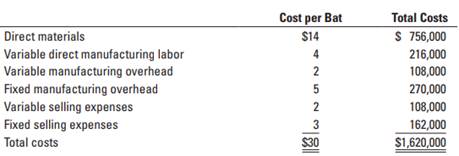

Special order, short-run pricing. Diamond Corporation produces baseball bats for kids that it sells for $37 each. At capacity, the company can produce 54,000 bats a year. The costs of producing and selling 54,000 bats are as follows:

1. Suppose Diamond is currently producing and selling 44,000 bats. At this level of production and sales, its fixed costs are the same as given in the preceding table. Home Run Corporation wants to place a one-time special order for 10,000 bats at $21 each. Diamond will incur no variable selling costs for this special order. Should Diamond accept this one-time special order? Show your calculations.

2. Now suppose Diamond is currently producing and selling 54,000 bats. If Diamond accepts Home Run’s offer, it will have to sell 10,000 fewer bats to its regular customers.

(a) On financial considerations alone, should Diamond accept this one-time special order? Show your calculations.

(b) On financial considerations alone, at what price would Diamond be indifferent between accepting the special order and continuing to sell to its regular customers at $37 per bat.

(c) What other factors should Diamond consider in deciding whether to accept the one-time special order?

7. Calip Corporation, a merchandising company, reported the following results for October: Sales ...

Calip Corporation, a merchandising company, reported the following results for October:

Sales | $433,000 |

Cost of goods sold (all variable) | $173,000 |

Total variable selling expense | $18,000 |

Total fixed selling expense | $9,900 |

Total variable administrative expense | $10,000 |

Total fixed administrative expense | $25,600 |

The contribution margin for October is:

$369,500

$196,500

$260,000

$232,000

8. Which of the following is not a tool or technique used by a financial statement analyst? (a)...

Which of the following is not a tool or technique used by a financial statement analyst?

(a) Common-size financial statements.

(b) Trend analysis.

(c) Random sampling analysis. ___

(d) Industry comparisons.

9. P 10-3) Spitfire Company was incorporated on January 2,1011, but was unable to begin

P 10-3) Spitfire Company was incorporated on January 2,1011, but was unable to begin manufacturing activities until July 1, 2011, because new factory facilities were not completed until that date.

The Land and Building account reported the following items during 2011.

January 31: Land and Building $160,000

February 28: Cost of removal of building $9,800

May 1: Partial payment of new construction $60,000

May 1: Legal fees paid $3,770

June 1: Second payment on new construction $40,000

June 1: Insurance premium $2,280

June 1: Special tax assessment $4,000

June 30: General expenses $36,300

July 1: Final payment on new construction $30,000

December 31: Asset write-up $53,800

Total: $399,950

December 31: Depreciation-2011 at 1% $4,000

December 31, 2011: Account balance $395,950

The following additional information is to be considered.

1. To acquire land and building the company paid $80,000 cash and 800 shares of its 8% cumulative preferred stock, par value $100 per share. Fair market value of the stock is $117 per share.

2. Cost of removal of old buildings amounted to $9,800 and the demolition company retained all materials of the building.

3. Legal fees covered by the following.

Cost of organization: $610

Examination of title covering purchase of land: $1,300

Legal work in connection with construction contract: $1,860

4. Insurance premiums covered the building for a 2-year term beginning May 1, 2011.

5. The special tax assessment covered street improvements that are permanent in nature.

6. General expenses covered the following for the period from January 2, 2011, to June 30, 2011.

President's salary: $32,100

Plant superintendent's salary-supervision of new building: $4,200

Total: $36,300

7. Because of a general increase in construction costs after entering into the building contract, the board of directors increased the value of the building $53,800, believing that such an increase was justified to reflect the current market at the time the building was completed. Retained earnings was credited for this amount.

8. Estimated life of building- 50 years

Depreciation for 2011: 1% of asset value (1% of $400,000, or $4,000)

a) Prepare entries to reflect correct land, building, and depreciation accounts at December 31, 2011.

b) Show the proper presentation of land, building, and depreciation on the balance sheet at December 31, 2011.

10. Ted Carman worked for Rivertide Country Club and earned $28,500 during the year. He also worked part

Ted Carman worked for Rivertide Country Club and earned $28,500 during the year. He also worked part time for Harrison Furniture Company and earned $12,400 during the year. The SUTA tax rate for Rivertide Country Club is 4.2% on the first $8,000, and the rate for Harrison Furniture Company is 5.1% on the first $8,000. Calculate the FUTA and SUTA taxes paid by the employers on Carman's earnings.

FUTA SUTA

a. Rivertide Country Club $ $

b. Harrison Furniture Company $ $

11. The MOST likely cost driver of direct material costs is

Multiple Choice

The MOST likely cost driver of direct material costs is

a. the number of parts within the product

b. the number of miles driven

c. the number of products manufactured

d. the number of production hours

12. ‘Depreciation is a process of allocation and not valuation." What do you think is meant by this...

‘Depreciation is a process of allocation and not valuation." What do you think is meant by this statement?

13. 31. An acceleration in the collection of receivables will tend to cause the accounts receivable...

31. An acceleration in the collection of receivables will tend to cause the accounts receivable turnover to

a. decrease.

b. remain the same.

c. either increase or decrease.

d. increase.

32. Based on the following data for the current year, what is the number of days' sales in inventory (rounded to the nearest whole day)?

Net sales on account during year | $1,204,000 |

Cost of merchandise sold during year | 630,000 |

Accounts receivable, beginning of year | 75,000 |

Accounts receivable, end of year | 85,000 |

Inventory, beginning of year | 81,600 |

Inventory, end of year | 98,600 |

a. 58

b. 48

c. 53

d. 30

33. Based on the following data, what is the amount of quick assets?

Accounts payable | $ 32,000 |

Accounts receivable | 56,000 |

Accrued liabilities | 7,000 |

Cash | 20,000 |

Intangible assets | 40,000 |

Inventory | 72,000 |

Long-term investments | 100,000 |

Long-term liabilities | 75,000 |

Marketable securities | 40,000 |

Notes payable (short-term) | 20,000 |

Property, plant, and equipment | 625,000 |

Supplies | 2,000 |

a. $228,000

b. $188,000

c. $116,000

d. $114,000

34. Based on the following data, what is the amount of working capital?

Accounts payable | $ 32,000 |

Accounts receivable | 64,000 |

Accrued liabilities | 7,000 |

Cash | 20,000 |

Intangible assets | 40,000 |

Inventory | 72,000 |

Long-term investments | 100,000 |

Long-term liabilities | 75,000 |

Marketable securities | 35,000 |

Notes payable (short-term) | 20,000 |

Property, plant, and equipment | 625,000 |

Prepaid expenses | 2,000 |

a. $190,000

b. $134,000

c. $118,000

d. $62,000

35. Based on the following data, what is the quick ratio, rounded to one decimal place?

Accounts payable | $ 32,000 |

Accounts receivable | 64,000 |

Accrued liabilities | 7,000 |

Cash | 20,000 |

Intangible assets | 40,000 |

Inventory | 72,000 |

Long-term investments | 100,000 |

Long-term liabilities | 75,000 |

Marketable securities | 35,000 |

Notes payable (short-term) | 25,000 |

Property, plant, and equipment | 625,000 |

Prepaid expenses | 2,000 |

a. 3.2

b. 2.1

c. 1.9

d. 1.4

36. Which of the following ratios provides a solvency measure that shows the margin of safety of noteholders or bondholders and also gives an indication of the potential ability of the business to borrow additional funds on a long-term basis?

a. Ratio of fixed assets to long-term liabilities

b. Ratio of net sales to assets

c. Number of days' sales in receivables

d. Rate earned on stockholders' equity

37. The number of times interest charges are earned is computed as

a. net income plus interest charges, divided by interest charges.

b. income before income tax plus interest charges, divided by interest charges.

c. net income divided by interest charges.

d. income before income tax divided by interest charges.

38. The tendency of the rate earned on stockholders' equity to vary disproportionately from the rate earned on total assets is sometimes referred to as

a. leverage.

b. solvency.

c. yield.

d. quick assets.

The balance sheets at the end of each of the first two years of operations indicate the following:

2011 | 2010 | |

Total current assets | $600,000 | $560,000 |

Total investments | 60,000 | 40,000 |

Total property, plant, and equipment | 900,000 | 700,000 |

Total current liabilities | 125,000 | 80,000 |

Total long-term liabilities | 350,000 | 250,000 |

Preferred 9% stock, $100 par | 100,000 | 100,000 |

Common stock, $10 par | 600,000 | 600,000 |

Paid-in capital in excess of par--common stock | 60,000 | 60,000 |

Retained earnings | 325,000 | 210,000 |

39. If net income is $130,000 and interest expense is $40,000 for 2011, what is the rate earned on stockholders equity for 2011 (rounded to one decimal place)?

a. 12.0%

b. 12.7%

c. 13.2%

d. 16.5%

40. If net income is $130,000 and interest expense is $40,000 for 2011, what is the rate earned on common stockholders equity for 2011 (rounded to one decimal place)?

a. 12.3%

b. 14.0%

c. 13.0%

d. 17.4%