Excelling in Fall: Expert Assistance in Accounting

21. MM-7 An office equipment representative has a machine for sale or lease. If you buy the machine,...

MM-7 An office equipment representative has a machine for sale or lease. If you buy the machine, the cost is $7,596. If you lease the machine, you will have to sign a noncancellable lease and make five payments of $2,000 each. The first pay- ment will be paid on the first day of the lease. At the time of the last payment you will receive title to the machine. The present value of an ordinary annuity of $1 is as follows:

Present Value Number

of Periods 10% 12% 16%

1 | 0.909 | 0.893 | 0.862 |

2 | 1.736 | 1.690 | 1.605 |

3 | 2.487 | 2.402 | 2.246 |

4 | 3.170 | 3.037 | 2.798 |

5 | 3.791 | 3.605 | 3.274 |

The interest rate implicit in this lease is approximately

a. 10% c. Between 10% and 12%

b. 12% d. 16%

22. CVP analysis, income taxes (CMA, adapted) R. A. Ro and

CVP analysis, income taxes (CMA, adapted) R. A. Ro and Company, a manufacturer of quality handmade walnut bowls, has had a steady growth in sales for the past five years. However, increased competition has led Mr. Ro, the president, to believe that an aggressive marketing campaign will be necessary next year to maintain the company’s present growth. To prepare for next year’s marketing campaign, the company’s controller has prepared and presented Mr. Ro with the following data for the current year, 2011: Variable cost (per bowl)

1. What is the projected net income for 2011? Required

2. What is the breakeven point in units for 2011?

3. Mr. Ro has set the revenue target for 2012 at a level of $550,000 (or 22,000 bowls). He believes an additional marketing cost of $11,250 for advertising in 2012, with all other costs remaining constant, will be necessary to attain the revenue target. What is the net income for 2012 if the additional $11,250 is spent and the revenue target is met?

4. What is the breakeven point in revenues for 2012 if the additional $11,250 is spent for advertising?

5. If the additional $11,250 is spent, what are the required 2012 revenues for 2012 net income to equal 2011 net income?

6. At a sales level of 22,000 units, what maximum amount can be spent on advertising if a 2012 net income of $60,000 isdesired?

23. Cute Camel Woodcraft Company Just reported earnings after tax (also called net income) of $9, 750...

Cute Camel Woodcraft Company Just reported earnings after tax (also called net income) of $9, 750,000, and a current stock price of $36.75 per share. The company Is forecasting an increase of 25% for its after-tax income next year, but it also expects it will have to issue 2, 900,000 new shares of stock (raising its shares outstanding from 5, 500,000 to 8, 400,000). If Cute Camel's forecast turns out to be correct and its price-to-earnings (P/E) ratio does not change, what does the company's management expect its stock price to be one year from now? (Round any P/E ratio calculation to four decimal places). $30.11 per share $36.75 per share $22.58 per share $37.64 per share One year later, Cute Camel's shares are trading at $47.12 per share, and the company reports the value of its total common equity as $50, 584, 800. Given this information, Cute Camel's market-to-book (M/B) ratio is Is it possible for a company to exhibit a negative EPS and thus a negative P/E ratio? No Yes Which of the following statements is true about market value ratios? Companies with high research and development (R&D) expenses tend to have high P/E ratios. Companies with high research and development (R&D) expenses tend to have low P/E ratios.

24. In a product-centric company, rewards would be measured on metrics like all of the following EXCEPT:

In a product-centric company, rewards would be measured on metrics like all of the following EXCEPT:Market shareShare of walletPercentage of revenue from products less than two years oldNumber of new products

25. 11) Which of the following statements is true of normal spoilage and abnormal spoilage? A) Normal...

11) Which of the following statements is true of normal spoilage and abnormal spoilage?

A) Normal spoilage is inherent in a particular production process, whereas abnormal spoilage is not inherent in a particular production process.

B) Abnormal spoilage arises even when the process is carried out in an efficient manner, whereas normal spoilage does not arise when the process is carried out in an efficient manner.

C) Normal spoilage is usually regarded as avoidable and controllable, whereas abnormal spoilage is unavoidable and uncontrollable.

D) The costs of normal spoilage are recorded as a loss as a separate line item in an income statement, whereas costs of abnormal spoilage are included as a component of the costs of good units manufactured.

12) The costs of normal spoilage are typically included as a component of the costs of good units manufactured.

13) Abnormal spoilage is spoilage inherent in a particular production process.

14) Abnormal spoilage is spoilage that should arise under efficient operating conditions.

15) Companies calculate the units of abnormal spoilage and record the cost in the Loss from Abnormal Spoilage account, which appears as a separate line item in an income statement.

16) Spoilage can be considered either normal or abnormal.

17) Normal spoilage is spoilage that is NOT considered to be inherent in a production process.

18) Under efficient operating conditions, all spoilage is considered to be abnormal spoilage.

19) Normal spoilage rates are computed by dividing units of normal spoilage by total good units completed, NOT total actual units started in production.

20) Costs of abnormal spoilage are separately accounted for as losses of the period.

26. Iris Beck is a licensed CPA. During the first month of operations of her business, the following...

Iris Beck is a licensed CPA. During the first month of operations of her business, the following events and transactions occurred.

May 1 Beck invested $20,000 cash in her business.

2 Hired a secretary-receptionist at a salary of $2,000 per month.

3 Purchased $2,500 of supplies on account from Tinio Supply Company.

7 Paid office rent of $900 cash for the month.

11 Completed a tax assignment and billed client $3,200 for services performed.

12 Received $3,500 advance on a management consulting engagement.

17 Received cash of $1,200 for services performed for Misra Co.

31 Paid secretary-receptionist $2,000 salary for the month.

31 Paid 60% of balance due Tinio Supply Company.

Iris uses the following chart of accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 201 Accounts Payable, No. 209 Unearned Service Revenue, No. 301 Owner’s Capital, No. 400 Service Revenue, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense.

Instructions

(a) Journalize the transactions.

(b) Post to the ledger accounts.

(c) Prepare a trial balance on May 31, 2014.

27. You own a house worth $400,000 that is located on a river. If the river floods moderately, the...

You own a house worth $400,000 that is located on a river. If the river floods moderately, the house will be completely destroyed. This happens about once every 50 years. If you build a seawall, the river would have to flood heavily to destroy your house, which only happens about once every 200 years. What would be the annual premium for an insurance policy that offers full insurance? For a policy that only pays 75% of the home value, what are your expected costs with and without a seawall? Do the different policies provide an incentive to be safer (i.e., to build the seawall)?

28. The product of a company passes through three distinct processes to reach completion.

The product of a company passes through three distinct processes to reach completion. They are A, B and C. From past experience it is ascertained that loss is incurred in each process as follows: Process A—2%, process B—5%, process C—10%.

In each case, the percentage of loss is computed on the number of units entering the process concerned. The loss of each process possesses a scrap value. The loss of processes A and B is sold at Rs 5 per 100 units and that of process C at Rs 20 per 100 units.

Process A (Rs) | Process B (Rs) | Process C (Rs) |

6,000 | 4,000 | 2,000 |

8,000 | 6,000 | 3,000 |

1,000 | 1,000 | 1,500 |

20,000 units have been issued to process A at a cost of Rs 10,000. The output of each process is as under process A—19,500 units; process B—18,800 units; and process C—16,000 units. There is no work-in-progress in any process. Prepare process accounts. Calculations should be made to the nearest rupee.

29. EVALUATE AND AUTHORIZE PAYMENT REQUESTS...

Task 1: Theory Assessment Student Instructions

- Type all the answers in a word document if required.

- You can conduct internet research to answer these questions.

- Provide explanation of 2-3 lines when answering ‘Describe’ questions.

- Provide detailed workings for calculations questions.

- Provide answers in table format wherever possible.

Question 1 – Written Answers

Your task is to choose an organisation and based on this organisation, answer the following questions. You may also choose to use the information in case study provided in the link https://www.flatworldsolutions.com/financial-services/success-stories/case-study-accounts-payables.php

- Identify the legislation and industry codes of practice relevant to the payment systems in the organisation.

- List and describe the organisational procedures for evaluating and authorising payment requests.

- Describe the types of payment requests and associated documentation handled by the organisation.

- Describe how payments are coded and allocated in the organisational system.

- Do a reconciliation of payments with Accounts payable register?

- Check whether we have claimed the discounts available for prompt payment allowed by the suppliers if we are entitled for a 5% discount for cash payments if we have paid 33250 in month 1 and 48936 in month 2?

- Prepare sample Creditors list based on due date of payments with 30 days 60 days and 90 days?Select the letter you consider to be the nearest correct alternative.

Task 2: Case Study and Practical Assessment Student Instructions

- Type all the answers in a word document if required.

- You can conduct internet research to answer these questions.

- Provide explanation of 2-3 lines when answering ‘Describe’ questions.

- Provide detailed workings for calculations questions.

- Provide answers in table format wherever possible.

Question 1 – Jacob Lee Pty Ltd

Using the information provided in case study ‘Jacob Lee Pty Ltd’ in appendix, undertake the following tasks. Use all relevant computer and software’s such as excel to complete this task.

Additional Information

- Accounting Standards: http://www.aasb.gov.au/Pronouncements/Current-standards.aspx

- Organisational policies and procedures: http://startupjunkies.com/extras/acct-policies.pdf

- Create templates of various payment documents that need to be created within the organisation

- List some ways for the organisation to verify and validate accuracy of payment requests

- Create all required payment documents for transactions listed by using required templates

- List some ways for organisation to check and authorise the payment request received

- Get authorisation for payment request documents created previously from your manager (assessor) during a role play before processing them for payment.

Assessor will be looking for following during the role play:

- Student followed all the requirements of organisation policies and procedures during the roleplay

- Used active listening and communication skills

- Used questions to confirm requirements and authorisations

- Provide all authorisation evidence.

Question2 –ABC Restaurant

Using the information provided in case study ‘ABC Restaurant’ in appendix, answer the following questions for the organisation.

- What types of documentation would you need to match payment requests to?

- What might payment requests relate to?

- What supporting documentation might you check to ensure it is correct?

- What is the purpose of a check requisition form?

- What should you check to ensure goods and services were supplied?

- What should you check on each invoice before obtaining or providing authorisation for payment?

- What do you need to do after a vendor invoice has been approved?

- What are payment codes and accounts?

- What organisational policies and procedure relate to payments and documentation?

- What is payment authorisation and how can you confirm it authenticity?

When can you release funds for payment?

30. Make versus buy, activity-based costing. The Svenson Corporation manufactures cellular modems. It...

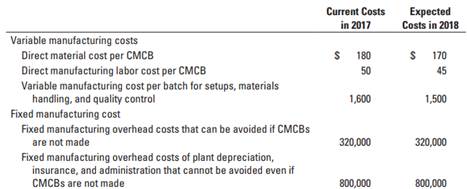

Make versus buy, activity-based costing. The Svenson Corporation manufactures cellular modems. It manufactures its own cellular modem circuit boards (CMCB), an important part of the cellular modem. It reports the following cost information about the costs of making CMCBs in 2017 and the expected costs in 2018.

Svenson manufactured 8,000 CMCBs in 2017 in 40 batches of 200 each. In 2018, Svenson anticipates needing 10,000 CMCBs. The CMCBs would be produced in 80 batches of 125 each. The Minton Corporation has approached Svenson about supplying CMCBs to Svenson in 2018 at $300 per CMCB on whatever delivery schedule Svenson wants.

1. Calculate the total expected manufacturing cost per unit of making CMCBs in 2018.

2. Suppose the capacity currently used to make CMCBs will become idle if Svenson purchases CMCBs from Minton. On the basis of financial considerations alone, should Svenson make CMCBs or buy them from Minton? Show your calculations.

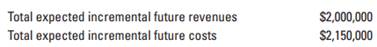

3. Now suppose that if Svenson purchases CMCBs from Minton, its best alternative use of the capacity currently used for CMCBs is to make and sell special circuit boards (CB3s) to the Essex Corporation. Svenson estimates the following incremental revenues and costs from CB3s:

On the basis of financial considerations alone, should Svenson make CMCBs or buy them from Minton? Show your calculations.