Excel in Winter with Top-notch Accounting Assignment Help

discovered on December 20, 2008. Ignore income tax considerations.

I. Rice’s income statement for the year ended December 31, 2008, should show the cumulative effect of this error in the amount of

a. $726,000.

b. $642,000.

c. $558,000.

d. $0.

II. Before the correction was made, and before the books were closed on December 31, 2008, beginning of year 2007 Retained Earnings was understated by

a. $810,000.

b. $726,000.

c. $642,000.

d. $558,000.

2. Assume you are the division controller for Auntie M’s Cookie

Assume you are the division controller for Auntie M’s Cookie Company. Auntie M has introduced a new chocolate chip cookie called Full of chips, and it is a success. As a result, the product manager responsible for the launch of this new cookie was promoted to division vice president and became your boss. A new product manager, Morgan, has been brought in to replace the promoted manager. Morgan notices that the Full of Chips cookie uses a lot of chips, which increases the cost of the cookie. As a result, Morgan has ordered that the amount of chips used in the cookies be reduced by 10%. The manager believes that a 10% reduction in chips will not adversely affect sales, but will reduce costs, and hence improve margins. The increased margins would help Morgan meet profit targets for the period.

You are looking over some cost of production reports segmented by cookie line. You notice that there is a drop in the materials costs for full of Chips. On further investigation, you discover why the chip costs have declined (fewer chips). Both you and Morgan report to the division vice president, who was the original product manager for Gull of chips. You are trying to decide what to do, if anything.

Discuss the options you mighty consider.

3. Which of the following statements is not considered a disadvantage of the corporate form of organ...

Which of the following statements is not considered a disadvantage of the corporate form of organization? Select one: A. Separation of ownership and management B. Limited liability of stockholders C. Additional taxes D. Government regulations

4. Let’s examine a case using Greg’s Tunes and another company,

Let’s examine a case using Greg’s Tunes and another company, Sal’s Silly Songs. It is now the end of the first year of operations, and both owners—Sally Siegman and Greg Moore—want to know how well they came out at the end of the year. Neither business kept complete accounting records and neither business paid out dividends. Moore and Siegman throw together the following data at year end:

Sal’s Silly Songs:

Total assets……………………………. $23,000

Common stock………………………… 8,000

Total revenues………………………… 35,000

Total expenses………………………... 22,000

Greg’s Tunes:

Total liabilities……………………….. $10,000

Common stock……………………….. 6,000

Total expenses……………………….. 44,000

Net income…………………………… 9,000

Working in the music business, Moore has forgotten all the accounting he learned in college. Siegman majored in English literature, so she never learned any accounting. To gain information for evaluating their businesses, they ask you several questions. For each answer, you must show your work to convince Moore and Siegman that you know what you are talking about.

1. Which business has more assets?

2. Which business owes more to creditors?

3. Which business has more stockholders’ equity at the end of the year?

4. Which business brought in more revenue?

5. Which business is more profitable?

6. Which of the foregoing questions do you think is most important for evaluating these two businesses? Why? (Challenge)

7. Which business looks better from a financial standpoint? (Challenge)

5. Estimate the variable cost per occupied room per day Problem: Resort Inns, Inc., has a total of...

Estimate the variable cost per occupied room per day

Problem:

Resort Inns, Inc., has a total of 2,000 rooms in its nationwide chain of motels. On average, 70% of the rooms are occupied each day. The Company’s operating costs are $21.00 per occupied room per day at this occupancy level, assuming a 30-day Month. This $21.00 figure contains both variable and fixed cost elements. During October, the occupancy rate dropped to only 45%. A total of $792,000 in operating cost was incurred during October.

1. Estimate the variable cost per occupied room per day.

2. Estimate the total fixed operating costs per month.

3. Assume that the occupancy rate increases to 60% during November. What total operating costs would you expect the company to incur during November?

Would you please show me the steps and solution to this problem so I can have a better understanding on future problems.

Estimate the variable cost per occupied room per day

6. Product cost distortions with traditional costing, original activity-based costing analysis The...

Product cost distortions with traditional costing, original activity-based costing analysis The Manhattan Company manufactures two models of compact disc players: a deluxe model and a regular model. The company has manufactured the regular model for years; the deluxe model was introduced recently to tap a new segment of the market. Since the introduction of the deluxe model, the company’s profits have steadily declined, and management has become increasingly concerned about the accuracy of its costing system. Sales of the deluxe model have been increasing rapidly.

The current cost accounting system allocates manufacturing support costs to the two products on the basis of direct labor hours. The company has estimated that this year it will incur $1 million in manufacturing support costs and will produce 5,000 units of the deluxe model and 40,000 units of the regular model. The deluxe model requires 2 hours of direct labor, and the regular model requires 1 hour. Material and labor costs per unit and selling price per unit are as follows:

ITEM | DELUXE | REGULAR |

Direct materials cost | $45 | $30 |

Direct labor cost | 20 | 10 |

Selling price | 140 | 80 |

Required

(a) Compute the manufacturing support cost driver rate for this year.

(b) Determine the cost to manufacture one unit of each model.

(c) The company has decided to trace manufacturing support costs to four activities. Following are the amount of manufacturing support costs traceable to the four activities this year:

|

|

| COST DRIVER UNITS DEMANDED | ||

ACTIVITY | COST DRIVER | COST | TOTAL | DELUXE | REGULAR |

Purchase orders | Number of orders | $180,000 | 600 | 200 | 400 |

Quality control | Number of inspections | 250,000 | 2,000 | 1,000 | 1,000 |

Product setups | Number of setups | 220,000 | 200 | 100 | 100 |

Machine maintenance | Machine hours | 350,000 | 35,000 | 20,000 | 15,000 |

|

| $1,000,000 |

|

|

|

Compute the total cost to manufacture one unit of each model.

(d) Compare the manufacturing activity resources demanded per unit of the regular model and per unit of the deluxe model. Why did the old costing system undercost the deluxe model?

(e) Is the deluxe model as profitable as the company thinks it is under the old costing system? Explain.

(f) What should the Manhattan Company do to improve its profitability? Consider pricing and product-level changes among your suggestions. Who should be involved in implementing your recommendations?

7. 39) Marlow Company purchased a point of sale system on January 1 for $6,800. This system has a us...

39)

Marlow Company purchased a point of sale system on January 1 for $6,800. This system has a useful life of 4 years and a salvage value of $1,100. What would be the depreciation expense for the second year of its useful life using the double-declining-balance method?

$1,636

$1,425

$3,400

$2,850

$1,700

8. 5.22 The U.S. Department of Transportation reported that in 2009, Southwest led all domestic...

5.22 The U.S. Department of Transportation reported that in 2009, Southwest led all domestic airlines in on-time arrivals for domestic flights, with a rate of 0.825. Using the binomial distribution, what is the probability that in the next six flights a. four flights will be on time? b. all six flights will be on time? c. at least four flights will be on time? d. What are the mean and standard deviation of the number of on-time arrivals? e. What assumptions do you need to make in (a) through (c)?

9. A budget should/can do all of the following EXCEPT

Multiple Choice

A budget should/can do all of the following EXCEPT

a. be prepared by managers from different functional areas working independently of each other

b. be adjusted if new opportunities become available during the year

c. help management allocate limited resources

d. become the performance standard against which firms can compare the actual results

10. Victor Mineli, the new controller of Santorini Company, has reviewed the expected useful lives...

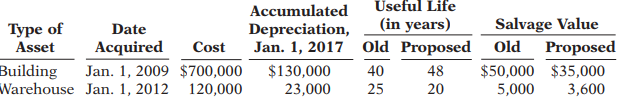

Victor Mineli, the new controller of Santorini Company, has reviewed the expected useful lives and salvage values of selected depreciable assets at the beginning of 2017. Here are his findings:

All assets are depreciated by the straight-line method. Santorini Company uses a calendar year in preparing annual financial statements. After discussion, management has agreed to accept Victor’s proposed changes. (The “Proposed” useful life is total life, not remaining life.) Instructions

(a) Compute the revised annual depreciation on each asset in 2017. (Show computations.)

(b) Prepare the entry (or entries) to record depreciation on the building in 2017.

Instructions

(a) Compute the revised annual depreciation on each asset in 2017. (Show computations.)

(b) Prepare the entry (or entries) to record depreciation on the building in 2017.

11. show in amortization table for both problems Problem 6-1 (IAA) Yellow Company recived issue 12% bond

show in amortization table for both problems P6,000,000 maturing January 1, 2030. Interest is payable annually on December 31. The bonds are callable at 102 plus accrued interest. On January 1, 2020, the entity issued the bonds for P6,737,000 with an effective yield of 10%. The fiscal year of the entity ends December 31. The effective interest amortization is used. Required: 1. Prepare journal entries relating to the bonds payable for 2020. 2. Present the bonds payable on December 31, 2020. Problem 6-2 (IAA) On January 1, 2020. Orange Company was authorized to issue 6% bonds with face amount of P5,000,000 maturing on December 31, 2021. Interest is payable semiannually on June 30 and December 31. On January 1, 2020, the entity issued all of the bonds for P4,818,500 with an effective rate of 8%. The fiscal year of the entity is the calendar year and the effective interest method of amortization is used. Required: 1. Prepare a table of amortization for the discount. 2. Prepare journal entries for 2020 and 2021.

12. Pr. 10-139 —Capitalization of interest. During 2010, Barden Building Company constructed various...

Pr. 10-139—Capitalization of interest.

During 2010, Barden Building Company constructed various assets at a total cost of $8,400,000. The weighted average accumulated expenditures on assets qualifying for capitalization of interest during 2010 were $5,600,000. The company had the following debt outstanding at

December 31, 2010:

1.10%, 5-year note to finance construction of various assets,

dated January 1, 2010, with interest payable annually on January 1$3,600,000

2.12%, ten-year bonds issued at par on December 31, 2004, with interest

payable annually on December 314,000,000

3.9%, 3-year note payable, dated January 1, 2009, with interest payable

annually on January 12,000,000

Instructions

Compute the amounts of each of the following (show computations).

1.Avoidable interest.

2.Total interest to be capitalized during 2010.

Pr. 10-140—Capitalization of interest.

Early in 2010, Dobbs Corporation engaged Kiner, Inc. to design and construct a complete modernization of Dobbs's manufacturing facility. Construction was begun on June 1, 2010 and was completed on December 31, 2010. Dobbs made the following payments to Kiner, Inc. during 2010:

Date Payment

June 1, 2010$3,600,000

August 31, 20105,400,000

December 31, 20104,500,000

In order to help finance the construction, Dobbs issued the following during 2010:

1.$3,000,000 of 10-year, 9% bonds payable, issued at par on May 31, 2010, with interest payable annually on May 31.

2.1,000,000 shares of no-par common stock, issued at $10 per share on October 1, 2010.

In addition to the 9% bonds payable, the only debt outstanding during 2010 was a $750,000, 12% note payable dated January 1, 2006 and due January 1, 2016, with interest payable annually on January 1.

Instructions

Compute the amounts of each of the following (show computations):

1.Weighted-average accumulated expenditures qualifying for capitalization of interest cost.

2.Avoidable interest incurred during 2010.

3.Total amount of interest cost to be capitalized during 2010.

13. George Clausen (age 48) is employed by Kline Company and is paid a salary of $42,640. He has just...

George Clausen (age 48) is employed by Kline Company and is paid a salary of $42,640. He has just decided to join the company’s Simple Retirement Account (IRA form) and has a few questions. Answer the questions for Clausen. (use 2015 tax information)

a.What is the maximum that he can contribute into this retirement fund? b.What would be the company’s contribution?

c.What would be his weekly take-home pay with the retirement contribution deducted(married, 2 allowances,wage-bracket method,and a 2.3%state income tax on total wages)?

d.What would be his weekly take-home pay without the retirement contribution deduction?

14. Black Company"s sales are $600,000, its fixed expenses are $150,000, and its variable expenses are...

Black Company"s sales are $600,000, its fixed expenses are $150,000, and its variable expenses are 60% of sales. Based on this information, the margin of safety is:

A) $90,000

B) $190,000

C) $225,000

D) $240,000

15. The administrators of Crawford County"s Memorial Hospital are interested in identifying

The administrators of Crawford County"s Memorial Hospital are interested in identifying the various costs and expenses that are incurred in producing a patient"s X-ray. A list of such costs and expenses is presented below.

1. Salaries for the X-ray machine technicians.

2. Wages for the hospital janitorial personnel.

3. Film costs for the X-ray machines.

4. Property taxes on the hospital building.

5. Salary of the X-ray technicians" supervisor.

6. Electricity costs for the X-ray department.

7. Maintenance and repairs on the X-ray machines.

8. X-ray department supplies.

9. Depreciation on the X-ray department equipment.

10. Depreciation on the hospital building.

The administrators want these costs and expenses classified as: (a) direct materials, (b) direct labor, or (c) service overhead.

Instructions

List the items (1) through (10). For each item, indicate the cost category to which the item belongs.

16. Which of the following best describes the activities of the production function?

1. Which of the following best describes the activities of the production function?

a. maintenance, inventory control, and production planning

b. production planning, quality control, manufacturing, and cost accounting

c. quality control, production planning, manufacturing, and payroll

d. maintenance, production planning, storage, and quality control

e. manufacturing, quality control, and maintenance

2. Which of the following best describes the activities of the accounting function?

a. inventory control, accounts payable, fixed assets, and payroll

b. fixed assets, accounts payable, cash disbursements, and cost accounting

c. purchasing, cash receipts, accounts payable, cash disbursements, and payroll

d. inventory control, cash receipts, accounts payable, cash disbursements, and payroll

e. inventory control, cost accounting, accounts payable, cash disbursements, and payroll

3. Which statement best describes the issue of distributed data processing (DDP)?

a. The centralized and DDP approaches are mutually exclusive; an organization must choose one approach or the other.

b. The philosophy and objective of the organization’s management will determine the extent of DDP in the firm.

c. In a minimum DDP arrangement, only data input and output are distributed, leaving the tasks of data control, data conversion, database management, and data processing to be centrally managed.

d. The greatest disadvantage of a totally distributed environment is that the distributed IPU locations are unable to communicate and coordinate their activities.

e. Although hardware (such as computers, database storage, and input/output terminals) can be effectively distributed, the systems development and maintenance tasks must remain centralized for better control and efficiency.

4. Which of the following is a disadvantage of distributed data processing?

a. End-user involvement in systems operation is decreased.

b. Disruptions due to mainframe failures are increased.

c. The potential for hardware and software incompatibility across the organization is increased.

d. The time between project request and completion is increased.

e. All of the above are disadvantages.

17. Dover Company began operations in 2014 and determined its ending inventory at cost and at LCN R V at

Dover Company began operations in 2014 and determined its ending inventory at cost and at

LCN R V at December 31, 2014, and December 31, 2015. This information is p r esented belo w .

Cost | Net Realizable Value | ||

12/31/14 | $346,000 | $322,000 | |

12/31/15 | 410,000 | 390,000 |

(a) Prepare the journal entries required at December 31, 2014, and December 31, 2015, assuming that the inventory is recorded at LCNRV and a perpetual inventory system using the cost-of-goods-sold method is used.

(b) Prepare journal entries required at December 31, 2014, and December 31, 2015, assuming that the inventory is recorded at cost and a perpetual system using the loss method is used.

(c) Which of the two methods above p r ovides the higher net income in each year?

18. In a company with materials and supplies that include a great number of items, a fundamental...

In a company with materials and supplies that include a great number of items, a fundamental deficiency in control requirements will be indicated if |

A. | The cycle basis for physical inventory taking was to be used |

B. | Minor supply items were to be expensed when acquired |

C. | A perpetual invenotry master file is not maintained for items of small value |

D. | The storekeeping function were to be combined with production and record keeping |

19. Propose one example of a nursing intervention related to the disaster from each of the following...

Propose one example of a nursing intervention related to the disaster from each of the following levels

Propose one example of a nursing intervention related to the disaster from each of the following levels: primary prevention, secondary prevention, and tertiary prevention

Throughout this course, you have viewed the “Diary of Medical Mission Trip” videos dealing with the catastrophic earthquake in Haiti in 2010. Reflect on this natural disaster by answering the following questions:

Propose one example of a nursing intervention related to the disaster from each of the following levels: primary prevention, secondary prevention, and tertiary prevention. Provide innovative examples that have not been discussed by a previous student.

Under which phase of the disaster do the three proposed interventions fall? Explain why you chose that phase.

With what people or agencies would you work in facilitating the proposed interventions and why?

Link to the “Diary of Medical Mission Trip” videos:

20. When an asset is transferred to a branch from the home office, which of the following occurs?a. Only

When an asset is transferred to a branch from the home office, which of the following occurs?a. Only a memo entry is made.b. A credit to Home Office accountc. A debit to Home Office accountd. A credit to Investment in Branch account