Essential Tips for Completing Income Statement Assignments

22. Growing Perpetuities-Mark Weinstein has been working on an advanced technology in laser eye surgery

Mark Weinstein has been working on an advanced technology in laser eye surgery. His technology will be available in the near term. He anticipates his first annual cash flow from the technology to be $215,000, received two years from today. Subsequent annual cash flows will grow at 4 percent in perpetuity. What is the present value of the technology if the discount rate is 10 percent?

23. Managerial Accountin Kimmel exercise 15-12

Don Lieberman and Associates, a CPA firm, uses job order costing to capture the costs of its audit jobs. There were no audit jobs in process at the beginning of November. Listed below are data concerning the three audit jobs conducted during November.

Lynn | Brian | Mike | ||||

Direct materials | $610 | $500 | $220 | |||

Auditor labor costs | $5,620 | $7,630 | $3,990 | |||

Auditor hours | 73 | 93 | 50 |

Overhead costs are applied to jobs on the basis of auditor hours, and the predetermined overhead rate is $57per auditor hour. The Lynn job is the only incomplete job at the end of November. Actual overhead for the month was $12,380.

(a) Determine the cost of each job.

Cost | ||

Lynn | $ | |

Brian | $ | |

Mike | $ |

(b) Indicate the balance of the Work in Process account at the end of November.

Balance in work in process account | $ |

(c) Calculate the ending balance of the Manufacturing Overhead account for November.

Balance in manufacturing overhead account | $ |

(a)

Lynn | Brian | Mike | ||||

Direct materials | $610 | $500 | $220 | |||

Auditor labor costs | 5,620 | 7,630 | 3,990 | |||

Applied overhead | 4,161 | 5,301 | 2,850 | |||

Total cost | $10,391 | $13,431 | $7,060 |

(b)The Lynn job is the only incomplete job, therefore, $10,391.

(c)

Actual overhead | $12,380 | (DR) | |

Applied overhead | 12,312 | (CR) | |

Balance | $68 | (DR) |

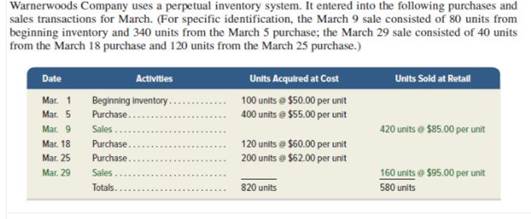

24. Required 1. Compute cost of goods available for sale and the number of units available for sale. 2..

Required 1. Compute cost of goods available for sale and the number of units available for sale. 2. Compute the number of units in ending inventory. 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. (Round all amounts to cents.) 4. Compute gross profit earned by the company for each of the four costing methods in part 3.

25.

25. CVP analysis, shoe stores. The WalkRite Shoe Company operates a

CVP analysis, shoe stores. The WalkRite Shoe Company operates a chain of shoe stores that sell 10 different styles of inexpensive men’s shoes with identical unit costs and selling prices. A unit is defined as a pair of shoes. Each store has a store manager who is paid a fixed salary. Individual salespeople receive a fixed salary and a sales commission. WalkRite is considering opening another store that is expected to have the revenue and cost relationships shown here:

Consider each question independently: Required

1. What is the annual breakeven point in (a) units sold and (b) revenues?

2. If 35,000 units are sold, what will be the store’s operating income (loss)?

3. If sales commissions are discontinued and fixed salaries are raised by a total of $81,000, what would be the annual breakeven point in (a) units sold and (b) revenues?

4. Refer to the original data. If, in addition to his fixed salary, the store manager is paid a commission of $0.30 per unit sold, what would be the annual breakeven point in (a) units sold and (b) revenues?

5. Refer to the original data. If, in addition to his fixed salary, the store manager is paid a commission of $0.30 per unit in excess of the breakeven point, what would be the store’s operating income if 50,000 units weresold?

26. Write up the asset, capital and liability accounts in the books of D. Gough to record the...

Write up the asset, capital and liability accounts in the books of D. Gough to record the following transactions:

2016

June

1 Started business with £16,000 in the bank.

2 Bought van paying by cheque £6,400.

5 Bought office fixtures £900 on time from Old Ltd.

8 Bought van on time from Carton Cars Ltd £7,100.

12 Took £180 out of the bank and put it into the cash till.

15 Bought office fixtures paying by cash £120.

19 Paid Carton Cars Ltd by Internet transfer from the bank account.

21 A loan of £500 cash is received from B. Berry.

25 Paid £400 of the cash in hand into the bank account.

30 Bought more office fixtures paying with the business debit card £480.

27. DQZ Telecom is considering a project for the coming year that will cost $50 million. DQZ plans to...

Items 1 and 2 are based on the following information:

DQZ Telecom is considering a project for the coming year that will cost $50 million. DQZ plans to use the following combination of debt and equity to finance the investment.

- Issue $15 million of 20-year bonds at a price of 101, with a coupon rate of 8%, and flotation costs of 2% of par.

- Use $35 million of funds generated from earnings.

The equity market is expected to earn 12%. US Treasury bonds are currently yielding 5%. The beta coefficient for DQZ is estimated to be .60. DQZ is subject to an effective corporate income tax rate of 40%.

Assume that the after-tax costs of debt is 7% and the cost of equity is 12%. Determine the weighted-average cost of capital.

- 10.50%

- 8.50%

- 9.50%

- 6.30%

The Capital Asset Pricing Model (CAPM) computes the expected return on a security by adding the risk-free rate of return to the incremental yield of the expected market return that is adjusted by the company’s beta. Compute DQZ’s expected rate of return.

- 9.20%

- 12.20%

- 7.20%

- 12.00%

28. Budgeted sales for the month

Below is budgeted production and sales information for Flushing Company for the month of December:

Product X Product Y

Estimated beginning inventory 30,000 units 18,000 units

Desired ending inventory 34,000 units 17,000 units

Region I, anticipated sales 320,000 units 260,000 units

Region II, anticipated sales 180,000 units 140,000 units

The selling price for product XXX is $6 and for product ZZZ is $15.

Budgeted sales for the month are:

a) $2,040,000

b)$4,680,000

c)$6,692,000

d) $9,000,000

Budgeted prouction for product XXX during the month is:

a) 496,000 units

b) 504,000 units

c) 542,000 units

d) 572,000 units

Budgeted production for product ZZZ during the month is:

a. 403,000 units

b. 390,000 units

c. 399,000 units

d. 423,000 units

29. 37.Which of the following is not a processing control? a)Record counts b)Control totals c)Hash...

37.Which of the following is not a processing control?

a)Record counts

b)Control totals

c)Hash totals

d)Check digits

38.Editing checks performed "in tandem" would be defined as:

a)Tests of alphanumeric field content

b)Tests for valid codes

c)Redundant data checks

d)Tests of reasonableness

39.A data field could pass all editing tests and still be invalid. Additional controls to cope with this would include:

a)Check digit

b)Unfound record test

c)Valid code test

d)both a and b could validate after editing tests

40.Check digits have which of the following attributes?

a)Guarantees data validity

b)Detects fraudulent data

c)Always recommended for accounting information systems

d)none of the above

41.Which of the following types of errors will check digits usually detect?

a)Transposition of two digits

b)Inaccuracy of one digit

c)Double mistakes canceling out each other

d)Fraudulent data

42.Which of the following is not normally used as a control total to check the validity of data processing activities?

a)Edit tests

b)Batch totals

c)Record counts

d)Hash totals

?

43.From the standpoint of computer fraud, which type of controls would probably be of highest importance?

a)Input controls

b)Access controls

c)Output controls

d)Processing controls

44.Tape and disk output controls are primarily concerned with:

a)The storage space problem

b)Building control totals

c)Validating checksums

d)The encoding process

45.Principal output controls include all but one of the following:

a)Sequence tests of check stubs

b)Character control totals

c)Strict regulation of preprinted forms

d)all of the above

46.Which of the following is not a control to ensure the physical safety of a company’s data processing center?

a)Strategic placement of the computer center

b)The use of password codes

c)The use of identification badges

d)all of the above are computer facility controls

14.1

30. On June 10, Pais Company purchased $9,000 of merchandise from McGiver Company, terms 3/10, n/30....

On June 10, Pais Company purchased $9,000 of merchandise from McGiver Company, terms 3/10, n/30. Pais pays the freight costs of $400 on June 11. Goods totaling $600 are returned to McGiver for credit on June 12. On June 19, Pais Company pays McGiver Company in full, less the purchase discount. Both companies use a perpetual inventory system.

Instructions

(a) Prepare separate entries for each transaction on the books of Pais Company.

(b) Prepare separate entries for each transaction for McGiver Company. The merchandise purchased by Pais on June 10 cost McGiver $5,000, and the goods returned cost McGiver $310.

31. Estimated cost and operating data for three companies for the upcoming year follow

Estimated cost and operating data for three companies for the upcoming year follow:

Company X Company Y Company Z

Direct labor-hours 80,000 45,000 60,000

Machine-hours 30,000 70,000 21,000

Direct materials cost $400,000 $290,000 $300,000

Manufacturing overhead cost $536,000 $315,000 $480,000

Predetermined overhead rates are computed using the following allocation bases in the three companies:

Allocation Base

Company X Direct labor-hours

Company Y Machine-hours

Company Z Direct materials cost

1. Compute each company's predetermined overhead rate.

2. Assume that Company X works on three jobs during the upcoming year. Direct labor-hours recorded by job are: Job 418, 12,000 hours; Job 419, 36,000 hours; and Job 420, 30,000 hours. How much overhead will the company apply to Work in Process for the year? If actual overhead costs total $530,000 for the year, will overhead be underapplied or overapplied? By how much?

32. Planet Music buys all of its inventory on credit. During 2015, Planet Music's inventory account...

Planet Music buys all of its inventory on credit. During 2015, Planet Music's inventory account increased by $10,000. Which of the following statements must be true for Planet Music during 2015

33. Cost Behavior: Analysis and Use

Managers often assume a strictly linear relationship between costs and volume. How can this practice be defined in light of the fact that many costs are curvilinear?

34. Cost drivers and functions. The list of representative cost driv

Cost drivers and functions. The list of representative cost drivers in the right column of this table are randomized with respect to the list of functions in the left column. That is, they do not match.

Function Representative Cost Driver

1. Accounting A. Number of invoices sent

2. Human resources B. Number of purchase orders

3. Data processing C. Number of research scientists

4. Research and development D. Hours of computer processing unit (CPU)

5. Purchasing E. Number of employees

6. Distribution F. Number of transactions processed

7. Billing G. Number of deliveries made

1. Match each function with its representative cost driver.

2. Give a second example of a cost driver for each function.