ECON340 International Economics

11. John and Martha Holloway are marnied filing jointly They are 35 and 31 years old, respectively. T...

John and Martha Holloway are marnied filing jointly They are 35 and 31 years old, respectively. Their address is 10010 Dove Street Atlanta, GA 30294. Additional information about Mr. and Mrs. Holloway is as follows social security numbers: Dohn: 412-34-567e Date of birth: 3/4/1982 W-2 for John shows these amounts: Martha: 412-34-5671 Date of birth: 8/28/1986 W-2 for Martha shows these amounts: Wages (box 1) $22,600.0e Federal W/H (box 2) $ 2,200.0 Social security wages (box 3) $22,ee0.ee Social security W/H (box 4) $ 1,364.80 Medicare wages (box S) $22,869.88 Medicare W/H (box 6) 319.80 Nages (box 1) 35, 580.80 Federal ผ/H (box 2) _ $ 4.10e.ee Social security wages (box 3)-$35,5e8.80 Social security W/H (box 4) 2,281.80 Nedicare wages (box 5) -$35, 5ee.00 Medicare W/H (box 6)-514-75 Form 1099-DIV for Martha shows this amount Box la and box 1b $345 00 from MAR Brokerage Form 1099-INT for Martha shows these amounts Box 1 $45000 from ABC Bank, Box 4 $35.00. Martha is a Human Resources Manager. Prepare the tax return for Mr. and Mrs. Holloway using the John is a maintenance worker and appropriate form. They want to contribute to the presidential election campaign. Mr. and Mrs. Holloway had qualifying health care coverage at all times during the tax year (List the names of the texpayers in the order in which they appear in the problem. Input al the values as positive numbers.)

12. On July 1, 2017, oriole company pays $20,000 to Pharaoh company for a 2-year insurance contract. ...

On July 1, 2017, oriole company pays $20,000 to Pharaoh company for a 2-year insurance contract. Both companies have fiscal years ending December 31. For oriole company, journalize the entry on July 1 and adjusting entry on December 31. (Record journal entries in the order presented in the problem. If no entry required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

13. Superior Cement Company has an 8 percent preferred stock issue outstanding, with each share having a...

Superior Cement Company has an 8 percent preferred stock issue outstanding, with each share having a $100 face value. Currently, the yield is 10 percent. What is the market price per share? If interest rates in general should rise so that the required return becomes 12 percent, what will happen to the market price per share?

14. Below is a series of cost of goods sold sections for companies B

Below is a series of cost of goods sold sections for companies B, F, L, and R.

Instructions

Fill in the lettered blanks to complete the cost of goods soldsections.

15. Suppose in its income statement for the year ended June 30, 2017, The Clorox Company reported the...

Suppose in its income statement for the year ended June 30, 2017, The Clorox Company reported the following condensed data (dollars in millions).

Instructions

(a) Prepare a multiple-step income statement.

(b) Calculate the gross profit rate and the profit margin and explain what each means.

(c) Assume the marketing department has presented a plan to increase advertising expenses by $340 million. It expects this plan to result in an increase in both net sales and cost of goods sold of 25%.

16. What is Snowbird"s margin of safety?

The following information relates to Snowbird Corporation:

Sales at the break-even point | $312,500 |

Total fixed expenses | $250,000 |

Net operating income | $150,000 |

What is Snowbird"s margin of safety?

A) $62,500

B) $187,500

C) $100,000

D) $212,500

17. Assume a bank has $200 million of assets with a duration of 2.5, and $190 million of liabilities...

Duration Gap Analysis

1) Assume a bank has $200 million of assets with a duration of 2.5, and $190 million of liabilities with a duration of 1.05. If interest rates increase from 5 percent to 6 percent, the net worth of the bank falls by

A) $1 million.

B) $2.4 million.

C) $3.6 million.

D) $4.8 million.

2) Assume a bank has $200 million of assets with a duration of 2.5, and $190 million of liabilities with a duration of 1.05. The duration gap for this bank is

A) 0.5 year.

B) 1 year.

C) 1.5 years.

D) 2 years.

3) If interest rates increase from 9 percent to 10 percent, a bank with a duration gap of 2 years would experience a decrease in its net worth of

A) 0.9 percent of its assets.

B) 0.9 percent of its liabilities.

C) 1.8 percent of its liabilities.

D) 1.8 percent of its assets.

4) One of the problems in conducting a duration gap analysis is that the duration gap is calculated assuming that interest rates for all maturities are the same. That means that the yield curve is

A) flat.

B) slightly upward sloping.

C) steeply upward sloping.

D) downward sloping.

19. about financial accounting

which concept of accounting holds that to the maximum extent possible, financial statements shall be based on arm's length transactions? a. revenue realization b. verifiability c. monetary unit d. matching

20. A. Redemption of debentures by converting them into equity shares of Rs 40,000 will result into (a).

A. Redemption of debentures by converting them into equity shares of Rs 40,000 will result into

(a) Cash inflow

(b) Cash outflow

(c) None of the above

B. If the net profits earned during the year is Rs 50,000 and the amount of debtors in the beginning and the end of the year is Rs 10,000 and Rs 20,000 respectively, then the cash from operating activities will be equal to

(a) Rs 50,000

(b) Rs 40,000

(c) Rs 60,000

(d) Rs 80,000

C. If the net profits made during the year are Rs 50,000 and the bills receivables have decreased by Rs 10,000 during the year then the cash flow from operating activities will be equal to

(a) Rs 50,000

(b) Rs 40,000

(c) Rs 60,000

(d) Rs 80,000

21. Koontz Company manufactures a number of products. The standards relating to one of these products...

Koontz Company manufactures a number of products. The standards relating to one of these products are shown below, along with actual cost data for May. Standard Cost per Unit Actual Cost per Unit Direct materials: Standard: 1.90 feet at $3.20 per foot $ 6.08 Actual: 1.85 feet at $3.60 per foot $ 6.66 Direct labor: Standard: 1.00 hours at $19.00 per hour 19.00 Actual: 1.05 hours at $18.40 per hour 19.32 Variable overhead: Standard: 1.00 hours at $8.00 per hour 8.00 Actual: 1.05 hours at $7.60 per hour 7.98 Total cost per unit $33.08 $33.96 Excess of actual cost over standard cost per unit $0.88 The production superintendent was pleased when he saw this report and commented: “This $0.88 excess cost is well within the 4 percent limit management has set for acceptable variances. It's obvious that there's not much to worry about with this product." Actual production for the month was 15,500 units. Variable overhead cost is assigned to products on the basis of direct labor-hours. There were no beginning or ending inventories of materials. Required: 1. Compute the following variances for May: a. Materials price and quantity variances. (Input all amounts as positive values. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e, zero variance).) b. Labor rate and efficiency variances. (Input all amounts as positive values. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e, zero variance).) c. Variable overhead rate and efficiency variances. (Input all amounts as positive values. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e, zero variance).) 2. How much of the $0.88 excess unit cost is traceable to each of the variances computed in (1) above.(Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Round your answers to 2 decimal places.) 3. How much of the $0.88 excess unit cost is traceable to apparent inefficient use of labor time? (Input all values as positive amounts. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Do not round intermediate calculations. Round your final answers to 2 decimal places.)

22. Darvin Company uses the weighted-average method in its process costing system. The first processing...

Darvin Company uses the weighted-average method in its process costing system. The first processing department, the Welding Department, started the month with 20,000 units in its beginning work in process inventory that were 10% complete with respect to conversion costs. The conversion cost in this beginning work in process inventory was $7,000. An additional 63,000 units were started into production during the month. There were 10,000 units in the ending work in process inventory of the Welding Department that were 10% complete with respect to conversion costs. A total of $237,600 in conversion costs were incurred in the department during the month. What would be the cost per equivalent unit for conversion costs for the month? (Round off to three decimal places.)

A) $3.255

B) $3.771

C) $3.500

D) $3.305

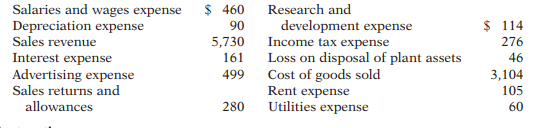

23. The following account balances were included in the trial balanc

The following account balances were included in the trial balance of Twain Corporation at June 30, 2012.

The Retained Earnings account had a balance of $337,000 at July 1, 2011. There are 80,000 shares of common stock outstanding.

Instructions

(a) Using the multiple-step form, prepare an income statement and a retained earnings statement for the year ended June 30, 2012.

(b) Using the single-step form, prepare an income statement and a retained earnings statement for the year ended June 30,2012.

24. Profitability stemming from how well a firm positions itself in the market is a key feature of which

Profitability stemming from how well a firm positions itself in the market is a key feature of which writer’s view on strategy?a)Peter Druckerb)Jay Barneyc)Michael Porterd)Henry Mintzberg

25. why is it necessary to find out profit prior and after incorporation?explain?

why is it necessary to find out profit prior and after incorporation?explain?

26. Multiple choice

1. All of the following constitute support activities EXCEPT:

A. technological development.

B. firm's infrastructure.

C. operations.

D. human resource management.

2. According to the value chain analysis, the process connected to the acquisition and utilization of resources is known as:

A. human resource management.

B. technological development.

C. firm infrastructure.

D. procurement

3. The internal audit concentrates on the availability or lack of critical __________ and the level of __________.

A. capital; skills

B. resources; capabilities

C. financial resources; management

D. skills; resources

4. The key to using a(n) __________ is to determine how well or poorly organizational functions are being performed.

A. internal audit

B. capabilities assessment profile

C. strategic audit

D. resource audit

27. On December 31, 2014, Green Company finished consultation services and accepted in exchange a pro...

On December 31, 2014, Green Company finished consultation services and accepted in exchange a promissory note with a face value of $600,000, a due date of December 31, 2017, and a stated rate of 5%, with interest receivable at the end of each year. The fair value of the services is not readily determinable and the note is not readily marketable. Under the circumstances, the note is considered to have an appropriate imputed rate of interest of 10%. The following interest factors are provided: Interest Rate Table Factors For Three Periods 5% 10% Future Value of 1 1.15763 1.33100 Present Value of 1 .86384 .75132 Future Value of Ordinary Annuity of 1 3.15250 3.31000 Present Value of Ordinary Annuity of 1 2.72325 2.48685 Instructions Determine the present value of the note. Use a separate sheet of paper or Excel and turn in by the end of class on Monday.

28. Oakmont Company has an opportunity to manufacture and sell a new product for a four-year period. The

Oakmont Company has an opportunity to manufacture and sell a new product for a four-year period. The companyA????1s discount rate is 15%. After careful study, Oakmont estimated the following costs and revenues for the new product: |

Cost of equipment needed | $ | 130,000 | |

Working capital needed | $ | 60,000 | |

Overhaul of the equipment in two years | $ | 8,000 | |

Salvage value of the equipment in four years | $ | 12,000 | |

Annual revenues and costs: | |||

Sales revenues | $ | 250,000 | |

Variable expenses | $ | 120,000 | |

Fixed out-of-pocket operating costs | $ | 70,000 | |

When the project concludes in four years the working capital will be released for investment elsewhere within the company. |

Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using tables. |

Required: |

Calculate the net present value of this investment opportunity. (Round discount factor(s) to 3 decimal places.) |

29. preparing Adjusting entries p2. On November 30, the end of the current fiscal year, the following...

preparing Adjusting entries

p2. On November 30, the end of the current fiscal year, the following information is available to assist Allerton Corporation’s accountants in making adjusting entries:

a. Allerton’s Supplies account shows a beginning balance of $2,350. Purchases during the year were $4,218. The end-of-year inventory reveals supplies on hand of $1,397.

b. The Prepaid Insurance account shows the following on November 30:

Beginning balance | $4,720 |

July 1 | 4,200 |

October 1 | 7,272 |

The beginning balance represents the unexpired portion of a one-year policy pur- chased in September of the previous year. The July 1 entry represents a new one-year policy, and the October 1 entry represents additional coverage in the form of a three- year policy.

c. The following table contains the cost and annual depreciation for buildings and equipment, all of which Allerton purchased before the current year:

Account | Cost | Annual Depreciation |

Buildings | $298,000 | $16,000 |

Equipment | 374,000 | 40,000 |

d. On October 1, the company completed negotiations with a client and accepted an advance of $18,600 for services to be performed monthly for a year. The $18,600 was credited to Unearned Services Revenue.

(Continued)

e. The company calculated that, as of November 30, it had earned $7,000 on an $11,000 contract that would be completed and billed in January.

f. Among the liabilities of the company is a note payable in the amount of $300,000. On November 30, the accrued interest on this note amounted to $18,000.

g. On Saturday, December 2, the company, which is on a six-day workweek, will pay its regular employees their weekly wages of $15,000.

h. On November 29, the company completed negotiations and signed a contract to pro- vide services to a new client at an annual rate of $23,000.

i. Management estimates income taxes for the year to be $22,000.

ReQUIReD

1. Prepare adjusting entries for each item listed above.

2. ConCept ? Explain how the conditions for revenue recognition are applied to transactions e and h.

30. Caitlin, Chris, and Molly are partners and share income and losses in a 3:4:3 ratio. The partners...

Caitlin, Chris, and Molly are partners and share income and losses in a 3:4:3 ratio. The partnership’s capital balances are Caitlin, $120,000; Chris, $80,000; and Molly, $100,000. Paul is admitted to the partnership on July 1 with a 20% equity and invests $60,000. The balance in Paul’s capital account immediately after his admission is:

31. 1. Financial Planning deals with: (a) Preparation of Financial Statements, (b)Planning for a Capital

1. Financial Planning deals with: (a) Preparation of Financial Statements,

(b)Planning for a Capital Issue, (c) Preparing Budgets, (d)All of the above.

2. Financial planning starts with the preparation of:(a) Master Budget,(b) Cash Budget,(c) Balance Sheet, (d)None of the above.

3. Which of the following is not a part of Master Budget?

(a)Projected Balance Sheet,(b) Capital Expenditure Budget,(c)Operating Budgets, (d) Budget Manual.

32. The Abco Company manufactures electrical assemblies

The Abco Company manufactures electrical assemblies. The current process uses 10 workers and produces 200 units per hour. You are considering changing the process with new assembly methods that increase output to 300 units per hour, but will require 14 workers. Particulars are as follows:

CURRENT PROCESS NEW PROCESS

OUTPUT (UNITS / HOUR) 200 300

NUMBER OF WORKERS 10 14

MATERIAL COST / HOUR $120 $150

Workers are paid at a rate of $10 per hour, and overhead is charged at 140% (or 1.4 times) labor costs. Finished switches sell for $20 / unit.

a. Calculate the multifactor productivity for the current process

b. Calculate the multifactor productivity for the new process

c. Determine if the new process should be implemented

33. During the months of January and February, Axe Corporation purchased goods from three suppliers. ...

During the months of January and February, Axe Corporation purchased goods from three suppliers. The sequence of events was as follows: Purchased goods for $1, 200 from Green with terms 2/10, n/30. Purchased goods from Munoz for $900 with terms 2/10, n/30. Paid Green in full. Paid Munoz in full. Purchased goods for $350 from Reynolds with terms 2/10, n/45. Assume that Axe uses a perpetual inventory system, the company had no inventory on hand at the beginning of January, and no sales were made during January and February. Calculate the cost of inventory as of February 28.

34. 1. A building owned by Hopewell Company was recently valued at $850,000 by a real estate expert. The

1. A building owned by Hopewell Company was recently valued at $850,000 by a real estate expert. The president of the company is questioning the accuracy of the firm s latest balance sheet because it shows a book value of $550,000 for the building. How would you explain this situation to the president? 2. At the beginning of the year, Mandela Company purchased a new building and some expensive new machinery. An officer of the firm has asked you whether this purchase will affect the firm s year-end income statement. What answer would you give? 3. Suppose the president of a company where you work as an accountant questions whether it is worthwhile for you to spend time making adjustments at the end of each accounting period. How would you explain the value of the adjustments? 4. How does the worksheet help provide vital information to management?

35. 1. Accounting is an information and measurement system that does all of the following except: A....

1. Accounting is an information and measurement system that does all of the following except: A. Identifies business activities. B. Records business activities. C. Communicates business activities. D

36. Calculate the earnings of workers A and B under straight piece-rate system and Taylor's differential...

Calculate the earnings of workers A and B under straight piece-rate system and Taylor's differential piece-rate system from the following particulars:

Normal rate per hour = Rs 1.80 |

Standard time per unit = 20 seconds |

Differentials to be applied: |

80% of piece rate below standard |

120% of piece rate at or above standard |

Worker A produces 1,300 units per day and worker B produces 1,500 units per day |