Dissertation Excellence, Help for Accounting Assignments

1. After several months of planning, Jasmine Worthy started a haircutting business called Expressions..

After several months of planning, Jasmine Worthy started a haircutting business called Expressions. The following events occurred during its first month of business. a. On August 1, Worthy invested $3,000 cash and $15,000 of equipment in Expressions. b. On August 2, Expressions paid $600 cash for furniture for the shop. c. On August 3, Expressions paid $500 cash to rent space in a strip mall for August. d. On August 4, it purchased $1,200 of equipment on credit for the shop (using a long-term note payable). e. On August 5, Expressions opened for business. Cash received from haircutting services in the first week and a half of business (ended August 15) was $825. f. On August 15, it provided $100 of haircutting services on account. g. On August 17, it received a $100 check for services previously rendered on account. h. On August 17, it paid $125 cash to an assistant for hours worked during the grand opening. i. Cash received from services provided during the second half of August was $930. j. On August 31, it paid a $400 installment toward principal on the note payable entered into on August 4. k. On August 31, Worthy made a $900 cash withdrawal from the company for personal use. Required 1. Arrange the following asset, liability, and equity titles in a table similar to the one Cash; Accounts Receivable; Furniture; Store Equipment; Note Payable; J. Worthy, Capital; J. Worthy, Withdrawals; Revenues; and Expenses. Show the effects of each transaction using the accounting equation. 2. Prepare an income statement for August. 3. Prepare a statement of owner’s equity for August. 4. Prepare a balance sheet as of August 31. 5. Prepare a statement of cash flows for August. 6. Determine the return on assets ratio for August.

2. Budgeted sales?

Friden Company has budgeted sales and production over the next quarter as follows:

April May June

Sales in Units 100,000 120,000 ??

Production in Units 104,000 128,000 156,000

The company has 20,000 units of product on hand at April 1. A minimum of 20% of the next month's sales needs in units must be on...

3. (Objective 6-10) Following are seven audit activities. a. Examine invoices supporting recorded...

(Objective 6-10) Following are seven audit activities.

a. Examine invoices supporting recorded fixed asset additions.

b. Review industry databases to assess the risk of material misstatement in the financial statements.

c. Summarize misstatements identified during testing to assess whether the overall financial statements are fairly stated.

d. Test computerized controls over credit approval for sales transactions.

e. Send letters to customers confirming outstanding accounts receivable balances.

f . Perform analytical procedures comparing the client with similar companies in the industry to gain an understanding of the client’s business and strategies.

g. Compare information on purchases invoices recorded in the acquisitions journal with information on receiving reports.

Required

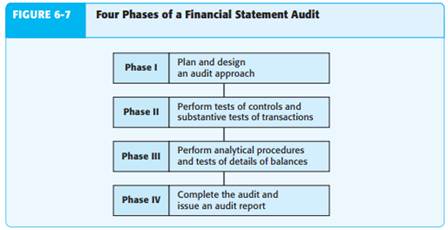

For each activity listed above, indicate in which phase of the audit the procedure was likely performed. 1. Plan and design an audit approach (Phase I)

2. Perform tests of controls and substantive tests of transactions (Phase II)

3. Perform analytical procedures and tests of details of balances (Phase III)

4. Complete the audit and issue an audit report (Phase IV)

(Objective 6-10)

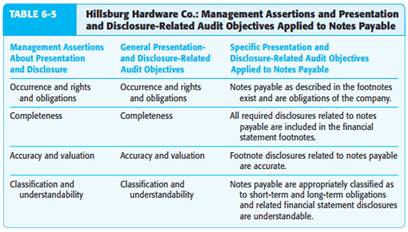

HOW AUDIT OBJECTIVES ARE MET

The auditor must obtain sufficient appropriate audit evidence to support all manage - ment assertions in the financial statements. This is done by accumulating evidence in support of some appropriate combination of transaction-related audit objectives and balance-related audit objectives. A comparison of Tables 6-3 (p. 158) and 6-4 illustrates the significant overlap between the transaction-related and balance-related audit objectives. Rights and obligations is the only balance-related assertion without a similar transaction-related assertion. Presentation and disclosure-related audit objectives are closely related to the balance-related audit objectives. Auditors often consider presentation and disclosure audit objectives when addressing the balancerelated audit objectives. The auditor must decide the appropriate audit objectives and the evidence to accumulate to meet those objectives on every audit. To do this, auditors follow an audit process, which is a well-defined methodology for organizing an audit to ensure that the evidence gathered is both sufficient and appropriate and that all required audit objec - tives are both specified and met. If the client is an accelerated filer public company, the auditor must also plan to meet the objectives associated with reporting on the effectiveness of internal control over financial reporting. PCAOB Auditing Standard 5 requires that the audit of the effectiveness of internal control be integrated with the audit of the financial statements. The audit process, as described in this text, has four specific phases, as shown in Figure 6-7 (p. 162). The rest of this chapter provides a brief intro duction to each of the four phases of the audit process.

For any given audit, there are many ways in which an auditor can accumulate evidence to meet the overall audit objective of providing an opinion on the financial statements. Two overriding considerations affect the approach the auditor selects: 1. Sufficient appropriate evidence must be accumulated to meet the auditor’s professional responsibility. 2. The cost of accumulating the evidence should be minimized. The first consideration is the most important, but cost minimization is necessary if CPA firms are to be competitive and profitable. If there were no concern for controlling costs, evidence decision making would be easy. Auditors would keep adding evidence, without concern for efficiency, until they were sufficiently certain that there were no material misstatements. Concern for sufficient appropriate evidence and cost control necessitates planning the engagement. The plan should result in an effective audit approach at a reasonable cost. Planning and designing an audit approach can be broken down into several parts. Three key aspects are introduced here and are discussed in subsequent chapters. Obtain An Understanding of the Entity and its Environment To adequately assess the risk of misstatements in the financial statements and to interpret information obtained throughout the audit, the auditor must have a thorough understanding of the client’s business and related environment, including knowledge of strategies and processes. The auditor should study the client’s business model, perform analytical procedures and make comparisons to competitors. The auditor must also understand any unique accounting requirements of the client’s industry. For example, when auditing an insurance company, the auditor must understand how loss reserves are calculated. Understand Internal Control and Assess Control Risk The risk of misstatement in the financial statements is reduced if the client has effective controls over computer operations and transaction processing. In Chapter 2, we discussed how the ability of the client’s internal controls to generate reliable financial information and safeguard assets and records is one of the most important and widely accepted concepts in the theory and practice of auditing. The auditor identifies internal controls and evaluates their effectiveness, a process called assessing control risk. If internal controls are considered effective, planned assessed control risk can be reduced and the amount of audit evidence to be accumulated can be significantly less than when internal controls are not adequate. Assess Risk of Material Misstatement The auditor uses the understanding of the client’s industry and business strategies, as well as the effectiveness of controls, to assess the risk of misstatements in the financial statements. This assessment will then impact the audit plan and the nature, timing, and extent of audit procedures. For example, if the client is expanding sales by taking on new customers with poor credit ratings, the auditor will assess a higher risk of misstatement for net realizable value of accounts receivable and plan to expand testing in this area. Before auditors can justify reducing planned assessed control risk when internal controls are believed to be effective, they must first test the effectiveness of the controls. The procedures for this type of testing are commonly referred to as tests of controls. For example, assume a client’s internal controls require the verification by an inde - pendent clerk of all unit selling prices on sales before sales invoices are transmitted to customers. This control is directly related to the accuracy transaction-related audit objective for sales. The auditor might test the effectiveness of this control by examining the sales transaction file for evidence that the unit selling price was verified. Auditors also evaluate the client’s recording of transactions by verifying the monetary amounts of transactions, a process called substantive tests of transactions. For example, the auditor might use computer software to compare the unit selling price on duplicate sales invoices with an electronic file of approved prices as a test of the accuracy objective for sales trans actions. Like the test of control in the preceding paragraph, this test satisfies the accuracy transaction-related audit objective for sales. For the sake of efficiency, auditors often perform tests of controls and substantive tests of transactions at the same time. There are two general categories of phase III procedures. Analytical procedures use comparisons and relationships to assess whether account balances or other data appear reasonable. For example, to provide some assurance for the accuracy objective for both sales transactions (transaction-related audit objective) and accounts receivable (balance-related audit objective), the auditor might examine sales transactions in the sales journal for unusually large amounts and also compare total monthly sales with prior years. If a company is consistently using incorrect sales prices or improperly recording sales, significant differences are likely. Tests of details of balances are specific procedures intended to test for monetary misstatements in the balances in the financial statements. An example related to the accuracy objective for accounts receivable (balance-related audit objective) is direct written communication with the client’s customers to identify incorrect amounts. Tests of details of ending balances are essential to the conduct of the audit because most of the evidence is obtained from a source independent of the client and therefore is considered to be of high quality. After the auditor has completed all procedures for each audit objective and for each financial statement account and related disclosures, it is necessary to combine the infor - mation obtained to reach an overall conclusion as to whether the financial statements are fairly presented. This highly subjective process relies heavily on the auditor’s professional judgment. When the audit is completed, the CPA must issue an audit report to accompany the client’s published financial statements. These reports were discussed in Chapter 3.

4. A Sole Proprietor and an Individual with No Business Form a PartnershipEspanol operated a...

A Sole Proprietor and an Individual with No Business Form a PartnershipEspanol operated a specialty shop that sold fishing equipment and accessories. Her post-closingtrial balance on Dec. 31, 2010 is as follows:FishPost-Closing Trial BalanceDec. 31, 2010 Debit CreditCash P 36,000Accounts Receivable 150,000Allowance for Uncollectible Accounts P 16,000Inventory 440,000Equipment 135,000Accumulated Depreciation 75,000Accounts Payable 30,000Espanol, Capital 640,000 P761,000 P761,000Espanol plans to enter a partnership with trusted associate, Quino, effective Jan. 1, 2011. Profitsor losses will be shared equally. Espanol is to transfer all assets and liabilities of her shop to thepartnership after revaluation. Quino will invest cash equal to Espanol’s investment afterrevaluation. The agreed values are as follows: accounts receivable (net), P140,000; inventory,P460,000; and equipment (net), P124,000. The partnership will operate under the business nameof Fish R’Us.Required:1. Prepare the opening journal entries in the books of the partnership.2. Prepare the partnership’s statement of financial position as at the date of formation of thepartnership

5. 93. Which of the following describes the classification and normal balance of the fees earned accoun

93. Which

of the following describes the classification and normal balance of the fees

earned account?

A. asset, credit

B. liability, credit

C. owner’s equity, debit

D. revenue, credit

94. The

classification and normal balance of the accounts payable account is

A. an asset with a credit balance

B. a liability with a credit balance

C. owner’s equity with a credit balance

D. revenue with a credit balance

95. The

classification and normal balance of the drawing account is

A. an expense with a credit balance

B. an expense with a debit balance

C. a liability with a credit balance

D. owner’s equity with a debit balance

96. Which

of the following accounts are debited to record increase in balances?

A. assets and liabilities

B. drawing and liabilities

C. expenses and liabilities

D. assets and expenses

97. In

which of the following types of accounts are increases recorded by

credits?

A. revenues and liabilities

B. drawing and assets

C. liabilities and drawing

D. expenses and liabilities

98. In

which of the following types of accounts are decreases recorded by

debits?

A. assets

B. revenues

C. expenses

D. drawing

99. In

which of the following types of accounts are decreases recorded by

credits?

A. liabilities

B. owner’s capital

C. drawing

D. revenues

100. A

credit balance in which of the following accounts would indicate a likely

error?

A. Fees Earned

B. Salary Expense

C. Janet James, Capital

D. Accounts Payable

6. 51.The following information pertains to Dodge Company’s three products: ABC Unit sales per...

51.The following information pertains to Dodge Company’s three products:

ABC

Unit sales per year250400250

Selling price per unit$9.00$12.00$ 9.00

Variable costs per unit3.609.009.90

Unit contribution margin$5.40$ 3.00$(0.90)

Contribution margin ratio60%25%(10)%

Assume that product C is discontinued and the extra space is rented for $300 per month. All other information remains the same as the original data. What would be the effect on annual profits?

a.Annual profits would decrease by $75.

b.Annual profits would remain the same.

c.Annual profits would increase by $75.

d.Annual profits would increase by $525.

52.Stars Manufacturing Company produces Products A1, B2, C3, and D4 through a joint process. The joint costs amount to $200,000.

If Processed Further

UnitsSales Value Additional Sales

ProductProducedat Split-OffCostsValue

A13,000$10,000$2,500$15,000

B25,00030,0003,00035,000

C34,00020,0004,00025,000

D46,00040,0006,00045,000

Suppose Product B2 is processed further. What will be the effect on profits?

a.Profits will decrease by $3,000.

b.Profits will increase by $2,000.

c.Profits will increase by $30,000.

d.Profits will increase by $32,000.

53.Manning Company uses a joint process to produce products W, X, Y, and Z. Each product may be sold at its split-off point or processed further. Additional processing costs of specific products are entirely variable. Joint processing costs for a single batch of joint products are $120,000. Other relevant data are as follows:

Sales Value Additional Sales Value of

Productat Split-OffProcessing CostsFinal Product

W$ 40,000$ 60,000$ 80,000

X$ 12,000$ 4,000$ 20,000

Y$ 20,000$ 32,000$120,000

Z$ 28,000$ 20,000$ 32,000

$100,000$116,000$252,000

Which of the following actions should be taken by Manning?

a.Process W further.

b.Sell X now.

c.Process Y further.

d.Process Z further.

54.Information about three joint products follows:

ABC

Anticipated production5,000 kg1,000 kg2,000 kg

Selling price/kg at split-off$10$30$16

Additional processing costs/kg after split-off

(all variable)$ 6$12$24

Selling price/kg after further processing$20$40$50

The cost of the joint process is $60,000. Which of the joint products should be sold at split-off?

a.joint product A

b.joint product B

c.joint product C

d.both joint product A and joint product B

55.Information about three joint products follows:

XYZ

Anticipated production12,000 kg8,000 kg7,000 kg

Selling price/kg at split-off$16$26$48

Additional processing costs/kg after split-off

(all variable)$ 8$20$20

Selling price/kg after further processing$20$40$70

The cost of the joint process is $140,000. Which of the joint products should be processed further?

a.X

b.Y

c.Z

d.both X and Y

Victor’s Detailing customers would be willing to pay $57 per detail. The average job would cost $30.

56.Refer to Victor’s Detailing. Assume Victor’s Detailing uses markup to set the price on each job. The company requires an 80% markup on each job. What price should Victor’s Detailing quote to a new customer?

a.$24

b.$30

c.$54

d.$84

57.Refer to Victor’s Detailing. Assume Victor’s Detailing uses target-costing to set price on each job. The company requires a 40% profit on each job. What price should Victor’s Detailing quote to a new customer?

a.$24

b.$30

c.$54

d.$57

58.Refer to Victor’s Detailing. Assume Victor’s Detailing uses target costing. The company requires a 40% profit on each job. Which of the following should Victor’s Detailing do?

a.reduce the required percentage to stay in business

b.ask customers to pay more

c.sell services at the price customers are willing to pay

d.find a way to reduce costs

Stein Company makes carpets. A customer wants to place a special order for 1,000 carpets in navy blue with the company logo woven in the middle, to be priced at $30 each. Normally, Stein would charge $60 per carpet for this type of order. Stein figures that yarn and backing will cost $12 per carpet, variable overhead (machining, electricity) is $5 per carpet, direct labour is $10 per carpet, and one setup will be required at $800 per setup. The setup charge costs are 100% labour. Currently, the workers needed to set up for and make the carpets are working at Stein. Their wages will be paid whether or not the special order is accepted. Stein’s policy is to avoid layoffs to the extent possible.

59.Refer to Stein Company. Which of the following is a cost of the special order in addition to yarn and backing?

a.setup costs

b.variable overhead

c.depreciation on machinery

d.direct labour

60.Refer to Stein Company. Which of the following is a qualitative factor that Stein would consider when making the decision to accept or reject the special order?

a.the cost of yarn and backing

b.the cost of setup labour

c.the no-layoff policy

d.the use of machinery