Boost Your Grades: Assistance with Accounting Assignments

(Objective 9-7)

ASSESSING ACCEPTABLE AUDIT RISK

Auditors must decide the appropriate acceptable audit risk for an audit, preferably during audit planning. First, auditors decide engagement risk and then use engage - ment risk to modify acceptable audit risk. Engagement risk is the risk that the auditor or audit firm will suffer harm after the audit is finished, even though the audit report was correct. Engagement risk is closely related to client business risk, which was discussed in Chapter 8. For example, if a client declares bankruptcy after an audit is completed, the likelihood of a lawsuit against the CPA firm is reasonably high, even if the quality of the audit was high. It is worth noting that auditors disagree about whether engagement risk should be considered in planning the audit. Opponents of modifying evidence for engagement risk contend that auditors do not provide audit opinions for different levels of assurance and therefore should not provide more or less assurance because of engagement risk. Proponents contend that it is appropriate for auditors to accumulate additional evidence, assign more experienced personnel, and review the audit more thoroughly on audits where legal exposure is high or other potential adverse actions affecting the auditor exist, as long as the assurance level is not decreased below a reasonably high level when low engagement risk exists. When auditors modify evidence for engagement risk, it is done by control of acceptable audit risk. We believe that a reasonably low acceptable audit risk is always desirable, but in some circumstances an even lower risk is needed because of engagement risk factors. Research points to several factors affecting engagement risk and, therefore, acceptable audit risk. Only three of those are discussed here: the degree to which external users rely on the statements, the likelihood that a client will have financial difficulties after the audit report is issued, and the integrity of management. The Degree to Which External Users Rely on the Statements When external users place heavy reliance on the financial statements, it is appropriate to decrease acceptable audit risk. When the statements are heavily relied on, a great social harm can result if a significant misstatement remains undetected in the financial statements. Auditors can more easily justify the cost of additional evidence when the loss to users from material misstatements is substantial. Several factors are good indicators of the degree to which statements are relied on by external users:

• Client’s size. Generally speaking, the larger a client’s operations, the more widely the statements are used. The client’s size, measured by total assets or total revenues, will have an effect on acceptable audit risk.

• Distribution of ownership. The statements of publicly held corporations are normally relied on by many more users than those of closely held corporations. For these companies, the interested parties include the SEC, financial analysts, and the general public.

• Nature and amount of liabilities. When statements include a large amount of liabilities, they are more likely to be used extensively by actual and potential creditors than when there are few liabilities. The Likelihood That a Client Will Have Financial Difficulties After the Audit Report Is Issued If a client is forced to file for bankruptcy or suffers a significant loss after completion of the audit, auditors face a greater chance of being required to defend the quality of the audit than if the client were under no financial strain. The natural tendency for those who lose money in a bankruptcy, or because of a stock price reversal, is to file suit against the auditor. This can result both from the honest belief that the auditor failed to conduct an adequate audit and from the users’ desire to recover part of their loss regardless of the adequacy of the audit work. In situations in which the auditor believes the chance of financial failure or loss is high and a corresponding increase in engagement risk occurs, acceptable audit risk should be reduced. If a subsequent challenge occurs, the auditor will be in a better posi tion to defend the audit results successfully. Total audit evidence and costs will increase, but this is justifiable because of the additional risk of lawsuits that the auditor faces. It is difficult for an auditor to predict financial failure before it occurs, but certain factors are good indicators of its increased probability:

• Liquidity position. If a client is constantly short of cash and working capital, it indicates a future problem in paying bills. The auditor must assess the likelihood and significance of a steadily declining liquidity position.

• Profits (losses) in previous years. When a company has rapidly declining profits or increasing losses for several years, the auditor should recognize the future solvency problems that the client is likely to encounter. It is also important to consider the changing profits relative to the balance remaining in retained earnings.

• Method of financing growth. The more a client relies on debt as a means of financing, the greater the risk of financial difficulty if the client’s operating success declines. Auditors should evaluate whether fixed assets are being financed with short- or long-term loans, as large amounts of required cash outflows during a short time can force a company into bankruptcy.

• Nature of the client’s operations. Certain types of businesses are inherently riskier than others. For example, other things being equal, a start-up technology company dependent on one product is much more likely to go bankrupt than a diversified food manufacturer.

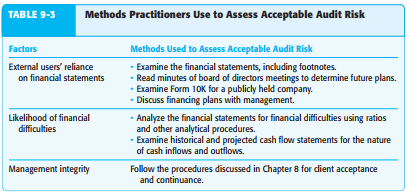

• Competence of management. Competent management is constantly alert for potential financial difficulties and modifies its operating methods to minimize the effects of short-run problems. Auditors must assess the ability of manage - ment as a part of the evaluation of the likelihood of bankruptcy. The Auditor’s Evaluation of Management’s Integrity As we discussed in Chapter 8 as a part of new client investigation and continuing client evaluation, if a client has questionable integrity, the auditor is likely to assess a lower acceptable audit risk. Companies with low integrity often conduct their business affairs in a manner that results in conflicts with their stockholders, regulators, and customers. In turn, these conflicts often reflect on the users’ perceived quality of the audit and can result in lawsuits and other disagreements. A prior criminal conviction of key management per - sonnel is an obvious example of questionable management integrity. Other examples of questionable integrity might include frequent disagreements with previous auditors, the Internal Revenue Service, and the SEC. Frequent turnover of key financial and internal audit personnel and ongoing conflicts with labor unions and employees may also indicate integrity problems. To assess acceptable audit risk, the auditor must first assess each of the factors affecting acceptable audit risk. Table 9-3 illustrates the methods used by auditors to assess each of the three factors already discussed. After examining Table 9-3, it is easy to observe that the assessment of each of the factors is highly subjective, meaning overall assessment of acceptable audit risk is also highly subjective. A typical evaluation of acceptable audit risk is high, medium, or low, where a low acceptable audit risk assess ment means a “risky” client requiring more extensive evidence, assignment of more experienced personnel, and/or a more extensive review of audit documentation. As the engagement progresses, auditors obtain additional information about the client, and acceptable audit risk may be modified.

(Objective 9-8)

ASSESSING INHERENT RISK

The inclusion of inherent risk in the audit risk model is one of the most important concepts in auditing. It implies that auditors should attempt to predict where misstatements are most and least likely in the financial statement segments. This information affects the amount of evidence that the auditor needs to accumulate, the assignment of staff and the review of audit documentation. The auditor must assess the factors that make up the risk and modify audit evidence to take them into consideration. The auditor should consider several major factors when assessing inherent risk:

• Nature of the client’s business

• Results of previous audits

• Initial versus repeat engagement

• Related parties

• Nonroutine transactions

• Judgment required to correctly record account balances and transactions

• Makeup of the population

• Factors related to fraudulent financial reporting

• Factors related to misappropriation of assets

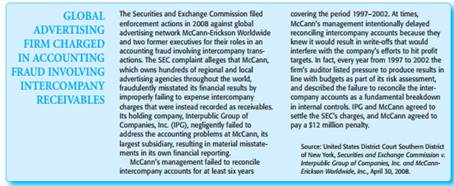

Nature of the Client’s Business Inherent risk for certain accounts is affected by the nature of the client’s business. For example, an electronics manufacturer faces a greater likelihood of obsolete inventory than a steel fabricator does. Inherent risk is most likely to vary from business to business for accounts such as inventory, accounts and loans receivable, and property, plant, and equipment. The nature of the client’s business should have little or no effect on inherent risk for accounts such as cash, notes, and mortgages payable. Information gained while obtaining knowledge about the client’s business and industry and assessing client business risk, as discussed in Chapter 8, is useful for assessing this factor. Results of Previous Audits Misstatements found in the previous year’s audit have a high likelihood of occurring again in the current year’s audit, because many types of misstatements are systemic in nature, and organizations are often slow in making changes to eliminate them. Therefore, an auditor is negligent if the results of the preceding year’s audit are ignored during the development of the current year’s audit program. For example, if the auditor found a significant number of misstatements in pricing inventory in last year’s audit, the auditor will likely assess inherent risk as high in the current year’s audit, and extensive testing will have to be done as a means of determining whether the deficiency in the client’s system has been corrected. If, however, the auditor found no misstatements for the past several years in conducting tests of an audit area, the auditor is justified in reducing inherent risk, provided that changes in relevant circumstances have not occurred. Initial Versus Repeat Engagement Auditors gain experience and knowledge about the likelihood of misstatements after auditing a client for several years. The lack of previous years’ audit results causes most auditors to assess a higher inherent risk for initial audits than for repeat engagements in which no material misstatements were previously found. Most auditors set a high inherent risk in the first year of an audit and reduce it in subsequent years as they gain more knowledge about the client. Related Parties Transactions between parent and subsidiary companies, and those between management and the corporate entity, are examples of related-party trans - actions as defined by accounting standards. Because these transactions do not occur between two independent parties dealing at “arm’s length,” a greater likelihood exists

that they might be misstated, causing an increase in inherent risk. We discussed related parties transactions in Chapter 8. Nonroutine Transactions Transactions that are unusual for a client are more likely to be incorrectly recorded than routine transactions because the client often lacks experience recording them. Examples include fire losses, major property acquisitions, and restructuring charges resulting from discontinued operations. By knowing the client’s business and reviewing minutes of meetings, the auditor can assess the con - sequences of nonroutine transactions. Judgment Required to Correctly Record Account Balances and Transactions Many account balances such as certain investments recorded at fair value, allowances for uncollectible accounts receivable, obsolete inventory, liability for warranty payments, major repairs versus partial replacement of assets, and bank loan loss reserves require estimates and a great deal of management judgment. Because they require considerable judgment, the likelihood of misstatements increases, and as a result the auditor should increase inherent risk. Makeup of the Population Often, individual items making up the total population also affect the auditor’s expectation of material misstatement. Most auditors use a higher inherent risk for accounts receivable where most accounts are significantly overdue than where most accounts are current. Examples of items requiring a higher inherent risk include transactions with affiliated companies (see vignette below), amounts due from officers, cash disbursements made payable to cash, and accounts receivable outstanding for several months. These situations require greater investigation because of a greater likelihood of misstatement than occurs with more typical transactions. Factors Related to Fraudulent Financial Reporting and Misappropriation of Assets In Chapter 6, we discussed the auditor’s responsibilities to assess the risk of fraudulent financial reporting and misappropriation of assets. It is difficult in concept and practice to separate fraud risk factors into acceptable audit risk, inherent risk, or control risk. For example, management that lacks integrity and is motivated to misstate financial statements is one of the factors in acceptable audit risk, but it may also affect control risk. Similarly, several of the other risk factors influencing manage - ment characteristics are a part of the control environment, as we’ll discuss in Chapter 10. These include the attitude, actions, and policies that reflect the overall attitudes of top management about integrity, ethical values, and commitment to competence.

To satisfy the requirements of auditing standards, it is more important for the auditor to assess the risks and to respond to them than it is to categorize them into a risk type. For this reason, many audit firms assess fraud risk separately from the assessment of the audit risk model components. The risk of fraud can be assessed for the entire audit or by cycle, account, and objective. For example, a strong incentive for management to meet unduly aggressive earnings expectations may affect the entire audit, while the susceptibility of inventory to theft may affect only the inventory account. For both the risk of fraudulent financial reporting and the risk of misappropriation of assets, auditors focus on specific areas of increased fraud risk and designing audit procedures or changing the overall conduct of the audit to respond to those risks. The specific response to an identified risk of fraud can include revising assessments of acceptable audit risk, inherent risk, and control risk. Assessing fraud risk will be the focus of Chapter 11. The auditor must evaluate the information affecting inherent risk and decide on an appropriate inherent risk level for each cycle, account, and, many times, for each audit objective. Some factors, such as an initial versus repeat engagement, will affect many or perhaps all cycles, whereas others, such as nonroutine transactions, will affect only specific accounts or audit objectives. Although the profession has not established standards or guidelines for setting inherent risk, we believe that auditors are generally conservative in making such assessments. Assume that in the audit of inventory the auditor notes that (1) a large number of misstatements were found in the previous year and (2) inventory turnover has slowed in the current year. Auditors will likely set inherent risk at a relatively high level (some will use 100 percent) for each audit objective for inventory in this situation. Auditors begin their assessments of inherent risk during the planning phase and update the assessments throughout the audit. Chapter 8 discussed how auditors gather information relevant to inherent risk assessment during the planning phase. For example, to obtain knowledge of the client’s business and industry, auditors may tour the client’s plant and offices and identify related parties. This and other information about the entity and its environment discussed in Chapter 8 pertain directly to assessing inherent risk. Also, several of the items discussed earlier under factors affecting inherent risk, such as the results of previous audits and nonroutine trans - actions are evaluated separately to help assess inherent risk. As audit tests are performed during an audit, the auditor may obtain additional information that affects the original assessment.

32. At Bargain Electronics, it costs $30 per unit ($20 variable and $10 fixed) to make an MP3 player...

At Bargain Electronics, it costs $30 per unit ($20 variable and $10 fixed) to make an MP3 player at full capacity that normally sells for $55. A foreign wholesaler offers to buy 4,960 units at $24 each. Bargain Electronics will incur special shipping costs of $4 per unit. Assuming that Bargain Electronics has excess operating capacity, indicate the net income (loss) Bargain Electronics would realize by accepting the special order

33. Tyler Smith had worked in an upholstery shop for 10 years. Last year Tyler's wages were $20,000. ...

Tyler Smith had worked in an upholstery shop for 10 years. Last year Tyler's wages were $20,000. Latley, Tyler had been unhappy with the shop's owner. Convinced that he could run an upholstery shop that did better work at a lower cost, Tyler decided to go into business for himself and opened CLASSIC UPHOLSTERY SHOP.

To get the business going TYler decided to invest heavily in advertising. He spent $6,000 on advertising aimed at consumers and another $2,000 on advertising aimed at getting work from interior decorators and interior design stores. Tyler also purchased industrial sweing machines costing $4,000 and other tools and equipment costing $3,000. He estimated that the sewing machines can be used for about five years before maintenance costs will be too high and the machines will need to be replaced. The other tools and equipment are not as durable and will have to be replaced in three years.

At the end of the first year of business. Tyler had received $80,000 in cash from customers for upholstery work. Tyler was owned another $2,500 from customers who are not required to pay cash but are billed every 30 days. A review of Tyler's checkbook shows he paid the following expenses (in addition to those mentioned previously) during the first year of busines.

Upholstery fabric $40,000, Other Supplies 10,000, wages-part-time assistant 9,500, rent 4,800 Insurance (two year policy) 3,200, Utilities $2,500 Misc expenses 1,700

Tyler utility bill for last month of the year has not arrived. He estimates that the bill will be approximately $320. Tyler keeps some stock of upholstery in popular colors on hand for customers who do not want to wait for special-order fabric to arrive. at the end of the year about $14,000 of the fabric purchased during the year was in store stock. In addition $2,300 in supplies had not been used. How much profit did Tyler make in his first year of business? Do you think it was a good idea to open the upholstery shop or woukd Tyler be better off with his old job? What account statements are used?

34. postive international critique with respect of standard IAS 16 property, plant and equipment

postive international critique with respect of standard IAS 16 property, plant and equipment

35. The following transactions were completed by The Wild Trout Gallery during the current fiscal year...

PR 8-1B Entries related to uncollectible accounts OBJ. 4

The following transactions were completed by The Wild Trout Gallery during the current fiscal year ended December 31:

Jan. 19. Reinstated the account of Arlene Gurley, which had been written off in the preceding year as uncollectible. Journalized the receipt of $2,660 cash in full payment of Arlene’s account.

Apr. 3. Wrote off the $12,750 balance owed by Premier GS Co., which is bankrupt.

July 16. Received 25% of the $22,000 balance owed by Hayden Co., a bankrupt business, and wrote off the remainder as uncollectible.

Nov. 23. Reinstated the account of Harry Carr, which had been written off two years earlier as uncollectible. Recorded the receipt of $4,000 cash in full payment.

Dec. 31. Wrote off the following accounts as uncollectible (compound entry): Cavey Co., $3,300; Fogle Co., $8,100; Lake Furniture, $11,400; Melinda Shryer, $1,200.

31. Based on an analysis of the $2,350,000 of accounts receivable, it was estimated that $60,000 will be uncollectible. Journalized the adjusting entry.

Instructions

1. Record the January 1 credit balance of $50,000 in a T account for Allowance for Doubtful Accounts.

2. Journalize the transactions. Post each entry that affects the following T accounts and determine the new balances:

Allowance for Doubtful Accounts Bad Debt Expense

3. Determine the expected net realizable value of the accounts receivable as of December 31.

4. Assuming that instead of basing the provision for uncollectible accounts on an analysis of receivables, the adjusting entry on December 31 had been based on an estimated expense of ½ of 1% of the net sales of $15,800,000 for the year, determine the following:

a. Bad debt expense for the year.

b. Balance in the allowance account after the adjustment of December 31.

c. Expected net realizable value of the accounts receivable as of December 31.

36. Steffi Derr and Leigh Finger form a partnership by combining assets of their separate businesses....

Steffi Derr and Leigh Finger form a partnership by combining assets of their separate businesses. Derr contributes the following: cash, $1,000; supplies that cost $2,400; inventory that cost $3,500; and machinery that cost $9,900 along with its accumulated depreciation of $5,000. The partners agree that $2,000 is a good estimate of supplies, that inventory has a market value of $3,000, and that machinery is worth $4,000. Prepare the partnership’s journal entry to record Derr’s investmen

37. Whitmore Company issued $500,000 of 5-year, 8% bonds at 97 on January 1, 2015. The bonds pay inte...

Whitmore Company issued $500,000 of 5-year, 8% bonds at 97 on January 1, 2015. The bonds pay interest twice a year.

A. Prepare the journal entry to record the issuance of the bonds. Compute the total cost of borrowing for these bonds.

B. Repeat the requirements from part (a), assuming the bonds were issued at 105.

Account Titles | Debit | Credit | |||

(a) (1) | |||||

(2) | |||||

(b) (1) | Account Titles | Debit | Credit | ||

(2) | |||||