BMGT417 Taxation of Corporations, Partnerships and Estates

26. . Dexterâ??s companyâ??s 2016 manufacturing costs were as follows:Direct materials and direct labor

ter 15.

26. 1. Dexter’s company’s 2016 manufacturing costs were as follows:Direct materials and direct labor 100,000Depreciation of manufacturing equipment 70,000Depreciation of factory building 40,000Janitor’s wages for cleaning factory premises 15,000How much of these costs should be inventories for external reporting purposes?a.225,000b.210,000c.385,000d.200,0002. Peter Paul company uses a job order cost system and applies factory overhead to production orders on the basis of direct labor cost. The overhead rates for 2016 are 200% for dept. A and 50% for dept. B. job 123 started and completed during 2016, was charged with the following costs: A BDirect materials 25,000 5,000 Direct labor ? 30,000 Direct materials 40,000 ? The total manufacturing costs associated with joab 123 should bea.135,000b.180,000c.195,000d.240,0003.Jorelle corporation has a job order cost system. The following debits (credits) appeared in the work-in-process account for the month of March of the current yearMarch Description Amount1 Balance 2,00031 Direct materials 12,00031 Direct labor 8,00031 Factory overhead 6,40031 To finished goods (24,000)Jorell supplies overhead to production at a predetermined rate of 80% based on direct labor cost. Job no. 30, the only job still in process at the end of march 2 has been charged with direct labor of 1,000.The amount of direct materials charged to job wasa.12,000b.4,400c.2,600d.1,5004. blue beach industries has two production departments. ABC and XYZ and uses a job order cost system. To determine manufacturing costs, the company applies manufacturing overhead to production orders based on direct labor costs using the departmental rates predetermined at the beginning of the year based on the annual budget. The 2016 budget for the two departments was as follows: ABC XYZDirect materials 630,000 90,000 Direct labor 180,000 720,000 Factory overhead 540,000 360,000Actual materials and labor costs of job np. 676 during 2014 were as follows:Direct materials 22,500Direct labor- ABC 7,200Direct labor- XYZ 10,800What was the total manufacturing cost associated with Job no. 678 for 2014?a.45,000b.49,500c.58,500d.67,5005. the Diamond company uses a job order cost accounting system. Overhead is applied to production at a predetermined rate of 80% based on direct labor cost. The following posting appear in the ledger accounts of the company for the month of September DebitWork in process, Sept. 1 30,000Direct materials 60,000Direct labor 50,000Factory overhead 40,000Cost of goods completed (155,000)Job no. 327 was the only job not completed in September and it has been charged 4,600 for factory overhead.Direct materials charged to Job no. 327 was:a.10,350b.14,650c.20,000d.25,000Direct labor charged to Job no. 327 was:a.5,750b.6,784c.8,280d.8,4806. Hamilton company uses job-order costing. Factory overhead is applied to production at a budgeted cost of 150% of direct labor costs. Any overapplied or underapplied factory overhead is closed to the cost of goods sold account at the end of each month. Job 101 was the only job in process at January 31 with accumulated costs as follows:Direct materials 4,000 Direct labor 2,000 Factory overhead applied 3,000Total 9,000Jobs 102, 103, and 104 were started during February. Direct materials requisitions for February totaled 26,000. Direct labor costs of 20,000 were incurred for February. Actual factory overhead was 32,000 for February. The only job still in process at February 28, was job 104, with cots of 2,800 for direct materials and 1,800 for direct labor.The cost of goods manufactured for February was:a.77,700b.78,000c.79,700d.85,0007. abner corporation had manufactured 100,000 units of compound X in 2016 at the following costs. Labor of 242,500 of which 93% represents direct labor. Materials of 182,500 of which 90% represents direct materials. Opening work in process is 88,125. Closing work in process inventory is 67,500. Overhead is applied at 125% of direct labor cost.The cost of goods manufactured isa.671,150b.692,306c.651,036d.629,9008. jolly co. employs the job order cost system. Relevant data for the month just ended are summarized below.work in process beg. 100,000direct labor used for the month 200,000direct labor costs for the month 160,000overhead supplies based on direct labor 120,000cost of goods completed 501,800ending work in process referred to job 106 which was charged with direct labor of 12,000 and job 107 charged with overhead of 9,600The cost of direct materials charged to jobs 106 and 107 wasa.34,600b.16,800c.30,000d.36,0009. the following information related to job no 2468 which is being manufactured by daisy co. to meet customers orders. Dept. A Dept. BDirect materials used 5,000 3,000 Direct labor hrs used 400 200 Direct labor rate per hr 4.00 5.00 Overhead rate per DL hr 4.00 5.00Administrative and selling expense 20% of full production costProfit markup 25% of selling priceThe selling price to the customer for job 2468 is:a.16,250b.20,800c.17,333d.10,80010. the work-in-process account of the malinta co. follows:April 1 bal 25,000Direct materials 50,000Direct labor 40,000Factory overhead applied 30,000Finished goods 125,450Overhead is applied to production at a predetermined rate, based on direct labor cost. The work in process at april 30 represents the cost of job 456 which has been charged with direct labor cost of 3,000 and job no. 789, which had been charged with applied overhead of 2,400The cost of direct materials charged to job no. 456 and 789 amounted to:a.8,700b.7,600c.4,500d.4,200The prime cost during the month amounted to:a.70,000b.90,000c.120,000d.145,000

27. Advanced Products Corporation has supplied the following data

Advanced Products Corporation has supplied the following data from its activity-based costing system:

During the year, Advanced Products completed one order for a new customer, Shenzhen Enterprises. This customer did not order any other products during the year. Data concerning that order follow:

Required:

1. Using Exhibit 8—5 as a guide, prepare a report showing the first-stage allocations of overhead costs to the activity cost pools.

2. Using Exhibit 8—6 as a guide, compute the activity rates for the activity cost pools.

3. Prepare a report showing the overhead costs for the order from Shenzhen Enterprises including customer support costs.

4. Using Exhibit 8—11 as a guide, prepare a report showing the customer margin for ShenzhenEnterprises.

28. P8-5A Watts Company makes various electronic products. The company is divided into a number of...

P8-5A Watts Company makes various electronic products. The company is divided into a number of autonomous divisions that can either sell to internal units or sell externally. All divisions are located in buildings on the same piece of property. The Board Division has offered the Chip Division $20 per unit to supply it with chips for 30,000 boards. It has been purchasing these chips for $22 per unit from outside suppliers. The Chip Division receives

$22.50 per unit for sales made to outside customers on this type of chip. The variable cost of chips sold externally by the Chip Division is $14.50. It estimates that it will save $4.50 per chip of selling expenses on units sold internally to the Board Division. The Chip Divi- sion has no excess capacity.

Instructions

(a) Calculate the minimum transfer price that the Chip Division should accept. Discuss whether it is in the Chip Division’s best interest to accept the offer.

(b) Suppose that the Chip Division decides to reject the offer. What are the financial impli- cations for each division, and for the company as a whole, of this decision?

29. Peking Duct Tape Company has outstanding a $1,000-face-value bond with a 14 percent coupon rate and...

Peking Duct Tape Company has outstanding a $1,000-face-value bond with a 14 percent coupon rate and 3 years remaining until final maturity. Interest payments are made semiannually.

a. What value should you place on this bond if your nominal annual required rate of return is (i) 12 percent? (ii) 14 percent? (iii) 16 percent?

b. Assume that we are faced with a bond similar to the one described above, except that it is a zero-coupon, pure discount bond. What value should you place on this bond if your nominal annual required rate of return is (i) 12 percent? (ii) 14 percent? (iii) 16 percent? (Assume semiannual discounting.)

30. 1. What are functional silos and how did they evolve in organizations? 2. What is the relationship..

1. What are functional silos and how did they evolve in organizations?

2. What is the relationship between organizational functional silos and IS functional silos?

3. Compare and contrast centralized, decentralized, and distributed IT architectures. Which do you think is most appropriate for ERP and why?

31. Gladstone Limited tracks the number of units purchased and sold throughout each accounting period...

32. On December 31, 2008, Ed Abbey Co. performed environmental consu

On December 31, 2008, Ed Abbey Co. performed environmental consulting services for Hayduke Co. Hayduke was short of cash, and Abbey Co. agreed to accept a $200,000 zero-interest-bearing note due December 31, 2010, as payment in full. Hayduke is somewhat of a credit risk and typically borrows funds at a rate of 10%. Abbey is much more creditworthy and has various lines of credit at 6%.

Instructions

(a) Prepare the journal entry to record the transaction of December 31, 2008, for the Ed Abbey Co.

(b) Assuming Ed Abbey Co.’s fiscal year-end is December 31, prepare the journal entry for December 31, 2009.

(c) Assuming Ed Abbey Co.’s fiscal year-end is December 31, prepare the journal entry for December 31, 2010.

(d) Assume that Ed Abbey Co. elects the fair value option for this note. Prepare the journal entry at December 31, 2009, if the fair value of the note is $185,000.

33. Adjusting entries The following is the post-closing trial balance for the Whitlow Manufacturing...

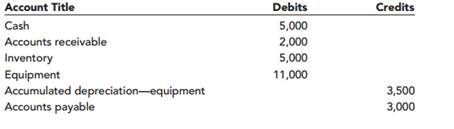

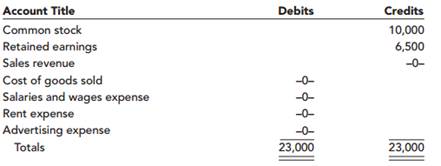

Adjusting entries

The following is the post-closing trial balance for the Whitlow Manufacturing Corporation as of December 31, 2015.

The following transactions occurred during January 2016:

Jan.

1 Sold merchandise for cash, $3,500. The cost of the merchandise was $2,000. The company uses the perpetual inventory system.

2 Purchased equipment on account for $5,500 from the Strong Company.

4 Received a $150 bill from the local newspaper for an advertisement that appeared in the paper on January 2.

8 Sold merchandise on account for $5,000. The cost of the merchandise was $2,800.

10 Purchased merchandise on account for $9,500.

13 Purchased equipment for cash, $800.

16 Paid the entire amount due to the Strong Company.

18 Received $4,000 from customers on account.

20 Paid $800 to the owner of the building for January’s rent.

30 Paid employees $3,000 for salaries and wages for the month of January.

31 Paid a cash dividend of $1,000 to shareholders.

Required:

1. Set up T-accounts and enter the beginning balances as of January 1, 2016.

2. Prepare general journal entries to record each transaction. Omit explanations.

3. Post the entries to T-accounts.

4. Prepare an unadjusted trial balance as of January 31, 2016.

34. Toth Company had the following assets and liabilities on the dates indicated. December 31 2016 20...

Toth Company had the following assets and liabilities on the dates indicated. December 31 2016 2017 2018 Total Assets L $454,000 $534,000 $664,000 Total Liabilities $281,000 $331,000 $431,000 Toth began business on January 1, 2016, with an investment of $96,000 from stockholders. From an analysis of the change in stockholders' equity during the year, compute the net income (or loss) for: (a) 2016, assuming Toth paid $22,000 in dividends for the year Net income (loss) for 2016 (b) 2017, assuming stockholders made an additional investment of $49,000 and Toth paid no dividends in 2017. Net income (loss) for 2017 (c) 2018, assuming stockholders made an additional investment of $25,000 and Toth paid dividends of $15,000 in 2018. Net income (loss) for 2018

35. On June 30, 2011, a flash flood damaged the warehouse

On June 30, 2011, a flash flood damaged the warehouse and factory of Magna Corporation, completely destroying the work-in-process inventory. There was no damage to either the raw materials or finished goods inventories. A physical inventory taken after the flood revealed the following valuations:

Finished goods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $123,000

Work in process . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0

Raw materials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46,100

The inventory on January 1, 2011, consisted of the following:

Finished goods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $109,000

Work in process . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 103,000

Raw materials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49,300

$261,300

A review of the books and records disclosed that the gross profit margin historically approximated 42% of sales. The sales for the first six months of 2011 were $584,000. Raw materials purchases were $88,000. Direct labor costs for this period were $130,000, and manufacturing overhead has historically been applied at 70% of direct labor. Compute the value of the work-in-process inventory lost on June 30, 2011.

36. Each of the following situations has an internal

Each of the following situations has an internal control weakness.

a. Upside – Down Applications develops custom programs to customer’s specifications. Recently, development of a new program stopped while the programmers redesigned Upside – Down’s accounting system. Upside – Down’s accountants could have performed this task.

b. Norma Rottler has been your trusted employee for 24 years. She performs all cash-handling and accounting duties. Ms. Rottler just purchased a new Lexus and a new home in an expensive suburb. As owner of the company, you wonder how she can afford these luxuries because you pay her only $30,000 a year and she has no source of outside income.

c. Izzie Hardwoods, a private company, falsified sales and inventory figures in order to get an important loan. The loan went through, but Izzie later went bankrupt and could not repay the bank.

d. The office supply company where Pet Grooming Goods purchases sales receipts recently notified Pet Grooming Goods that its documents were not pre-numbered. Howard Mustro, the owner, replied that he never uses receipt numbers.

e. Discount stores such as Cusco make most of their sales for cash, with the remainder in credit-card sales. To reduce expenses, one store manager ceases purchasing fidelity bonds on the cashiers.

f. Cornelius’ Corndogs keeps all cash receipts in an empty bread box for a week, because he likes to go to the bank on Tuesdays when Joann is working.

Requirements

1. Identify the missing internal control characteristics in each situation.

2. Identify the possible problem caused by each control weakness.

3. Propose a solution to each internal control problem.

37. 62. The journal entry to record a particular business transaction includes a credit to the...

62. The journal entry to record a particular business transaction includes a credit to the Cash account. This transaction is most likely also to include:

A. Issuance of new capital stock.

B. The purchase of an asset on account.

C. Payment of an outstanding note payable.

D. A credit to Accounts Receivable.

63. The collection of an account receivable is recorded by a debit to Cash and a credit to Accounts Payable. If this error is not corrected:

A. Total liabilities are understated.

B. Total assets are understated.

C. Total liabilities are overstated.

D. Owners' equity is overstated.

64. Posting is the process of:

A. Transferring debit and credit entries from the journal into the appropriate ledger accounts.

B. Determining that the dollar amount of debit entries recorded in the ledger is equal to the dollar amount of credit entries.

C. Entering information into a computerized data base.

D. Preparing journal entries to describe each business transaction.

65. If a company purchases equipment for cash:

A. Assets will increase and owners' equity will also increase.

B. Assets will increase and owners' equity will decrease.

C. Assets will increase and owners' equity will remain unchanged.

D. Total assets and owners' equity will remain unchanged.

66. A trial balance that is out of balance indicates that:

A. The number of ledger accounts with debit balances is not equal to the number of accounts with credit balances.

B. A debit has been posted to the wrong account.

C. There is not an equality of debit and credit amounts in the ledger.

D. A journal entry has been completely omitted from the posting process.

67. A trial balance consists of:

A. A two-column schedule of all debit and credit entries posted to ledger accounts.

B. A two-column financial statement intended for distribution to interested parties outside the business.

C. A two-column schedule showing the totals of all debits and of all credits made in journal entries.

D. A two-column schedule listing names and balances of all ledger accounts.

68. Green Systems sold and delivered modems to Blue Computers for $660,000 to be paid by Blue in three equal installments over the next three months. The journal entry made by Blue Computers to record the last of the three installment payments will include:

A. A debit of $220,000 to Modem Expense.

B. A debit of $220,000 to Accounts Receivable.

C. A debit of $220,000 to Cash.

D. A debit of $220,000 to Accounts Payable.

69. Which of the following errors would be disclosed by preparation of a trial balance?

A. The collection of an account receivable was recorded by a debit to the Land account rather than to the Cash account.

B. The collection of an account receivable for $219 was recorded by a $291 debit to Cash and a $291 credit to Accounts Receivable.

C. The collection of a $365 account receivable was not recorded at all.

D. The collection of a $325 account receivable was recorded by a $325 debit to Cash and a $325 debit to Accounts Receivable.

70. Which of the following errors would not be disclosed by preparation of a trial balance?

A. An error was made in computing the balance of the Cash account.

B. A journal entry included a debit to the Equipment account for $3,200, but this amount was erroneously posted as $2,300.

C. During the posting process, a $1,700 debit to Cash was accidentally entered in the credit side of the Cash account.

D. The journal entries recorded on the last day of the year have never been posted to the ledger.

71. Black Systems sold and delivered modems to White Computers for $330,000 to be paid by White in three equal installments over the next three months. The journal entry made by Black Systems to record this transaction will include:

A. A debit to Sales Revenue for $330,000.

B. A debit to Accounts Receivable for $330,000.

C. A debit to Accounts Receivable for $110,000.

D. A debit to Cash Paid for $330,000.