BMGT323 Taxation of Individuals Exam Resources

34. 51. The Lucas Manufacturing Company has two production departments (fabrication and assembly)...

51. The Lucas Manufacturing Company has two production departments (fabrication and assembly) and three service departments (general factory administration, factory maintenance, and factory cafeteria). A summary of costs and other data for each department, prior to allocation of service department costs for the year ended June 30, appears below:

The costs of the general factory administration department, factory maintenance department, and factory cafeteria are allocated on the basis of direct labor hours, square footage occupied, and number of employees, respectively.

Fabrication

Assembly

General

Factory

Admin.

Factory

Maint.

Factory

Cafeteria

Direct labor costs:

$1,950,000

$2,050,000

Direct material costs:

$3,130,000

$ 950,000

Factory overhead costs:

$1,650,000

$1,850,000

$80,000

$67,500

$58,000

Direct labor hours:

237,690

387,810

Number of employees:

160

128

20

42

25

Sq. footage occupied:

20,000

30,000

2,400

2,000

4,800

Assuming that Lucas elects to use the sequential method to distribute service department costs (starting with the factory cafeteria), what would be the amount of factory cafeteria costs that would be allocated to the factory maintenance department?

A. $3,314

B. $6,960

C. $5,800

D. $0

52. Once the amounts of the service department allocations have been determined, a journal entry should be prepared to record the distributions, the result of which is:

A. debit balances in the Factory Overhead accounts of the production departments for which the total agrees to the total amount of factory overhead incurred.

B. credit balances in the Factory Overhead accounts of the production departments for which the total agrees to the total amount of factory overhead incurred.

C. debit balances in the Factory Overhead accounts of the service departments for which the total agrees to the total amount of factory overhead incurred.

D. credit balances in the Factory Overhead accounts of the service departments for which the total agrees to the total amount of factory overhead incurred.

53. A predetermined factory overhead rate is computed by dividing

A. Actual overhead cost by actual production.

B. Actual overhead cost by budgeted production.

C. Budgeted overhead by actual production.

D. Budgeted overhead by budgeted production.

54. Meger Manufacturing uses the direct labor cost method for applying factory overhead to production. The budgeted direct labor cost and factory overhead for the previous fiscal year were $1,000,000 and $800,000, respectively. Actual direct labor cost and factory overhead were $1,100,000 and $825,000, respectively.

What was Meger’s predetermined factory overhead rate?

A. 80%

B. 125%

C. 75%

D. 133%

55. Meger Manufacturing uses the direct labor cost method for applying factory overhead to production. The budgeted direct labor cost and factory overhead for the previous fiscal year were $1,000,000 and $800,000, respectively.

During the year, the company started and completed Job 352A, which had direct material and labor costs of $32,000 and $45,000, respectively. What was the cost of Job 352A?

A. $77,000

B. $81,000

C. $102,600

D. $113,000

56. The Davis Corporation uses the direct labor hour method of applying factory overhead to production. The budgeted factory overhead last year was $300,000, and there were 50,000 machine hours and 40,000 direct labor hours budgeted. Job 564 was started and completed during the period. Direct materials costing $5,400 were incurred. Thirty-six direct labor hours were worked at a cost of $500, and 50 machine hours were incurred. What is the amount of factory overhead applied to Job 564?

A. $375

B. $270

C. $216

D. $300

57. The Mason Corporation budgeted overhead at $240,000 for the period for Department A based on a budgeted volume of 60,000 direct labor hours. During the period, Mason started and completed Job B25, which incurred 200 labor hours at a cost of $2,200, and $5,000 of direct materials. What was the cost of Job B25?

A. $7,400

B. $8,000

C. $7,250

D. $13,800

58. Which of the following statements about using the direct labor hour method of applying factory overhead to production is false?

A. It may not be as accurate as the direct labor cost method if factory overhead primarily consists of items more closely tied to employee wages, such as benefits.

B. The application base could be substantially smaller than when direct labor cost is used.

C. It is the most appropriate method for a highly automated department.

D. The amount of factory overhead applied is not affected by the mix of labor rates.

59. When a manufacturing company has a highly automated manufacturing plant, what is probably the most appropriate basis of applying factory overhead costs to work in process?

A. Machine hours

B. Cost of materials used

C. Direct labor hours

D. Direct labor dollars

60. The Owens Company uses the machine hour method of applying factory overhead to production. The budgeted factory overhead last year was $200,000, and there were 40,000 machine hours budgeted. Job 84 was started and completed during the period. Direct materials costing $900 were incurred. Twenty-five direct labor hours were worked at a cost of $350, and 40 machine hours were incurred. What was the cost of Job 84?

A. $1,450

B. $1,375

C. $1,250

D. $1,290

35. Perdue Company purchased equipment on April 1, 2012, for $270,000. The equipment was expected to...

PR 9-3A Depreciation by three methods; partial years

Perdue Company purchased equipment on April 1, 2012, for $270,000. The equipment was expected to have a useful life of three years, or 18,000 operating hours, and a residual value of $9,000. The equipment was used for 7,500 hours during 2012, 5,500 hours in 2013, 4,000 hours in 2014, and 1,000 hours in 2015.

Instructions

Determine the amount of depreciation expense for the years ended December 31, 2012, 2013, 2014, and 2015, by (a) the straight-line method, (b) the units-of-output method, and (c) the double-declining-balance method.

36. 168.Which of the following show the proper effect of a stock split and a stock dividend? Item Stock.

168.Which of the following show the proper effect of a stock split and a stock dividend?

Item Stock SplitStock Dividend

a.Total paid-in capitalIncreaseIncrease

b.Total retained earningsDecreaseDecrease

c.Total par value (common)DecreaseIncrease

d.Par value per shareDecreaseNo change

169.A stock split

a.may occur in the absence of retained earnings.

b.will increase total paid-in capital.

c.will increase the total par value of the stock.

d.will have no effect on the par value per share of stock.

170.Outstanding stock of the Colt Corporation included 20,000 shares of $5 par common stock and 5,000 shares of 5%, $10 par noncumulative preferred stock. In 2010, Colt declared and paid dividends of $2,000. In 2011, Colt declared and paid dividends of $6,000. How much of the 2011 dividend was distributed to preferred shareholders?

a.$3,000

b.$3,500

c.$2,500

d.None of the above

171.Outstanding stock of the Abel Corporation included 20,000 shares of $5 par common stock and 10,000 shares of 5%, $10 par noncumulative preferred stock. In 2010, Abel declared and paid dividends of $4,000. In 2011, Abel declared and paid dividends of $12,000. How much of the 2011 dividend was distributed to preferred shareholders?

a.$7,000

b.$4,000

c.$5,000

d.None of the above

172.On January 1, Castagno Corporation had 800,000 shares of $10 par value common stock outstanding. On March 31, the company declared a 15% stock dividend. Market value of the stock was $15/share. As a result of this event,

a.Castagno’s Paid-in Capital in Excess of Par Value account increased $600,000.

b.Castagno’s total stockholders’ equity was unaffected.

c.Castagno’s Retained Earnings account decreased $1,800,000.

d.All of the above.

173.On January 1, Edmiston Corporation had 1,000,000 shares of $10 par value common stock outstanding. On March 31, the company declared a 20% stock dividend. Market value of the stock was $15/share. As a result of this event,

a.Edmiston’s Paid-in Capital in Excess of Par Value account increased $1,000,000.

b.Edmiston’s total stockholders’ equity was unaffected.

c.Edmiston’s Retained Earnings account decreased $3,000,000.

dAll of the above.

174.Sun Inc. has 5,000 shares of 5%, $100 par value, cumulative preferred stock and 50,000 shares of $1 par value common stock outstanding at December 31, 2010. What is the annual dividend on the preferred stock?

a.$50 per share

b.$25,000 in total

c.$5,000 in total

d.$0.50 per share

175.Allstate, Inc., has 10,000 shares of 6%, $100 par value, noncumulative preferred stock and 100,000 shares of $1 par value common stock outstanding at December 31, 2011. If the board of directors declares a $200,000 dividend, the

a.preferred stockholders will receive 1/10th of what the common stockholders will receive.

b.preferred stockholders will receive the entire $200,000.

c.$60,000 will be held as restricted retained earnings and paid out at some future date.

d.preferred stockholders will receive $60,000 and the common stockholders will receive $140,000.

176.Archer, Inc has 10,000 shares of 5%, $100 par value, noncumulative preferred stock and 40,000 shares of $1 par value common stock outstanding at December 31, 2011. There were no dividends declared in 2010. The board of directors declares and pays a $120,000 dividend in 2011. What is the amount of dividends received by the common stockholders in 2011?

a.$0

b.$50,000

c.$20,000

d.$70,000

177.Luther Inc has 2,000 shares of 6%, $50 par value, cumulative preferred stock and 100,000 shares of $1 par value common stock outstanding at December 31, 2011, and December 31, 2010. The board of directors declared and paid a $5,000 dividend in 2010. In 2011, $24,000 of dividends are declared and paid. What are the dividends received by the preferred stockholders in 2011?

a.$17,000

b.$12,000

c.$7,000

d.$6,000

37. Presented below is the trial balance of Thompson Corporation at

Presented below is the trial balance of Thompson Corporation at December 31, 2012.

A physical count of inventory on December 31 resulted in an inventory amount of $64,000; thus, cost of goods sold for 2012 is $645,000.

Instructions

Prepare a single-step income statement and a retained earnings statement. Assume that the only changes in retained earnings during the current year were from net income and dividends. Thirty thousand shares of common stock were outstanding the entireyear.

38. NEED HELP ASAP!! WILL RATE!!!

A hotel pays the phone company $200per month plus $.15 for each call made. During January 7,000 callswere made. In February 8,000 calls were made.

a)Calculate the hotel's phone bills for January and February.

b)Calculate the cost per phone call in January and in February.

c)Separate the January phone b...

39. On August 15, 2011, a hurricane damaged a warehouse of

On August 15, 2011, a hurricane damaged a warehouse of Rheinhart Merchandise Company. The entire inventory and many accounting records stored in the warehouse were completely destroyed. Although the inventory was not insured, a portion could be sold for scrap. Through the use of the remaining records, the following data are assembled:

Inventory, January 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 375,000

Purchases, January 1–August 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,385,000

Cash sales, January 1–August 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . 225,000

Collection of accounts receivable, January 1–August 15 . . . . . . . . . 2,115,000

Accounts receivable, January 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 175,000

Accounts receivable, August 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 265,000

Salvage value of inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,000

Gross profit percentage on sales . . . . . . . . . . . . . . . . . . . . . . . . . . . 32%

Compute the inventory loss as a result of the hurricane.

40. 21.Which of the following statements is incorrect? A. Preference shares usually have a fixed...

21.Which of the following statements is incorrect?

A. | Preference shares usually have a fixed dividend and rate higher than ordinary shares in a situation where a company goes into liquidation. |

B. | A redeemable preference share with a fixed redemption date is classified as equity. |

C. | A non-redeemable cumulative preference share gives the right to be paid current or accumulated dividends before ordinary shareholders. |

D. | A non-redeemable cumulative preference is normally classified as equity. |

22.Which of the following statements is incorrect?

A. | A redeemable preference share that is redeemable by the holder is classified as equity if it is not probable that redemption will occur. |

B. | A redeemable preference share with a fixed redemption date is classified as debt. |

C. | Sole proprietorships, partnerships and limited companies can all raise equity finance from owners’ contributions but only limited companies can issue ordinary shares. |

D. | A company distributes profits in the form of dividends, which is a reduction in retained profits, whereas distributions of profits by partnerships and sole proprietors are reductions in owners’ equity. |

The following information applies to questions 23 and 24.

Kucinta Manufacturing Company started operations with the following capital:

Partners’ contribution of cash | $25 000 |

Cash obtained from ABC Finance | $15 000 |

Loan obtained from the local bank | $5000 |

23.What is the amount of equity financing for this partnership?

A. | $30 000 |

B. | $25 000 |

C. | $45 000 |

D. | $20 000 |

24.What is the amount of debt financing for this partnership?

A. | $5000 |

B. | $45 000 |

C. | $20 000 |

D. | $15 000 |

25.When a company obtains financial resources from owners, it is termed:

A. | debt. |

B. | operating. |

C. | equity. |

D. | risk-free. |

26.The following amounts of capital were obtained to start operations of Yuppie Manufacturing at the beginning of the financial year:

Owners’ contribution of cash | $80 000 |

Owners’ contribution of machinery & equipment | 46 000 |

Loan from the owner | 18 000 |

$144 000 |

What is the amount of equity financing for this firm?

A. | $18 000 |

B. | $62 000 |

C. | $98 000 |

D. | $126 000 |

27.Deep Lake Lodging Company was established at the beginning of the financial year with the following capital:

Partners’ cash contributions | $46 000 |

Cash obtained from XYZ Credit | 30 000 |

Loan obtained from the local bank | 10 000 |

Total | $86 000 |

What is the amount of equity financing for this firm?

A. | $10 000 |

B. | $40 000 |

C. | $46 000 |

D. | $76 000 |

28.Which of the following provide resources to an organisation in exchange for future returns?

Owners Liabilities creditors

A. | No Yes |

B. | No No |

C. | Yes Yes |

D. | Yes No |

29.Which type of shares has a higher claim on dividends and assets than ordinary shares?

A. | Voting |

B. | Preference |

C. | Senior |

D. | Favoured |

30.Which of the following represent capital that has been earned by the profitable operation of a company?

Paid-in capital Retained profits

A. | Yes Yes |

B. | Yes No |

C. | No Yes |

D. | No No |

41. Locard’s exchange principle implies all of the following except a) Fibers can be transferred from...

Locard’s exchange principle implies all of the following except a) Fibers can be transferred from one person to another. b) Blood spatter can be used to identify blood type. c) Cat hair can be transferred to your pants. d) Soil samples can be carried from the yard into your home.

42. Identify specific asset, liability, and owner’s equity accounts that Cookie Creations will likely...

Identify specific asset, liability, and owner’s equity accounts that Cookie Creations will likely use to record its business transactions.

43. Activity-based costing, manufacturing. Decorative Doors, Inc., produces two types of doors,...

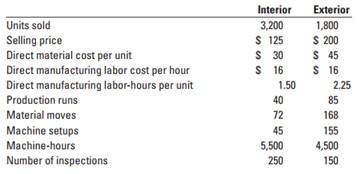

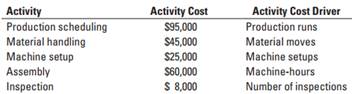

Activity-based costing, manufacturing. Decorative Doors, Inc., produces two types of doors, interior and exterior. The company’s simple costing system has two direct-cost categories (materials and labor) and one indirect-cost pool. The simple costing system allocates indirect costs on the basis of machinehours. Recently, the owners of Decorative Doors have been concerned about a decline in the market share for their interior doors, usually their biggest seller. Information related to Decorative Doors production for the most recent year follows:

The owners have heard of other companies in the industry that are now using an activity-based costing system and are curious how an ABC system would affect their product costing decisions. After analyzing the indirect-cost pool for Decorative Doors, the owners identify six activities as generating indirect costs: production scheduling, material handling, machine setup, assembly, inspection, and marketing. Decorative Doors collected the following data related to the indirect-cost activities:

Marketing costs were determined to be 3% of the sales revenue for each type of door.

1. Calculate the cost of an interior door and an exterior door under the existing simple costing system.

2. Calculate the cost of an interior door and an exterior door under an activity-based costing system.

3. Compare the costs of the doors in requirements 1 and 2. Why do the simple and activity-based costing systems differ in the cost of an interior door and an exterior door?

4. How might Decorative Doors, Inc., use the new cost information from its activity-based costing system to address the declining market share for interior doors?

44. “An efficient system of cost accounting is an essential factor for industrial control under modern...

“An efficient system of cost accounting is an essential factor for industrial control under modern conditions of business and as such may be regarded as an important part in the efforts of any management to secure business stability.” Elaborate this statement.

45. On April 1, Adventures Travel Agency, Inc. began operations. The following transactions were...

On April 1, Adventures Travel Agency, Inc. began operations. The following transactions were completed during the month.

1. Issued common stock for $24,000 cash.

2. Obtained a bank loan for $7,000 by issuing a note payable.

3. Paid $11,000 cash to buy equipment.

4. Paid $1,200 cash for April office rent.

5. Paid $1,450 for supplies.

6. Purchased $600 of advertising in the Daily Herald, on account.

7. Performed services for $18,000: cash of $2,000 was received from customers, and the balance of $16,000 was billed to customers on account.

8. Paid $400 cash dividend to stockholders.

9. Paid the utility bill for the month, $2,000.

10. Paid Daily Herald the amount due in transaction (6).

11. Paid $40 of interest on the bank loan obtained in transaction (2).

12. Paid employees’ salaries, $6,400.

13. Received $12,000 cash from customers billed in transaction (7).

14. Paid income tax, $1,500

46. Annie Rasmussen is the owner and operator of Go44, a motivational consulting business. At the end...

Annie Rasmussen is the owner and operator of Go44, a motivational consulting business. At the end of its accounting period, December 31, 2018, Go44 assets of $720,000 and liabilities of $180,000. Using the accounting equation and considering each case independently, determine the following amounts: a. Annie Rasmussen, capital, as of December 31, 2018. $338.100 b. Annie Rasmussen, capital, as of December 31, 2019, assuming that assets increased by $96, 500 and liabilities increased by $30,000 during 2019. $411.740 c. Annie Rasmussen, capital, as of December 31, 2019, assuming that assets increased by $168,000 and liabilities increased by $15,000 during 2019. $ 3, 250, 30. d. Annie Rasmussen, capital, as of December 31, 2019, assuming that assets increased by $175,000 and liabilities decreased by $18,00o during 2019. $ e..Net Income (or net toss) during 2019, assuming that as of December 31, 2019, assets were $880,000, liabilities were $220,000, and there were no additional investments or withdrawals. If you know two figures for the accounting equation (Assets = + Equity), you can rearrange it to calculate the missing amounts.

47. Betsy Strand's regular hourly wage rate is $14, and she receives an hourly rate of $21 for work i...

Betsy Strand's regular hourly wage rate is $14, and she receives an hourly rate of $21 for work in excess of 40 hours. During a January pay period, Betsy works 47 hours. Betsy's federal income tax withholding is $90, and she has no voluntary deductions. Assume that the FICA tax rate is 7.65%. Prepare the employer's journal entry to record payroll taxes for the period. Ignore unemployment taxes. (Round answers to 2 decimal places, e.g. 15.15. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

48. Discuss what is meant by the statement, “The accounting system is a conceptual flow of information...

1. Discuss what is meant by the statement, “The accounting system is a conceptual flow of information that represents the physical flows of personnel, raw materials, machinery, and cash through the organization.”

2. Discuss the importance of accounting independence in accounting information systems. Give an example of where this concept is important (use an example other than inventory control).

3. Discuss why it is crucial that internal auditors report solely to the uppermost level of management (either to the chief executive officer or the audit committee of the board of directors) and answer to no other group.

4. Contrast centralized data processing with distributed data processing. How do the roles of systems professionals and end users change? What do you think the trend is today?

49. Emeril Corporation encounters the following situations

This question from book : accounting principles 9th for Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Chapter 3

E3-4 Emeril Corporation encounters the following situations:

1. Emeril collects $1,000 from a customer in 2010 for services to be performed in 2011.

2. Emeril incurs utility expense which is not yet paid in cash or recorded.

3. Emeril's employees worked 3 days in 2010, but will not be paid until 2011.

4. Emeril earned service revenue but has not yet received cash or recorded the transaction.

5. Emeril paid $2,000 rent on December 1 for the 4 months starting December 1.

6. Emeril received cash for future services and recorded a liability until the revenue was

earned.

7. Emeril performed consulting services for a client in December 2010. On December 31, it

billed the client $1,200.

8. Emeril paid cash for an expense and recorded an asset until the item was used up.

9. Emeril purchased $900 of supplies in 2010; at year-end, $400 of supplies remain unused.

10. Emeril purchased equipment on January 1, 2010; the equipment will be used for 5 years.

11. Emeril borrowed $10,000 on October 1, 2010, signing an 8% one-year note payable.

Instructions

Identify what type of adjusting entry (prepaid expense, unearned revenue, accrued expense, accrued

revenue) is needed in each situation, at December 31, 2010.

Please help with this question

50. The following selected transactions were completed during April between Swan Company and Bird...

PR 5-4B Sales-related and purchase-related transactions for seller and buyer

The following selected transactions were completed during April between Swan Company and Bird Company:

Apr. 2. | Swan Company sold merchandise on account to Bird Company, $32,000, terms FOB shipping point, 2/10, n/30. Swan Company paid freight of $330, which was added to the invoice. The cost of the merchandise sold was $19,200. |

8. | Swan Company sold merchandise on account to Bird Company, $49,500, terms FOB destination, 1/15, n/eom. The cost of the merchandise sold was $29,700. |

8. | Swan Company paid freight of $710 for delivery of merchandise sold to Bird Company on April 8. |

12. | Bird Company returned $7,500 of merchandise purchased on account on April 8 from Swan Company. The cost of the merchandise returned was $4,800. |

12. | Bird Company paid Swan Company for purchase of April 2, less discount. |

23. | Bird Company paid Swan Company for purchase of April 8, less discount and less return of April 12. |

24. | Swan Company sold merchandise on account to Bird Company, $67,350, terms FOB shipping point, n/eom. The cost of the merchandise sold was $40,400. |

26. | Bird Company paid freight of $875 on April 24 purchase from Swan Company. |

30. | Bird Company paid Swan Company on account for purchase of April 24. |

Instructions

Journalize the April transactions for (1) Swan Company and (2) Bird Company.