Achieve Excellence in Accounting: Fall Semester Support

26. Rainmaker Environmental Consultants is just finishing its second year of operations. The company'...

Please answer this with details, thank you

Rainmaker Environmental Consultants is just finishing its second year of operations. The company's unadjusted trial balance a October 31, 2017, follows RAINMAKER ENVIRONMENTAL CONSULTANTS Unadjusted Trial Balance October 31, 2017 Acct No. Account Debit Credit 101 Cash 25.300 106 Accounts receivable 66,000 109 nterest receivable 55,000 111 Notes receivable 4,600 126 Supplies 128 Prepaid insurance 2.210 24,900 131 Prepaid rent 93,000 161 Office furniture 31,000 162 Accumulated depreciation, office furniture 201 Accounts payable 17,300 210 Wages payable 24,600 233 Unearned consulting revenue 231,580 301 Jeff Moore, capital 27,300 302 Jeff Moore, withdrawals 237,020 401 Consulting revenue 409 nterest income 410 601 Depreciation expense, office furniture 197,000 622 Wages expense 637 Insurance expense 40,500 640 Rent expense 650 Supplies expense 6,100 Totals 541,910 541,910

27. Kenworth Company uses a job-order costing system. Only three jobs-Job 105, Job 106, and Job 107- ...

Show transcribed image text Kenworth Company uses a job-order costing system. Only three jobs-Job 105, Job 106, and Job 107- were worked on during November and December. Job 105 was completed on December 10: the other two jobs were still in production on December 31, the end of the company's operating year. Data from the job cost sheets of the three jobs follow: The following additional information is available: Manufacturing overhead is applied to jobs on the basis of direct labour cost. Balances in the inventory accounts at November 30 were as follows: Required Prepare T-accounts for Raw Materials, Work in Process, Finished Goods, and Manufacturing Overhead. Enter the November 30 inventory balances given above: in the case of Work in Process, compute the November 30 balance and enter it into the Work in Process T-account.

28. (Objectives 6-6, 6-8) The following are specific balance-related audit objectives applied to the...

(Objectives 6-6, 6-8) The following are specific balance-related audit objectives applied to the audit of accounts receivable (a through h) and management assertions about account balances (1 through 4). The list referred to in the specific balance-related audit objectives is the list of the accounts receivable from each customer at the balance sheet date.

Specific Balance-Related Audit Objective

a. There are no unrecorded receivables.

b. Receivables have not been sold or discounted.

c. Uncollectible accounts have been provided for.

d. Receivables that have become uncollectible have been written off.

e. All accounts on the list are expected to be collected within 1 year.

f . The total of the amounts on the accounts receivable listing agrees with the general ledger balance for accounts receivable.

g. All accounts on the list arose from the normal course of business and are not due from related parties. h. Sales cutoff at year-end is proper.

Management Assertion about Account Balances

1. Existence 3. Valuation and allocation

2. Completeness 4. Rights and obligations

For each specific balance-related audit objective, identify the appropriate management assertion.

(Objective 6-6)

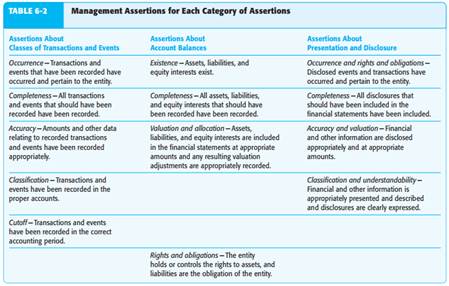

Management assertions are implied or expressed representations by management about classes of transactions and the related accounts and disclosures in the financial statements. In most cases they are implied. Examine Figure 6-4 on page 150. Manage - ment of Hillsburg Hardware Co. asserts that cash of $827,568 was present in the company’s bank accounts as of the balance sheet date. Unless otherwise disclosed in the financial statements, management also asserts that the cash was unrestricted and avail - able for normal use. Management also asserts that all required disclosures related to cash are accurate and are understandable. Similar assertions exist for each asset, liability, owners’ equity, revenue, and expense item in the financial statements. These assertions apply to classes of transactions, account balances, and presentation and disclosures. Management assertions are directly related to the financial reporting framework used by the company (usually U.S. GAAP or IFRS), as they are part of the criteria that management uses to record and disclose accounting information in financial statements. The definition of auditing in Chapter 1, in part, states that auditing is a comparison of information (financial statements) to established criteria (assertions established according to accounting standards). Auditors must therefore understand the assertions to do adequate audits. International auditing standards and U.S. GAAS classify assertions into three categories:

1. Assertions about classes of transactions and events for the period under audit

2. Assertions about account balances at period end

3. Assertions about presentation and disclosure The specific assertions included in each category are included in Table 6-2 (p. 154). The assertions are grouped so that assertions related across categories of assertions are included on the same table row.

Management makes several assertions about transactions. These assertions also apply to other events that are reflected in the accounting records, such as recording depre - ciation and recognizing pension obligations. Occurrence The occurrence assertion concerns whether recorded transactions in - cluded in the financial statements actually occurred during the accounting period. For example, management asserts that recorded sales transactions represent exchanges of goods or services that actually took place. Completeness This assertion addresses whether all transactions that should be included in the financial statements are in fact included. For example, management asserts that all sales of goods and services are recorded and included in the financial statements. The completeness assertion addresses matters opposite from the occurrence assertion. The completeness assertion is concerned with the possibility of omitting trans - actions that should have been recorded, whereas the occurrence assertion is concerned with inclusion of transactions that should not have been recorded. Thus, violations of the occurrence assertion relate to account overstatements, whereas violations of the completeness assertion relate to account understatements. The recording of a sale that did not take place is a violation of the occurrence assertion, whereas the failure to record a sale that did occur is a violation of the completeness assertion. Accuracy The accuracy assertion addresses whether transactions have been recorded at correct amounts. Using the wrong price to record a sales transaction and an error in calculating the extensions of price times quantity are examples of violations of the accuracy assertion. Classification The classification assertion addresses whether transactions are recorded in the appropriate accounts. Recording administrative salaries in cost of sales is one example of a violation of the classification assertion.

(Objective 6-8)

BALANCE-RELATED AUDIT OBJECTIVES

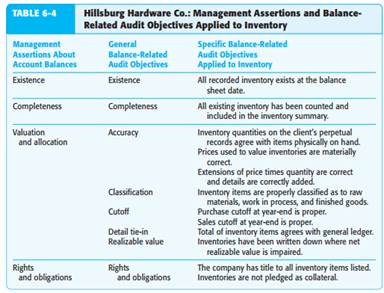

Balance-related audit objectives are similar to the transaction-related audit objectives just discussed. They also follow from management assertions and they provide a frame - work to help the auditor accumulate sufficient appropriate evidence related to account balances. There are also both general and specific balance-related audit objectives. There are two differences between balance-related and transaction-related audit objectives. First, as the terms imply, balance-related audit objectives are applied to account balances such as accounts receivable and inventory rather than classes of trans - actions such as sales transactions and purchases of inventory. Second, there are eight balance-related audit objectives compared to six transaction-related audit objectives. Because of the way audits are performed, balance-related audit objectives are almost always applied to the ending balance in balance sheet accounts, such as accounts receivable, inventory, and notes payable. However, some balance-related audit objectives are applied to certain income statement accounts. These usually involve nonroutine transactions and unpredictable expenses, such as legal expense or repairs and main - tenance. Other income statement accounts are closely related to balance sheet accounts and are tested simultaneously, such as depreciation expense with accumulated deprecia - tion and interest expense with notes payable. When using the balance-related audit objectives to audit account balances, the auditor accumulates evidence to verify detail that supports the account balance, rather than verifying the account balance itself. For example, in auditing accounts receivable, the auditor obtains a listing of the accounts receivable master file that agrees to the general ledger balance (see page 527 for an illustration). The accounts receivable balance-related audit objectives are applied to the customer accounts in that listing. Throughout the following discussion of the eight balance-related audit objectives, we make references to a supporting schedule, by which we mean a client-provided schedule or electronic file, such as the list of accounts receivable just discussed. Existence—Amounts Included Exist This objective deals with whether the amounts included in the financial statements should actually be included. For example, inclusion of an account receivable from a customer in the accounts receivable trial balance when there is no receivable from that customer violates the existence objective. This objective is the auditor’s counterpart to the management assertion of existence for account balances.

Completeness—Existing Amounts Are Included This objective deals with whether all amounts that should be included have actually been included. Failure to include an account receivable from a customer in the accounts receivable trial balance when a receivable exists violates the completeness objective. This objective is the counterpart to the management assertion of completeness for account balances. The existence and completeness objectives emphasize opposite audit concerns. Existence deals with potential overstatement; completeness deals with unrecorded amounts (understatement). Accuracy—Amounts Included Are Stated at the Correct Amounts The accuracy objective refers to amounts being included at the correct amount. An inventory item on a client’s inventory listing can be wrong because the number of units of inventory on hand was misstated, the unit price was wrong, or the total was incorrectly extended. Each of these violates the accuracy objective. Accuracy is one part of the valuation and allocation assertion for account balances. Classification—Amounts Included in the Client’s Listing are Properly Classified Classification involves determining whether items included on a client’s listing are included in the correct general ledger accounts. For example, on the accounts receivable listing, receivables must be separated into short-term and longterm, and amounts due from affiliates, officers, and directors must be classified separately from amounts due from customers. Classification is also part of the valuation and allocation assertion. The classification balance-related audit objective is closely related to the presentation and disclosure-related audit objectives, but relates to how balances are classified in general ledger accounts so they can be appropriately presented and disclosed in the financial statements. Cutoff—Transactions Near the Balance Sheet Date Are Recorded in the Proper Period In testing for cutoff of account balances, the auditor’s objective is to determine whether transactions are recorded and included in account balances in the proper period. An account balance is likely to be misstated by those transactions recorded near the end of the accounting period. For an annual audit this is as of the balance sheet date. Cutoff tests can be thought of as a part of verifying either the balance sheet accounts or the related transactions, but for convenience, auditors usually perform them as a part of auditing balance sheet accounts. For this reason, we also include cutoff as a balance-related audit objective related to the valuation and allocation assertion for account balances. The timing objective for transactions deals with the proper timing of recording transactions throughout the year, whereas the cutoff objec - tive for balance-related audit objectives relates only to transactions near year-end. For example, in a December 31 year-end audit, a sales transaction recorded in March for a February shipment is a transaction-related audit objective error, but not a balancerelated audit objective error. Detail Tie-In—Details in the Account Balance Agree with Related Master File Amounts, Foot to the Total in the Account Balance, and Agree with the Total in the General Ledger Account balances on financial statements are supported by details in master files and schedules prepared by clients. The detail tie-in objective is concerned that the details on lists are accurately prepared, correctly added, and agree with the general ledger. For example, individual accounts receivable on a listing of accounts receivable should be the same in the accounts receivable master file, and the total should equal the general ledger control account. Detail tie-in is also a part of the valuation and allocation assertion for account balances. Realizable Value—Assets Are Included at the Amounts Estimated to Be Realized This objective concerns whether an account balance has been reduced for declines from historical cost to net realizable value or when accounting standards require fair market value accounting treatment. Examples when the objective applies

are considering the adequacy of the allowance for uncollectible accounts receivable and write-downs of inventory for obsolescence. The objective applies only to asset accounts and is also a part of the valuation and allocation assertion for account balances. Rights and Obligations In addition to existing, most assets must be owned before it is acceptable to include them in the financial statements. Similarly, liabilities must belong to the entity. Rights are always associated with assets and obligations with liabilities. This objective is the auditor’s counterpart to the management assertion of rights and obligations for account balances. The same as for transaction related-audit objectives, after the general balance-related audit objectives are determined, specific balance-related audit objectives for each account balance on the financial statements can be developed. At least one specific balance-related audit objective should be included for each general balance-related audit objective unless the auditor believes that the general balance-related audit objective is not relevant or is unimportant for the account balance being considered. There may be more than one specific balance-related audit objective for a general balance-related audit objective. For example, specific balance-related audit objectives for rights and obligations of the inventory of Hillsburg Hardware Co. could include (1) the company has title to all inventory items listed and (2) inventory is not pledged as collateral for a loan unless it is disclosed. Table 6-4 illustrates the relationships among management assertions, the general balance-related audit objectives, and specific balance-related audit objectives as applied to inventory for Hillsburg Hardware Co. Notice that there is a one-to-one relationship between assertions and objectives, except for the valuation and allocation assertion. The valuation and allocation assertion has multiple objectives because of the complexity of valuation issues and the need to provide auditors with additional guidance for testing valuation.

29. Case study Steinberg v Scala (Leeds) Ltd [1923] 2 Ch 452 [2.461] A minor applied for shares in a...

Case study

Steinberg v Scala (Leeds) Ltd [1923] 2 Ch 452

[2.461] A minor applied for shares in a company and paid the amounts due on application and at the first call. She received no dividends and attended no meetings. After 18 months and while still a minor she repudiated the contract and asked for her money back. It was held that she could repudiate but that the money paid was irrecoverable as the allotment of shares was a benefit as the shares, at one period, had value.

30. 41) A business purchases equipment by paying $8,000 in cash and issuing a note payable of $12,000...

41) A business purchases equipment by paying $8,000 in cash and issuing a note payable of $12,000. Which of the following journal entries would be recorded?

A)

Equipment | 20,000 | |

Notes payable | 12,000 | |

Cash | 8,000 |

B)

Cash | 8,000 | |

Notes payable | 12,000 | |

Equipment | 20,000 |

C)

Cash | 8,000 | |

Notes payable | 4,000 | |

Equipment | 12,000 |

D)

Equipment | 8,000 | |

Notes payable | 4,000 | |

Cash | 12,000 |

42) The following transactions have been journalized and posted to the proper accounts.

1. Mark Call invested $7,000 cash in his new design services corporation in exchange for stock.

2. The corporation paid the first month's rent of $700.

3. The corporation purchased equipment by paying $2,000 cash and executing a note payable for $4,500.

4. The corporation purchased supplies for $850 cash.

5. The corporation billed a client for $4,000 of design services completed.

6. The corporation received $3,000 of the account for the completed services.

What is the balance in Cash?

A) $7,850

B) $6,450

C) $8,450

D) $8,150

43) Which of the following journal entries would be recorded if a business purchased $200 of supplies by paying cash?

A)

Cash | 200 | |

Supplies | 200 |

B)

Accounts payable | 200 | |

Supplies | 200 |

C)

Supplies | 200 | |

Cash | 200 |

D)

Supplies | 200 | |

Accounts payable | 200 |

44) A business purchased a building by paying part of the purchase price in cash as a down payment and signing a mortgage note for the remainder. The business should:

A) debit the mortgage note payable for the amount of the mortgage.

B) debit the building account for the amount of the mortgage.

C) debit cash for the amount paid on the down payment.

D) credit the mortgage note payable for the amount of the mortgage.

45) A company received $75,000 from a customer "on account." The journal entry would be to:

A) debit Accounts receivable and credit Sales revenue.

B) debit Accounts receivable and credit Cash.

C) debit Cash and credit Accounts receivable.

D) debit Sales revenue and credit Accounts receivable.

46) ABC Company reported the following transactions for September, 2013.

A) The company opened the business with a capital contribution of $23,500 cash. It was credited to common stock.

B) The company purchased office equipment for $11,500. The company paid $2,500 down and put the balance on a note payable.

C) The company paid a utility bill for $980 cash.

D) The company paid $2,000 cash for September rent.

E) The company had sales of $15,000 in September. Of these sales, 60% were cash sales, and the balance was credit sales.

F) The company paid $9,700 cash for office furniture.

What is the net income for September, 2013?

A) $12,020

B) $9,000

C) $6,020

D) $5,300

47) ABC Company reported the following transactions for September, 2013.

A) The company opened the business with a capital contribution of $23,500 cash. It was credited to common stock.

B) The company purchased office equipment for $11,500. The company paid $2,500 cash down and put the balance on a note payable.

C) The company paid insurance expense of $1,350 cash.

D) The company paid a utility bill for $980 cash.

E) The company paid $2,000 cash for September rent.

F) The company had sales of $12,000 in September. Of these sales, 60% were cash sales, and the balance was credit sales.

G) The company paid $9,700 cash for office furniture.

What are the total liabilities at the end of September, 2013?

A) $980

B) $2,330

C) $9,000

D) $4,800

48) ABC Company reported the following transactions for September, 2013.

A) The company opened the business with a capital contribution of $23,500 cash. It was credited to common stock.

B) The company purchased office equipment for $11,500. The company paid cash of $2,500 down and put the balance on a note payable.

C) The company purchased $1,350 of supplies on account.

D) The company paid a utility bill for $980 cash.

E) The company paid $2,000 cash for September rent.

F) The company had sales of $20,000 in September. Of these sales, 60% were cash sales, and the balance was credit sales.

G) The company paid $9,700 cash for office furniture.

What is the total amount in the Cash account at the end of September, 2013?

A) $15,520

B) $20,320

C) $28,320

D) $18,970

49) The following transactions have been journalized and posted to the proper accounts.

1. Mark Call invested $7,000 cash in his new design services corporation in exchange for stock.

2. The corporation paid the first month's rent with $700 cash.

3. The corporation purchased equipment by paying $2,000 down and executing a note payable for $4,500.

4. The corporation purchased supplies for $850 cash.

5. The corporation billed its clients a total of $4,000 for design services rendered.

6. The corporation collected $3,000 on account from one of its clients.

What is the balance in Accounts receivable?

A) $8,500

B) $1,000

C) $7,000

D) $4,000

50) The following transactions have been journalized and posted to the proper accounts.

1. Mark Call invested $7,000 cash in his new design services corporation in exchange for stock.

2. The corporation paid the first month's rent with $700 cash.

3. The corporation purchased equipment by paying $2,000 down and executing a note payable for $4,500.

4. The corporation purchased supplies for $850 cash.

5. The corporation billed its clients a total of $4,000 for design services rendered.

6. The corporation collected $3,000 on account from one of its clients.

What is the total amount of assets after all the above transactions have been completed?

A) $7,800

B) $13,800

C) $12,800

D) $14,800

31. Carrie Overwood works fluctuating work schedules. Besides her fixed salary of $1,050 per weekl.

2-17A LO 5. Carrie Overwood works fluctuating work schedules. Besides her fixed salary of $1,050 per week, her employment agreement provides for overtime pay at an extra halfrate for hours worked over 40. This week she worked 48 hours. Compute:

a. The overtime earnings. . . . . . . . . . $

b. The total earnings . . . . . . . . . . . . . $

c. If this was a BELO plan with a pay rate of $22.00 per hour and a maximum of 53 hours, how much would Overwood be paid for 48 hours? . . $

32. Many businesses borrow money during periods of increased busines

Many businesses borrow money during periods of increased business activity to finance inventory and accounts receivable. Neiman Marcus is one of America’s most prestigious retailers. Each Christmas season, Neiman Marcus builds up its inventory to meet the needs of Christmas shoppers. A large portion of these Christmas sales are on credit. As a result, Neiman Marcus often collects cash from the sales several months after Christmas. Assume that on November 1, 2011, Neiman Marcus borrowed $4.8 million cash from Texas Capital Bank for working capital purposes and signed an interest-bearing note due in six months. The interest rate was 8 percent per annum payable at maturity. The accounting period ends December 31.

Required:

1. Give the journal entry to record the note on November 1.

2. Give any adjusting entry required at the end of the annual accounting period.

3. Give the journal entry to record payment of the note and interest on the maturity date, April 30, 2012.

4. If Neiman Marcus needs extra cash during every Christmas season, should management borrow money on a long-term basis to avoid the necessity of negotiating a new short-term loan each year?