Achieve Distinction with Expert Assignment Help

33. Greenland Papery is a stationary supply company with offices and boutiques in Ontario and Québec...

Greenland Papery is a stationary supply company with offices and boutiques in Ontario and Québec. The organization started operations in 1978 and currently has an approximate annual payroll of $12,000,000 in each jurisdiction.

The organization is considering terminating the employment of five employees in each jurisdiction. To assist with forecasting the budget for the balance of the year, Fadwa Simon, the Director of Finance has asked you, as the Payroll Supervisor, to provide her with the details on all legislated payments on termination of employment required for each jurisdiction. In addition to the required payments on termination, include any employer costs related to the employees’ statutory deductions.

34. Job costing, consulting firm. Frontier Partners, a management consulting firm, has the following...

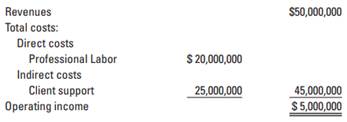

Job costing, consulting firm. Frontier Partners, a management consulting firm, has the following condensed budget for 2017:

Frontier has a single direct-cost category (professional labor) and a single indirect-cost pool (client support). Indirect costs are allocated to jobs on the basis of professional labor costs.

1. Prepare an overview diagram of the job-costing system. Calculate the 2017 budgeted indirect-cost rate for Frontier Partners.

2. The markup rate for pricing jobs is intended to produce operating income equal to 10% of revenues. Calculate the markup rate as a percentage of professional labor costs.

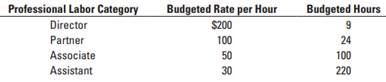

3. Frontier is bidding on a consulting job for Sentinel Communications, a wireless communications company. The budgeted breakdown of professional labor on the job is as follows:

Calculate the budgeted cost of the Sentinel Communications job. How much will Frontier bid for the job if it is to earn its target operating income of 10% of revenues?

35. The equity accounts of Terrell SE on January 1, 2017, were as follows. Share Capital-Preference (9%,

The equity accounts of Terrell SE on January 1, 2017, were as follows. Share Capital-Preference (9%, €50 par, cumulative, 10,000 shares authorized)..............................................................€ 400,000 Share Capital-Ordinary (€1 stated value, 2,000,000 shares authorized)......1,000,000 Share Premium-Preference............................................................100,000 Share Premium-Ordinary............................................................1,450,000 Retained Earnings.....................................................................1,816,000 Treasury Shares-Ordinary (20,000 shares)...........................................50,000 During 2017, the corporation had the following transactions and events pertaining to its equity. Feb. 1 Issued 30,000 ordinary shares for €120,000. Apr. 14 Sold 9,000 treasury shares-ordinary for €42,000. Sept. 3 Issued 7,000 ordinary shares for a patent valued at €32,000. Nov. 10 Purchased 1,000 ordinary shares for the treasury at a cost of €6,000. Dec. 31 Determined that net income for the year was €452,000. No dividends were declared during the year. Instructions (a) Journalize the transactions and the closing entry for net income. (b) Enter the beginning balances in the accounts, and post the journal entries to the equity accounts. (Use J5 for the posting reference.) (c) Prepare an equity section at December 31, 2017, including the disclosure of the preference dividends in ar

36. What is the primary source document for recording (1) cash sales and (2) credit sales?

(a) What is the primary source document for recording (1) cash sales and (2) credit sales?

(b) Using XXs for amounts, give the journal entry for each of the transactions in part (a), assuming perpetual inventory.

37. Break-Even Analysis. The Carey Company sold 100,000 units of its product at $20 per unit. Variable

Break-Even Analysis. The Carey Company sold 100,000 units of its product at $20 per unit. Variable costs are $14 per unit (manufacturing costs of $11 and marketing costs of $3). Fixed costs are incurred uniformly throughout

19- and amount to $792,000 (manufacturing costs of $500,000 and marketing costs of $292,000).

Required: (1) The break-even point in units and in dollars.

(2) The number of units that must be sold to earn a net income of $60,000 for 19- before income taxes.

(3) The number of units that must be sold to earn an aftertax income of

$90,000 if the income tax rate is 40%.

(4) The number of units required to break even if labor costs are 50% of

variable costs and 20% of fixed costs and if there is a 10% increase in wages and salaries.

38. Kael Company maintains a petty cash fund for small expenditures. These transactions occurred...

Kael Company maintains a petty cash fund for small expenditures. These transactions occurred during the month of August.

Aug. 1 Established the petty cash fund by writing a check payable to the petty cash custodian for $200. 15 Replenished the petty cash fund by writing a check for $175. On this date, the fund consisted of $25 in cash and these petty cash receipts: freight-out $74.40, entertainment expense $36, postage expense $33.70, and miscellaneous expense $27.50.

16 Increased the amount of the petty cash fund to $400 by writing a check for $200.

31 Replenished the petty cash fund by writing a check for $283. On this date, the fund consisted of $117 in cash and these petty cash receipts: postage expense $145, entertainment expense $90.60, and freight-out $46.40.

Instructions

(a) Journalize the petty cash transactions.

(b) Post to the Petty Cash account.

(c) What internal control features exist in a petty cash fund?

39. 1 What three factors would influence your evaluation as to whether a company’s current ratio is good

1 What three factors would influence your evaluation as to whether a company’s current ratio is good or bad, why?

2 Suggest several reasons why a 2:1 current ratio might not be adequate for a particular company

3 Why is working capital given special attention in the process of analyzing balance sheets?

4 What does the number of days’ sales uncollected indicate and who would be interested in these ration?

5 What does a relatively high accounts receivable turnover indicate about a company’s short-term liquidity?

6 Why is a company’s capital structure, as measured by debt and equity ratios, important to financial statement analysts?

7 How does inventory turnover provide information about a company’s short-term liquidity?

8 Discuss why there may or may not be ratios that would be more important in a service vs manufacturing environment and which rations would those be?

please provide a brief explanation of how this information is important in managerial decision making

40. 1 The breakeven point is the activity level where: a revenues equal fixed costs b contribution margi

1 The breakeven point is the activity level where:

a revenues equal fixed costs

b contribution margin equals variable costs

c revenues equal the sum of variable and fixed costs

d revenues equal variable costs

2 When fixed costs are $100,000 and variable costs are 20%

of the selling price, then breakeven sales are:

a $100,000

b $500,000

c $125,000

d indeterminable

3 Ruben intends to sell his customers a special round-trip

airline ticket package He is able to purchase the package from the airline

carrier for $150 each The round-trip tickets will be sold for $200 each and

the airline intends to reimburse Ruben for any unsold ticket packages Fixed

costs include $5,000 in advertising costs

What is the contribution margin per ticket package?

a $50

b $100

c $150

d $200

4 If unit outputs exceed the breakeven point:

a total sales revenue exceeds total costs

b there is a profit

c there is a loss

d Both total sales revenue exceeds total costs and there is

a profit

5 Ruben intends to sell his customers a special round-trip

airline ticket package He is able to purchase the package from the airline

carrier for $150 each The round-trip tickets will be sold for $200 each and

the airline intends to reimburse Ruben for any unsold ticket packages Fixed

costs include $5,000 in advertising costs

How many ticket packages will Ruben need to sell to break

even?

a 34 packages

b 50 packages

c 100 packages

d 150 packages

6 Ruben intends to sell his customers a special round-trip

airline ticket package He is able to purchase the package from the airline

carrier for $150 each The round-trip tickets will be sold for $200 each and

the airline intends to reimburse Ruben for any unsold ticket packages Fixed

costs include $5,000 in advertising costs

How many ticket packages will Ruben need to sell in order to

achieve $60,000 of operating income?

a 367 packages

b 434 packages

c 1,100 packages

d 1,300 packages

7 Ruben intends to sell his customers a special round-trip

airline ticket package He is able to purchase the package from the airline

carrier for $150 each The round-trip tickets will be sold for $200 each and

the airline intends to reimburse Ruben for any unsold ticket packages Fixed

costs include $5,000 in advertising costs

For every $25,000 of ticket packages sold, operating income

will increase by:

a $6,250

b $12,500

c $18,750

d an indeterminable amount

41. Brown Company paid cash to purchase the assets of Coffee Company on January 1, 2019. Information...

Brown Company paid cash to purchase the assets of Coffee Company on January 1, 2019. Information is as follows: | ||||||||

Total cash paid | $2,990,000 |

| ||||||

Assets acquired: |

| |||||||

Land | $600,000 |

| ||||||

Building | $600,000 |

| ||||||

Machinery | $500,000 |

| ||||||

Patents | $600,000 |

| ||||||

| ||||||||

The building is depreciated using the double-declining balance method. Other information is: | ||||||||

Salvage value | $60,000 |

| ||||||

Estimated useful life in years | 30 |

| ||||||

| ||||||||

The machinery is depreciated using the units-of-production method. Other information is: | ||||||||

Salvage value, percentage of cost | 10% |

| ||||||

Estimated total production output in units | 400,000 |

| ||||||

Actual production in units was as follows: |

| |||||||

2019 | 40,000 |

| ||||||

2020 | 80,000 |

| ||||||

2021 | 120,000 |

| ||||||

| ||||||||

The patents are amortized on a straight-line basis. They have no salvage value. |

| |||||||

Estimated useful life of patents in years | 20 |

| ||||||

On December 31, 2020, the value of the patents was estimated to be | $900,000 |

| ||||||

| ||||||||

| ||||||||

Where applicable, the company uses the ½ year rule to calculate depreciation and amortization expense in the years of acquisition and disposal. Its fiscal year-end is December 31. | ||||||||

| ||||||||

The machinery was traded on December 2, 2021 for new machinery. Other information is: | ||||||||

Fair value of old machinery | $240,000 |

| ||||||

Trade-in allowance | $336,000 |

| ||||||

List price for new machinery | $504,000 |

| ||||||

Estimated useful life of new machinery in years | 20 |

| ||||||

Estimated salvage value of new machinery | $15,120 |

| ||||||

The new machinery if depreciated using the stright-line method and ½ year rule. |

| |||||||

| ||||||||

On August 14, 2023, an addition was made. This amount was material. Other relevant information is as follows: | ||||||||

Amount of addition, paid in cash | $100,000 |

| ||||||

Number of years of useful life from 2023 (original machinery and addition): |

| |||||||

20 |

| |||||||

Salvage value, percentage of addition | 10% |

| ||||||

| ||||||||

Required: Prepare journal entries to record: |

| |||||||

1 | The purchase of the assets of Coffee. |

| ||||||

2 | Depreciation and amortization expense on the purchased assets for 2019. |

| ||||||

3 | The decline (if any) in value of the patents at December 31, 2020. |

| ||||||

4 | The trade-in of the old machinery and purchase of the new machinery. |

| ||||||

5 | Depreciation on the new machinery for 2021. |

| ||||||

6 | Cost of the addition to the machinery on August 14, 2023. |

| ||||||

7 | Depreciation on the new machinery for 2023. |

| ||||||

42. What is the NPV for a project whose cost of capital is 15 percent and initial after-tax cost is...

What is the NPV for a project whose cost of capital is 15 percent and initial after-tax cost is $5,000,000 and is expected to provide after-tax operating cash inflows of $1,800,000 in year 1, $1,900,000 in year 2, $1,700,000 in year 3, and $1,300,000 in year 4? $1,700,000 $371,764 -$137,053 -$4,862,947

43. Zero beginning inventory, materials introduced in middle of

Zero beginning inventory, materials introduced in middle of process. Roary Chemicals has a Mixing Department and a Refining Department. Its process-costing system in the Mixing Department has two direct materials cost categories (Chemical P and Chemical Q) and one conversion costs pool. The following data pertain to the Mixing Department for July 2009:

Chemical P is introduced at the start of operations in the Mixing Department and Chemical U is added when the product is three-fourths completed in the Mixing Department. Conversion costs are added evenly during the process. The ending work in process in the Mixing Department is two-thirds complete.

1. Compute the equivalent units in the Mixing Department for July 2009 for each cost category.

2. Compute (a) the cost of goods completed and transferred to the Refining Department during July and (b) the cost of work in process as of July 31,2009.

44. Provide a compensating balance for bank

1. Which of the following combinations of asset structures and financing patterns is likely to create the most volatile earnings?

a. Illiquid assets and heavy long-term borrowing

b. Illiquid assets and heavy short-term borrowing

c. Liquid assets and heavy short-term borrowing

d. Liquid assets and heavy long-term borrowing

2. How would electronic funds transfer affect the use of “float”?

a. Decrease its use somewhat

b. Increase its use somewhat

c. Have no effect on its use

d. Virtually eliminated its use

3. “Float” takes place because

a. The level of cash on the firms books is equal to the level cash in the bank

b. A firm is early in paying its bills

c. A customer writes “hot” checks

d. A lag exists between writing a check and clearing it through the banking system

4. Which is the following is not valid reason for holding cash?

a. To earn the highest return possible

b. To meet transaction requirement

c. To provide a compensating balance for bank

d. To satisfy emergency needs for funds

45. The lease of land and buildings when split causes difficulty in the allocation of the minimum lease...

The lease of land and buildings when split causes difficulty in the allocation of the minimum lease payments. In this case the minimum lease payments should be split

(a) According to the relative fair value of two elements.

(b) By the entity based on the useful life of the two elements.

(c) Using the sum of the digits method.

(d) According to any fair method devised by the entity.

46. If revenue was $45,000, expenses were $37,500, and the owner’s withdrawals were $10,000, the amount...

If revenue was $45,000, expenses were $37,500, and the owner’s withdrawals were $10,000, the amount of net income or net loss would be:

A. $45,000 net income.

B. $7,500 net income.

C. $37,500 net loss.

D. $2,500 net loss.

47. On September 1, 2008, the account balances of Rand Equipment Repair, Inc. were as follows

P3-5A On September 1, 2008, the account balances of Rand Equipment Repair, Inc. were as follows. No. Debits No. Credits 101 Cash $4,880 154 Accumulated Depreciation $1,500 112 Accounts Receivable 3,520 201 Accounts Payable 3,400 126 Supplies 2,000 209 Unearned Service Revenue 1,400 153 Store Equipment 15,000 212 Salaries Payable 500 311 Common Stock 15,000 320 Retained Earnings 3,600 $25,400 $25,400 During September the following summary transactions were completed. Sept. 8 Paid $1,400 for salaries due employees, of which $900 is for September. 10 Received $1,200 cash from customers on account. 12 Received $3,400 cash for services performed in September. 15 Purchased store equipment on account $3,000. 17 Purchased supplies on account $1,200. 20 Paid creditors $4,500 on account. 22 Paid September rent $500. 25 Paid salaries $1,250. 27 Performed services on account and billed customers for services provided $1,500. 29 Received $650 from customers for future service. Adjustment data consist of: 1. Supplies on hand $1,200. 2. Accrued salaries payable $400. 3. Depreciation is $100 per month. 4. Unearned service revenue of $1,450 is earned. Instructions (a) Journalize the September transactions. (Your instructor may advise you to post to ledger accounts, that should be turned in as part of the problem.) (b) Prepare a trial balance at September 30. (c) Journalize and post adjusting entries. (d) Prepare an adjusted trial balance. (e) Prepare an income statement and a retained earnings statement for September and a balance sheet at September 30

48. Summers Corporation is composed of five divisions. Each division is allocated a share of Summers'...

Summers Corporation is composed of five divisions. Each division is allocated a share of Summers's overhead to make divisional managers aware of the cost of running the corporate headquarters. The following information relate? to the Metro Division: If the Metro Division is closed, 100% of the traceable fixed operating costs can be eliminated. What will be the impact on Summers's overall profitability if the Metro Division is closed? Decrease by $500,000. Decrease by $2.100.000. Decrease by $2, 400,000. Decrease by $200,000. None of the answers are correct.

49. The Central Valley Company is a manufacturing firm that produces and sells a single product The c...

The Central Valley Company is a manufacturing firm that produces and sells a single product The company's revenues and expenses for the last four months are given below. Required: Management is concerned about the lessee experienced during the spring and would like to know more about the cost behaviour. Develop a cost equation for each of the costs. Assume that fixed costs are incurred uniformly throughcut the year. Compute the annual profit if 82,000 units are sold during the year. Calculate the change in profit r the selling price were reduced by $11.5 each and annual sales were to increase by 7, 800 units. Determine the change in profit if the company were to increase advertising by $114,000 and it this were to increase sales by 7, 300 units.

50. 7. FRC Inc. acquired Marketing Inc on 1/1/2014. Marketing Inc. has 10,000 shares outstanding....

7.

FRC Inc. acquired Marketing Inc on 1/1/2014. Marketing Inc. has 10,000 shares outstanding. Each share in Marketing Inc. was exchanged for half a share in FRC, Inc. Shares of FRC Inc., were trading at $100 per share at the date of the announcement of the transaction. Marketing Inc, had the following assets and liabilities that were assumed by FRC Inc.

The amount of Goodwill recognized by FRC, Inc. on January 1, 2014 is:

- $400,000

- $360,000

- $495,000

- $455,000