Accounting Information Systems: Assignment Guidance

33. PROBLEM 8–26 Completing a Master Budget [LO2, LO4, LO7, LO8, LO9, LO10] The following data relate...

The following data relate to the operations of Picanuy Corporation, a wholesale distributor of consumer goods:

a. The gross margin is 30% of sales. (In other words, cost of goods sold is 70% of sales.)

b. Actual and budgeted sales data are as follows:

c. Sales are 40% for cash and 60% on credit. Credit sales are collected in the month following sale. The accounts receivable at December 31 are the result of December credit sales.

d. Each month’s ending inventory should equal 20% of the following month’s budgeted cost of goods sold.

e. One-quarter of a month’s inventory purchases is paid for in the month of purchase; the other three-quarters is paid for in the following month. The accounts payable at December 31 are the result of December purchases of inventory.

f. Monthly expenses are as follows: commissions, $12,000; rent, $1,800; other expenses (exclud- ing depreciation), 8% of sales. Assume that these expenses are paid monthly. Depreciation is

$2,400 for the quarter and includes depreciation on new assets acquired during the quarter.

g. Equipment will be acquired for cash: $3,000 in January and $8,000 in February.

h. Management would like to maintain a minimum cash balance of $5,000 at the end of each month. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $50,000. The interest rate on these loans is 1% per month, and for simplicity, we will assume that inter- est is not compounded. The company would, as far as it is able, repay the loan plus accumu- lated interest at the end of the quarter.

Required:

Using the data above:

1.  Complete the following schedule:

Complete the following schedule:

| January |

| February |

| March |

| Quarter |

Cash sales . . . . . . . . . . | $28,000 |

|

|

|

|

|

|

Credit sales . . . . . . . . . . | 36,000 |

|

|

|

|

|

|

Total collections . . . . . . . | $64,000 |

|

|

|

|

|

|

2. Complete the following:

3.  Complete the following schedule:

Complete the following schedule:

| January |

| February |

| March |

|

| Quarter |

Commissions . . . . . . . . . . . . . . . . . . . . . $12,000 Rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,800 Other expenses . . . . . . . . . . . . . . . . . . . 5,600 |

|

|

|

|

|

|

| |

Total disbursements . . . . . . . . . . . . . . . . $19,400 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

4. |

Complete the following cash budget: |

|

|

|

|

|

|

|

| Cash Budget January |

|

February |

|

March |

|

|

Quarter |

| Cash balance, beginning . . . . . . . . . . . . $ 6,000 Add cash collections . . . . . . . . . . . . . . . . 64,000 |

|

|

| ||||

| Total cash available . . . . . . . . . . . . . . . . 70,000 |

|

| |||||

| Less cash disbursements: For inventory . . . . . . . . . . . . . . . . . . . . 45,150 For operating expenses . . . . . . . . . . . . 19,400 For equipment . . . . . . . . . . . . . . . . . . 3,000 |

|

| |||||

| Total cash disbursements . . . . . . . . . . . . 67,550 |

|

| |||||

| Excess (deficiency) of cash . . . . . . . . . . . 2,450 |

|

| |||||

5.  Prepare an absorption costing income statement, similar to the one shown in Schedule 9 in the chapter, for the quarter ended March 31.

Prepare an absorption costing income statement, similar to the one shown in Schedule 9 in the chapter, for the quarter ended March 31.

6. Prepare a balance sheet as of March 31.

34. Knickknack, Inc., manufactures two products: odds and ends. The firm uses a single, plantwide...

Knickknack, Inc., manufactures two products: odds and ends. The firm uses a single, plantwide over- head rate based on direct-labor hours. Production and product-costing data are as follows:

Knickknack, Inc., manufactures two products: odds and ends. The firm uses a single, plantwide over- head rate based on direct-labor hours. Production and product-costing data are as follows:

*Calculation of predetermined overhead rate:

*Calculation of predetermined overhead rate:

Machine-related costs ....................................................................................................................... | $1,800,000 |

Setup and inspection ......................................................................................................................... | 720,000 |

Engineering ....................................................................................................................................... | 360,000 |

Plant-related costs ............................................................................................................................. | 384,000 |

Total ................................................................................................................................................. | $3,264,000 |

Predetermined overhead rate:

Budgeted manufacturing overhead Budgeted direct-labor hours

$3,264, 000 (1, 000)(4) (5, 000)(6)

$3,264, 000 (1, 000)(4) (5, 000)(6)

$96 per direct-labor hour

$96 per direct-labor hour

Knickknack, Inc., prices its products at 120 percent of cost, which yields target prices of $796.80 for odds and $1,195.20 for ends. Recently, however, Knickknack has been challenged in the market for ends by a European competitor, Bricabrac Corporation. A new entrant in this market, Bricabrac has been sell- ing ends for $880 each. Knickknack’s president is puzzled by Bricabrac’s ability to sell ends at such a low cost. She has asked you (the controller) to look into the matter. You have decided that Knickknack’s traditional, volume-based product-costing system may be causing cost distortion between the firm’s two products. Ends are a high-volume, relatively simple product. Odds, on the other hand, are quite complex and exhibit a much lower volume. As a result, you have begun work on an activity-based costing system.

Required:

1. Let each of the overhead categories in the budget represent an activity cost pool. Categorize each in terms of the type of activity (e.g., unit-level activity).

2. The following cost drivers have been identified for the four activity cost pools.

You have gathered the following additional information:

• Each odd requires 8 machine hours, whereas each end requires 2 machine hours.

• Odds are manufactured in production runs of 25 units each. Ends are manufactured in 125 unit batches.

• Three-quarters of the engineering activity, as measured in terms of change orders, is related to odds.

• The plant has 3,840 square feet of space, 80 percent of which is used in the production of odds. For each activity cost pool, compute a pool rate.

3. Determine the unit cost, for each activity cost pool, for odds and ends.

4. Compute the new product cost per unit for odds and ends, using the ABC system.

5. Using the same pricing policy as in the past, compute prices for odds and ends. Use the product costs determined by the ABC system.

6. Show that the ABC system fully assigns the total budgeted manufacturing overhead costs of

$3,264,000.

7. Show how Knickknack’s traditional, volume-based costing system distorted its product costs. (Use Exhibit 5–10 for guidance.)

35. C.F. Wong holds a well-diversified portfolio of high-quality, large-cap shares. The current value...

C.F. Wong holds a well-diversified portfolio of high-quality, large-cap shares. The current value of Wong’s portfolio is $475 000, but he is concerned that the market is heading for a big fall (perhaps as much as 10%) over the next three to six months. He doesn’t want to sell all his shares because he feels they all have good long-term potential and should perform nicely once share prices have bottomed out. As a result, he decides to look into the possibility of using index options to hedge his portfolio. Assume that the ASX 200 currently stands at 2910 points and among the many put options available on this index are two that have caught his eye: (1) a six month put with a strike price of 2890 that is trading at 26, and (2) a six-month put with a 2830 strike price that is quoted at 12.

a. How many ASX 200 puts would Wong have to buy to protect his $475 000 share portfolio? How much would it cost him to buy the necessary number of 2890 puts? How much would it cost to buy the 2830 puts?

b. Now, considering the performance of both the put options and the Wong portfolio, determine how much net profit (or loss) Wong will earn from each of these put hedges if both the market (as measured by the ASX 200) and the Wong portfolio fall by 10% over the next six months? What if the market and the Wong portfolio fall by only 5%? What if they go up by 10%?

c. Do you think Wong should set up the put hedge and, if so, using which put option? Explain.

Q

36. What is the relationship between cost flows in the accounts and the flow of physical products...

Why are certain costs referred to as period costs? What are the major types of period costs incurred by a manufacturer?

Explain why the income statement of a manufacturing company differs from the income statement of a merchandising company.

What is the general content of a statement of cost of goods manufactured? What is its relationship to the income statement?

What is the relationship between cost flows in the accounts and the flow of physical products through a factory?

37. Accounting 102

At the end of April, Cavy Company had completed Job 766 & 765. Job 766 is for 675 units and Job 765 is for 900 units.

Job direct materials direct labor machine hours

756 5,670 3,500 27

766 8,900 4,755 44

job 756 produced 152 units & job 766 consisted of 250 units

Assuming that the predetermined overhead rate is applied by using machine hours at a rate of $200 per hour, determine the (a) balance on the job costs sheets for each job, (b) the cost per unit at the end of April.

38. Quo Co. rented a building to Hava Fast Food. Each month Quo receives a fixed rental amount plus a...

Quo Co. rented a building to Hava Fast Food. Each month Quo receives a fixed rental amount plus a variable rental amount based on Hava’s sales for that month. As sales increase so does the variable rental amount, but at a reduced rate. Which of the following curves reflects the monthly rentals under the agreement?

- I

- II

- III

- IV

39. The partners agree that loan balances should be closed to capital accounts and that remaining cash...

Installment liquidation

The partnership of Gary, Henry, Ian, and Joseph is preparing to liquidate. Profit and loss sharing ratios are shown in the summarized balance sheet at December 31, 2011, as follows:

Cash | $200,000 | Other liabilities | $100,000 |

Inventories | 200,000 | Gary capital (40%) | 300,000 |

Loan to Henry | 20,000 | Henry capital (30%) | 320,000 |

Other assets | 510,000 | Ian capital (20%) | 100,000 |

Joseph capital (10%) | 110,000 | ||

$930,000 | $930,000 |

REQUIRED

1. The partners anticipate an installment liquidation. Prepare a cash distribution plan as of January 1, 2012, that includes a $50,000 contingency fund to help the partners predict when they will be included in cash distributions.

2. During January 2012, the inventories are sold for $100,000, the other liabilities are paid, and $50,000 is set aside for contingencies. The partners agree that loan balances should be closed to capital accounts and that remaining cash (less the contingency fund) should be distributed to partners. How much cash should each partner receive?

40. Image text transcribed for accessibility: Recording Transactions with the Accounting Equation During

Image text transcribed for accessibility: Recording Transactions with the Accounting Equation During the year, the Decker Company experienced the following accounting transactions: 1. Issued common stock in the amount of $100,000 2. Paid a $30,000 cash dividend 3. Borrowed $25,000 from a bank 4. Made a principal payment of $2,500 on an outstanding bank loan 5. Made an interest payment of $1,200 on an outstanding bank loan Using the accounting equation, record each of the transactions in columnar format using the following template:

41. Five years ago Gerald invested $150,000 in a passive activity, his sole investment venture. On...

Five years ago Gerald invested $150,000 in a passive activity, his sole investment venture. On January 1, 2011, his amount at risk in the activity was $30,000. His shares of the income and losses were as follows:

Year | Income (Loss) |

2011 | ($40,000) |

2012 | (30,000) |

2013 | 50,000 |

How much can Gerald deduct in 2011 and 2012? What is his taxable income from the activity in 2013? Consider the at-risk rules as well as the passive loss rules.

42. computerized accounting with quickbooks 2013 chapter 5

I NEED CASE 1 AND 2 DONE

Document Preview:

Cha r Review an ssment Procedure Check 1. Your company will be selling a new product. Describe the steps that must be taken to add the new item to the system. 2. Explain the difference between using Enter Bills or Receive Items and Enter Bills from the Vendors pull-down menu. 3. Which QuickBooks report(s) would you use to view the sales and pur- chases of specific inventory items? 4. At year-end, you wish to confirm the quantity on hand for each inven- tory item. How would you use QuickBooks reports to determine the quantity and value of the ending inventory? 5. Your company wishes to view the profitability of each inventory item. How could you use QuickBooks to develop this information? 6. Discuss the advantages of using a computerized accounting system to maintain a perpetual inventory system. Case Problems Case Problem 1 On April 1, 2014, Lynn Garcia began her business, called Lynn's Music Studio. In the first month of business, Lynn set up the music studio, pro- vided guitar and piano lessons, and recorded month-end activity. In May, the second month of business, Lynn decides to purchase and sell inventory items of guitars, keyboards, music stands, and sheet music. For customers that purchase merchandise inventory, the terms of payment are 2110, Net 30 Days. For illustration purposes, assume a 7% sales tax is charged on the sale of all inventory items. The company file includes the information for Lynn's Music Studio as of May 1, 2014. 1. Open the company file CH5 Lynn's Music Studio.QBW. 2. Make a backup copy of the company file LMS5 ['YourName] Lynn's Music Studio. 3. Restore the backup copy of the company file. I~~both the Open Backup Copy and Save Company File as windows use the file name LMS5 [Your Name] Lynn's Music Studio. 4. Change the Company Name to LMS5 [Your Name] Lynn's Music Studio. 5. Add the following inventory items to the Item List: Type: Inventory Part Item Name/Number: Keyboards Description on Purchase/Sales Transactions: Keyboards Cost:...

43. Multiple choice

1. In large companies, the independent internal verification procedure is often assigned to

management.

computer operators.

outside CPAs.

internal auditors.

2. Shandy Shutters has the following inventory information.

Nov.1Inventory15 units @$8.00

8Purchase60 units @$8.60

17Purchase30 units @$8.40

25Purchase45 units @$8.80

A physical count of merchandise inventory on November 30 reveals that there are 50 units on hand.

Assume a periodic inventory system is used. Ending inventory under FIFO is

$846.

$863.

$438.

$421.

3. Which of the following would not be reported on the balance sheet as a cash equivalent?

Sixty-day certificate of deposit

Money market savings certificate

Six-month Treasury bill

Money market fund

4. If a petty cash fund is established in the amount of $250, and contains $150 in cash and $95 in receipts

for disbursements when it is replenished, the journal entry to record replenishment should include credits to the following accounts

Petty Cash, $95.

Petty Cash, $100.

Cash, $100.

Cash, $95; Cash Over and Short, $5.

44. GOVERNMENTAL

The following is a pre-closing trial balance for sun city's General fund as of June 30, 2009:

Debit Credit

Cash 116,500

Taxes Receivable-Current 29,000

Estimated uncollectible current taxes 3,000

Accounts Payable 7,800

Due to other funds 5,500

Tax anticipation notes payable 50,000

Reserve for encumbrances 5,000

budgetary fund balance 1000

Fund Balance 70,200

Estimated Revenues 100,000

Revenues 102,000

Appropriations 99,000

Encumbrances 5,000

Expenditures 93,000

Totals 343,500 343,500

(1) Providde the entries to close the budgetary and operating statement accounts.

(2) What is the fund balance as of June 30, 2009 after all closing entries have been made? Show your work."

(3) what is the total fund balance as of june 30

45. Munn Bicycle Company manufactures bicycles specifically for college campuses. The bicycles sell...

Munn Bicycle Company manufactures bicycles specifically for college campuses. The bicycles sell for $100 and are very sturdy, with built-in saddlebags on the rear designed to carry backpacks. Selected data for last year's operations are as follows: Required: Hide A. Prepare income statement using variable costing method. Prepare an income statement using the Absorption costing method. Enter all amounts as positive numbers.

46. Reconciling a bank statement; journalizing a bank service charge, a dishonored check, and petty...

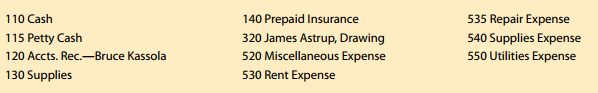

Reconciling a bank statement; journalizing a bank service charge, a dishonored check, and petty cash transactions James Astrup owns a business called LawnMow. Selected general ledger accounts are given below

Instructions: 1. Journalize the following transactions completed during August of the current year. Use page 20 of the journal given in the Working Papers. Source documents are abbreviated as follows: check, C; memorandum, M; calculator tape, T.

47. Highsmith Rental Company purchased an apartment building early in 2016. There are 15 apartments i...

Highsmith Rental Company purchased an apartment building early in 2016. There are 15 apartments in the building and each is furnished with major kitchen appliances. The company has decided to use the group depreciation method for the appliances. The following data are available:

Appliance | Cost | Residual Value | Service Life (in Years) |

Stoves | $31,000 | $4,000 | 6 |

Refrigerators | 26,000 | 9,000 | 5 |

Dishwashers | 24,000 | 8,000 | 4 |

In 2019, three new refrigerators costing $3,500 were purchased for cash. The old refrigerators, which originally cost $3,100, were sold for $1,000.

Required:

Calculate the group depreciation rate, group life, and depreciation for 2016.

Prepare the journal entries to record the purchase of the new refrigerators and the sale of the old refrigerators.

Please show the steps and calculation.

Thank you!

48. Required information The Foundational 15 L07-1, L07-3, LO7-4) [The following information applies ...

Required information The Foundational 15 L07-1, L07-3, LO7-4) [The following information applies to the questions displayed below. Hickory Company manufactures two products-14,000 units of Product Y and 6,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is consideringg implementing an activity-based costing (ABC) system that allocates all $791,400 of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Estimated Overhead Cost Expected Activity Activity Cost Pool Machining Machine setups Product design General factory Activity Measure Machine-hours Number of setups Number of products 87,000 Direct labor-hours 379,500 12,000 DLHs 203,000 10,000 MHs 121,900 230 setups 2 products Activity Measure Product Y Product z Machine-hours Number of setups Number of products Direct labor-hours 7,300 50 2,700 180 9,500 2,500

49. P4. Sid Patel bid for and won a concession to rent bicycles in the local park during the summer....

P4. Sid Patel bid for and won a concession to rent bicycles in the local park during the summer. During the month of April, Patel completed the following transaction for his bicycle rental business:

Apr.

2 Began business by placing $14,400 in a business checking account in the name of the company.

3 Purchased supplies on account for $300.

50. ACTIVE Participation - Module 3 "Real-World" Discussion This discussion forum counts towards your...

ACTIVE Participation - Module 3 "Real-World" Discussion

This discussion forum counts towards your grade. It will NOT be accessible after the due date for your Module 3 assignments.

The purpose of this discussion forum is to engage the class by sharing with your peers the knowledge you have learned from this course. Therefore, this forum is structured to be similar to a "mini-research presentation forum." Each student shares with the class in their discussion posting the knowledge they have gained from their research.

For your initial post:

Option 1:

View our guest speaker Cristina McCormack's video sharing information about the Leepa Rattner Museum of Art (LRMA) and how GASB (Governmental Accounting Standards Board) prepared financial statements differ from financial statements prepared under FASB (Financial Accounting Standards Board). See attached 2016 Annual Report below. In addition read about upcoming changes to our revenue recognition standard on the top of page 121 of our text titled "Coming Soon" which is part of the convergence initiative with IASB (International Accounting Standards Board).

Click on this link to view her presentation: Guest Speaker Cristina McCormack View before completing your discussion assignment

Leepa-Rattner 2016 Financial Statements

Research and reflect on the similarities/differences between these standards and share what your have learned from your research/reflection. If you have visited the Leepa Rattner Museum of Art (LRMA)please also share with your peers what you have learned from this experience and how it relates to learning about their financial statements. For example, Cameron (a student in our blended class) shared the following:

I got the opportunity to go on an exclusive tour of the vault of the Leepa Rattner Museum of Art with the museum's Curator Christine Carter and the museum's Preparator Larry Fineout . It was a very neat experience, as we got to see where they kept all of the paintings. I was very surprised how many paintings they actually have down there, from many artists from Picasso, Rattner, Leepa, and many more. Most of the Rattner paintings have a very interesting story. Some of them were recovered from Europe, as he had to leave some due the Holocaust, as he was Jewish. The way the others were discovered, I think, is the coolest part of the story. The bulk of Rattner's collection came from Allen Leepa, who kept his step-father's paintings on his property in Tarpon Springs. Allen Leepa stored his step-father's paintings (Rattner) in 6 large sheds where they weren't kept and placed in the best conditions. The amount of hard work and dedication to get these painting in the condition they are today is tremendous. Most of Abraham Rattners painting are quite valuable. One thing that I also find interesting is that Abraham Rattner kept very good financial records. In the museum vault, the have his financial records from the 30's and the 40's. They show all of his purchases and deposits. For anyone who hasn't been, I recommend that you do. It's free for all students, and its a pretty cool experience. It also has so much History.

Option 2:

Find an annual report for a company of interest (perhaps your employer). Publicly held company annual reports (10K) can be located via Edgar Archives on the Security and Exchange website.

To perform the search in the Edgar Archives you can use either the company name or "ticker symbol" for the company. [View instructions on how to access the annual reports]

ACG 2021 Chapter 4 Learning Objective 6 View before completing your discussion assignment

Current Ratio - JBL

Accounting Toolkit - Current Ratio

Click on the link to "Interactive Data" and then the link to the "Financial Statements". Locate and review the Income Statement and Balance Sheet. Title your post with the name of your company and share the following in your post:

What is the name of your company?

What is the web address that leads to your financial reports?

Why are you interested in this company?

Calculate the current ratio.

What have you learned from this analysis?

After you have conducted your research, please share with the class approximately 1-2 paragraphs.

Use proper sentence structure and language.

In order to receive full credit you will need to make a Post ("Start a New Thread") and reply to at least two classmates by the Module due date.

Take a look at the Discussion Forum Grading Rubric in order to understand how you will be evaluated.

The goal of this assignment is to share with your peers "real-world" application of knowledge you have learned from this course.

Replies:

Once you have made your initial post, the other students' posts will appear. Respond to two classmates' posts with substantive responses. A response should not be a simple "Good ideas" or "Nice Job." You need to put some time and effort into your responses. A response should be well thought out and at least 2-3 sentences.

For example, please review your peer's computation and share in your reply comment whether (or not) you agree with their computation. Please share your company's final ratio calculation and compare it to your peer's calculation. Analyze the comparison -- i.e., which company appears to be better/stronger etc.