Reliable Help for Accounting Assignments and Quiz Preparation

19. (Objective 8-3) Explain why auditors need an understanding of the client’s industry. What...

(Objective 8-3) Explain why auditors need an understanding of the client’s industry. What information sources are commonly used by auditors to learn about the client’s industry?

(Objective 8-3)

UNDERSTAND THE CLIENT’S BUSINESS AND INDUSTRY

A thorough understanding of the client’s business and industry and knowledge about the company’s operations are essential for the auditor to conduct an adequate audit. The second standard of field work states:

The nature of the client’s business and industry affects client business risk and the risk of material misstatements in the financial statements. (Client business risk is the risk that the client will fail to meet its objectives. It is discussed further later in the chapter.) In recent years, several factors have increased the importance of understanding the client’s business and industry:

• Recent significant declines in economic conditions around the world are likely to significantly increase a client’s business risks. Auditors need to understand the nature of the client’s business to understand the impact of major economic downturns on the client’s financial statements and ability to continue as a going concern.

• Information technology connects client companies with major customers and suppliers. As a result, auditors need greater knowledge about major customers and suppliers and related risks. • Clients have expanded operations globally, often through joint ventures or strategic alliances. • Information technology affects internal client processes, improving the quality and timeliness of accounting information.

• The increased importance of human capital and other intangible assets has increased accounting complexity and the importance of management judgments and estimates.

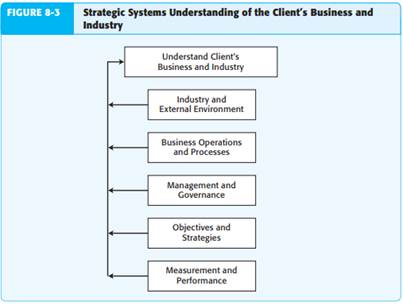

• Many clients may have invested in complex financial instruments, such as col - lateralized debt obligations or unusual mortgage backed securities, which may have declined in value, require complex accounting treatments, and often involve unknown counterparties who may create unexpected financial risks for the client. Auditors consider these factors using a strategic systems approach to under - standing the client’s business. Figure 8-3 provides an overview of the approach to understanding the client’s business and industry. Next, we will discuss several aspects of this approach. The three primary reasons for obtaining a good understanding of the client’s industry and external environment are:

1. Risks associated with specific industries may affect the auditor’s assessment of client business risk and acceptable audit risk—and may even influence auditors against accepting engagements in riskier industries, such as the financial services and health insurance industries.

2. Many inherent risks are common to all clients in certain industries. Famil - iarity with those risks aids the auditor in assessing their relevance to the

client. Examples include potential inventory obsolescence in the fashion clothing industry, accounts receivable collection inherent risk in the consumer loan industry, and reserve for loss inherent risk in the casualty insurance industry. 3. Many industries have unique accounting requirements that the auditor must understand to evaluate whether the client’s financial statements are in accordance with accounting standards. For example, if the auditor is doing an audit of a city government, the auditor must understand governmental accounting and auditing requirements. Unique accounting requirements exist for construction companies, railroads, not-for-profit organizations, financial institutions, and many other organizations. Many auditor litigation cases (like those described in Chapter 5) result from the auditor’s failure to fully understand the nature of transactions in the client’s industry, similar to what occurred in the Enron case discussed in the opening vignette to this chapter. The auditor must also understand the client’s external environment, including such things as wide volatility in economic conditions, extent of competition, and regulatory requirements. For example, auditors of utility companies need more than an understanding of the industry’s unique regulatory accounting requirements. They must also know how recent deregulation in this industry has increased competition and how fluctuations in energy prices impact firm operations. To develop effective audit plans, auditors of all companies must have the expertise to assess external environment risks. The auditor should understand factors such as major sources of revenue, key customers and suppliers, sources of financing, and information about related parties that may indi - cate areas of increased client business risk. For example, many technology firms are dependent on one or a few products that may become obsolete due to new technologies or stronger competitors. Dependence on a few major customers may result in material losses from bad debts or obsolete inventory.

20. What are the five key phases of ASCOR Digital Marketing Framework? Choose any one of the phases and.

What are the five key phases of ASCOR Digital Marketing Framework? Choose any one of the phases and expand on its key activities. Explain the six key elements of the ‘6i model’ that in a combined manner help create a compelling reason for any product/service to be marketed online.

21. SHL Talent Measurement Question 1 of 18 Time Remaining: 0h 21m 11s Sales Figures for ABC RV Sales...

SHL Talent Measurement Question 1 of 18 Time Remaining: 0h 21m 11s Sales Figures for ABC RV Sales Warranty Units Number of RV Model Price Profit* Bonus Sold Warranties 7 Treeline $39,000 22% 9% 14 Lumberman $48,000 20% 8% 12 "The percentage of the sale price that is profit for ABC RV Sales The percentage of the sale price that is given to ABC RV Sales for every warranty sold The figure shows the sales figures of ABC RV Sales for a calendar year. Recently, a computer problem caused the company to lose track of how many Lumberman units it sold during the year. If the owner knows that the total company profit including warranty bonuses was $363,570 for the year, how many Lumberman units were sold? a O 15 O 16 C O 18 d O 23 O 35 Next

22. During 2015, Patnode recorded sales of $17,000. How much cash did it collect from its customers?

During 2015, Patnode recorded sales of $17,000. How much cash did it collect from its customers?

23. Mickley Corporation produces two products, Alpha6s and Zeta7s, which pass through two operations,...

Show transcribed image text Mickley Corporation produces two products, Alpha6s and Zeta7s, which pass through two operations, Sintering and Finishing. Each of the products uses two raw materials, X442 and Y661. The company usesa standard cost system, with the following standards for each product (on a per unit basis) Raw Material Standard Labor Time Product Alpha6 Zeta7 X442 3.0 kilos 4.0 kilos Y661 2.5 liters 4.5 liters Sintering 0.30 hours 0.30 hours Finishing 1.20 hours 0.70 hours Information relating to materials purchased and materials used in production during May follows Purchase Cost Standard Price Used in Production Material X442 Y661 Purchases 5,600 kilos $49,920$3.00 per kilo 10,100 kilos 16,600 liters $24,900 $1.60 per liter 14,600 liters The following additional information is available a. The company recognizes price variances when materials are purchased b. The standard labor rate is $22.00 per hour in Sintering and $21.00 per hour in Finishing c. During May, 1,400 direct labor-hours were worked in Sintering at a total labor cost of $33,740, and 3,010 direct labor-hours were worked in Finishing at a total labor cost of $69,230 d. Production during May was 2,200 Alpha6s and 1,000 Zeta7s Requied 1. Complete the standard cost card for each product, showing the standard cost of direct materials and direct labor. (Round your answers to 2 decimal places.)

24. Prevosti Farms and Sugarhouse pays its employees according to their job classification....

Required information

[The following information applies to the questions displayed below.]

Prevosti Farms and Sugarhouse pays its employees according to their job classification. The following employees make up Sugarhouse's staff:

Employee | Name and Address | Payroll information |

A-Mille | Thomas Millen | Hire Date: 2-1-2016 |

1022 Forest School Rd | DOB: 12-16-1982 | |

Woodstock, VT 05001 | Position: Production Manager | |

802-478-5055 | PT/FT: FT, nonexempt | |

SSN: 031-11-3456 | No. of Exemptions: 4 | |

401(k) deduction: 3% | M/S: M | |

Pay Rate: $35,000/year | ||

A-Towle | Avery Towle | Hire Date: 2-1-2016 |

4011 Route 100 | DOB: 7-14-1991 | |

Plymouth, VT 05102 | Position: Production Worker | |

802-967-5873 | PT/FT: FT, nonexempt | |

SSN: 089-74-0974 | No. of Exemptions: 1 | |

401(k) deduction: 5% | M/S: S | |

Pay Rate: $12.00/hour | ||

A-Long | Charlie Long | Hire Date: 2-1-2016 |

242 Benedict Road | DOB: 3-16-1987 | |

S. Woodstock, VT 05002 | Position: Production Worker | |

802-429-3846 | PT/FT: FT, nonexempt | |

SSN: 056-23-4593 | No. of Exemptions: 2 | |

401(k) deduction: 2% | M/S: M | |

Pay Rate: $12.50/hour | ||

B-Shang | Mary Shangraw | Hire Date: 2-1-2016 |

1901 Main Street #2 | DOB: 8-20-1994 | |

Bridgewater, VT 05520 | Position: Administrative Assistant | |

802-575-5423 | PT/FT: PT, nonexempt | |

SSN: 075-28-8945 | No. of Exemptions: 1 | |

401(k) deduction: 3% | M/S: S | |

Pay Rate: $10.50/hour | ||

B-Lewis | Kristen Lewis | Hire Date: 2-1-2016 |

840 Daily Hollow Road | DOB: 4-6-1950 | |

Bridgewater, VT 05523 | Position: Office Manager | |

802-390-5572 | PT/FT: FT, exempt | |

SSN: 076-39-5673 | No. of Exemptions: 3 | |

401(k) deduction: 4% | M/S: M | |

Pay Rate: $32,000/year | ||

B-Schwa | Joel Schwartz | Hire Date: 2-1-2016 |

55 Maple Farm Way | DOB: 5-23-1985 | |

Woodstock, VT 05534 | Position: Sales | |

802-463-9985 | PT/FT: FT, exempt | |

SSN: 021-34-9876 | No. of Exemptions: 2 | |

401(k) deduction: 5% | M/S: M | |

Pay Rate: $24,000/year base plus 3% | ||

B-Prevo | Toni Prevosti | Hire Date: 2-1-2016 |

10520 Cox Hill Road | DOB: 9-18-1967 | |

Bridgewater, VT 05521 | Position: Owner/President | |

802-673-2636 | PT/FT: FT, exempt | |

SSN: 055-22-0443 | No. of Exemptions: 5 | |

401(k) deduction: 6% | M/S: M | |

Pay Rate: $45,000/year | ||

S-Student | Student F. Success | Hire Date: 2-1-2016 |

1644 Smitten Road | DOB: 1-1-1991 | |

Woodstock, VT 05001 | Position: | |

555-555-5555 | PT/FT: PT, nonexempt | |

SSN: 555-55-5555 | No. of Exemptions: 2 | |

M/S: S | ||

Pay Rate: $34,000/year |

The departments are as follows:

Department A: Agricultural Workers

Department B: Office Workers

Voluntary deductions for each employee are as follows:

Name | Deduction |

Thomas Millen | Insurance: $155/paycheck |

401(k): 3% of gross pay | |

Marital Status: Married | |

Avery Towle | Insurance: $100/paycheck |

401(k): 5% of gross pay | |

Marital Status: Single | |

Charlie Long | Insurance: $155/paycheck |

401(k): 2% of gross pay | |

Marital Status: Married | |

Mary Shangraw | Insurance: $100/paycheck |

401(k): 3% of gross pay | |

Marital Status: Single | |

Kristen Lewis | Insurance: $155/paycheck |

401(k): 4% of gross pay | |

Marital Status: Married | |

Joel Schwartz | Insurance: $100/paycheck |

401(k): 5% of gross pay | |

Marital Status: Married | |

Toni Prevosti | Insurance: $155/paycheck |

401(k): 6% of gross pay | |

Marital Status: Married | |

Student F Success | Insurance: $100/paycheck |

401(k): 2% of gross pay | |

Marital Status: Single | |

rev: 02_10_2017_QC_CS-78488

[The following information applies to the questions displayed below.]

February 12 is the end of the first pay period for Prevosti Farms and Sugarhouse and includes work completed during the week of February 8-12. Using the payroll register, compute the employee gross pay and net pay using 35 hours as the standard workweek for all employees except Mary Shangraw, who works 20 hours per week and receives overtime for any time worked past that point. The other hourly employees receive overtime pay when they work more than 35 hours in one week. Joel Schwartz has made $5,000 in case sales at a 3% commission rate during this pay period. Remember that the employees are paid biweekly. The first day of work for Prevosti Farsm and Sugarhouse for all employees is February 8, 2016. Note that the first pay period comprises only one week of work, but the pay frequency for federal income tax purposes is biweekly. Federal withholding tax should be computed using the wage-bracket tables in Appendix C. State witholding tax for Vermont is computed at 3.55% of taxable wages (i.e., gross pay less pre-tax deductions).

The hours for the nonexempt employees are as follows:

Name | Hourly rate | Hours worked | ||||

Towle | $ | 12.00 | 35 hours | |||

Long | $ | 12.50 | 40 hours | |||

Shangraw | $ | 10.50 | 21 hours | |||

Success (You) | $ | 34,000/year | 35 hours | |||

Complete the payroll register for this pay period and update the Employee Earnings Record form for each employee with the corresponding information. Ensure to input an hourly rate for each employee (including those that are salaried) that is rounded to 5 decimal places.

rev: 12_23_2016_QC_CS-72925, 01_27_2017_QC_CS-75977

25. PROBLEM 4.Cost Saving by Use of EOQ. Warner Co. uses 6,000 units of material per year at a cost of..

PROBLEM

4.Cost Saving by Use of EOQ. Warner Co. uses 6,000 units of material per year at a cost of $4 per unit. Carrying costs are estimated to be $1.125 per unit per year, and order costs amount to $60 per order. As an incentive to its customers, Warner will extend quantity discounts according to the following schedule:

MinimumListNet

Order PriceDiscountPrice

500$42%$3.92

1,000443.84

2,000463.76

Required:

(1)Determine the economic order quantity (ignoring quantity discounts) and the total annual order cost, carrying cost, and materials costs at EOQ (considering quantity discounts).

(2)Compute the annual order cost, carrying cost, materials cost, and total cost at each discount level. (Round to the nearest dollar.)

(3)Identify the order size, choosing from one of the three discount levels, that will minimize the total cost.

26. Your organization currently has a defined contribution pension plan with employees contributing...

Your organization currently has a defined contribution pension plan with employees contributing up to 3% with a company match. Effective with the first pay of the new year, new employees will no longer be enrolled in that plan. Instead, they will be enrolled in the new Group Registered Retirement Savings Plan (RRSP) with the same contribution options. In your own words, explain the difference in the T4 information slip reporting for these two groups of employees.

27. For the past several years, Jolene Upton has operated a part-time consulting business from her ho...

For the past several years, Jolene Upton has operated a part-time consulting business from her home. As of July 1, 2019, Jolene decided to move to rented quarters and to operate the business, which was to be known as Gourmet Consulting, on a full-time basis. Gourmet Consulting entered into the The following assets were received from Jolene Upton: cash, $19,000, accounts receivable, $22,300 supplies, $3,800, and office equipment, $8,900. There were no liabilities received Ju.1 t, $6,000 2 Paid the premiums on property and casualty insurance policies, $4,500 4 Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $8,000 5 Purchased additional office equipment on account from Office Necessities Co, s5,100

28. 1. What are the four levels of activity in the pyramid representing the business organization?...

1. What are the four levels of activity in the pyramid representing the business organization?

Distinguish between horizontal and vertical flows of information.

29. On January 1, 2018, the general ledger of 3D Family Fireworks includes the following account bala...

11:15 PM * 40%--1 value: 15.00 points On January 1, 2018, the general ledger of 3D Family Fireworks includes the following account balances Accounts Cash Accounts Receivable Allowance for Uncollectible Accounts Supplies Notes Receivable (6%, due in 2 years) Land Accounts Payable Common Stock Retained Earnings Debit Credit S 25,100 14,200 $ 2,000 3,100 26,000 77,600 9,000 102,000 33,000 Totals $146,000 $146,000 During January 2018, the following transactions occur: January 2 Provide services to customers for cash, $41,100 January 6 Provide services to customers on account, $78,400 January 15 Write off accounts receivable as uncollectible, $1,600 January 20 Pay cash for salaries, $32,000 January 22 Receive cash on accounts receivable, $76,000 January 25 Pay cash on accounts payable, $6,100 January 30 Pay cash for utilities during January, $14,300 The following information is available on January 31, 2018 a. At the end of January, $5,600 of accounts receivable are past due, and the company estimates that 20% of these accounts will not be collected. Of the remaining accounts receivable, the company estimates that 5% will not be collected. The note receivable of $26,000 is considered fully collectible and therefore is not included in the estimate of uncollectible accounts b. Supplies at the end of January total $1,000 c. Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31 d. Unpaid salaries at the end of January are $34,100

30. Fill in the blanks with the appropriate words based on Más cultura. 1. El imperio Inca comprende...

Fill in the blanks with the appropriate words based on Más cultura.

1. El imperio Inca comprende (spans over) territorios de lo que actualmente (currently) son Ecuador, , Argentina, y Perú.

2. Atahualpa es el emperador Inca.

3. Antes de morir (Before dying), Huayna Capac divide su , y le da a Atahualpa la parte norte del territorio, y a Huáscar la parte sur.

4. La madre de Atahualpa es una de Quito.

5. La guerra (war) entre Huáscar y Atahualpa se conoce como (is known as) la Guerra de los .

6. Atahualpa ofrece (offers) una gran cantidad de a cambio de (in exchange for) su liberación.

31. 1. Which one of the following would be the same total amount on a flexible budget and a static...

1. Which one of the following would be the same total amount on a flexible budget and a static budget if the activity level is different for the two types of budgets?

A- Direct materials cost

B- Direct labor cost

C- Variable manufacturing overhead

D- Fixed manufacturing overhead

2. The Chambers Manufacturing Company recorded overhead costs of $14,182 at an activity level of 4,200 machine hours and $8,748 at 2,300 machine hours. The records also indicated that overhead of $9,730 was incurred at 2,600 machine hours. What is the variable cost per machine hour using the high-low method to estimate the cost equation?

$2.78

$2.86

$3.10

$3.38

3. Southern Company’s budgeted and actual sales for 2009 were:

Product:

X

Y

Budgeted Sales

X-20,000 Units at $5.00 per unit

Y-35,000 Units at $9.00 per unit

Actual Sales:

X-17,500 Units at $5.30 per unit

Y-17,300 Units at $8.30 per unit

What is the total sales variance for the two products?

A- $2,210 Favorable

B- $5,990 Favorable

C- $6,990 Favorable

D- $8,200 Favorable

4. Southern Company manufactures Product X. The standard cost of one unit of output is $12.00 (four pieces at $3.00 per piece). During the first quarter, 5,000 units were made, at an actual cost of $10.50 per unit (three pieces were $3.50 per piece). What is the material price variance?

A- $7,500 Favorable

B- $10,000 Favorable

C- $7,500 Unfavorable

D- $10,000 Unfavorable